Leisure travel will present a $15 trillion opportunity for airlines, hotels, and other travel industry stakeholders in 2040, up from $5 trillion in 2024. The reasons for this jump are myriad. One is the burgeoning middle class in many emerging markets, eager to travel. Another is the growing emphasis on experiences, rather than things—people are increasingly choosing to spend their money on creating good memories.

Making good memories doesn’t have to mean taking international trips, though it can. Domestic trips compose the bulk of leisure travel, especially in emerging markets. To tap the true potential value of leisure travel, stakeholders should try to attract local and regional tourists as well as international visitors.

Travel companies should also prepare for a rapidly evolving customer base, distinguished primarily by shifting demographics. The travelers of the near future are a rich tapestry of identities and preferences. For example, more and more visitors are coming from emerging markets, including China, India, Saudi Arabia, Bulgaria, and Cambodia. Travelers will also skew younger and embrace digital technologies. So travel companies along the value chain should find ways to understand and welcome new travelers while continuing to cater to traditional visitors.

Our global review of leisure travel explores the sources and motivations driving growth in leisure travel. (See “About Our Research.”) We look at questions relevant to travel industry stakeholders:

- Where is growth coming from?

- What drives travelers’ choices?

- How will travelers plan and book?

- How should the industry respond?

About Our Research

Most important, together with our Center for Customer Insight, we undertook detailed surveys with individual travelers in 11 countries whose populations currently travel frequently or are poised to travel more in the future: Australia, China, India, Indonesia, Germany, Mexico, Nigeria, Saudi Arabia, UK, US, and Vietnam. For each country included in the Traveler of the Future survey, we posed our questions to 400 to 500 individuals. Our surveys covered travel motivations; companions; favorite destination types; needs; how travelers get inspired, search, and book; how they combine experiences; and what they perceive as luxury.

Note that our forecasts did not take into account any impact of geopolitical trends and events.

Where Is Growth Coming From?

Leisure travel, measured by the number of overnights, will grow by about 4% annually from 2024 through 2029 and then slow to approximately 3% annually through 2040. Domestic leisure travel makes up the vast majority of overnights, followed by regional travel.

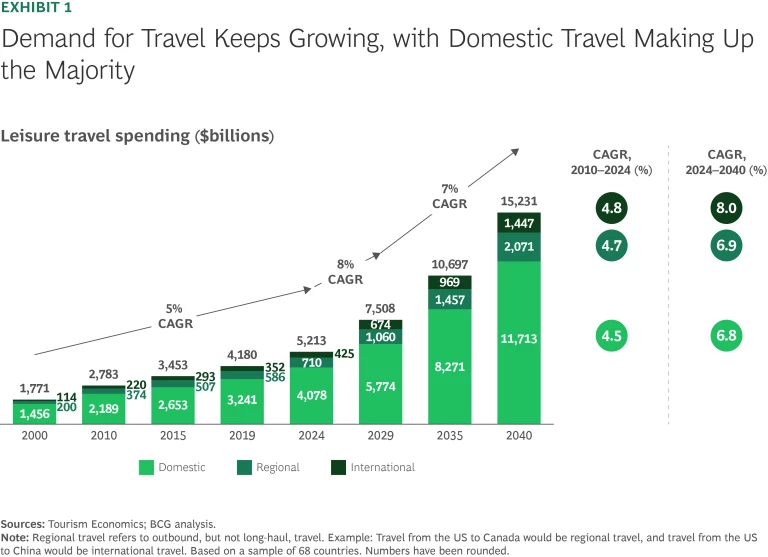

Spending on leisure travel is growing too: we expect it to increase by 8% per year through 2029 before slowing to 7% through 2040 (see Exhibit 1):

- Domestic leisure travel accounted for about $4.1 trillion in spending in 2024, on the strength of almost 13 billion overnights, and we project that it will pull in about $11.7 trillion in 2040 (approximately 18 billion overnights).

- We expect regional leisure travel to roughly triple from $710 billion (more than 3 billion overnights) to just over $2 trillion (7 billion overnights) in the same time horizon.

- We anticipate that international leisure travel will more than triple from about $425 billion to approximately $1.4 trillion from 2024 through 2040 (rising from almost 2 billion overnights to 5 billion).

Note that the evolving geopolitical landscape, US tariffs, and shifting immigration policy may affect travel demand. Some sources have adjusted travel forecasts downward, particularly to and from the US; we have not modified the outlooks shared in this report. Changing demand will have both negative and positive implications for travel companies—some destinations might benefit as travelers reroute to different destinations. The mid- to long-term impact of policy developments on travel to the US and on leisure travel overall remains to be seen.

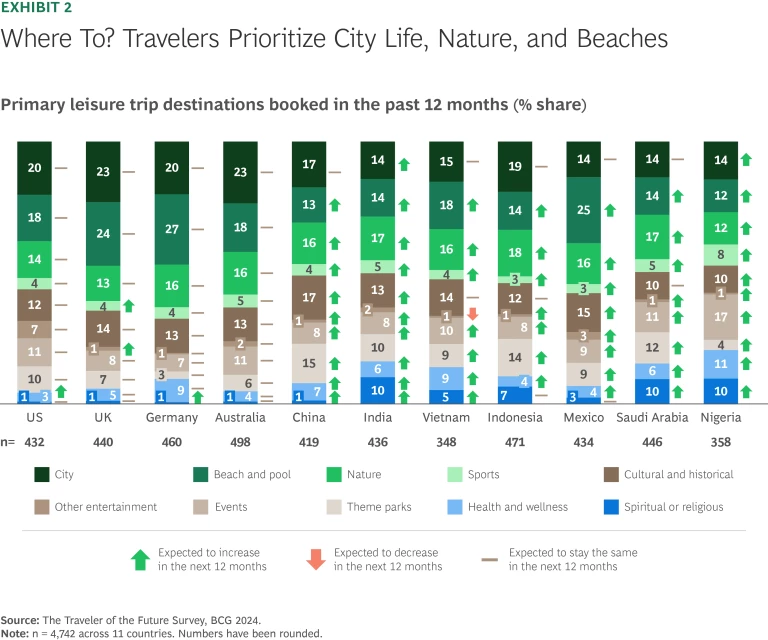

Nevertheless, leisure travel continues, and whether travelers venture near or far, they seek a variety of destination types. (See Exhibit 2.) Beaches, nature trips, and cities—the classics—are still alluring. They remain the top destinations for leisure travel. Solo travelers prefer cities even slightly more than others. High spenders favor these three destination types, too. But now, travelers are also seeking destinations that offer more curated, purpose-driven experiences. (For an example, see “How Qatar and Qiddiya Are Tackling Destination Marketing.”) Wellness and spiritual travel is becoming more popular, with rising demand for mindfulness retreats, holistic health resorts, and religious travel.

How Qatar and Qiddiya Are Tackling Destination Marketing

They have developed distinct and detailed strategies to become travel hubs of choice. Qatar offers events tied to holidays popular in nearby markets: Chinese New Year and Diwali, for instance. Qiddiya has been designed to be a global hub for entertainment, sports, and culture. The city is marketed as a place for fun using the slogan Play Qiddiya City.

To meet their strategic goals, both destinations rely on a well-oiled machine.

Technology plays a key role:

- Travel businesses in Qatar use SMS and WhatsApp marketing to reach potential travelers with personalized offerings and updates. Qatar also uses augmented reality (AR) and virtual reality (VR) to give potential travelers the chance to experience destinations before booking. In addition, specialized motivations are served by a tourism app that uses an AI concierge to create itineraries and communicate with travelers.

- Qiddiya is developing an advanced digital platform (called the Play Life Connected Experience) that leverages AI, data analytics, and cloud technology to deliver personalized and seamless visitor interactions, further enhancing engagement with its diverse attractions.

- Qatar works with tour operators and via B2B channels to attract visitors to big events, for example. And it uses high-profile influencers to promote the destination overall; micro-influencers are employed to draw potential travelers with more specialized motivations, like food and adventure.

- Qiddiya’s Spirit of Play executive office works with businesses, investors, and industry leaders to develop experiences that will attract and cater to visitors seeking adventure.

Regardless of the destination, much of the growth in leisure travel will come from new sources and new types of travelers, distinguished by geography, age group, travel companions, and expectations.

By Geography

When we look at the value and growth of leisure travel, we observe different clusters of countries.

Hyper-experienced travel countries—the US, UK, and Germany—show a high level of spending as well as leisure lodging nights, but the outlook for growth from these starting points is moderate.

The next wave of travelers is coming largely from emerging markets that already have significant leisure travel (domestic, regional, or international) and will show further growth from 2024 through 2040. Prominent among them:

- China. While the growth of leisure travel spending in China was moderate from 2019 to 2024—impacted by COVID-19—the country is expected to continue its strong growth trajectory with spending increases of more than 10% per year, no matter the destination: spending on domestic travel will grow by 10% annually; on regional travel, 11%; on international travel, 11%. China is on track to become the country with the highest leisure travel spending. On a similar note, domestic, regional, and international overnights are expected to rise by 3%, 11%, and 12%, respectively, per year.

- India. India experienced moderate to strong growth in leisure travel spending from 2019 through 2024, suggesting a quick recovery from COVID-19-related impacts on travel. We expect significant continued growth. Indian travelers are increasingly exploring their own country, as well as the world (domestic, regional, and international overnights will rise by 3%, 4%, and 6%, respectively, per year). Spending will increase by 12% per year domestically, 8% per year regionally, and 10% per year internationally. Our survey found that the younger generations are especially keen to travel more and spend more on travel.

- Saudi Arabia. Saudi Arabia has been experiencing—and will likely continue to experience—strong growth in leisure travel spending, especially when it comes to domestic travel, where spending rose by 10% from 2019 to 2024. Spending on regional travel grew by 9%, while spending on international travel declined slightly. Looking ahead to 2040, spending on domestic, regional, and international travel will increase annually by 7%, 3%, and 5%, respectively. Domestic overnights will rise by 2% annually through 2040; regional overnights, by 3%; international overnights, 4%. Contributing factors: the importance of religious travel and the appeal of new destinations within Saudi Arabia.

People from Bangladesh, Bulgaria, Egypt, Morocco, and Vietnam, among other countries, are also part of this group of travelers.

A second wave of travel newcomers is ready to pack their bags and go; though they are starting from relatively low numbers, we expect significant growth. These travelers will come from Bolivia, Malaysia, and Turkey, as well as other countries.

By Age Group

Millennials and Gen-Zers are the most influential travelers globally. Relative to older generations, they are planning more trips. (The share of younger generations planning to increase the number of trips is 4 to 26 percentage points higher than that of older generations.) These cohorts are mobile-savvy, socially conscious, and highly engaged online.

In emerging markets, Gen-Xers remain an important segment, particularly in India and China.

By Travel Companion

Couples and the classic “family of four” still travel together, but new groupings are becoming more common.

Multigenerational and blended travel is on the rise because of changing lifestyles, flexible work setups, and aging populations. While 10% of travelers across all markets undertake multigenerational travel, it is especially prevalent in certain countries, including Vietnam, India, Mexico, and Saudia Arabia. These travelers seek experiences that meet diverse needs—across age groups, mobility levels, and interests.

At the same time, solo travel has become a mainstream trend, not a niche. Today, 18% to 39% of travelers say they take solo trips. Millennials and Gen-Zers are the most likely to travel on their own. Solo travelers, relative to others, are less likely to choose beach or poolside vacations and more likely to visit urban destinations. They also travel to events and seek out locales that offer cultural and historical, health and wellness, and spiritual or religious features. They’re interested in connecting with like-minded people at destinations.

Multigenerational and blended travel is on the rise because of changing lifestyles, flexible work setups, and aging populations.

By Expectation

The travelers of the future—who tend to come from different nations, be younger, and travel in larger groups or alone—want different things. They expect:

- Digital Service. Mobile-first booking, super-apps, and social commerce are the norm.

- Hyper-Personalized Experiences. AI-driven recommendations, flexible itineraries, and seamless booking experiences should all be tailored to the traveler.

- Cultural Relevance. Travelers will favor destinations that can cater to aspects of their culture. Consider food tourism, which is a major travel motivator. Food tourists want to be sure that their dietary preferences and restrictions are met.

- Community-Driven Options. New and future travelers will rely more on social media and peer recommendations, rather than traditional advertising, to make travel decisions.

What Drives Travelers’ Choices?

Wanderlust is always a motivator. It’s baked into our DNA: people everywhere have a deep desire to explore beyond their horizons and experience other geographies and cultures.

But people use their leisure time to travel for reasons that go far beyond simply taking a vacation. Travelers today seek meaning, convenience, and experiences that align with their lifestyles. But don’t scrap the beach chairs, cabanas, snorkeling, golf courses, and the like. The primary motivations for leisure travel continue to be relaxation, escape, exploration, outdoor activity, and visiting friends and relatives.

In addition, a quest for health and wellness, an appetite for good food, and even a desire to combine work time with leisure time are becoming important motivators.

People use their leisure time to travel for reasons that go far beyond simply taking a vacation.

Motivations for Travel

Across all markets, relaxing and spending quality time with loved ones remain top reasons to travel.

What’s changed? How people relax.

Traditional beach getaways, urban adventures, and nature experiences are still popular. Other travel themes—including sports, cultural and historical interests, health and wellness, and spiritual or religious goals—are on the rise.

And food tourism is booming, especially in Asia. Travelers from China, Vietnam, and Indonesia, in particular, rank food as a top motivator. Travelers plan entire trips around food experiences, from Michelin-starred dining to tours focused on street food. Food tourism has its place in Western markets too, though it remains secondary to travel aimed at relaxation and related traditional motivators.

Other niches of interest:

- Religious travel overall is a niche, but one that is more prominent among travelers from India, Nigeria, and Saudi Arabia.

- Travelers from experienced and hyper-experienced markets want to increase exploration, health and wellness, and romantic getaways.

- Travelers from the US and UK want to travel more for educational purposes.

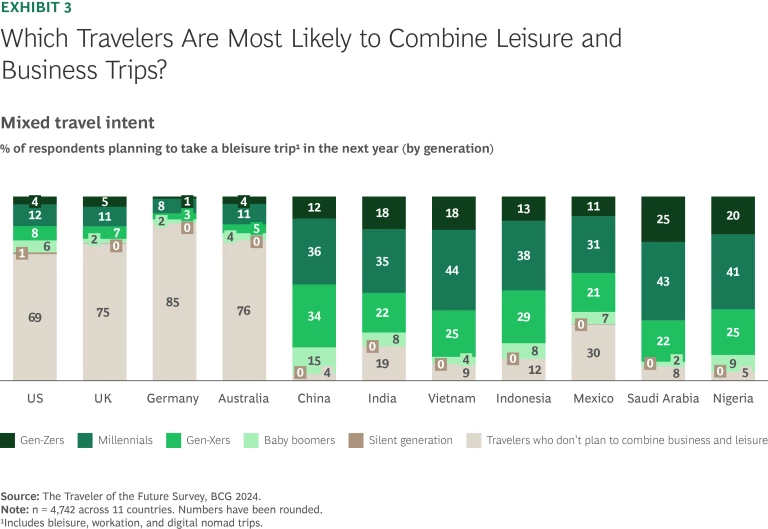

Business trips and leisure trips are coming together in what is known as “bleisure” travel, which manifests in different ways: Sometimes people extend work trips to allow for leisure time, taking advantage of the opportunity to save money on the trip overall. Sometimes they are living the life of digital nomads, who can work from almost any location and at any time, making it easier to incorporate leisure time into their schedules. (See “How Bleisure Travel Benefits MICE Locations.”)

How Bleisure Travel Benefits MICE Locations

To take advantage of this boost, MICE destinations should maintain separate facilities for business and leisure activities on a single site—distinct lobbies and breakfast areas, for example. MICE destinations can also evolve to tap rising demand for ecotourism as the hosts of business travel seek to deliver on corporate sustainability and social responsibility commitments.

Interesting destinations for MICE-related bleisure travel are those that have world-class venues, connectivity to global hubs, government support, as well as attractive social and entertainment activities. Among them: Las Vegas, Walt Disney World Resort in Orlando, PortAventura in Spain, and Abu Dhabi.

Emerging markets show higher flexibility in bleisure travel compared with hyper-experienced countries (the US, UK, and Germany). More than 70% of travelers in emerging-market countries such as China, India, Nigeria, and Saudi Arabia plan to combine work trips with leisure. Only some 15% to 30% of travelers in the hyper-experienced travel markets plan to do the same. (See Exhibit 3.)

Five Traveler Archetypes

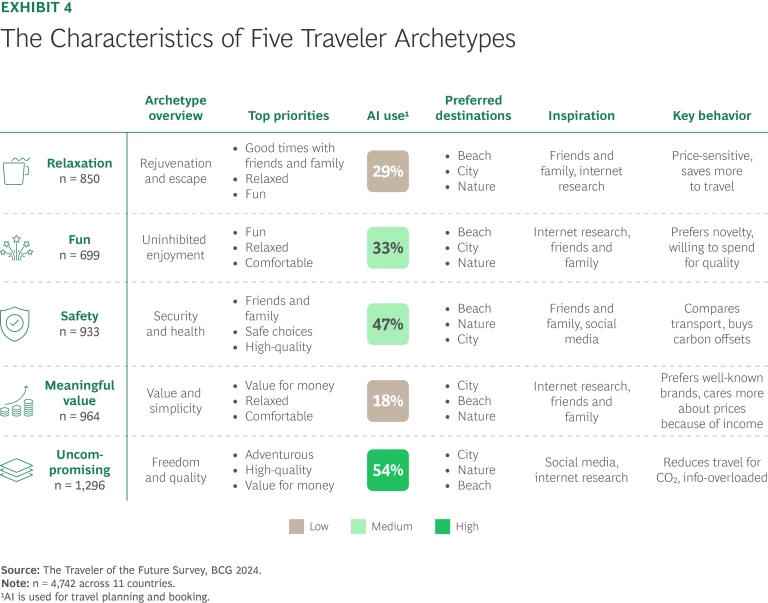

We cross-tabulated our survey results to create five archetypes of leisure travelers that encapsulate their needs and describe their foremost motivations and concerns. These archetypes tend to vary regionally. Understanding who they are and what they need is essential for travel companies’ growth. (See Exhibit 4.) Here are the five archetypes:

- Relaxation. As we’ve seen, the desire for relaxation remains a dominant and consistent need. It’s especially important to older generations. More specifically, travelers who make up our relaxation category seek to be rejuvenated, visit loved ones, and explore new destinations and nature. While this is not the top archetype in any country, it exists in each country.

- Fun. These travelers are all about freedom, escape, and enjoyment. Their interests include exploration, food, adventure, and shopping. This archetype is particularly common in Germany and China.

- Safety. Travelers in this group value choices that keep them and their families safe and healthy. This encompasses health, the environment, and social impact. It’s especially important for travelers from countries including Nigeria, India, Vietnam, and Saudi Arabia.

- Meaningful Value. People in this category want comfort, good value, and stress-free trips with family and friends. They travel for connection, food, and exploration. Travelers from Western countries place particular emphasis on these needs.

- Uncompromising. These travelers—many of whom come from emerging markets (such as China, India, Indonesia, Mexico, and Saudi Arabia) and are young (millennials and Gen-Zers)—defy easy categorization. They want it all: relaxation as well as exciting, high-quality experiences. They also seek a balance of comfort, value, and sustainability. Their desires reflect the “premiumization” and “experience over things” trends that we observe, reasons that luxury is also on the rise.

AI Arrives. How Will Travelers Plan and Book?

People who aspire to travel already use multiple channels for inspiration and search. Although friends and family are important sources of information, travelers increasingly turn to social media, influencers, and celebrity recommendations for travel ideas. To get travelers’ attention—and dollars—companies should be able to engage in real-time, two-way communications and offer seamless booking across multiple channels, including channels like social media and AI-powered sites that are still relatively new to travelers and the travel industry.

To get travelers’ attention—and dollars—companies should be able to engage in real-time, two-way communications and offer seamless booking across multiple channels.

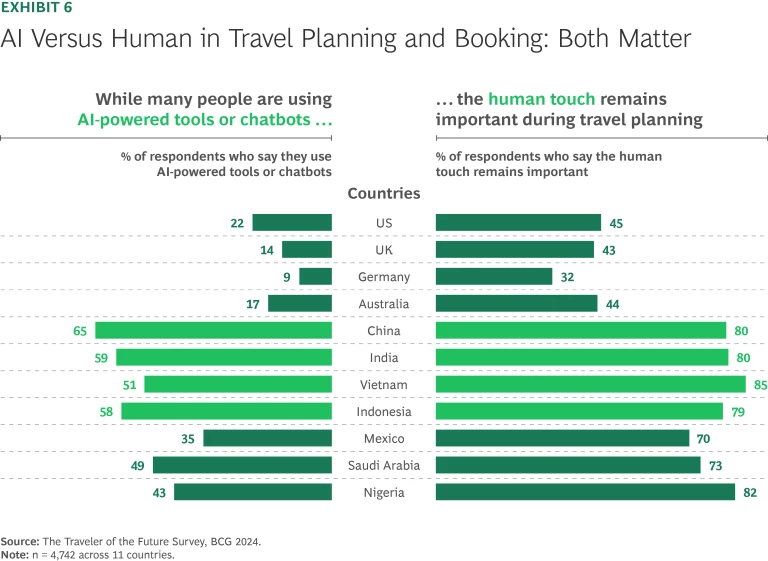

Our survey found that travelers—especially those from emerging markets—are using these new tools. Emerging-market travelers have the most browsing touch points, starting with social media and then looking to general internet research, brand and retailer websites, and online advertising. Interestingly, they are also the most likely to say they often experience information overload.

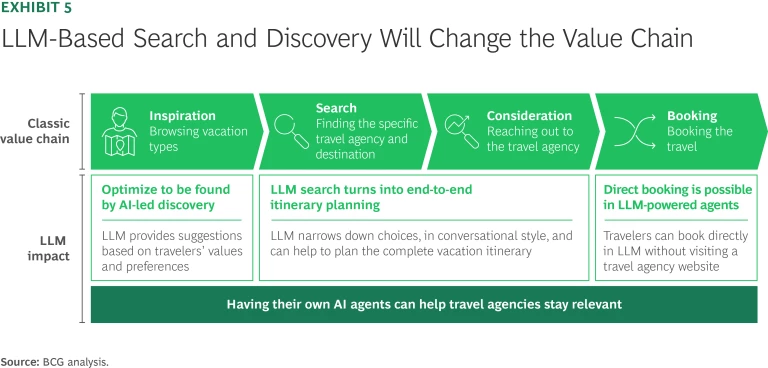

Nonetheless, information about travel will abound and become all the more accessible. Search capabilities based on large language models (LLMs) are already reshaping traditional search behaviors in multiple categories (such as shopping, real estate, and automotive classifieds). (See Exhibit 5.) Travelers now engage in deeper, more interactive conversations with LLM-based search agents such as ChatGPT and Gemini, significantly expanding their research phase. Rather than simply searching for a specific hotel or destination, they can ask detailed, exploratory questions and receive personalized inspiration. This frequently leads travelers to directly visit provider or destination websites, making it essential that these sites use search engine optimization to ensure that they will be found.

As a next stage, travelers can make even greater use of AI when it comes to planning and booking their trips. LLMs are evolving into comprehensive travel agents capable of planning entire itineraries. Travelers can converse with advanced AI systems like ChatGPT’s new Operator offering, orchestrating everything from itinerary recommendations to eventual bookings—with travelers also increasingly booking in the AI-driven environment.

Looking forward, travelers will move beyond dedicated LLM search chatbots into social media environments like Instagram and Facebook. Here, travelers enter an imagination and inspiration phase. Leveraging social interactions, likes, and viewed content, AI-powered travel agents can proactively suggest and facilitate travel bookings directly within the social platforms. This contextually enriched browsing experience relies on extensive user behavior data, transforming casual browsing into a highly personalized, seamless booking journey and fundamentally disrupting current travel discovery and booking paradigms.

In fact, GenAI search may pose an existential threat to travel companies as AI-driven search platforms take on a more active role in directing users to relevant offers—bypassing traditional aggregators. The pace of change remains uncertain, but companies should begin adapting.

GenAI search may pose an existential threat to travel companies.

Travel aggregators such as Booking.com, Expedia, Tripadvisor, and GuideGeek are launching their own LLM-powered conversational booking agents to enhance the customer experience. By engaging users in conversations, the search process becomes highly personalized to individual preferences, providing relevant inspiration that can drive upselling opportunities and ultimately improve conversion rates. Much like trends observed in e-commerce, conversational search is on track to gradually replace traditional search and planning functionalities on travel websites, becoming the primary interaction method for users.

But the growing appreciation of AI does not negate the value of human interaction for travelers. (See Exhibit 6.) Interestingly, in countries where AI is considered particularly valuable for travel planning, human interaction is also especially important to travelers. Smart integration and handoffs between technology and the human touch will best meet travelers’ needs. Winning platforms will combine AI-powered simplicity with personalization, cultural relevance, and hybrid engagement.

How Should the Industry Respond?

More people are taking vacations, and they are taking them more frequently. Our research shows that the number of overnights spent on leisure trips will only increase. So will the diversity of trips—and the use of tech-enabled platforms and channels.

Travelers have new expectations, behaviors, and decision-making patterns, all of which will continue to evolve. Overall, travel is becoming a modular, lifestyle-aligned product. Personalization and flexibility now shape the full journey. For travel companies, this means knowing more and doing more, by taking advantage of new technologies. They should consider their general strategies and specific tactical plans for attracting and pleasing the traveler of the future.

The Strategic Travel Plan

Know your emerging traveler. The next generation of travelers is more diverse than ever before. Growth is coming from new markets, motivations, travelers, and travel parties. Companies should invest in smarter ways to understand what travelers need and how to meet those needs. They can establish themselves as a service and destination of choice for particular preferences.

Inspire differently. Personalization is key for travel companies seeking to attract the next waves of travelers. So is understanding where to reach them. Travelers are accessing travel information by tapping into AI-powered sites and bots, social media, and influencers. Companies should identify ways to make these connections, too.

Embrace AI. Companies should make sure that travelers seeking information and booking opportunities through AI-powered channels can discover their companies and book with them. They should ensure that they can be found via LLM search, watch out for LLMs that might be entering their business space, and start investing in their own AI chatbots. These bots should be able to communicate with travelers and help them easily book trips right at the travel company’s site to improve the user experience and at social media sites to attract and convert new customers.

Leverage loyalty. Travel companies will benefit from developing an understanding of the evolving characteristics of loyalty programs. Travelers who favor multigenerational or bleisure travel, for example, will seek new kinds of rewards. Companies should continue to leverage loyalty programs and their benefits to incentivize travelers to book directly.

Stay ahead with BCG insights on travel and tourism

The Tactical Approach

Travel companies should take advantage of new technologies to facilitate everything from trip planning and booking to personalization to loyalty programs that ensure ongoing relationships and repeat business. A hotel should offer more than hotel amenities, for example—it should also be a technologist that optimizes cutting-edge digital options and a curator that can deliver on a host of desired travel experiences.

Along these lines, different travel sectors can take specific steps to prosper in the future of travel.

Insights for airlines:

- Refine networks on the basis of new travel routes. New travel flows are shifting toward emerging markets in the East and are changing demand patterns. To capture growth, airlines should understand the importance of regional travel.

- Review fleet requirements and deployments. Analyze the current fleet and the potential to optimize it. For example, narrow-body, long-range aircrafts enable direct service to secondary cities.

- Make cabin configuration flexible. Cabin configurations that are more modular and customizable—offering, for example, the ability to create family configurations in business class or opportunities for premiumization—could be useful.

- Enhance modern retailing and new distribution capabilities. Given the proliferation of highly individual travel preferences, these capabilities can help airlines leverage dynamic pricing and bundling.

- Personalize the travel experience with AI. Airlines can use AI to personalize pretrip recommendations (such as meal preferences) while empowering frontline staff to deliver responsive, high-touch service.

- Push loyalty. As the number of business-and-leisure, multigenerational, and solo trips grows, airlines should analyze the potential value of introducing flexible and relevant tiers, companion benefits, and experience-based rewards. They should ensure frequent interactions with customers.

Insights for hotels and other lodging hosts:

- Cater to bleisure travelers. Companies should analyze detailed needs and corresponding options to integrate work-friendly amenities, like coworking lounges or meeting-friendly rooms, into leisure environments.

- Adapt to multigenerational travel. Consider how best to provide flexible room configurations and tiered experiences (such as activities for teens and accessible amenities for seniors) to support diverse needs.

- Ensure “findability” in AI-driven platforms to stay relevant in LLM searches. Hotels should provide structured data and integrate with AI-driven platforms so that travelers will discover them.

- Optimize loyalty programs. Most players already offer loyalty programs. Further personalization can make offers more attractive and incentivize customers to book directly.

- Capitalize on multicity tour demand. Affluent travelers want to visit cities. Hotel chains can meet this demand with packages that feature multiple urban destinations.

- Respond to the growth of vacation rentals with flexible models. As the number of emerging-market and multigenerational travelers increases, the need for apartments and homes is likely to rise as well.

- Optimize revenue management. Companies can analyze the benefits of offering flexible weekday rates to bleisure travelers, bundled family packages for multigenerational trips, and premium upgrades for high spenders.

Insights for cruise lines:

- Establish emerging markets as cruise hubs. Cruise operators should consider expanding deployment beyond traditional hubs such as Miami and European ports to cities like Singapore and Dubai, where infrastructure and regional demand are rapidly evolving.

- Attract first-timers. Amid rising numbers of middle-class travelers and increasing travel intent—especially among millennials and Gen-Zers—establishing an early presence would allow operators to capture loyalty and shape new cruising behavior. They can boost their short-trip offerings to give first-time passengers a glimpse of the cruise experience while keeping barriers to booking low.

- Leverage revenue management. Modular cruise formats enable dynamic pricing by day, segment, or cabin type. In the future, with advances in technical capabilities, flexible embarkation and disembarkation across different legs of a trip might help to better fill capacity and apply differentiated pricing strategies—maximizing yield per available berth and catering to travelers with varied time and budget constraints.

Insights for online travel aggregators (OTAs):

- Optimize the AI interface and findability. With travelers increasingly using LLMs for trip inspiration and planning, traditional search engine optimization and advertising (SEO and SEA) are not sufficient anymore. Businesses should seek ways to refine their SEO and SEA tactics to ensure findability in today’s LLM-based searches.

- Actively monitor the evolution of LLM search engines. OTAs that prepare for the future can avoid falling behind when the next wave of search disruption hits.

- Prepare for conversational shopping to become the new standard. Consumers expect a conversational, human-like interaction that leads to highly personalized offerings. Companies can leverage their own LLM-empowered agents to make trip planning more intuitive, drive conversion, and upsell.

- Expand business lines to remain relevant. OTAs can bolster their business lines, moving, for example, into the B2B vertical, including APIs and advertising capabilities. Other possibilities: investing to provide experiences and services, exploring options for partnerships (with credit card companies, for example), and finding ways to form long-term relationships with customers via loyalty programs.

Insights for tourism boards and destination management companies:

- Boost personalized marketing campaigns. Travelers in emerging markets often rely on social media for travel planning. Companies have the opportunity to use AI to personalize ads and suggestions on these platforms to ensure higher click-through rates and deeper relevance.

- Develop regional tourism partnerships and short-trip incentives. Because most trips are domestic or regional, destinations can look for opportunities to attract volume while minimizing travel friction—for example, promoting “weekend getaway” packages.

- Collaborate with tour operators to bundle curated experiences. Tourism boards and destination management companies can consider partnerships. For example, culinary-focused tours in Vietnam or Indonesia can bundle local food tours with cooking classes and street food crawls, appealing to Asian travelers who prioritize gastronomy.

- Team up with MICE agencies to attract bleisure travelers. Companies can leverage options to position their destination as bleisure-ready by combining professional and leisure offerings. They can promote destination packages that include both high-quality MICE facilities and access to cultural or recreational activities (such as heritage sites, wellness retreats, and guided nature tours) or develop infrastructure and messaging that enable seamless business-plus-leisure transitions.

The authors thank Andy Reilly of BCG Vantage for his contributions to this research.