Uncertainty is often seen as the enemy of dealmaking—but it doesn’t have to be. Although volatility has dominated global markets since the shocks of 2020, savvy executives have found ways not only to navigate turbulent conditions but to thrive in them.

After a bullish wave of optimism at the end of 2024, renewed geopolitical and economic jitters quickly stalled momentum, leaving dealmakers hesitant. Today, even as activity recovers, especially in the US, caution remains widespread. Indicators such as BCG’s M&A Sentiment Index signal that subdued confidence persists in most regions.

Yet BCG’s latest research reveals that uncertain times can yield exceptional opportunities for dealmakers who take the right approach. Analyzing global deal activity through mid-2025, we found that while uncertainty dampens overall deal values, it drives a surge in smaller, strategically targeted acquisitions. In an environment where average returns on deals turn negative, experienced players capture outsized value by shifting to de-risking strategies—favoring same-industry deals close to home, capitalizing on reduced valuations, and emphasizing stock-based financing.

For CEOs, the imperative is clear: rather than retreating from uncertainty, embrace it by systematically considering it as part of due diligence, knowing where to focus, and building institutional M&A capabilities.

Gauging Uncertainty

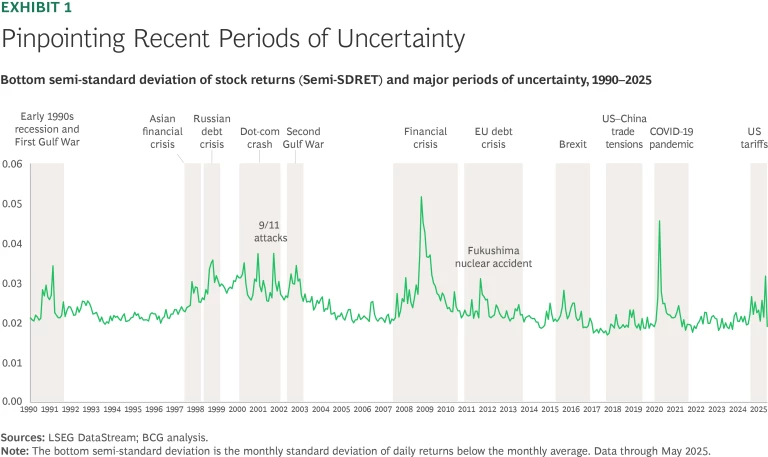

Uncertainty has become the new normal since 2020, reshaping the global economic landscape. Geopolitical tensions, shifting trade policies, and ongoing supply chain disruptions now regularly amplify market volatility. Traditional measures of volatility, such as the VIX index, offer insights primarily into US markets. To understand global volatility, we focus on a more precise measure: the bottom semi-standard deviation of stock returns (Semi-SDRET). This indicator correlates strongly with VIX while providing global coverage and granular detail on regional disruptions. (See “Understanding Semi-SDRET.”)

Understanding Semi-SDRET

It is calculated as the square root of the semi-variance of returns falling below a defined threshold. In our implementation, we apply a stricter cutoff at zero rather than the mean return, which sharpens the focus on material downside events: σ− = √[(1/(n − 1)) Σ min(r_t − r̄, 0)^2], where r̄ is the mean return and n counts negative deviations.

Semi-SDRET effectively maps periods of uncertainty, highlighting asymmetric risk in downturns, such as in 2008 and 2020. It outperforms the full standard deviation by excluding upside volatility, which is less relevant for risk-aware decision making.

Unlike the VIX index, which reflects implied volatility on the US-centric S&P 500, Semi-SDRET is globally applicable. A validity check shows a strong correlation (approximately 0.80) with VIX.

To use Semi-SDRET for M&A analysis, we calculate the metric over the 12 months preceding each deal announcement. We aggregate results at the region–industry–year level, using four regions and industry classifications based on four-digit SIC codes. Across the 1990-to-2025 sample studied, we sort values into terciles: normal, medium, and turbulent periods. This enables us to compare deal attributes—such as valuation multiples, deal volume, transaction size, and shareholder returns—across differing levels of macroeconomic uncertainty.

Over the past 25 years, Semi-SDRET has consistently spotlighted critical periods of uncertainty. (See Exhibit 1.) These have included both regionally concentrated events, such as Brexit’s European shakeup and the US–China trade tensions affecting Asia-Pacific markets, and global crises, such as the 2008–2009 financial crisis and the COVID-19 pandemic. In 2024–2025, global markets experienced another spike in uncertainty, driven by escalating tariff conflicts and heightened geopolitical risks, with Semi-SDRET exceeding long-term medians by 20% to 30% in key regions.

Although these periods complicate M&A decision making and negatively affect overall average returns from deals, historical evidence shows that times of uncertainty offer prime opportunities for value creation—if acquirers adopt disciplined approaches.

How Does Uncertainty Affect Dealmaking?

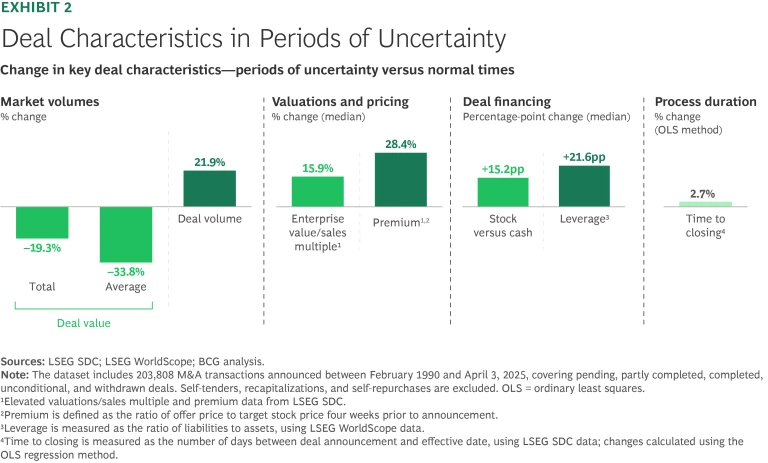

When uncertainty spikes, M&A strategies shift decisively toward risk mitigation. Executives instinctively grow cautious—but the nuances of their responses reveal that savvy dealmakers recognize these occasions as strategic opportunities. (See Exhibit 2.)

Smaller Deals, Higher Volumes. In turbulent times, average deal values plunge dramatically—down more than 34%, from $280 million to $186 million. This reflects caution amid an uncertain outlook, as few CEOs dare to embark on a headline-making deal when dark clouds are on the horizon.

Conversely, overall deal volume jumps by 27%, fueled primarily by a 70% surge in smaller transactions (less than $50 million). Adopting this “string-of-pearls” strategy of multiple small deals allows executives to deploy capital with reduced exposure.

Sector differences are pronounced. Cyclical sectors such as materials and technology see marked increases in deal activity as companies consolidate to manage volatility and seize opportunities, whereas more stable industries such as health care and consumer experience minimal change.

Stay ahead with BCG insights on M&A, transactions, and PMI

Familiarity Before Ambition. As uncertainty rises, deal makers prioritize risk avoidance over strategic diversification. Large and midsize cross-border and cross-industry deals plummet by 31% and 70%, respectively, while domestic, same-industry acquisitions surge by nearly 200%.

Elevated Valuations and Higher Premiums for Smaller Targets. Economic turbulence drives up average deal valuations significantly. Average enterprise value/sales multiples increase by almost 16%, from 1.36x to 1.58x. This reflects, in part, a selection effect as fewer lower-quality assets come to market. But targets also become more expensive: as competition for smaller assets escalates, deal premiums for small and midsize public-to-public transactions rise by around 59% (from a low level) and 28%, respectively, even as premiums on large deals remain broadly stable.

Stocks Over Cash. During uncertain periods, acquirers increasingly favor stock-based financing to preserve liquidity. Approximately 79% of equity value is paid in cash under normal economic conditions, but this figure drops to 64% during turbulent times. This trend is especially pronounced for large deals, which tend to be financed more with stocks than cash. The shift toward stock-based compensation drags down relative total shareholder return (rTSR), on average, as cash deals typically outperform stock-based transactions—a finding in line with our previous research.

The use of debt also increases, as acquirers’ leverage ratios as a percentage of total assets rise by 22 percentage points overall. The most pronounced increase is for smaller transactions. Dealmakers shore up their liquidity with the help of external financing, particularly in smaller deals for which it is often not possible to use stock as an alternative means of payment.

Longer Times to Deal Closure. Heightened risk aversion and the complexity of diligence and negotiations under uncertainty extend deal timelines. Using the average period between announcement and closing as a proxy, deals during volatile periods take, on average, from 20% (small deals) to 4% (large deals) longer to close. Although the increase for large deals may appear modest, they already take substantially more time to complete—typically three times as much as small deals. Overall, the average increase across all deal sizes is just 3% (or roughly one to two days). This reflects a negative mix effect from the strong growth in small deals and the decline in the number of large deals—with their much longer closing times.

Clearly, dealmakers naturally gravitate toward safer strategies during storms. But does playing it safe create value?

Experienced Acquirers Outperform—Again

Across deal sizes, sectors, and regions, two-year rTSRs of M&A transactions drop sharply during periods of uncertainty—falling into negative territory with a median of –0.4%. This stands in contrast to rTSR performance during actual downturns, when returns on deals tend to rise.

The ambiguous outlook during volatile times explains the differences in performance. Unlike clear-cut downturns—during which depressed valuations and expectations offer attractive buying opportunities—periods of uncertainty leave the market in limbo. Future conditions could improve rapidly or deteriorate into recession, making accurate forecasting extremely challenging. This ambiguity deters many companies from pursuing acquisitions, and it significantly depresses returns for acquirers that proceed without a clear strategy.

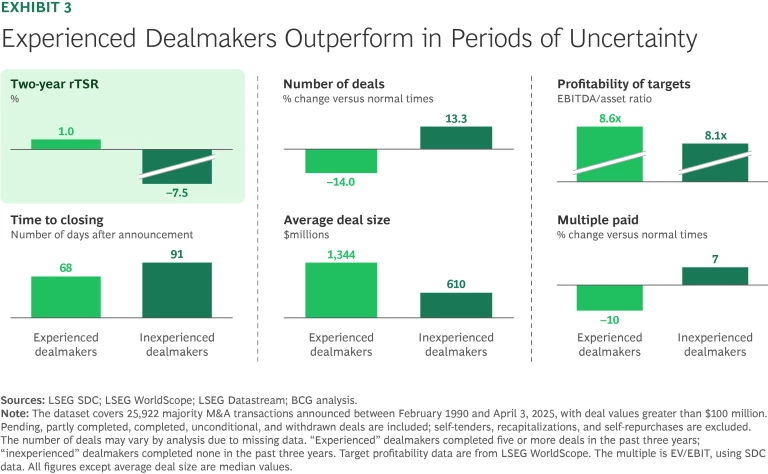

Yet within this ambiguity, a clear pattern emerges: companies with deep, institutionalized M&A experience dramatically outperform their less seasoned counterparts during periods of uncertainty. In line with our previous findings, our latest research indicates that experienced acquirers generate positive returns that are substantially higher than the negative returns realized by inexperienced acquirers. For example, in deals valued at more than $100 million, two-year rTSR is approximately 1% for experienced acquirers versus –7.5% for inexperienced acquirers. The advantage of experience is evident across all major metrics. (See Exhibit 3.)

Why the stark difference? A key success factor is the institutional muscle—within both dedicated M&A teams and the broader organization—that seasoned acquirers build over time. This embedded experience accelerates decision making, sharpens due diligence, and enables focused post-merger integration, all of which are critical to maximizing value from each transaction. Experienced companies also approach M&A with some distinctive capabilities:

- Disciplined Patience. They strategically reduce activity during uncertainty.

- Contrarian Thinking. Experienced firms pursue larger, high-quality deals when others retreat to smaller, safer acquisitions.

- Selective Targeting. They avoid weaker targets, instead focusing predominantly on robust businesses with resilient EBITDA.

- Negotiation Strength. In an environment characterized by higher prices, they can secure high-quality assets at discounted valuations.

- Efficient Execution. Their institutional expertise and streamlined processes enable them to close deals faster, despite doing larger and more complex deals.

- Clear Value Thesis. Experienced acquirers apply a disciplined approach that links corporate strategy to M&A strategy, and then to the deal-specific investment thesis and synergy potential.

- Always-on M&A Capability. They systematically review targets, build deal sourcing networks, and embed M&A into their core strategy. This permits superior deal sourcing, exclusive access to deals, and timely execution.

Replicating this success is not easy. The secret sauce of experienced acquirers is their accumulated organizational knowledge—developed deliberately over years through disciplined execution and investment in dedicated M&A capabilities. Even so, our analysis identifies specific M&A strategies or archetypes that consistently create value in uncertain environments, offering a playbook for executives seeking to confidently navigate the fog of market volatility.

The Most Effective M&A Strategies in Uncertain Times

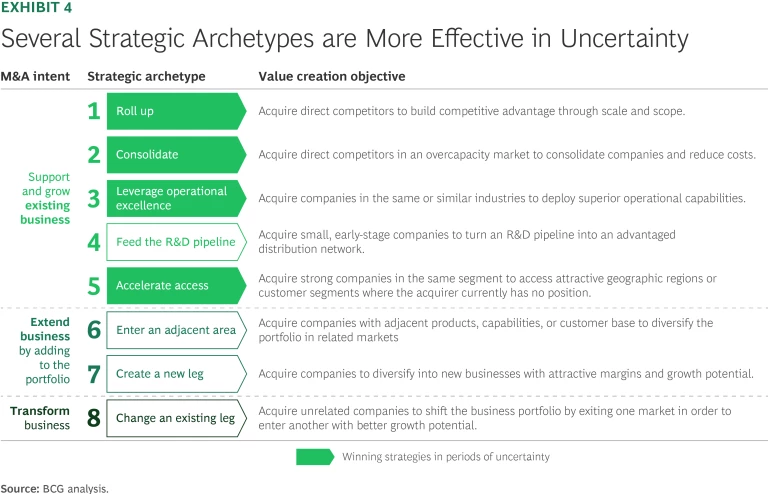

M&A serves diverse strategic purposes: accelerating growth, diversifying portfolios, acquiring capabilities, and driving transformative change. During periods of significant uncertainty, however, not all approaches are equally effective or advisable. (See Exhibit 4.)

Transformative deals may offer appealing long-term opportunities, but our research consistently shows that these transactions are particularly risky during turbulent periods. Consequently, when visibility is limited, companies should prioritize strategies that leverage their core strengths and minimize complexity. We find that three growth strategies are especially effective:

- Roll-ups and Consolidation Plays. One of the most successful approaches involves executing roll-ups—acquiring smaller, closely related companies to boost market share, realize scale efficiencies, and reduce industry overcapacity. These smaller “tuck-in” acquisitions, representing up to 1% of the acquirer’s total assets, typically generate positive median two-year rTSRs of 2.5% in uncertain times. In contrast, rTSRs on large deals representing more than 30% of the acquirer’s assets turn sharply negative. Although small deals may not dramatically shift the acquirer’s overall financial performance, they send an important qualitative signal to investors that a company is executing its M&A strategy consistently. Importantly, they also normally require only minimal integration effort and can be executed rapidly, making them accessible even to companies with limited M&A experience.

- Staying in or Near Your Core. In times of heightened uncertainty, companies should resist the allure of diversification into unfamiliar industries. Instead, staying within or adjacent to core business areas allows more effective due diligence and integration, maximizing operational synergies. Historical performance data underscores this: diversification moves often result in negative returns in periods of uncertainty, with a median rTSR of –2.8%, whereas same-industry acquisitions consistently deliver superior performance, at a median rTSR of 0.9%.

- Targeting Cross-Border Deals Close to Home. Although caution is advisable, uncertainty should not prevent companies from pursuing strategic international opportunities. Cross-border deals, particularly within familiar industries and geographic regions, consistently outperform purely domestic acquisitions. Deals within the same region (for example, Europe or Asia-Pacific) are especially attractive due to the more manageable regulatory, cultural, and operational differences involved. These targeted international acquisitions enable firms to quickly penetrate new markets—growth that would take substantially longer to achieve organically.

Five Imperatives for Dealmakers

Taken together, our analyses point to the five imperatives for navigating uncertainty effectively:

- Enhance your due diligence. Incorporate scenario planning into your diligence process to distinguish short-term volatility from long-term value drivers. De-average the target’s performance to distinguish its underlying business health and resilience from its current market position.

- Be bold—within reason. To avoid introducing unnecessary complexity, consider expanding into new markets cautiously. Stick to familiar business models to simplify integration and capitalize on operational synergies.

- Seek inherent value. Prioritize substance over appearance. Focus on solid EBITDA and resilient business models. Volatility can provide opportunities to secure premium assets at discounted valuations—capitalize on these windows.

- De-risk your financing. Lean toward equity financing, conserving cash reserves for flexibility—though potentially reducing returns. Where debt is appropriate, apply it prudently to maintain a strong, stable balance sheet capable of absorbing further shocks.

- Build institutional expertise. Experience pays off, so develop your organization’s M&A muscle early. Companies newer to M&A should explore partnerships, joint ventures, or strategic alliances as initial forays into dealmaking, reducing risk while building internal skills.

Periods of uncertainty can seem daunting, but they also offer exceptional opportunities for companies prepared to act with strategic precision. In short, successful M&A during uncertainty hinges on executing a clear strategy: consolidate your core market position through targeted acquisitions, carefully expand geographically within your comfort zone, and steer clear of overly complex or transformative moves. This disciplined, strategic approach not only mitigates risk but also can unlock significant long-term value, even when markets are at their most volatile.

The authors are grateful to Francesca Pietrogrande of BCG’s Transaction Center for her valuable insights and support in the preparation of this article.