For aerospace and defense (A&D) companies aiming to stay competitive, the urgency to capture value from AI is clear—and so is the need for strategic foresight. Most A&D firms have launched AI efforts, but many haven’t translated those investments into real value. A recent BCG survey found that 65% of A&D AI efforts are still only in the proof-of-concept phase. Only one in three is improving the business in measurable ways.

Getting better results from AI requires a different approach. Companies need to make strategic decisions about how and where they will invest in the technology. Informed by the practices already in place at top-performing organizations in A&D and other sectors, we have some practical suggestions to help A&D leaders make those decisions and scale AI for maximum impact.

Three Truths

Our work with clients points to three truths about AI investment—and what A&D companies should do differently.

1. Competitive Advantage Comes from the Top of the AI Tech Stack—Yet Most Spending Has Been Focused at the Bottom

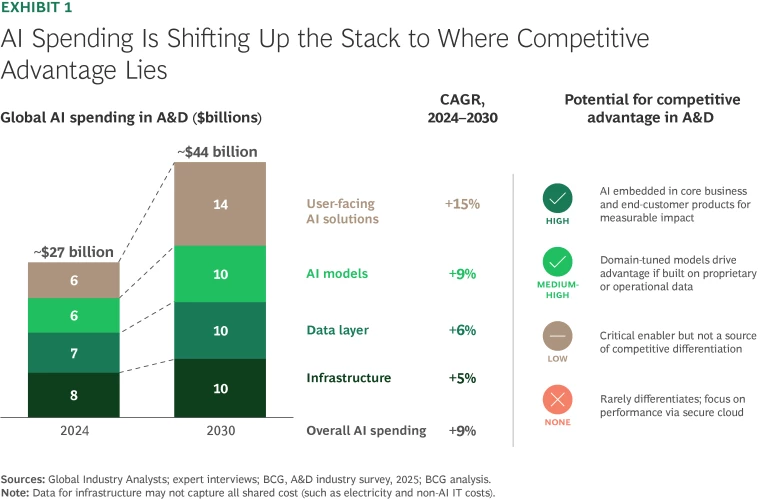

In 2024, the A&D industry spent $26.6 billion on AI, roughly 3% of total revenue. This share is expected to grow at a compound annual rate of 9%, to $44 billion, by 2030. But the real story is where spending is shifting.

The AI tech stack can be thought of in terms of layers: infrastructure is the foundation; data integration enables information to flow; models add intelligence; and user-facing AI solutions are where value is delivered. Today, over half of A&D AI spending is still concentrated in the bottom layers—in infrastructure and data integration. But that is rapidly changing. Spending on user-facing AI solutions is expected to grow at a rate of 15% between 2024 and 2030—triple the rate of spending on infrastructure—as firms shift from investing in foundations to embedding AI into core operations and products to unlock business value. (See Exhibit 1.)

Why the change? User-facing AI solutions and domain-tuned models are the only parts of the stack that create real competitive advantage for A&D companies. By contrast, infrastructure and data integration are essential, but they don’t provide a means of differentiation. With hyperscalers like Google and Microsoft doing the heavy lifting in terms of investment in efficient cloud infrastructure, A&D firms no longer need to build these elements internally to compete.

A related issue is the industry’s reliance on on-premise software, which limits a company’s ability to implement AI at scale. Across the A&D sector, only 40% of AI infrastructure currently runs in the cloud. In Europe, regulatory and data sovereignty constraints are a real concern, causing many firms to remain dependent on on-premise systems. But in the US, these barriers are self-imposed—and self-limiting.

Tech-native A&D players like Anduril already run up to 70% of AI infrastructure in the cloud. The US Department of Defense and many intelligence agencies are leveraging secure, mission-ready cloud environments—without compromising mission performance or control. Other regulated industries are making the shift, too. In health care, Epic Systems reduced security incidents by 40% after migrating to a cloud compliant with Health Insurance Portability and Accountability Act regulations to host AI solutions.

To invest more strategically in AI, A&D companies should:

- Refocus investment at the top of the stack, where user-facing AI drives mission outcomes.

- Adopt a cloud-first posture, reserving on-premise options for latency-critical edge environments.

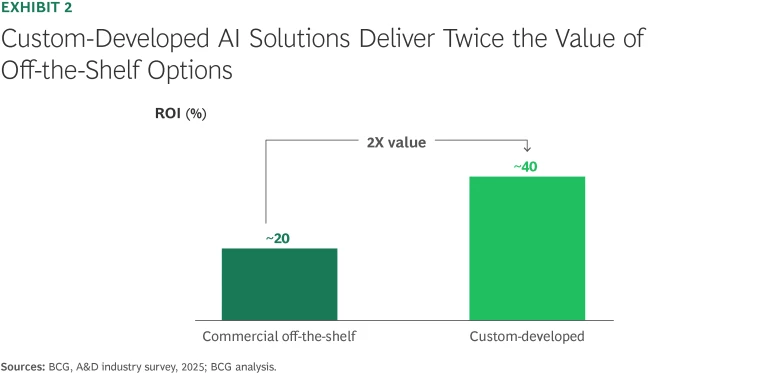

2. Custom AI Solutions Deliver Twice the Value, Yet Companies Still Buy Off-the-Shelf Systems

When investing in top-of-the-stack, user-facing AI solutions, the build-versus-buy decision is critical. A recent BCG survey of A&D leaders found that custom-built AI solutions, developed either in-house or with trusted external partners, consistently deliver twice the ROI of commercial off-the-shelf (COTS) alternatives. (See Exhibit 2.) Yet one in three A&D AI initiatives still relies on COTS options, even in core workflows.

There are cases where COTS options make sense. Support functions like finance, HR, and general IT benefit from mature, cross-industry tools. In these areas, COTS solutions can be faster and cheaper to implement, delivering results that are “good enough,” especially when lightly customized. However, as companies move closer to core business areas—like mission systems, sustainment, or customer-facing products—COTS options often fall short, requiring lengthy customization and often failing to gain traction with end users.

In contrast, custom-designing fit-for-purpose AI solutions is more likely to generate a durable advantage for several reasons:

- Designing around real workflows drives adoption. Solutions tailored to the way teams operate gain more traction and trust with end users and are more likely to deliver impact at scale.

- Tight integration with current systems and processes accelerates deployment. Custom solutions avoid the complexity and delays often experienced when generic tools are shoehorned into specialized environments.

- Designing for secure environments shortens time to value. Starting with A&D-specific security requirements in mind minimizes rework and speeds compliance.

- Focusing on mission outcomes increases ROI. Custom solutions targeted at a firm’s highest-value, domain-specific problems deliver measurable operational gains. For example, GE Aviation built a tailored, AI-driven system for predictive maintenance and reduced unplanned downtime by 30%—gains that COTS tools struggle to replicate in complex environments.

To make the right build-versus-buy decisions, A&D companies should:

- Build AI to fit the company’s unique mission, prioritizing the user-facing solutions that deliver the biggest impact.

- Focus on the handful of solutions where AI can measurably move the needle on core operations or mission outcomes.

Stay ahead with BCG insights on industrial goods

3. A&D Builds Large Internal AI Teams, While Other Industries Scale Smarter

In our survey, 80% of A&D firms reported that they are building internal AI teams that are up to three times larger than the teams found in comparable industries like automotive. This push is understandable, but it often outpaces firms’ ability to attract and retain the talent needed to succeed. Seventy percent of A&D companies cite AI recruitment as a core challenge. Even when these teams are in place, the pace of change in AI demands constant upskilling, making it hard to maintain momentum. The result: high cost, low retention, and limited ability to scale AI effectively.

In response, many firms end up augmenting their internal workforce with substantial investments in AI development platforms, such as those offered by Palantir, DataRobot, C3.ai, or Databricks. This often pulls dollars down the stack and compounds costs by locking in external vendors.

Meanwhile, leaders in other sectors are scaling smarter. At Stanley Black & Decker, 80% of AI use cases were built through a focused internal center of excellence, complemented by external partners with deep expertise and flexible capacity. External partners can deliver technical expertise in specific skills, without increasing headcount over the long term. A&D can adopt a similar model: lean internal teams focused on governance and core IP, scaled with the help of trusted partners for delivery and speed.

To avoid the issue of building and retaining large internal AI teams, A&D companies should:

- Have an AI workforce strategy. Clearly define the roles needed to be filled, and plan to recruit, retain, and develop those employees over time.

- Leverage trusted partners to move fast, reduce risk, and access hard-to-hire talent.

- Avoid propping up underperforming teams with expensive platforms. Development tools don’t create value without focus and execution.

The Path Forward Starts with a Redefined Focus

A&D’s AI challenge isn’t ambition, it’s focus. Too much investment is tied up in infrastructure, off-the-shelf offerings, and internal team build-outs that don’t deliver impact—three critical missteps that limit value.

To optimize their AI investments and strategy, the most effective A&D leaders are talking to operators and experts, learning from what has worked (and what hasn’t), and then moving fast on a few high-priority AI use cases that solve a real operational need. By shifting focus to where AI truly creates value—at the top of the stack, in custom solutions that serve real mission needs and are supported by right-sized internal teams and external partners—A&D leaders can unlock the transformative impact of AI at scale.