The past few years have been challenging for shippers and logistics providers—the carriers and third-party logistics companies (3PLs) that manage and execute the transportation of the goods. Regional conflicts are disrupting established trade and freight corridors, forcing companies to identify alternative routes and solutions. Rising trade tensions are transforming old economic ties and shaping new global economic clusters. Meanwhile, technology is fundamentally altering the entire industry. The result: a substantially changed landscape for companies on both sides of the supply chain relationship.

To better understand the new environment that these companies face and how they are adapting, BCG recently partnered with Alpega—a leading software player that offers end-to-end logistics services, including transport management services and freight exchanges—to conduct an in-depth survey of shippers and logistics providers. (See the sidebar, “Survey Demographics.”)

Survey Demographics

Respondents at logistics providers included 83 experts from logistics services ranging from contract logistics and freight forwarding to trucking, ocean, and air carriers. The survey captured views from logistics companies operating at national, regional, and global scales, with a balance of small (less than $10 million in revenues), medium-size ($10 million to $100 million), and large (more than $100 million) companies represented.

Respondents among shippers included 63 leaders of both smaller players with limited logistics spending and large multinationals that manage complex, multimodal logistics. The sample consisted of a healthy mix of companies using ocean, air, and overland freight, yielding a well-rounded view of shipping realities across both modes and regions.

Five takeaways from the survey results stood out as key issues of shippers and logistics providers:

- Nearly 80% of the shippers in our survey reported cost increases from tariffs and duties.

- Almost 70% of shippers hope to cut shipping costs, and contract renegotiation is their primary lever.

- Nearly half of the logistics companies in our survey are already adapting operations to the nearshoring trend in response to geopolitical uncertainty, whereas only 16% of shippers report concrete nearshoring actions.

- Logistics companies see GenAI as the most transformative force in the industry, even though just one in ten respondents have deployed it.

- Although European logistics providers talk green, shippers still vote with their wallets.

In this article, we examine how shippers and logistics providers are developing strategies to deal with increased geopolitical tensions, supply chain shifts, and rising costs.

Freight Rates and Geopolitics Are Dominant Concerns for Both Shippers and Logistics Providers

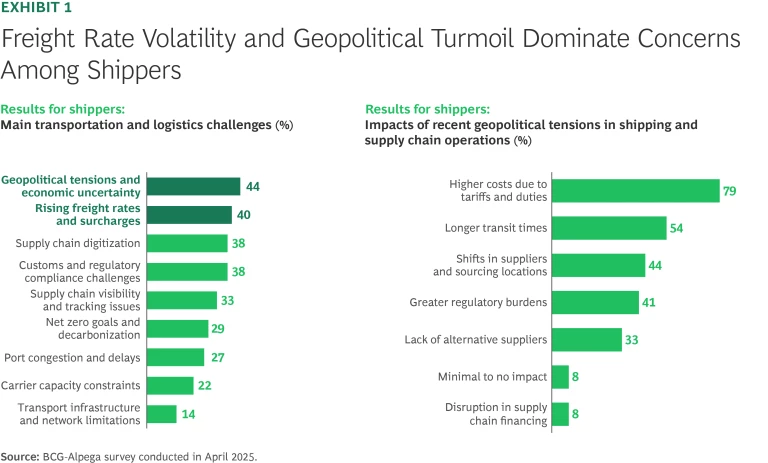

The volatility of freight rates and ongoing geopolitical turmoil are key concerns for both shippers and logistics providers. On the one hand, shippers face persistent disruptions driven by rising costs, challenges in trade compliance, and sudden shifts in how and where to source goods. Nearly 80% of shippers in our survey reported cost increases from tariffs and duties, and more than 50% cite longer transit times. (See Exhibit 1.)

Among all shipping modes, ocean shippers are more likely to be affected by increased costs (83%) and longer transit times (67%) than air and overland shippers. Small and medium spenders on logistics services appear to be particularly exposed to sourcing vulnerabilities and regulatory burdens.

To manage the disruption, 62% of shippers are increasing their inventory buffers, while 60% are diversifying the range of materials, parts, and components suppliers that they work with. Big-spending shippers are most open to trying to secure long-term logistics contracts, while medium-size companies are most likely to explore shifts in shipping mode. Ocean shippers emphasize redundancy in logistics suppliers, whereas air shippers lead in shifting transport modes and investing in digital capabilities.

Logistics providers agree that disruption is widespread, but the intensity of their reactions varies depending on their size, region, and logistics segment. Rate volatility is the top concern overall, and particularly in Europe. In contrast, North American providers cite geopolitical uncertainty and trade tensions as their most pressing challenge. Concerns about geopolitical tension are especially high among global players (60%). The biggest source of geopolitical tensions is the shift in trade lanes and routing strategies, a particular concern among large global 3PLs.

To manage disruptions, 3PLs engage in the widest range of tactical shifts. The most common option is to review partnerships with alternative carriers and suppliers, cited by 58% of respondents, followed by pricing strategies (55%) and cost efficiencies (32%). This indicates a balanced focus on agility, collaboration, and operational resilience. Forwarders prefer strategic diversification and partnerships: 70% are looking to diversify services and routes, and 55% want to strengthen partnerships, a reflection of their role as network orchestrators in a volatile environment. Carriers are prioritizing automation and internal cost control, moves that reflect their fixed-asset-heavy models.

Cost Pressures Boost Contract Renegotiation

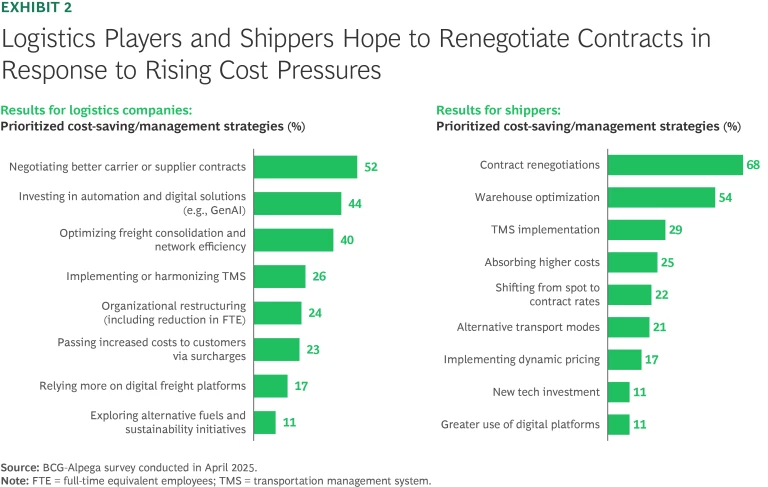

Cost pressures brought on by the current disruptions in trade and geopolitics are affecting both logistics providers and shippers. In response, 68% of shippers say that they are looking to renegotiate their freight contracts, and 54% plan to cut costs by optimizing their warehouses. (See Exhibit 2.) Larger shipping spenders are more than twice as likely as medium-size and small companies to adopt transportation management systems to drive efficiency and resilience.

Depending on the kinds of services they offer, logistics providers are responding to increased cost pressure in several ways besides contract renegotiation. Many are revising their pricing strategies, especially in North America, where more than half say they are adopting dynamic pricing. 3PLs say that they are also investing in automation, consolidation, and partnerships, while freight forwarders are relying heavily on commercial levers, notably supplier negotiations (80%) and route diversification (70%). For their part, carriers are relying less on flexible contracting and instead turning their focus inward, with 48% emphasizing automation and 39% looking to optimize their route networks.

Stay ahead with BCG insights on transportation and logistics

Nearshoring Is Top of Mind

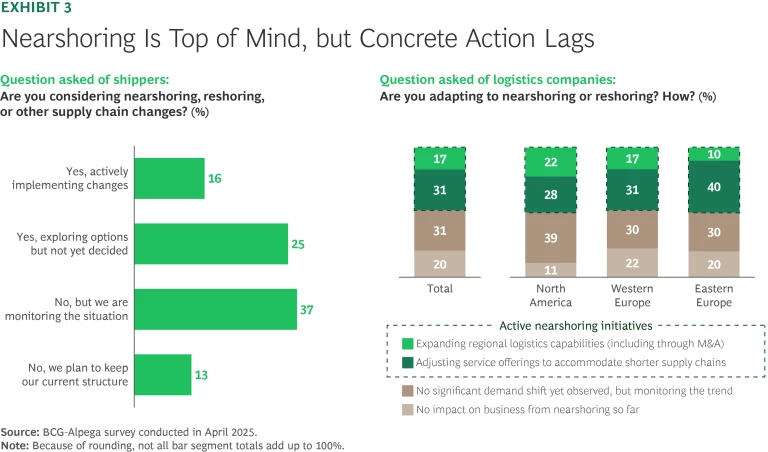

In response to geopolitical uncertainty, nearly half of logistics providers surveyed are boost their nearshoring actions, including adjusting service offerings and expanding regional capabilities. (See Exhibit 3.) In part, their expansion efforts are a reaction to discussions among their shipping clients about opening new routes and markets, and expanding their footprint to new countries. Seizing nearshoring opportunities is a critical key to growth for logistics providers. Such opportunities can offer them better market conditions—including less competition, more premium products, and better rates—than they might find in established regions. And many new markets have relatively low barriers to entry, particularly in cases involving expansion through acquisition of local established players.

In sharp contrast, just 16% of shippers report having taken concrete nearshoring actions, reflecting a more cautious approach to the current geopolitical situation. Still, another 35% say that they are reassessing their nearshoring options. Air freight users and large spenders indicate the greatest interest in shifting to nearshoring and risk mitigation.

GenAI Adoption Lags Behind GenAI Potential

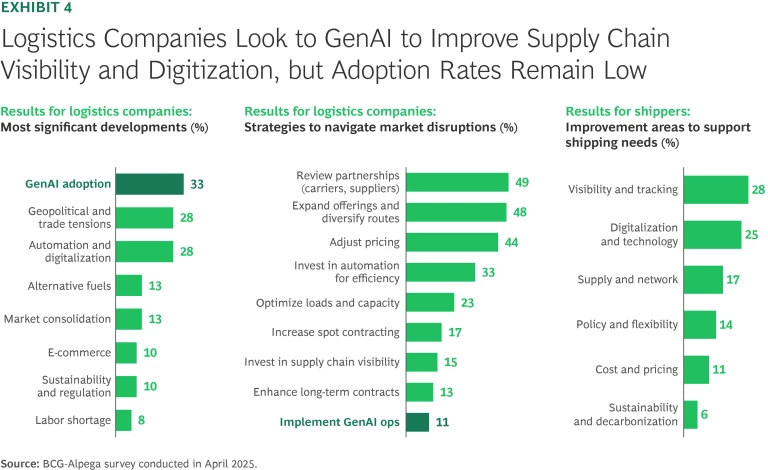

Logistics providers see GenAI as the most transformative force in the industry today, ranking it as their top innovation priority and viewing it as having the greatest potential to reshape operations. (See Exhibit 4.) So far, however, just one in ten providers have begun deploying GenAI to help overcome current market disruptions.

Regional providers express the strongest enthusiasm, as 57% identify GenAI as their top expected disruptor, but few have begun deploying it. Global players are more cautious, prioritizing geopolitical and structural risks over emerging technologies. Overall, 3PLs are the most advanced in digital adoption, though their GenAI usage is still in its early stages.

Despite citing GenAI as a key future force, carriers remain largely focused on automation and internal efficiency rather than on AI. These differences suggest that while belief in GenAI’s potential is widespread, each company’s scale, operating model, and digital maturity continue to shape actual investment.

GenAI could be especially helpful in improving certain areas of particular concern to shippers. Across the board, shippers are calling for better visibility and digitization in logistics operations, highlighting a shared demand for greater transparency, smarter systems, and real-time tracking. Specific priorities vary by company profile, however.

Small shippers overwhelmingly point to visibility as their top improvement area, underscoring the need for faster communication, greater transparency into logistics providers’ activities, and a more seamless customer experience when working with logistics providers. Large shippers, on the other hand, are more focused on broader digitization initiatives—no surprise, given their more complex networks and automation ambitions. Meanwhile, medium-size shippers maintain a balanced set of priorities, emphasizing technology, network reliability, and sourcing flexibility. As is the case with carriers, the contrasts among shippers reveal that while the digital imperative is universal, a company’s specific improvement goals reflect its size, complexity, and stage of digital maturity.

Logistics Providers Are More Committed to Sustainability Than Shippers

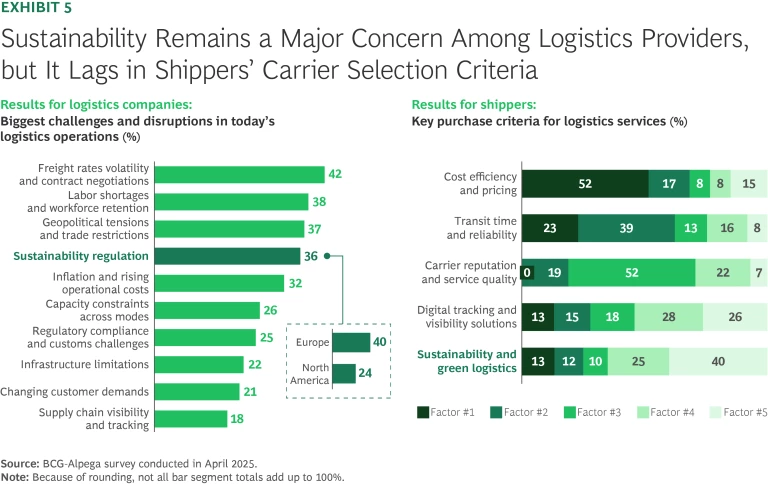

Sustainability has emerged as a strategic priority for many logistics providers, particularly in Europe, where about 40% in our survey rank environmental regulation among their top concerns. (See Exhibit 5.) That’s not much lower than percentages for other top concerns, including freight rates and trade issues. Although the pace of implementation remains slow, this level of interest presents a significant opportunity. Few providers have yet to fully integrate environmental sustainability into their cost structures and investment decisions, indicating substantial room for leadership and innovation. Only 12% of European and 7% of North American providers currently view sustainability as a major disruptive force over the next few years, suggesting that there is untapped potential for first movers to differentiate themselves in a changing landscape.

Meanwhile, shippers, despite regularly communicating about their environmental sustainability goals, have considerably more work to do to incorporate those goals into their procurement criteria. Just 13% identify sustainability as a top priority in selecting carriers, and just 6% cite it as a top area for industry improvement. Cost, reliability, and digital visibility consistently outrank green metrics across all types of shippers. This presents a valuable opportunity for providers to educate and collaborate with shippers, demonstrating to them how sustainable practices can align with and enhance traditional priorities.

Bridging the gap between logistics providers’ sustainability ambitions and shippers’ current expectations will require a combination of increased regulation and innovative commercial models. Logistics providers who embed sustainability into their operations in a way that delivers measurable value—in the form of cost efficiencies, reliability gains, or digital transparency, for example—can help shape shippers’ procurement decisions and redefine industry standards. The momentum for such change is building; companies that act now will position themselves to lead the transition to a more sustainable and resilient supply chain future.

A Joint Agenda for the Next Phase of Logistics

Each of the five themes discussed above points to a significant gap between the concerns and goals of shippers and those of their logistics providers. At a time when disruptions in trade and geopolitics are profoundly affecting the logistics industry, both sides of the logistics equation would do well to work more closely together to their mutual benefit.

To that end, companies should take action toward six goals:

- Co-design creative strategic and resilience levers without waiting for the next shock. To bypass chokepoints and reduce exposure to tariffs and compliance burdens, shippers and logistics providers should jointly explore nontraditional resilience tactics such as bonded warehousing, multiport entry strategies, and neutral logistics hubs. In parallel, they should prioritize joint strategic and tactical planning, with a focus on smarter orchestration, including shared control towers that enable preemptive, coordinated action.

- Bridge the nearshoring execution gap. Shippers and logistics providers should work collaboratively to align their nearshoring roadmaps. Shippers could share any forecasted route shifts with their providers at an early stage, and logistics firms could make shippers aware of any changes in their network plans and capabilities.

- Don’t just watch GenAI—start piloting now. Begin with low-risk GenAI pilots that deliver quick returns—for example, automated carrier matching, estimated time of arrival forecasting, and routing adjustments. Then consider experimenting with GenAI to streamline supply chain communications and automate customer interactions from inquiry to booking. Scaling these capabilities over time can unlock significant cost and productivity gains.

- Make cost optimization a shared strategic discipline. Move from transactional negotiations to joint cost efficiency programs, including win-win levers such as shared warehousing, backhaul optimization, and smarter route planning.

- Pursue operational excellence to improve resilience, not just to lower costs. Resilience and efficiency aren’t tradeoffs; they reinforce each other when planned together. Shift from firefighting alone to improving operational design collaboratively. Co-invest in route optimization, shared visibility platforms, modular warehouse setups, and smart automation.

- Treat sustainability as an operating mandate, not just a marketing slogan. Logistics providers must embed sustainability into their operations, prioritizing the highest-impact levers, including optimized routing, improved cargo consolidation, greener transport modes, and greater carbon visibility. Besides reducing emissions, these actions can help drive operational resilience (through better asset utilization, for example), cost efficiencies (such as lower fuel costs), and long-term customer trust. Shippers should make sustainability a core part of their procurement criteria to meet their own sustainability goals, to reduce long-term supply chain risks, and to align with logistics providers who are innovating for efficiency and transparency. When treated as a performance driver, sustainability can become a shared source of competitive edge—not just a communications talking point.

Conclusion

Shippers and their logistics providers operate at ground zero of the issues currently disrupting global trade. Tariff disputes and geopolitical conflicts bear directly on how they conduct business, and the resulting high levels of uncertainty make it difficult for them to develop strategies for the future.

The results of this survey reveal their concerns about how to respond to the current situation and indicate that while shippers and logistics providers face similar challenges, they appear to be responding to them in different ways.

But in unity there is strength. Shippers and their logistics providers will be best able to meet current and future challenges by identifying their common goals and working together to fulfill them.