After experiencing a boom during the pandemic years, the US freight transportation and logistics industry has been mired in a recession. Facing softer freight rates and volumes coupled with rising costs, the squeeze in freight transportation has been well documented. Higher tariffs introduced in early 2025 and ongoing geopolitical tensions have placed further pressure on transportation and logistics companies.

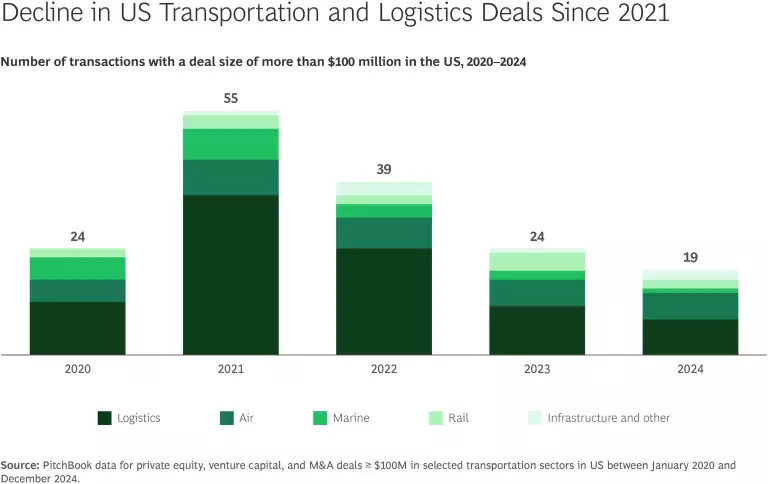

In the face of such challenges, US transactions activity in the sector has declined steadily since 2021. From a peak of more than 50 deals with a size of over $100 million, transactions have dwindled to fewer than 20 deals of that size in 2024. (See the exhibit.) This muted activity has continued thus far in 2025. Potential sellers and buyers have been more cautious. Sellers have been less active, electing to hold onto assets longer while hoping for a return to stronger freight conditions and better valuations. Buyers, particularly corporate ones, have faced a funding crunch from softer top-line performance and increased costs, including wages, equipment, insurance, and technology. Taken together, these challenges have slowed the transportation transactions environment––a trend also seen in the broader global market, where deals activity continues to be slower compared with that of 2021-2022.

From a peak of more than 50 deals with a size of over $100 million, transactions have dwindled to fewer than 20 deals of that size in 2024.

Yet the current freight market still presents opportunities for private equity investors and corporate development teams. A number of key themes are shaping decision making that enable players to uncover value either insulated from––or benefiting from––broader market challenges.

Finding Value in a Turbulent Environment

Private equity investors are finding value in several key areas, particularly in assets that:

- are insulated from freight cyclicality;

- drive fleet efficiency and cost reduction to alleviate the freight transportation squeeze; or

- participate in specialty logistics and related segments.

Insulated Companies. Given the freight environment and tariffs, investors are taking a close look at transportation segments that offer insulation from volatility.

[Some] businesses have reliable, recurring revenues, with pricing linked more closely to inflation than the ebb and flow of freight rates.

Illustrative investment areas include:

- Assets with exposure to stable end-markets, such as food and energy, which show resilience in softer economic conditions. Examples of logistics subsectors include contract logistics assets that handle food and beverage products and short-line rail players that ship essentials such as energy and agriculture. In addition, these segments are often indexed toward domestic transportation lanes rather than international ocean and air trade routes, thus providing insulation from tariff volatility or supply chain disruptions.

- Logistics businesses, often technology companies, which are not exposed to freight rates and instead have revenue tied in varying degrees to underlying volumes. Maritime software is a good example, where revenue is linked to a ship’s number of port calls rather than sea freight rates (this is also less volatile than revenue linked to container volumes, which typically vary more than the number of ship voyages). Similarly, the average contract value of an over-the-road freight logistics technology company can be linked to volumes within a “tier,” or range, rather than to specific daily activity and freight rates. As a result, these businesses have reliable, recurring revenues, with pricing linked more closely to inflation than the ebb and flow of freight rates that shift with supply and demand, tariff news, or geopolitical developments.

- Transportation companies with mechanisms to protect against volatility, such as longer-term contracts. These contracts may include volume commitments or minimums, or pass-through clauses for underlying costs. They may be structured so that only a portion of the business is up for renegotiation each year. Logistics businesses with these types of characteristics include dedicated contract carriage and fleet leasing.

- Businesses with asset intensity, which can create downside protection if cash flows decrease with market conditions as well as structural barriers that support pricing stability. For example, asset-heavier leasing businesses provide investors with downside protection via liquidation value, while less-than-truckload freight maintains greater price stability due to higher barriers to entry. This hub-and-spoke business model has a complex physical network compared with point-to-point truckload.

Asset-heavier leasing businesses provide investors with downside protection via liquidation value.

Enablers of Efficiency and Cost Reduction. With the ongoing squeeze in freight transportation, logistics businesses are seeking ways to improve profitability through cost management and fleet efficiency, creating opportunities for investors.

Illustrative investment areas include:

- Services that help transportation companies streamline operations. These solutions mitigate rising costs by optimizing routing and asset management, reducing maintenance costs, improving labor efficiency, and reducing fuel usage. Examples of subsectors include fleet software and outsourced mobile maintenance and fleet services.

- Technology that mitigates the rising risk of cargo theft, accidents and injuries, and increased insurance costs. Specifically, nuclear verdicts of $10 million or more continue to plague the trucking industry. Technology that mitigates this risk—saving both lives and costs––continues to be a core investment area for transportation companies and a good bet for investors. Solutions include safety and telematics technology, trailer and freight tracking tools, and carrier identity software.

Specialty Logistics and Related Segments. While a recent BCG survey found that nearly 70% of shippers are pursuing price reductions with their logistics providers to offset tariffs, shippers in specialty and high-value sectors are often less price sensitive. Strong execution and service level agreement performance typically outweigh haggling over price. As a result, these segments have proven attractive targets for investors.

Illustrative investment areas include:

- Logistics and supporting services for higher-value goods, where transportation cost as a percentage of revenue is lower on a relative basis; and cold-chain logistics, which has specialized needs.

- Segments for which the cost of failure far outweighs incremental logistics costs, allowing service providers to charge a premium for expertise.Businesses that share these characteristics include: customs brokerage––where failure means getting stuck at the border, a particularly costly delay for just-in-time supply chains; and rail services––where failure can affect safety, a critical metric for the industry.

Capitalizing on Market Softness with Corporate M&A

From the perspective of corporate development in transportation, the softer freight environment gives market leaders the opportunity to strengthen their position and capitalize on the broader challenges facing the industry. In particular, as market laggards feel the revenue and cost pinch, leaders can deploy mergers and acquisitions to build their position in the core, expand geographically, grow into adjacencies, and build new capabilities.

The softer freight environment gives market leaders the opportunity to strengthen their position and capitalize on the broader challenges facing the industry.

Grow scale in the core. Deploy M&A to take advantage of cost synergies in areas such as procurement and operations, while improving network efficiency, density, and asset utilization. Recent examples include Schneider’s acquisition of Cowan Systems and RXO’s acquisition of Coyote Logistics.

Expand geographically. Leverage an acquisition to expand the company’s footprint into new geographies, enabling companies to meet current customers’ needs more comprehensively while gaining access to new customers in different regions. A recent example is Lineage’s acquisition of ColdPoint Logistics.

Expand into adjacent products or capabilities. Use M&A to expand the product portfolio into a broader, bundled solution to monetize existing customer relationships through cross-selling, while creating the opportunity to offer existing products to a new set of customers. Additionally, M&A can enable transportation businesses to acquire a new set of capabilities rather than building organically. A recent example is Kenan Advantage Group’s acquisition of XBL to build capabilities in dry bulk.

Although recent transactions in transportation and logistics haven’t matched the deal activity from the pandemic era, the softer market offers opportunities for private equity investors and corporate development teams alike. With the right investment thesis and vision for value creation, investors can seize the opportunity in this uncertain time.