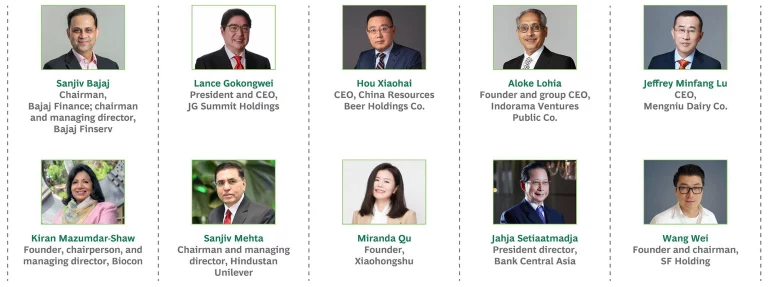

Introducing Ten Asian Leaders

Asia’s rise since 2000 has been one of the amazing economic stories of the 21st century. At the start of the century, China was a $1.2 trillion economy; if you combined China with India and Indonesia, you still had a GDP that was less than a tenth of the G7’s. Today, the GDP of China alone is close to $15 trillion, and India and the countries of Southeast Asia have vaulted to much higher positions among world economies.

Other, equally dramatic data points underscore the point. In 2000, only 1 in every 20 Fortune 500 companies was based in Asia, and only one of every nine patents granted globally was to an Asian company. (These data points exclude Japan.) And it would have been impossible to calculate the Western-to-Asian ratio of unicorns—a proxy for the dynamism of a region’s startup sector—because Asia had no unicorns. Today, Mainland China alone has more companies than the US in the Fortune 500. Emerging Asia (China, India, and Southeast Asia) has many companies growing much faster than Western companies. And Asia is home to one-third of the world’s unicorns.

These are the headline statistics that people see and that signal a shift in the traditional order. But with earlier structures still in place—including the domination of global media by Western companies and English’s status as the lingua franca of the world—a deeper picture of Asian businesses hasn’t really emerged.

In this article, we set out to bridge this information gap. As part of a wide-ranging research project, we present the perspectives of ten Asian executives who exemplify the region’s leadership approaches. We also discuss five characteristics commonly demonstrated by successful Asian business leaders (including some traits that have benefited their companies during the pandemic). Our hope is that business leaders all over the world will benefit from our research, with Asian executives getting some insights into the approaches used by their most successful peers and Western executives gaining insights to help them perform better in markets that are very different from their own. (See “Study Methodology.”)

Study Methodology

To avoid the differential effects of the pandemic on sectors, we used December 2019 as an endpoint for most of the financial analyses in this report. (Where we used a different time frame, we’ve noted it.)

The financial analyses were all done in US dollar terms.

Asia’s Unique Context

To understand Asian business leaders, one has to understand the context in which they operate.

The first point to keep in mind is Asia’s colonial and semicolonial history. Many Asian countries emerged from foreign political rule only recently—in the last half century. They are still evolving. And their laws and business structures can change suddenly, depending on the prevailing geopolitics and on which lobbying groups have the most power.

Other factors contribute to Asia’s unique business context: the ubiquity of state-owned businesses, the likelihood that large businesses are family owned, and the larger influence of state and family on the individual than is typical in other parts of the world. Following is a little more on each.

Colonialism and Semicolonialism. Many Asian countries earned their independence through resistance and protest and have had to work to change institutional structures and laws that are rooted in the colonial past. Even today, leadership shifts and political factionalism can lead to policy changes that disrupt business and force industries to adjust on the fly.

State Influence. Asian businesses tend to operate in countries where governments have a large say in the functioning of the business sector. In some cases, indeed, a particularly “activist” state can have almost as big an impact on outcomes as market forces have. Businesses must therefore remain sensitive to politics, navigating changes and endeavoring to coexist with the state.

Family Businesses. Another unique aspect of the Asian business world is the prevalence of family-owned and -operated businesses. Family-owned businesses can avoid some of the pressures other companies face for immediate returns and cash flows. Because majority voting rights are held by family members, these companies can make decisions and set strategy with a longer-term time horizon. In India alone, 300 of the 500 largest companies by revenue are family owned and are thus in this situation.

Social Norms. In Asia, family and societal bonds are never far from individuals’ minds and have a strong influence on people’s behavior. For this reason, business decisions tend to be less transactional and made with a longer-term view in Asia than in the West.

A Multistakeholder Definition of Success

Asia’s distinct context creates unique conditions and ways in which leaders must build their organizations. It also influences how they define success.

As in the West, revenue growth and profitability matter in Asia. So do shareholder returns. Indeed, these are relevant measures of company performance all over the world. But they are not enough in Asia, where more stakeholders must be factored into decisions.

The most obvious “extra” stakeholder that matters in Asia is the state. There are also interest groups and civil society elements that wield a lot of power. For family-owned businesses, the complexities multiply.

Historically, Western businesses have been freer to focus the bulk of their attention on financial shareholders and to worry less about other stakeholders. This is changing as Western companies rethink the responsibilities they have—to their employees, to the communities in which they operate, and to the environment. As business leaders around the world increasingly become more multistakeholder in their thinking, they may turn to Asia for examples of how to do it.

Five Characteristics of Successful Asian Executives

In our conversations with Asian business leaders, we identified five characteristics that have played a part in their careers and helped them steer their companies to success. (See the exhibit.) Here’s a look at those characteristics and how different leaders embody them.

They take a long-term view. The best business leaders in Asia always look beyond quarterly results. This doesn’t mean that their companies don’t push hard for every yuan and crore of profit they can find. However, the more important objective is to win in the medium and long term.

As Sanjiv Bajaj of Bajaj Finance, one of India’s largest and most profitable financial companies, puts it, “If there is a short-term opportunity that doesn’t get in the way of where you need to be in the end, go ahead and get it. But if it conflicts with where you’re headed in the long term, step away.” Maintaining that discipline, he adds, “is often easier said than done.”

The top Asian leaders position their companies for success after they have moved on. “You shouldn’t look at a CEO’s performance only during his or her tenure,” says Sanjiv Mehta, chairman and managing director of Hindustan Unilever, Asia’s largest household product company based on market capitalization. “It’s also important how the CEO has reinvented or reimagined the organization for the future.”

Yet another perspective on the idea of long-term thinking—one that reflects an awareness of social responsibilities—comes from Wang Wei, founder of the Chinese courier service SF Holding. During the pandemic, Wang—seeing a chance to give back—mobilized SF’s resources to support disease containment. Wang believes that companies get the benefits of growth, reputation, and shareholder gains (what he calls the “results”) only when they focus on essential value creation (the “purpose”). “If a company focuses only on the results and ignores its purpose,” he says, “its efforts will be in vain.”

They institutionalize an owner mindset. A long-term mindset isn’t something that a business leader can ensure on his or her own. Some key decisions inevitably get made outside the CEO’s line of sight. The business leaders we spoke to recognize this, and they use financial incentives and other tactics to get managers and employees to think as they do. They “delegate to the edge,” as Unilever’s Mehta puts it, minimizing overhead and encouraging risk taking while emphasizing the importance of accepting responsibility. In effect, these Asian executives are institutionalizing an owner’s mindset.

Consider the actions taken by Mengniu Dairy’s Jeffrey Minfang Lu after he was appointed CEO of the company in 2016. Lu put an end to the company’s centralized structure, which was seen as partly responsible for Mengniu’s struggles at the time, and returned decision-making authority to Mengniu’s business units. He also increased the financial incentives for managers in nonexecutive positions. A profit-sharing system that had previously set aside two-thirds of rewards for the top management team was rethought. With the new incentive scheme, Lu says, “the salaries of frontline employees have doubled and managerial salaries have tripled.”

“Our regional managers all know that if they work hard, they will be rewarded,” Lu says.

Decentralization has also helped JG Summit Holdings remain on a growth path. Lance Gokongwei, president and CEO of the family-run company, which is one of the largest enterprises in the Philippines, says empowering the organization has enabled JG to foster a culture of entrepreneurialism. “You can’t have a command and control organization if you want to grow really large,” he says. “People have to feel like they are running their own business.”

They have a strong people orientation. Asian companies have many talent challenges. To start with, the region’s rapid growth has led to an extremely high level of demand for workers. Second, the types of workers who are needed are in limited supply—talented workforces don’t spring from nowhere, and these are still regions with low per capita incomes and education levels. Businesses must make an investment in developing the skills of those they hire. As for “branded talent”—people who have learned their skills at organizations whose excellence and standards are universally acknowledged—those who have such backgrounds in Asia are in high demand. That makes them expensive and hard to keep.

On top of all this, some of the most talented people still leave Asia for the West, drawn elsewhere despite Asia’s skyrocketing opportunities.

So it’s not surprising that many of Asia’s top business leaders make a point of being personally involved in the recruitment and development of employees.

For Hou Xiaohai, CEO of China Resources Beer, recruitment is so important that he sometimes inserts himself into the screening process for candidates at the N-3 and N-4 levels, several rungs below him. While headhunters can provide an initial picture of an applicant’s qualifications—relaying a person’s educational background and work experience—they can’t make an assessment of how well suited a candidate is to a position CR Beer is trying to fill, Hou points out. “No candidate is perfect,” he says. So he meets with many people directly—assessing intangibles like a job candidate’s attitude, temperament, working style, and modes of personal interaction.

For people already on board, Hou says, CR Beer provides support, tries to engender trust, and helps them improve in areas where they’re weak. “Criticizing your team rarely solves problems,” he notes. “Mentorship is a better way to get them on track.”

Jahja Setiaatmadja, president director of Indonesia’s Bank Central Asia, the largest bank in Southeast Asia, agrees that positive encouragement is usually better than criticism. The important thing, Setiaatmadja says, is to “gain the heart of your employees.” In Asia, he adds, people will “give their all” if they trust and feel loyal to a business leader.

Consequently, Setiaatmadja has tried to create an environment at BCA where employees feel valued. Teamwork is encouraged, and people aren’t pitted against each other. Setiaatmadja values profits, but he says his focus is on the company’s people and culture in order to make sure BCA retains top talent. His efforts seem to be working. BCA has low attrition rates and is recognized as one of the world’s top employers. It also has an excellent record of total shareholder returns.

They effectively navigate their ecosystems. Business leaders all over the world must manage ecosystems. In Asia, those ecosystems include the government—whether at the national, regional, or local level—nongovernmental organizations, and labor unions. The ecosystems in Asia also include suppliers and distributors, which companies must take into consideration even when it’s not in their immediate financial interest to do so.

In the early months of the pandemic, for instance, dairy company Mengniu had to make a snap decision about whether to keep buying milk from its suppliers and extending credit to those it was working with. CEO Lu did so despite a high probability that some inventory would spoil and that Mengniu would suffer losses. Lu’s support for his suppliers paid off later in 2020 when China’s dairy market came roaring back.

Whether it’s an issue with suppliers, a set of regulatory demands, or a scarce natural resource, external forces in Asia can impede a company’s progress. These barriers can create peril for companies that are otherwise robust and well organized.

As the head of a technology-dependent company in a highly regulated industry, Aloke Lohia knows all about external barriers. The Bangkok-based chemical company he founded, Indorama Ventures, is the world’s largest producer of PET polymers. Instead of recruiting only from local research labs and universities, he encourages his teams to compete for the best talent they can find globally. And Lohia has pushed Indorama to get out in front of regulations. “Our commitment to environmental sustainability and social responsibility is significant,” Lohia says. “We use this in our differentiation.”

In the case of Kiran Mazumdar-Shaw, the external reality she needs to keep in mind is also a regulatory one—with the added challenge of an ingrained perceptual bias. Mazumdar-Shaw is the founder of Biocon, an India-based biopharmaceutical company that has succeeded in marketing its biosimilars not just in India but in the most developed markets in the world. “I am trying to bust the myth that Indian quality is not good enough for global markets,” Mazumdar-Shaw says. The bets she has made have required her to navigate health care and regulatory ecosystems in places like the US, whose institutions are very different from India’s. The skill with which Biocon has done this is evident in the success of the company, which is now among Asia’s largest biotech players.

They demonstrate a fierce agility and an ability to survive and thrive. Agility is an important characteristic of successful businesses everywhere. But it is especially crucial in Asia, because of the region’s exponential growth rate. It’s not just China’s economy that has raced forward since the turn of the century—the economies of India, South Korea, Indonesia, and much of Southeast Asia have surged, too. In the face of this growth, Asian executives can’t rely on past experience to guide them. They have to tap into a different type of insight—one born of their imaginations.

“We used to make a strategic plan, put it in a nice binder, and send it to corporate headquarters in London,” says Mehta of Hindustan Unilever. “For the next three years it was very placid waters.” The pandemic has highlighted the limits of that practice. But even if the pandemic had not emerged, Mehta says, his company would now be treating the planning it does as provisional. A leader today has to be able to pivot, he says—to reimagine and reinvent himself. “If you don’t, you will not be able to survive for very long.”

That could practically be a mantra for Biocon’s Mazumdar-Shaw. Initially, she did not get the job she wanted. But, eventually, she got connected with an Irish entrepreneur who wanted to use India as an R&D hub for an enzyme business. Mazumdar-Shaw—always drawn to innovation—found the opportunity exciting and decided to jump in. She was a young female leader, building her niche in a new space. Banks were reluctant to lend to her, and prospective employees were hard to recruit. “But I had a lot of energy and the willingness to stick it out,” she says. “And once I started doing things that succeeded, I overcame the credibility hurdle.”

Miranda Qu has proven to be similarly adaptable. Xiaohongshu, the company Qu founded (which is now one of China’s unicorns), started as an overseas shopping guide and is now focused on new consumption and experience scenarios in areas like cosmetics, beauty, personal care, and travel. “Every company undergoes twists and turns,” Qu points out.

Iteration is essential, she says. “Iteration has been the source of Xiaohongshu’s development in the past, and it will continue to be so in the future. It means that one cannot be content with past achievements. It also means that one has to be open-minded when faced with challenges, be able to constantly switch perspectives between long-term strategy and short-term results, and do the truly right things, which are usually tough to do.”

Looking to the Future

Effective leadership is particularly important in difficult times.

The pandemic has put to the test every one of the executive approaches we see as critical in Asia. Taking a long-term perspective at a time of crisis, empowering employees at every level, making people feel cared for and ensuring they can be productive as they settle into new models of work, navigating ecosystems, and having the grit to survive and thrive under fast-changing circumstances—these capabilities are more important now than ever.

While the factors have a specific meaning in an Asian context, they are valuable aspects of leadership everywhere. An osmosis is already going on between the East and West, and it seems prudent, especially after the past year, to be open to ideas whatever their origin. “Put it this way,” says Indian financial executive Bajaj, using a metaphor to hint at the advantage of a culturally integrated business philosophy. “If I had to put a man on Mars in five years, I would probably ask the West to do it. But if I had to make sure the man survives on Mars, I would look to the East.”

Leaders who can find their own ways to use executive practices from other cultures will have the best chance of being winners wherever in the world they operate. They’ll certainly be better positioned to capitalize on the growth that’s happening in Asia.

Sanjiv Bajaj

Bajaj also leads Bajaj Finserv, a regular name on Forbes’ global lists and the parent company of Bajaj Finance.

Success, to me, at its simplest, is about delivering superior returns compared with your peers when looking through a long-term lens. If there is a short-term opportunity that doesn’t get in the way of where you need to be in the end, go ahead and take it. But if it conflicts with where you’re headed in the long term, step away.

First, finding entrepreneurial people and empowering them to think like owners. This has been a differentiator in my own journey, and we have tried to replicate it for our businesses.

Second, we have differentiated our offering by innovating in the middle-income segment, which is less saturated than the commoditized mass end of the market.

Third, while we think with the flexibility and agility of owners, we execute with the rigor of a multinational. This is something leaders who join us from other firms always mention. You can build great plans, but they are of no use if you don’t execute.

Annually, we spend a few days with teams across skills, responsibilities, and age groups to evaluate multiple projects that will help build or strengthen our future businesses. These discussions are open and transparent, nonhierarchical, and objective oriented. Thereafter, we closely link performance to incentives. For example, even two levels below the CEO, the variable compensation is a much larger part of annual compensation compared with our peers. You have a significant upside, but also the opposite if you don’t perform. You are empowered to build your business and accountable for it.

We also have very rigorous metrics and review systems and a strong focus on data. I am direct and transparent with my feedback, irrespective of the personal relationship. When things go wrong, we separate the issue from the individual, to foster a productive discussion.

The West tends to be more individualistic culturally, faster to innovate, and more driven by instant gratification. That is what the environment rewards you for. The East is better at longevity and long-term sustenance.

Put it this way: If I had to put a man on Mars in five years, I would probably ask the West to do it. But if I had to make sure the man survives on Mars, I would look to the East.

First, not to get complacent. Celebrate every success, and then look to the future. Second, don’t let short-term wins detract from building long-term success. And third, resist the temptation to become a do-it-all generalist. We have built each business in a focused way, starting a new product line every few years.

It is imperative to feel like an owner. Then, it is important to find your own leadership style. Follow your gut. Your instincts will get better as you listen and learn.

(A complete version of this Q&A can be found here.)

Lance Gokongwei

One indicator is a strong long-term shareholder return. At the same time, as a family business, you look at other factors, including maintaining family harmony, creating value for your employees, living your purpose, and creating value for customers, community, and your country.

Assembling a team that shares your culture and purpose is half the battle.

It’s also critical to choose industries where you can earn sustainable returns and continue to grow. We are willing to take a minority stake rather than holding a controlling position, which can be difficult for many business owners. We don’t fall in love with a business. We exited certain businesses at the right time. We adapt and make quick decisions.

We have been successful in growing internationally, which is unusual in the Philippines. It makes us more competitive.

Even as we grow, we have tried to retain the founder’s mentality in the business. My father, our founder, was very entrepreneurial. He was pragmatic, down to earth, and frugal. He wanted to ensure that we would think long term and not be consumed by family disputes. He had a strong sense of responsibility toward his country. We have tried to codify these elements in our culture.

We are becoming more digital and agile and less centralized. You can’t have a command and control organization if you want to grow really large. People have to feel like they are running their own business.

Creating employee value is also important. We focus on maintaining high engagement and low turnover. Our people tend to stay for a long time.

Superficially, Western leaders may be better communicators, and Asian leaders tend to be more hierarchical. But fundamentally, successful leaders share many common characteristics. They are focused on delivering innovation and tend to be risk takers with a growth mindset.

Technology will continue to transform the way we work.

In the past, a manager could lead a business. Now, given the speed of change, one must have an entrepreneur’s mindset.

Agility, collaboration, dealing with ambiguity, quick decision making, and experimenting and failing fast are critical. Scale alone is no longer a differentiator. Speed is as important as scale.

Being CEO is a lonely job. People want to help—you just need to reach out. Have a strong point of view, but brainstorm with colleagues and mentors to gain multiple perspectives. And most importantly, listen to the customer.

(A complete version of this Q&A can be found here.)

Hou Xiaohai

After I became CEO, I proposed seven strategic initiatives to improve performance and market cap. One was optimizing manufacturing, which was risky. It could have set us up for success or brought everything crashing down. We cut our breweries from 98 to 75. Although that caused some short-term pain, it boosted productivity and improved our cost structure in the long run.

Another initiative was a workforce reorganization. We almost halved our head count but increased salaries by an average of 60%, making employees feel more valued. We used to be the lowest-paying employer in the industry. Now we’re one of the highest.

We also rebranded and transitioned to premium products, which revitalized sales and growth.

Leaders dare to go where competitors do not. It’s like a duel between masters in a martial arts novel—you need to have a trick up your sleeve if you want to win.

You need to set ambitious goals for yourself and your business. You need keen judgment and foresight. To do this, you need to become a constant learner and read more, but you also need to observe, reflect, and take action.

You need to find talent that is a good fit. A CEO cannot outsource screening for key positions to a headhunter. They should be personally involved to ensure those selected will go above and beyond. Sometimes, a candidate may be highly qualified but not the right fit for the position. No candidate is perfect.

Let employees do what they do best. Minimize their weak points, and let them play to their strengths. Bringing out the best in your employees allows you to achieve the best performance yourself. Delegate responsibility, and give employees credit for their achievements. Criticizing your team rarely solves problems. Mentorship is a better way to get them on track.

Asian leaders are more adept at managing informal relationships inside and outside their organization. These skills are a product of Asia’s cultural heritage, which emphasizes the importance of just and harmonious societies. Business leaders in the West put their faith in institutions, taking a data-backed and scientific view of their businesses.

These differences mean that when a quick response is needed, an Asian company can respond with agility, allowing it to seize opportunities. Decision making at a Western company can sometimes be hamstrung by the formality of the internal structures.

In the past 20 years, a new generation of Chinese internet companies has emerged that integrated Asian and Western management approaches. Leaders of these companies are more creative, place more value on formal rules, and have a global vision. Asian leaders will be even more successful in the future because they incorporate the best from Asian and Western traditions.

(A complete version of this Q&A can be found here.)

Aloke Lohia

I see three stages of evolution.

In the first, you define your long-term vision and set up the building blocks to get there. You may need to make tactical fixes to governance structures as you grow, but the strategy, essence, and ethics remain in place.

In the second stage, you need to take deliberate actions to deliver on the building blocks: by developing an “A team,” creating a competitive advantage, and gaining stakeholders’ trust.

Finally, you must maintain the vision and deliver the building blocks over a sustained period of time.

We identify driven individuals, provide them with a purpose, and help them become world class. Being family led, we also succeed by providing this opportunity while avoiding internal politics.

It is important not to be limited by your ecosystem. We must leverage global resources, universities, and research labs to innovate and serve customers with best-in-class products.

Finally, our commitment to environmental sustainability and social responsibility is significant. We use this in our differentiation.

The first is growing the business and remaining first-quartile in our industry for economic value creation. Getting to the first billion is probably the hardest. Maintaining a strong compound annual growth rate, and supplementing growth with acquisitions, can help you get to the $10 billion mark in eight to nine years. Beyond this, growth becomes more challenging as the market and regulators fear your leadership.

Second, you have to combat the aging and potential complacency of your A team, yourself included. Building future teams is crucial for a company’s ability to succeed over time.

The third challenge is to diversify and add new businesses that let you continue to create above-average value. Select new markets to enter that have elements of your existing company’s DNA and the potential to grow. Then leverage your strengths to put the new business into a leadership position.

I tell budding entrepreneurs the same thing I tell family members: Have patience. Do not compromise on doing the right thing. Build trust with your stakeholders. Doing this will provide you with the capital you need to create value for your customers, employees, and shareholders.

(A complete version of this Q&A can be found here.)

Jeffrey Minfang Lu

First and foremost, a business has to grow. At public companies, investors are interested in market value, which reflects the company’s profitability, growth, shareholder return, and, ultimately, performance.

Second is a company’s ability to exercise market leadership, raise its competitive position, and build its image.

Last is the vitality of a company’s people—if they are cohesive, have a fighting spirit, and keep the initial entrepreneurial drive alive.

I knew the board of directors, capital markets, and shareholders wouldn’t give me much time to adapt. People expect to see results even in the first year.

The September after I joined, I did a two-month tour of almost all plants and provinces where we operate. After that, I met with our core team and it became clear there was consensus for reform. We kick-started the transition in December and completed it by the end of January. Once I made the decision, there was no turning back.

Our best fighters are on the front line. That’s why I initiated a company-wide reorganization involving all 40,000 employees. I placed business unit heads in charge of the front and back ends and empowered frontline employees. I streamlined the headquarters head count by more than 30%. I replaced 11 of the 12 executives who reported to me. You need to ensure that you have people you can trust and who can deliver growth. Where excuses are accepted for poor performance, the business will fail.

Also, I reformed incentives. With our new incentive scheme, the salaries of frontline employees have doubled and managerial salaries have tripled. Our regional managers all know that if they work hard, they will be rewarded.

I told the board I would never hire any of my former associates because I believed I could find capable people within the company or on the open market. I also promote young people. We have a talent review system, and I insist on interviewing promising individuals in person.

After the initial outbreak, retail sales were down 90%. Many roads were blocked. We couldn’t ship milk in or our products out. I launched an epidemic response to make sure we could get emergency supplies as soon as possible. We built production lines to produce masks and provided interest-free loans and low-interest credit to pastures and distributors to protect the industry supply chain. I instituted a rule that we would not lay off a single employee.

Our 56 Chinese factories continued production without interruption. The industry chain recovered. The pandemic did not defeat us, it inspired confidence and a sense of pride in our team.

(A complete version of this Q&A can be found here.)

Kiran Mazumdar-Shaw

I call myself an accidental entrepreneur. An Irish entrepreneur wanted to develop an enzyme business using India as an R&D hub and approached me. I found it interesting and decided to put myself behind it. It was a new space, banks were reluctant to lend, and prospective employees were hesitant to work for a woman. But I had a lot of energy and the willingness to stick it out. And once I started doing things that succeeded, I overcame the credibility hurdle.

I had to shatter many stereotypes when I started out. Women were not considered risk takers or aggressive and competitive enough. I had to challenge those preconceived biases.

Women often are more diffident in their expression. I have consciously challenged that. I speak my mind, with fierce conviction, along with compassion and empathy.

Success is identifying an opportunity ahead of the curve and delivering on it in a way that keeps you in the lead. When you are building something new, especially as a first-time entrepreneur, success also depends on how quickly you can build credibility and win market confidence.

I spotted the opportunity in biosimilars ahead of the market. I focused on understanding the competitive landscape and built a niche where we could become a leader and be hard to overtake. We differentiated ourselves by focusing on high-risk, high-reward opportunities where fewer companies are willing to compete. Once we delivered on that, our valuation reflected it.

My vision has always been global. Being a global player has its challenges. I am trying to bust the myth that Indian quality is not good enough for global markets. Today, we are the only Indian company supplying biosimilars to the most advanced markets of the world.

In the past, leadership was focused on market share. Now, it is critical for leaders to address brand value. In the future, leadership based on technology advantage will be a determinater of success. Companies that are not agile and that do not adapt will get left behind. Effective, decentralized leadership will also become important to facilitate this.

Be thoughtful about building differentiation. It paves the way for you to be innovative and strategic, which creates a foundation for sustained success. Don’t be a “me too” entrepreneur. Leaders and organizations that only follow cannot be successful over the long term.

(A complete version of this Q&A can be found here.)

Sanjiv Mehta

You shouldn’t look at a CEO’s performance only during his or her tenure. It’s also important how the CEO has reinvented or reimagined the organization for the future.

Success definitely shouldn’t be measured only in terms of shareholder value. Successful leaders set goals that encompass various stakeholders and recognize that in doing so, they also create value for investors and shareholders.

The definition has remained the same, but the circumstances in which we operate have changed. What the government and community expect from business has evolved, making it more necessary than ever to take a multistakeholder approach.

Our market cap trajectory will tell you how we have grown financially during my tenure. But more importantly, we have taken many steps to create a foundation for sustained success. Our sights are set clearly on the long term. This is reflected in the choices we have made. We have taken bold action to transform our portfolio and make it future-ready.

Leaders need to view the organization through a microscope, to pinpoint the details and challenges they face, and through a telescope, to focus on the big picture. You need to be comfortable with ambiguity. And you need to proactively identify emerging opportunities and tap into them.

We used to make a strategic plan, put it in a nice binder, and send it to corporate headquarters in London. For the next three years it was very placid waters. Now, you need to be able to reimagine your business. If you don’t, you will not be able to survive for very long.

Good leaders empower their people while holding themselves accountable.

The concept of purpose that extends beyond financial obligations to stakeholders has been more engrained in Asian businesses leaders, particularly in owner- and family-run businesses. Similarly, empathy and building personal connections come more naturally to Asian leaders. These traits are becoming hallmarks of leadership globally.

Scale alone is no longer a differentiator of success. To win, organizations must combine scale with speed, resilience, agility, and adaptability.

Organizations must be forward looking, harness technology, and constantly reinvent themselves.

In Asia, given the stage of development, we also need to be more mindful of the impact of our businesses on the climate and environment.

(A complete version of this Q&A can be found here.)

Miranda Qu

The most important factor is strategy. We had the right vision—that life in China was poised to become far more multifaceted.

The second most important thing is organization. Designing the right structure and mechanisms and attracting the best minds are key to a company’s vitality and strength. As the external environment becomes more uncertain, organizational structure will become more like a sports team’s starting lineup. Every player has a common goal—to win—and there is a coach and a rough formation. But players adjust during the game, and even players at the back of the court can score.

Most entrepreneurs first become the best product manager in their field. Then, they have to transition from product manager to CEO and from having a dream to putting that dream into tangible form. The sustainability of their success largely depends on getting through this second stage.

On a micro level, everyone is different. For example, they may have different management and communication styles. But good leaders have more similarities than differences. They have an open mind, appreciate science and art, and balance rationality with sensitivity. Good leaders understand global trends in technology, business, and human nature. They stick to long-term values and have the determination needed to win key battles.

The most striking quality of Chinese business leaders is their ability to evolve. In the West, 30 years is considered the cutoff between generations, whereas in China it is about 10 years. The difference reflects the speed of change. China has developed very quickly, from the first generation of pioneering entrepreneurs and the second generation of overseas returnees to the third generation that is growing with the digital economy.

Resilience is a quality that all founders and organizations need to have. When it has the wind at its back, any company can thrive. But when there is no wind, or there are headwinds, is the leader still able to steer the company in the right direction, at the right pace?

Be ready to iterate.

Iteration has been the source of Xiaohongshu’s development in the past, and it will continue to be so in the future. It means that one cannot be content with past achievements. It also means that one has to be open-minded when faced with challenges, be able to constantly switch perspectives between long-term strategy and short-term results, and do the truly right things, which are usually tough to do.

I have benefited greatly from iteration, but it is a tough process. A short, sharp shock might deliver a valuable lesson. But true iteration involves deeper pain. If you are doing what you love and believe in, the pain is worth it.

(A complete version of this Q&A can be found here.)

Jahja Setiaatmadja

We must look at multiple stakeholders to measure success. We cannot look only at profitability. Our responsibility to our employees and our community is as important as our responsibility to our investors.

We used digitization to become our customers’ transactional banking partner rather than only their savings bank. This allowed us to manage our cost of funds and be more selective about who we lend to.

We don’t chase targets. If your team aggressively chases fixed targets, it is easy to give additional credit at the cost of prudence. Can you drive a Ferrari at the same speed on a racetrack and a crowded city road? You cannot. Similarly, you must adapt prospects to the environment. We use dashboards to monitor our performance, and we set moving internal targets based on the situation. This has become particularly important given the uncertainty the world faces now.

We were early movers in digitization. Companies that do not advance with technological change are bound to fail. We now run an agile setup with multiple scrum teams to facilitate collaboration and innovation.

We maintain a relentless customer focus. We have created simple, user-friendly products for different customer segments. I personally spend time with customers to understand their needs and build strong relationships.

It goes against our fundamental tenet of prudence in credit. To compete effectively with established local players in other countries, we would need to compensate for increased costs with decreased prudence.

A significant part of Indonesia’s population is still not served by formal banking. There is ample opportunity within our country given the economy’s growth potential and financial inclusion journey.

Prudence in credit, customer focus, and leveraging technology. How we execute on them may continue to evolve.

It is difficult to compare leaders between regions because they play to their own environments. A player must adapt his game to the pitch. Similarly, as a leader, you have to adapt to your context.

One thing I see as important in Asia is the need to gain the heart of your employees. People will give their all if they trust and feel loyal to a business leader.

(A complete version of this Q&A can be found here.)

Wang Wei

A successful company makes a difference in society, creates a better life for employees, and raises the bar in servicing customers. A company will be able to achieve a solid reputation and shareholder growth—what I call the “results”—only by paying attention to its purpose, which is essential value creation. If a company focuses only on the results and ignores its purpose, its efforts will be in vain.

SF started out as an express delivery service. In 2017, we began to transform, investing in technology and developing a smart supply chain. We adjusted our organizational model, talent and capabilities, company culture, and incentives. We incubated new companies and a group of business leaders. These moves were well received by the capital markets.

In 2015, when we started our reorganization, we encountered resistance that threatened our survival. But it was through this process that we recognized what the issues were, found ways to solve them, and eventually climbed out of the abyss and developed new capabilities.

At the time, we thought a new structure would work best for some of our businesses, so we divided the main organization into different business units and groups. People assumed that their unit would perform better if they competed for more company resources. But they ignored the potential synergies from sharing resources, which meant costs rose and professional capabilities declined.

We later completely reorganized and adopted a unified strategy, with independent management but shared resources.

I don’t see regrets as failures. If we improve, and turn regrets into strengths, they could turn out to be the biggest growth drivers for the company. We would never have developed the capabilities we did if we had not fallen into the abyss.

Asian and Western leaders are the products of their respective environments. They have developed the skills to survive on their home turf. But being able to survive in one environment does not necessarily mean that you can survive in another. If a company wants to go global, it must adapt and take advantage of the local environment.

Internet and tech giants have advantages in many areas, as they control the flow of business, goods, and capital. In addition to disrupting their own industries, they create competition in other industries. The challenge for traditional companies is finding the right positioning to break the market grip of these giants. If a company can hold its own against such competitors, it has truly taken its technological, professional, and governance capabilities to the next level.

Run your business with a conscience.

(A complete version of this Q&A can be found here.)