BCG's Centre for Growth conducts a monthly Consumer Sentiment Snapshot to track public attitudes towards spending habits, disposable income and the UK's economic outlook.

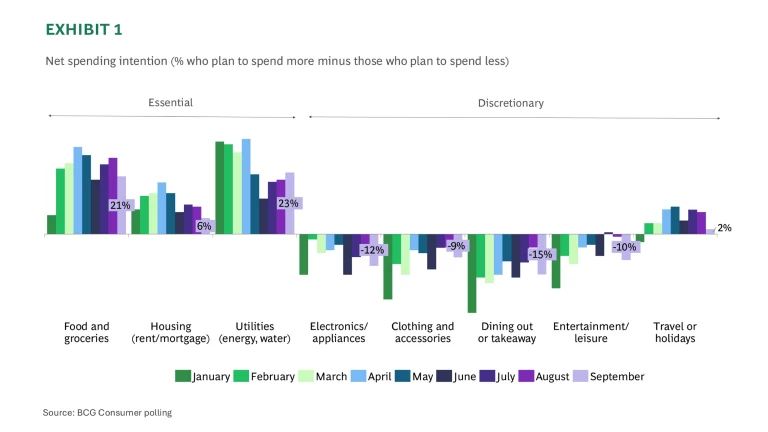

In September, consumer sentiment has softened as households report planning to cut back across almost all discretionary categories. Dining out and entertainment see the sharpest declines, with net spending intentions falling by 10 and 9 percentage points respectively. This contraction is most visible among higher-income households who typically drive discretionary spending. Essential spending showed a mixed picture: while utilities rose modestly, food spending fell back, with nearly half of those reducing their grocery spend citing higher prices as the reason.

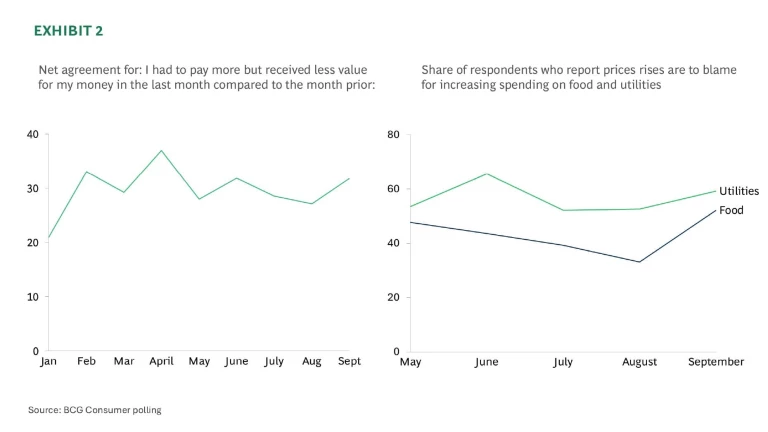

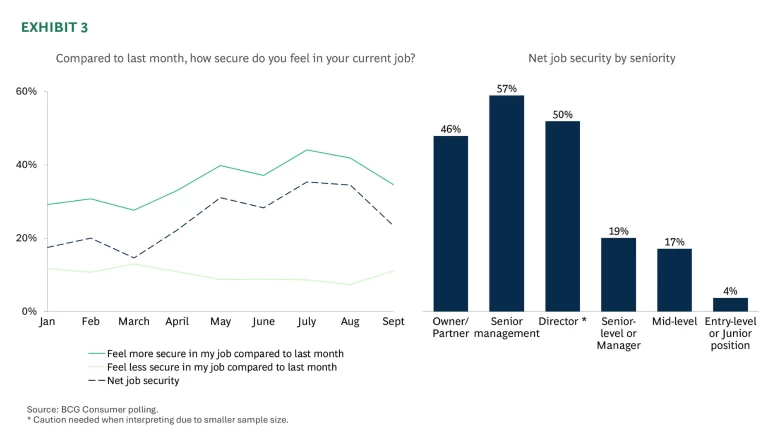

At the same time, there are emerging signs that economic pressures are being felt more acutely by the public. The share of respondents attributing higher food and utilities spending to price rises is at its highest since the survey began. Alongside this, perceptions of job security have weakened slightly, particularly among more junior staff, with a net 12 percentage point fall in confidence overall since July. Taken together, these results suggest that rising awareness of inflation and a softening labour market are beginning to weigh on household confidence and spending patterns.

Key findings

The public are cutting back on discretionary spending, likely driven by higher inflation and seasonal effects. This month we see significant falls across all discretionary spending categories. There has been a 10pp net fall in spending on dining out and a 9pp fall in spending on entertainment. Essential spending shows a more mixed picture. Utilities spending has climbed by 3pp but food spending has fallen by a net 7pp. This is likely explained by higher prices causing people to cut back – of those who said they planned to spend less on food this month, 43% said this was because prices have increased so they will purchase less. There has also been noticeable falls in spending intentions among higher income groups, who typically drive consumer spending.

Consumers may to starting to notice inflationary impacts. It is typical for there to be a lag between inflation rising and the public noticing the cost of items increasing. This month we start to see an indication that the public is noticing higher prices. The share of the public saying spending on food has increased due to higher prices is at its highest level since our survey began, at 52%. Meanwhile those who say utilities spending is up due to price rises is also higher, at 59%. There has also been a small uptick in respondents feeling they had to may more but received less value for money compared to last month.

There are also signs of the public starting to feel less secure in their jobs. The public’s perception of their own job security fell very slightly in August and then to a greater extent in September, resulting in a 12pp fall between July and September. Low job security is being driven by more junior members of staff. This suggests that as unemployment starts to tick up and vacancies come down slightly, the public may now be starting to reflect on what this means for the own job security, having shown less awareness of this during the Spring and early Summer.

Details on the survey:

These results are from a nationally representative poll of UK adults with a sample size of 1,500. Fieldwork was conducted between the 29th August and 1st September. The poll results were weighted to the latest UK figures for gender, age, education, and region to ensure overall representativeness.

For further information on the findings, please contact Mel Walker.