Infrastructure investments have become an even more attractive alternative investment opportunity over the past year because of the uncertainty roiling the world’s economies and financial markets. By their very nature, investments in infrastructure tend to be more resilient than other investment classes during periods of economic volatility and surging inflation.

Drivers of Infrastructure Investments

Moreover, as governments the world over focus on rebuilding infrastructure—power generation and distribution, water supply, urban transportation, health care, and telecommunications networks, among others—their plans will provide infrastructure investors with fresh opportunities. A large amount of capital must be deployed to decarbonize developed countries’ energy sources, and the developing world needs resources to create basic infrastructure such as drinking water, housing, and sanitation in fast-growing cities. Both country groups must also meet their 17 sustainable development goals, whose financial costs are estimated at between $5 trillion and $7 trillion a year from 2020 to 2030.

In the aftermath of the COVID-19 pandemic, governments have limited finances at their disposal, so infrastructure funds have an essential role to play in to bridging the gap between the demand for and the supply of capital. Policymakers everywhere are creating a more conducive environment for private sector infrastructure investment.

In the US, the Biden Administration has overseen the enactment of the Infrastructure Investment Jobs Act (IIJA) of 2021 and the Inflation Reduction Act (IRA) of 2022 to boost infrastructure development. While the IIJA has budgeted $1.2 trillion for infrastructure spending, the IRA has earmarked $400 billion for creating energy-related infrastructure. Meanwhile, in the EU, the RepowerEU policy will reduce the region’s dependence on fossil fuels by developing its renewable energy infrastructure.

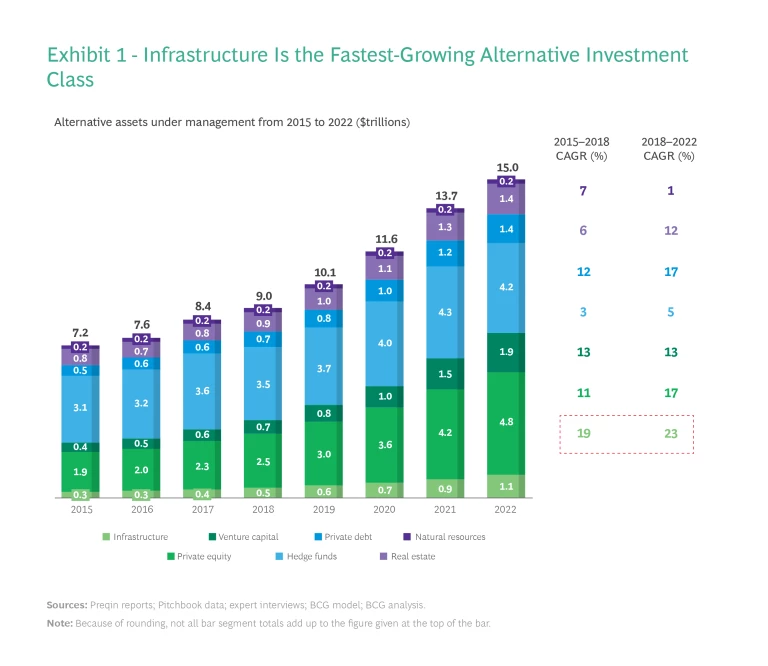

In anticipation of governments’ fiscal incentives, assets under management in the infrastructure industry rose from $0.9 trillion in 2021 to $1.1 trillion in 2022—a compound annual growth rate (CAGR) of 22.2%, only a little lower than the CAGR in assets of 23% from 2018 to 2022. (See Exhibit 1.) Last year, in terms of percentage growth, infrastructure funds attracted more money than all the other alternative investments did. Although real estate funds raised 25% more, private equity funds 21% more, and venture capital funds 9% more in 2022 than in 2021, infrastructure funds attracted an additional 50%, according to Preqin data.

The largest infrastructure funds became bigger, with the ten largest funds that closed in 2022 raising $36 billion more than their counterparts did in 2021. As a result, the amount of capital committed to infrastructure funds but not yet invested reached a record level of $346 billion in 2022—up from $298 billion in 2021—suggesting that there’s currently more money chasing investable projects than vice versa.

That’s partly why the nature of infrastructure investing is likely to change, as these structural shifts shake up the usually slow-and-steady market. According to an analysis by BCG and EDHECinfra—which, for the second year, teamed up to study the risks incurred and the returns generated by infrastructure investors—the current environment will require innovative investment approaches for success. Three points are noteworthy.

One, all the infrastructure funds will try to invest more in larger projects, which take longer to evaluate, especially since there is a dearth of megaprojects at present. Two, because of the paucity of megaprojects, the competition for infrastructure assets will intensify, driving up valuations. In fact, investors are likely to expand their definition of infrastructure to include sectors such as higher education, medical diagnostics, and aquaculture. Three, some of the larger funds will invest through development platforms, which channel public and private funds into projects that may not be entirely commercially viable. For their part, the smaller funds will specialize by geography or sector.

Understanding the 2022 Leaderboard

Specialization was one of the strategies highlighted by the BCG-EDHECinfra 2022 Infrastructure Investors Leaderboard, which is based on EDHECinfra’s The Infrastructure Company Classification Standard (TICCS). (See the Appendix on page 26 of the full report.) Working with a data set of 681 investment portfolios and applying a methodology similar to the one used last year, the Leaderboard classifies comparable investors into four broad groups—global peer groups, groups by location, asset manager types, and asset owner types—and ranks the performance of each group. (See the sidebar “How We Rank Infrastructure Investors” on page 13 of the full report.)

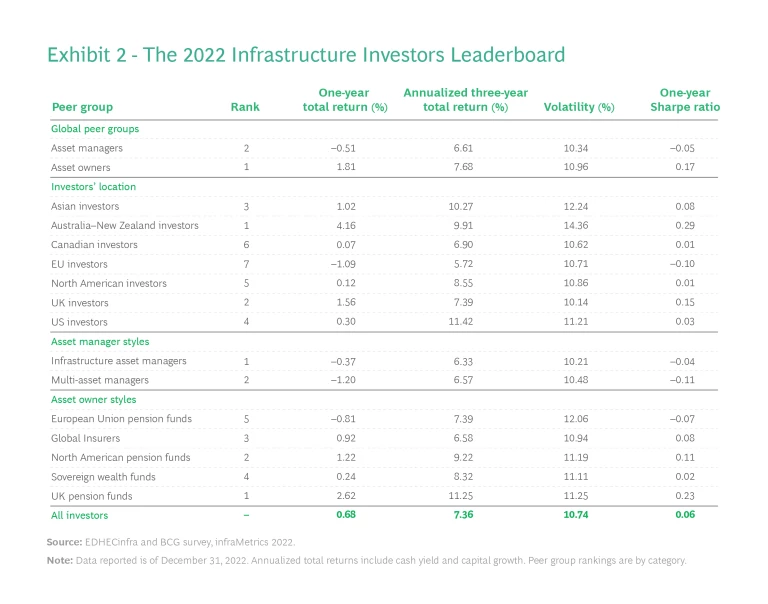

Despite the fickle market in 2022, infrastructure investments outperformed all the other alternative assets on a marked-to-market basis even though the return of 0.68% was much lower than the 9.65% return in 2021. Interest rates increased over the year by more than 250 basis points, causing the peer groups’ valuations to fall by 16% on average, but infrastructure assets benefited because they were better protected from inflation. That factor, along with the postcrisis economic recovery, offset almost 50% of the negative impact of higher interest rates on valuations last year.

As inflation rose, so did infrastructure investment groups’ cash flows, lifting their valuations, on average, by 3%. Equity risk premiums, after rising sharply in 2020 because of the COVID-19 pandemic, fell by 50 basis points in 2022, increasing valuations by 6%. Even so, in the three years from December 31, 2019, to December 31, 2022, infrastructure remained an attractive investment, delivering both cash yields and valuation increases. (See Exhibit 2.)

Specifically, the BCG–EDHECinfra study of the risk-adjusted returns that infrastructure investors generated found that in 2022:

- Asset owners outperformed asset managers among the global peer groups.

- Investors based in Australia and New Zealand performed better than UK investors and Asian investors—the latter a new addition to the study.

- Specialized fund managers generated higher returns than multi-asset fund managers did in the asset managers group.

- UK pension funds outperformed their North American counterparts, while sovereign wealth funds followed behind them, slipping a notch from their rank of second in 2021 in the asset owners group.

For the first time, we also conducted a value decomposition study, separating the value created by an investment into three components: debt paydown, profit growth as measured by EBITDA, and price-earnings multiple expansion. Our analysis revealed one common trend among all the peer groups in 2022. Asset owners and investors based in Australia–New Zealand experienced higher value creation because of the growth of price-earnings multiples. The price-earnings multiples of asset managers’ allocations also grew, which is why they saw more value creation than the infrastructure specialists did. Only the performance of the asset owner funds differed; the North American pension funds, which led the group, were buoyed mainly by the rise in profit margins in their oil and gas investments.

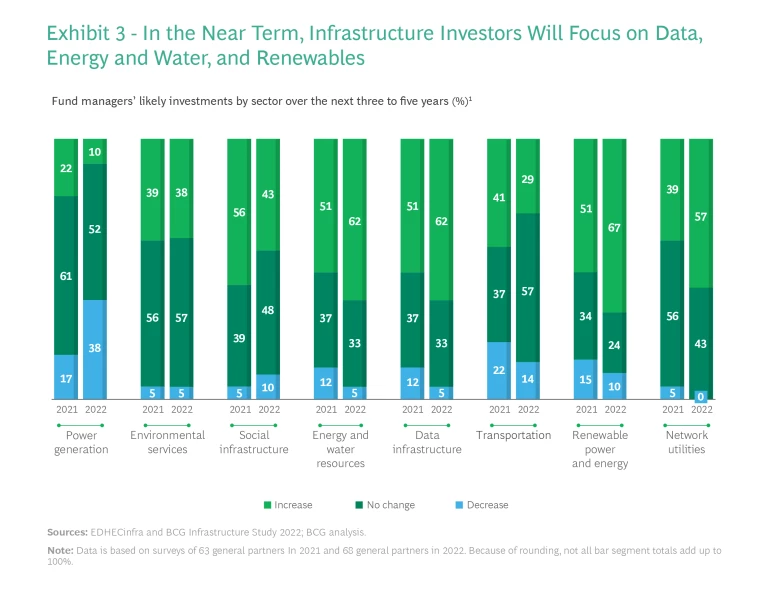

The 2022 Infrastructure Investors’ Leaderboard differed from the previous year’s mainly because of portfolio allocations and market performance. Although the infrastructure market is associated with cash payouts, some market segments offered an opportunity for value creation last year. In addition, investors’ allocations to digital infrastructure rose, as anticipated in last year’s report, and constituted from 8% to 10% of most peer groups’ portfolios. In fact, according to another BCG survey of general partners in the last quarter of 2022, infrastructure investors are likely to focus on sectors such as renewable energy; data infrastructure; and energy and water resources over the next three to five years. (See Exhibit 3.)

The Green in Green Hydrogen

In that context, one fast-emerging investment opportunity for infrastructure inventors is hydrogen, the most abundant element in the universe. It is attracting attention because, as the world’s economies try to grow more sustainably, they are finding it necessary to make an energy transition. The 2015 Paris Agreement on Climate Change has set a limit on global warming of less than 2°C—ideally, less than 1.5°C—compared to preindustrial levels, so carbon emissions must drop by 45% from today’s levels by 2030, and then reach net zero by 2050, when the world’s nations have promised to decarbonize the planet.

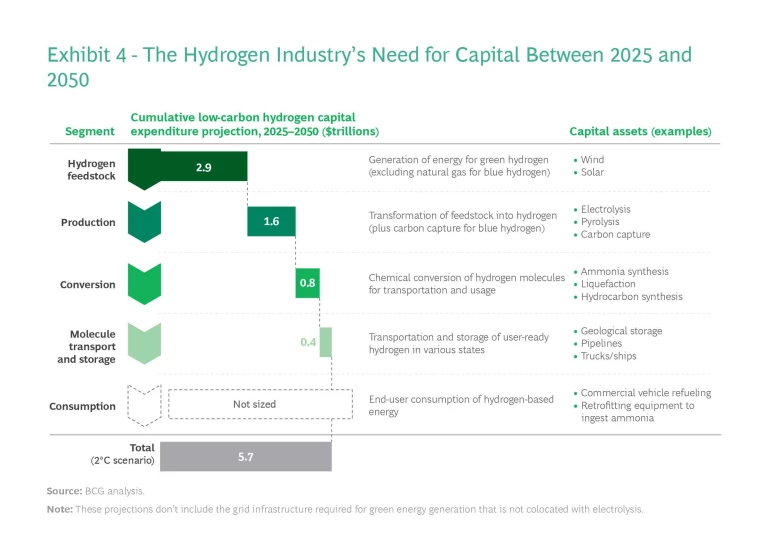

Low-carbon hydrogen will play a key role in the decarbonization of several industries whose emissions are difficult to abate, such as basic chemicals, aviation, steel production, shipping, and long-haul road transportation. In 2021, demand for hydrogen was around 94 million tons, most of it in the form of gray hydrogen; but by 2050, the demand for low-carbon hydrogen will soar to roughly 350 million tons per annum (mtpa) to 530 mtpa. To meet that demand, governments and companies must invest approximately $6 trillion to $12 trillion between 2025 and 2050 to produce and transport low-carbon hydrogen, according to BCG estimates. (See Exhibit 4.)

That increase in demand will ensure that investment opportunities emerge at various points along the value chain, from feedstock development and hydrogen generation to hydrogen transportation and storage. The need for capital will vary at each link in the chain, and regional economic policies will significantly influence investors’ choices. Moreover, $300 billion to $700 billion needs to be deployed in the hydrogen industry right away, between 2025 and 2030, if countries are to meet their net-zero targets.

Subscribe to our Climate Change and Sustainability E-Alert.

In infrastructure industries such as hydrogen, first-movers gain an early and sustainable competitive advantage. Four strategies will help investors outperform others:

- Follow the hydrogen subsidies. Invest only in countries and segments of the hydrogen value chain where policymakers have announced or plan to create monetary incentives that will limit the risks of private sectors players.

- Shift the risks. Invest in hydrogen projects, which can be complex, risky, and time-consuming, after shifting as many of the execution risks as possible to experienced partners such as turnkey project developers.

- Create a hydrogen portfolio. Invest in a portfolio of hydrogen-related projects to create synergies that will help each of them perform better.

- Expand your risk appetite. Expand risk tolerance by increasing involvement during the project development phase, broadening the range of financial instruments—such as convertible debt—used, and find creative ways to de-risk investments. Becoming ecosystem enablers, for instance, will optimize investors’ returns by reducing a hydrogen company’s exposure to a single market and attracting public funding, which will also lower risks.

Other medium- and long-term strategies will emerge as the low-carbon hydrogen sector matures, but our analysis shows that infrastructure investors can test the waters right away in different ways. For example, they can identify low-carbon hydrogen assets whose bottom lines will receive a boost because of newly enacted government policies. They can invest in find keen-to-green companies such midstream oil and gas assets. And they can target their investments at chokepoints in the hydrogen value chain where capacity is currently nonexistent. Whatever strategy they choose to use today and in the future, fact is, smart infrastructure investors can no longer afford to ignore the sunrise hydrogen sector.