Our Insurance Industry Services

Related Services

How We Help the Insurance Industry

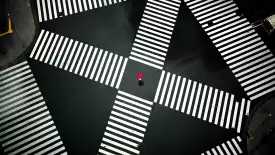

The insurance industry is one of the least digitally mature industries. How can insurers close the gap—and serve customers better?

The key isn’t simply to embrace technology in insurance but to apply the right levers in the right ways, guided by a forward-looking insurance strategy. To help insurers do this, we combine expertise in insurance consulting with deep knowledge of new technologies and approaches, translating the insurance industry outlook into actionable strategies. The key levers include:

- Value creation and growth. In the global industry, often seen as slow and complacent, investors are responding to bold moves. We help insurers shape insurance business strategy by identifying the partnership agreements, technology investments, and M&A deals that spark growth.

- Customer centricity. We help redesign the customer journey from the customer’s perspective, so insurance companies can improve response times and quality while providing seamless interactions, greater transparency, and personalized service.

- Downcycle management. As seen in previous downturns, those who take on a proactive mindset can emerge as winners. Our industry experts combine with BCG's transformation consultants to deliver short-term impact and fuel longer-term insurance transformations.

- Data analytics and AI in insurance. At its core, insurance is a data-driven business. We help insurers leverage data science—particularly AI—to master insurance analytics and transform decision making.

- CFO excellence. Today’s insurance CFOs must deliver business intelligence and insight while maintaining tight control over financial data. With BCG’s Center for CFO Excellence, leaders can align financial oversight with insurance business strategy, achieving the highest standard of performance and efficiency.

- Productivity. Insurers are reimagining how they operate across five key areas of digital innovation in insurance: distribution, customer service, operations, organization, and claims handling. We help identify—and make—productivity improvements that quicken that response.

- Complexity reduction. Insurance companies often have a myriad of offerings and business lines. We help reduce complexity—in products and processes—to create a foundation, and drive momentum, for digital transformation.

- Agile ways of working. Agile enables teams to move faster and with greater autonomy. We help insurance companies adopt agile at scale—and accelerate product development.

- Systems migration. Legacy IT systems—an insurance industry staple—don’t play well with digital offerings and end-to-end customer journeys. We help insurers modernize their tech stack without starting from scratch.

Our Clients' Success in the Insurance Industry

Our insurance consulting team has partnered with insurers around the globe, helping them improve customer experiences, develop sustainable strategies, and undertake large-scale transformation.

Our Solutions for Insurance Technology

Digital Acceleration Index

Digital Acceleration Index

FinTech Control Tower

FinTech Control Tower

Value Creators in Insurance

approaches to manage physical climate risk.