Managing long-tail spend is a tall order for many procurement teams. But that’s changing rapidly, thanks to digital technologies. Digital provides visibility into millions of purchases made every year, helping companies understand and manage their tail spend at a level of detail never before possible. And with the maturation of big data and advanced analytics, artificial intelligence (AI), automation, and digital platforms, companies can improve operational processes and even eliminate some tail expenditures entirely.

Firms that use digital to manage tail spend can cut their annual expenditures by 5% to 10%, on average—a significant amount, especially for global companies with total expenditures in the billions.

Firms that use digital to manage tail spend can cut their annual expenditures by 5% to 10%, on average.

Conventional Approaches

Tail spend is generally defined as the amount of money that an organization spends on purchases that make up approximately 80% of transactions but only 20% of total spend volume. Yet what constitutes tail spend varies by category: for example, machine parts for industrial-goods companies, specialty chemical materials for chemical companies, and office supply items for banks. The number of tail spend items will vary as well. A turbine manufacturer might have more than 130,000 such items, while a bank will probably have far fewer.

Most procurement functions devote little attention to managing tail spend because it’s so complex. Typically, it involves a vast number of transactions, many product categories, and a huge, largely anonymous, supplier base. (A big chemical company, for example, can have as many as 3,000 suppliers—and that’s just for direct materials.) This level of complexity requires a lot of resources, which most procurement functions simply don’t have.

In addition, tail items aren’t a top priority. They are usually purchased only once every two or three years, so they are often overlooked during discussions with suppliers. Procurement managers tend to focus instead on more strategic spend: the 20% of suppliers that account for 80% of total spend volume.

Firms that have been able to devote resources to long-tail spend management use a few different tactics:

- Standardization and Bundling. Harmonizing the specifications of components used in different products reduces the number of items in the tail, and consolidating suppliers in groups makes collaboration easier.

- Catalogs and Purchasing Cards. To make standardization and supplier bundling sustainable, procurement teams try to put as many tail spend items as possible in catalogs. AI can then analyze spend data to provide guidance on which items should be procured this way. Catalogs are popular with buyers because they offer only one option and one supplier for each desired item. They can be clunky to work with, however, and since they are typically updated infrequently, they don’t always provide the parts or services that are needed.

Catalogs are also good for corporate governance because they enforce spending regulations. They proactively support compliance because they provide a small number of items rather than an assortment, thus reducing the number of SKUs significantly. In addition, catalogs can reduce transactional cost by as much as 30% to 40% per transaction.

Purchasing cards can support compliance as well. For a company buying office supplies, for instance, purchasing cards automatically record who is buying what and how often, while ensuring that the ordering process goes smoothly. It’s a good idea to procure as many products as possible this way, since the process is more efficient and the prices of components and services are lower than when other methods are used.

- Outsourcing. Using a third party to handle tail spend can eliminate the entire challenge. It can also cut costs because a company that focuses entirely on tail spend is probably able to optimize savings and has better economies of scale than others. But using a third party also means depending on a provider, which can hamper flexibility and innovation.

Standardization, bundling, catalogs, purchasing cards, and outsourcing can help prevent tail spend from growing further, but procurement functions are still grappling with some basic challenges. They don’t have enough transparency into commercial and technical purchases. In addition, they provide too much information to buyers and suppliers on tenders, which makes the tender process difficult. No less important, the huge amount of manual work makes it difficult to manage tail spend effectively.

Tapping into the Advantages of Digital Approaches

Digital technologies address these challenges. Big data and advanced analytics, along with AI, can help procurement functions develop better visibility into their expenditures; indeed, AI can help get rid of certain areas of tail spend altogether. Automation and platforms can boost the efficiency of key procurement processes, including mass tenders.

AI can help get rid of certain areas of tail spend altogether.

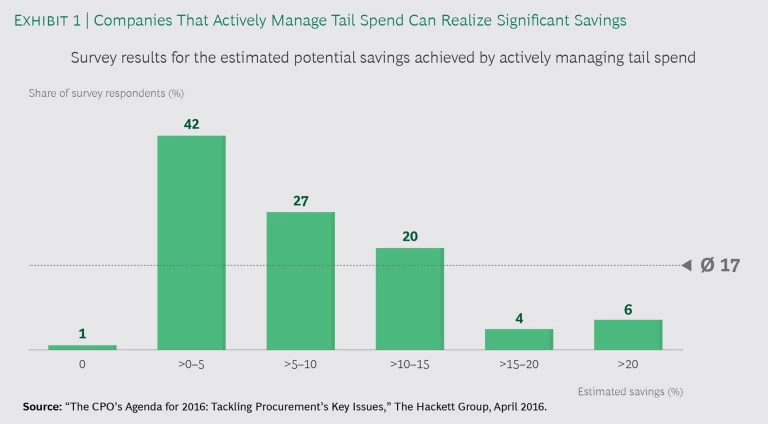

The potential impact on cost savings is considerable. According to a recent Hackett Group study, more than 27% of companies said that they experienced savings of 5% to 10%, while 30% of companies had savings of at least 10%. (See Exhibit 1.)

Creating Tail Spend Transparency

The key to managing long-tail expenditures is to analyze the data behind these purchases. Before the advent of digital, most tail spend data was inaccessible and unwieldy. Today, big data and analytics, AI, automation, and digital platforms allow companies to develop an overview of the spend baseline by automatically collecting and assessing different types of high-quality data.

Internal Spend Data. Before the advent of digital, purchase order (PO) data was hard to mine manually because it was typically stored in PDFs in different systems across the company.

Now, thanks to consolidation programs, it’s possible to combine data from various systems into one view. Data-crawling robots can then go through fragmented files and collect information by looking for a unique part number or description. And a software solution can scan the lists of items and suppliers to see if any are recorded under multiple names. For example, a supplier could be listed as BASF Germany, BASF AG, or Badische Anilin- & Sodafabrik—all of which refer to the same company.

Procurement managers can then conduct a spend cube analysis for expenditures across categories, business units, and suppliers. This data can also shed insight into spend per subcategory; the extent of fragmentation in the supplier base; the range of prices for any given item across suppliers, sites, volume, and time; and the proportion of spend managed by the procurement function, devoted to catalogs, and so on.

Supplementing PO Data. Whenever PO data is insufficient for classifying and consolidating tail items, other digital technologies can fill in the blanks. Drawing and non-drawing-based information excellence tools, for instance, can help companies determine whether various machine parts are identical or merely similar.

Advanced analytics can also help, by detecting when slight differences in the product specifications of different tail items lead to unnecessarily high handling costs. When a manufacturing company, for example, needed to gain better visibility into approximately $400 million of annual miscellaneous spend, it used an algorithm to analyze supplier invoice details and specifications. The algorithm found thousands of duplications; eliminating those redundancies cut down expense entries by 30%.

After data is collected from various sources, an AI algorithm can scan it for errors and fix them. If the algorithm notices, for example, that the weight of a spare part is entered as 1,000 kilograms, it can look to see whether 1,000 grams would be more plausible. What’s more, the algorithm’s ability to detect such errors can improve over time. Algorithms can also mine invoices and other documents to provide information missing from PO data.

Supplier Data. Consolidating the number of suppliers a company uses can often get in the way of collecting important information about what the suppliers can provide—quantities of different components, the types of materials in those components, pricing, and so on.

But contract management platforms equipped with optical character recognition (OCR) technology can read and capture contractual information quickly and accurately. AI can then see if a contract is already in place for a particular item or for another that would serve the same need.

Digital collection platforms are also helpful. Instead of requiring suppliers to fill an empty page with all kinds of unnecessary information, the platform provides a partially filled-out form with just a few blanks for the supplier. This makes the process easier for suppliers—and more likely that they’ll fill out the form completely.

Companies can also extract pricing information from external benchmarks to create a database across parts, suppliers, business units, countries, and so on. AI tools can then compare prices and alert buyers when favorable buying conditions arise.

Managing Tail Spend More Efficiently

Once procurement functions have a good sense of what their tail spend looks like, they can use a variety of digital tools to manage it.

Improving Mass Tenders. In predigital times, mass tenders were extremely challenging because of the vast number of items and suppliers involved. Today, platforms such as electronic requests for information (eRFI) and quotes (eRFQ), as well as e-auctions, represent a big step forward in this regard.

ERFI Platforms. Manual requests for information used to demand a great deal of effort from a buying company because of the high volume of requests every year and the lack of accessible data, especially on less critical parts and services.

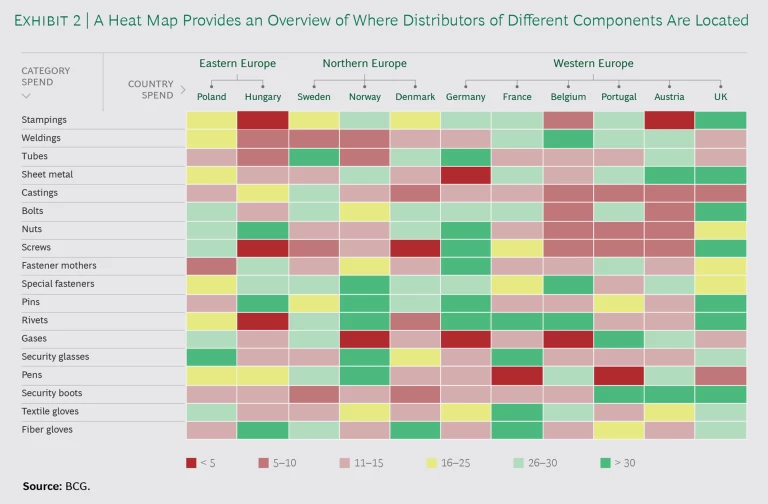

Today, companies can issue a large-scale eRFI to many suppliers (distributors) around the world. The vendors, in turn, can provide information—quantities, prices, and delivery timelines—about the products they can supply. The number of distributors in each country for each product can then be illustrated with a heat map. (See Exhibit 2.)

ERFQ Platforms. The information generated by the eRFI and the heat map serves as the basis for an eRFQ. In a typical tail mass tender, a supplier would have to wade through thousands of line items in a list rather than the few hundred it could actually provide. Many vendors would not want to take the time to identify those items because of the low profit involved. Often, suppliers would provide quotes for only some of the items they could supply rather than for all of them, which made the tail even longer.

ERFQ platforms dispense with this problem because they allow each distributor to see only the line items that that company can provide. After the distributors have submitted their bids, digital tools use the answers to present a comprehensive overview of competitors and pricing.

E-Auctions. Mass tenders are possible not only in static setups but also in dynamic ones, such as e-auctions. Companies can use e-auctions to realize savings in one of two ways: They can select many suppliers, cherry picking so that they choose only the supplier with the lowest price for each particular item. Alternatively, they can consolidate the number of suppliers in the portfolio, being careful to preserve a healthy level of competition.

They can then use a digital analysis to review the existing bids and propose different scenarios. For example, a manufacturer that had a tender with 200 suppliers ran a scenario analysis to learn the maximum number of suppliers that priced at least one line item more cheaply than any other supplier; there were 81. But a different scenario, which looked for the minimum number of suppliers that offered the lowest-priced item, identified 27. Since each of these 27 suppliers bid at least one line item that no other vendor bid on, the manufacturer saw that 27 was the minimum number of suppliers it could have on the tender.

Whenever suppliers don’t meet the preset business and regulatory criteria, the platform uses a bidding algorithm to automatically award projects to vendors whose bids meet the original conditions. For more critical events, it can make well-informed suggestions regarding which suppliers should be selected. The algorithm systematically “learns” from past auction data to make better recommendations. As a result, the speed and quality of decisions made during bidding and negotiations have improved substantially, taking days instead of weeks.

In addition, companies can use advanced algorithm tools to build a database of bids that suppliers have made in the past, and then deploy AI to analyze supplier bidding behavior and predict changes in price. These predictions give procurement professionals the information they need to maneuver during negotiations.

Reducing Tail Spend to Extract Value

After setting up tenders and e-auctions, procurement functions can deploy big data and analytics, AI, and automation to reduce whatever tail spend can’t be eliminated altogether.

Using Big Data, Advanced Analytics, and AI. Following the identification of spend patterns with a spend cube, companies can consolidate purchases and suppliers across locations and plants.

Advanced analytics and AI can automatically analyze 2D and 3D drawings created by drawing information excellence tools to develop standardized components, and they can also recommend ways to adapt specifications that are not proprietary to any one vendor. For example, there may be a functional reason for a particular plastic part to be available in different colors; but then again, the colors could simply be decorative. A buyer can now make its own determination about whether color really matters for its purpose. Such practices can help companies realize economies of scale while shrinking the size of the supplier base. An additional 1% to 2% of cost savings is possible.

Automating Processes Related to Purchase Orders and Invoices. Robotic process automation (RPA) technologies come in handy for sorting through the tail items procured via the purchase request (PR) to purchase order (PO) process. An RPA robot can consolidate information about the various vendors available and select the best one. After an employee submits the PR, the robot can validate it and forward it to the selected vendor. At the same time, digital governance technology can crosscheck what people are buying and raise alarms if they disregard tail spend guidelines. As a result, 80% to 90% of workflow can be automated, and full-time equivalents can be reduced by 30% to 35%.

Such technologies can also automate invoice processing and reconciliations. RPA can standardize the invoice format, entering the details directly into internal systems. A PDF can then be digitized using OCR, and data fields can be mapped to standard columns robotically. Invoice details can then be matched against the PO sent to the vendor, automatically returning erroneous invoices to the vendor and clearing reconciled invoices for payments. Automation of invoice processing and reconciliations can lower employee costs by 30% to 35%.

Ensuring the Sustainability of Tail Spend Management

Companies should also think about using AI technologies to cut out some areas of tail spend altogether.

For example, firms can use advanced analytics to analyze previous purchases and predict demand for the subsequent year and can use AI for one-off purchases. Together, the two technologies can automatically recommend which tail items to eliminate.

In addition, AI-based instructions to ban spending can be integrated into several digital tools to prohibit spending under certain conditions. For example, a spending ban can be integrated into catalogs to stop purchases once a certain budget limit is reached. AI even allows for more complex governance models that indicate which suppliers are preferred or banned.

Thanks to digital technologies, tail spend is now truly manageable, allowing companies to generate savings, preserve quality, and mitigate risk. To maximize results, companies should create a dedicated team that focuses on tail spend. The team will need to have clear targets and metrics that emphasize supplier consolidation and the use of leading tools, such as mass eRFQs, as well as savings.

Thanks to digital technologies, tail spend is now truly manageable, allowing companies to generate savings, preserve quality, and mitigate risk.

Digital technologies can have a major impact on tail spend because they enable a level of spend transparency and management never before possible. To get the most from digital, companies need first to assess their pain points, how much value there is to gain from digitizing, and how an initiative aligns with their current digital capabilities. Only by understanding how large the tail really is and how much of it can realistically be managed is it possible to turn this source of bloated expenditures into an advantage.