Transportation infrastructure assets—airports, seaports, railways, roads—constitute the backbone of any economy. Each dollar plowed into such assets boosts gross domestic product (GDP) and has a multiplier effect on job creation. Moreover, transportation accounts for about 50% of total capital expenditure on infrastructure, according to a recent IHS Global Insight report. Current global spending on such assets tops $1.7 trillion, and the World Bank reported in 2015 that this spending is expected to grow at 7% annually through 2020.

Owners of such infrastructure assets therefore play a vital role in driving sustained economic growth. However, they face multiple challenges that limit their assets’ power to drive GDP and job growth. To surmount these challenges, owners must first understand them and then build new capabilities for overcoming them.

Grasping the Challenges

A number of difficulties are limiting transportation infrastructure’s ability to generate maximum economic value:

- A Narrow Planning Perspective. Many owners plan for a single-asset solution rather than incorporating the impact of integrated transportation networks in their plans. G20 countries and the B20 coalition have repeatedly advised asset owners to broaden their planning perspective.

- Rigid Public-Private Partnerships. In PPP contracts, asset owners have difficulty injecting enough flexibility to accommodate unforeseen scenarios. Consequently, long-term multistakeholder projects often experience financial difficulties and contract disputes, with little or no room for resolution.

- Declining Revenues. Revenues from core sources, such as tickets and passenger charges, are decreasing because of stiffening competition within and across transportation modes, a deteriorating macroeconomic environment, and public resistance to rising charges. Asset owners are worsening the situation by not capturing revenue synergies with adjacent or alternate industry players—such as telecommunications companies.

- New Technologies. Disruptive digital technologies, such as autonomous vehicles, act as a double-edged sword. On the one hand, they enhance efficiency by automating key tasks. On the other hand, they alter the ways that passengers use transportation, making planning even more challenging.

- Financing and Funding Constraints. The global infrastructure investment gap of $1 trillion to $1.5 trillion per year is only being worsened by high debt positions and austere policies. Many governments are looking to private-sector investors to bridge this gap, but there aren’t enough well-structured projects to attract such investors.

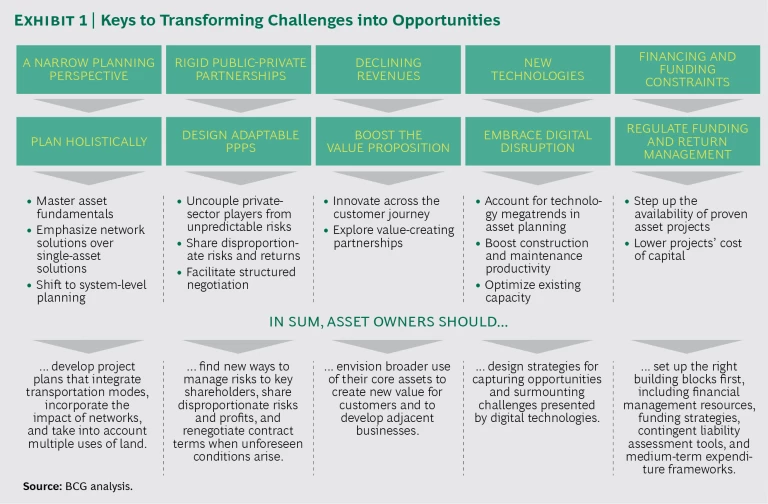

To unlock more value from their transportation assets, owners must overcome these challenges. Building new capabilities will prove crucial. (See Exhibit 1.) Below, we take a closer look at the capabilities they must develop.

Plan Holistically

Transportation asset owners not only provide basic infrastructure but also foster economic development, influence land use and urban planning, and enhance the livableness of cities and the environment. But owners don’t always take into account long-term benefits and costs when selecting projects.

Master asset fundamentals. Once owners develop transportation network plans, they should evaluate potential assets based on network objectives, economic and social-welfare impacts, second-order effects like environmental impact, and delivery readiness. Such comprehensive multicriteria asset analysis is vital to developing assets that improve, or at least maintain, economic and social welfare over the long term.

Emphasize network solutions over single-asset solutions. In many countries, narrow planning has led to underutilization of or excessive congestion in certain transport modes. For instance, the inland transport chain in the US is largely disconnected from the country’s maritime system. As a result, the US has little infrastructure to support coastal shipping of nonbulk goods.

Effective transportation networks include efficient road systems integrated with airports, railway stations, ports, and logistics hubs. Accordingly, decisions made for a specific asset, such as increasing capacity at an airport, affect the rest of the network. Consider the expansion of the Port of Rotterdam. Planners ensured that trunk roads, railways, and waterways connecting to the port had sufficient capacity to handle greater container volumes.

Shift to system-level planning. Demand for urban amenities, including easy access to transit, powerfully influences asset owners’ investments. Forward-thinking owners are investing in transit-oriented developments (TODs). TODs integrate urban mass-transit systems with mixed-use spaces (commercial, residential, and civic) to increase location efficiency, reduce congestion by boosting multimodal transit ridership, and create a sense of community. In northern Virginia, for instance, TODs have added 15 million square feet of commercial space, 20,000 residences, and 2 million square feet of retail space.

Design Adaptable Public-Private Partnerships

Large infrastructure projects require multiple stakeholders with different interests to collaborate over long periods of time. For PPPs to succeed, asset owners should allocate risks to the parties that are best positioned to manage them.

Most project risks are directly controllable by the public or private partners in a PPP and thus can be managed. But macroeconomic risks—such as fluctuations in exchange rates or economic growth rates—are uncontrollable. How such risks will affect performance on critical project metrics such as demand, revenue, and profits is unpredictable. Asset owners must therefore manage them by designing adaptive contracts, including practices such as the following.

Uncouple private-sector players from unpredictable risks. Owners can mitigate crises’ impact on transportation infrastructure projects by passing on risks they cannot predict.

For example, through a least present value of revenue (LPVR) mechanism, a concession is auctioned to the private partner that offers the minimum cost of capital. During the project, the concession period is adjusted to account for unexpected events, such as lower-than-anticipated traffic or changes in toll revenue, to ensure that the private partner generates the expected revenue. Chile uses LPVR, and several other governments are considering it.

Hybrid annuity models are another case in point. India’s Ministry of Road Transport and Highways uses a variant of the standard build, operate, and transfer model. The public and private sectors partly fund project construction. Financial returns to the concessionaire are predetermined using semiannual annuity payments, while toll revenue goes to the government, transferring unpredictable commercial risk to the public-sector partner. The provision of inflation-adjusted costs and annuity payments with interest at minimum bank rates helps to hedge against inflation and revenue risks.

Share disproportionate risks and returns. Flexible PPP contracts include levers that enable the public and private players to share profits or losses beyond the fair rate of return, while maintaining performance incentives for the private player. Russia’s Western High-Speed Diameter toll road is a case in point. For this project, RB 10 billion in annual revenue is guaranteed by the regulator on the downside, and 90% of excess profits go to the city council, supporting risk sharing at both ends.

Facilitate structured negotiation. Some events—such as variation in actual traffic for a transportation asset—lead to substantial, permanent changes in operating environments. To account for such possibilities, asset owners should provide for contract renegotiation, including triggers for exceptional reviews and dispute resolution mechanisms, while defining contract terms.

Boost the Value Proposition

Asset owners should supplement core revenue with additional earnings. Airports have unlocked this opportunity, by drawing 40% of overall revenue from non-aeronautical sources. Consider Singapore’s Changi Airport. In 2016, it earned $1.5 billion from sales at airport shops. It also offers attractions such as theme gardens, Jacuzzis, and movie theaters.

According to a World Economic Forum and BCG report, other transportation asset owners could generate as much as 10% to 30% of overall revenue from ancillary sources. (See Strategic Infrastructure: Steps to Prepare and Accelerate Public-Private Partnerships, BCG and World Economic Forum report, 2013.) To do so, they’ll need to identify adjacent value opportunities while planning projects. The following strategies can help.

Innovate across the customer journey. Leading asset owners are extracting additional revenue from core assets by tailoring their offerings to unmet customer needs. For example, Japanese railway operator JR-East generates more than 30% of its revenue from offerings that include retail and office space.

Explore value-creating partnerships. Progressive asset owners are expanding their offerings for customers and other industry players by forging new kinds of partnerships. For example, Deutsche Bahn, the largest rail operator in Europe, has initiated intermodal bus and bike options. Meanwhile, some owners are leasing their core assets for adjacent business services. RailTel, a subsidiary of Indian Railways, built a broadband business on the rail infrastructure and is now leasing its assets to other government departments and private telcos.

Embrace Digital Disruption

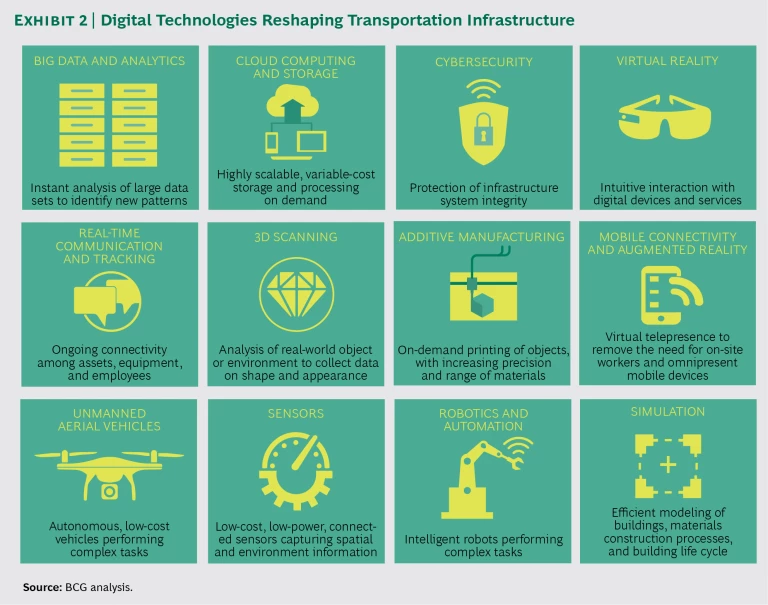

Digital advances are reshaping transportation infrastructure and presenting new possibilities across the value chain. (See Exhibit 2.) Some digital technologies are also transforming infrastructure usage patterns in ways that defy forecasts made during asset planning. Owners can consider the following tactics for managing both the opportunities and the challenges presented by these technologies.

Account for technology megatrends in asset planning. Owners need to monitor for digital disruptions capable of altering infrastructure usage patterns. Just as the onset of automobiles slashed railway usage in most economies, the advent of autonomous vehicles is set to transform transit mechanisms. Players controlling innovations such as self-parking, traffic jam autopilot technology, and lane-keeping technology—coupled with easy ride sharing and last-mile connectivity—will capture market share from railways as well as public transportation systems. Leading industry players like Google and Tesla have made tremendous progress in autonomous vehicles, and some smaller players such as nuTonomy have already piloted autonomous taxis.

Boost construction and maintenance productivity. Building information modeling (BIM), coupled with emerging technologies like advanced robotics, is enhancing construction and maintenance productivity—reducing complexity, optimizing costs, and improving asset quality and safety. Owners who build digital competencies can leapfrog to new growth horizons, leaving their peers behind. For instance, Japanese equipment manufacturer Komatsu has developed fully autonomous bulldozers, controlled by drones that map landscapes in real time and provide data on how much rock is being moved during construction. Similarly, Sweden-based global construction leader Skanska enhances equipment productivity by using sensors, radio frequency identification, and data analytics for predictive maintenance.

Optimize existing capacity. As asset usage intensifies, owners must infuse new efficiencies into their operations and minimize congestion in existing assets. For instance, Aruba’s airport uses biometric facial recognition to identify passengers as they check in and then enable them to quickly transition through baggage checking, border control, and aircraft boarding—all without need for further documentation. Similarly, the Florida Department of Transportation uses geographic mapping to provide real-time traffic and alternate route updates to travelers through text messages, phone calls, and app notifications.

Regulate Funding and Return Management

Creative funding approaches can present new opportunities for private investors to close infrastructure gaps. Asset owners can deploy the following novel funding and financing structures to attract such investment.

Step up the availability of proven asset projects. Investors prefer brownfield assets, owing to reduced construction risk and readily observable asset conditions. Yet analysis by BCG and others indicates that the value of brownfield transportation deals from 2014 through 2016 was just 13% of total deal value. Increasing the number of brownfield assets will unlock value trapped in existing assets and give investors more opportunities to participate in public infrastructure.

Consider Australia’s asset-recycling program, which aims to raise funding for new infrastructure by selling or leasing assets to the private sector. The program provides an incentive to nonfederal asset owners worth 15% of sale proceeds. This move led to the recent sale and concession to the private sector of Transgrid (AUD 2.9 billion) and the Port of Melbourne (AUD 870 million). Some countries have gone a step further by bundling various transportation assets into large-scale monetization programs.

Lower projects’ cost of capital. Debt financing drives the infrastructure market, yet its availability and high cost can call into question infrastructure projects’ viability, especially in developing markets. Public-sector owners can use their ability to borrow from the market at lower rates to provide primary debt, or refinancing, to developers on concessional terms. Additionally, central agencies can on-lend to public-sector owners to lower the overall cost of capital. Denmark’s central government, for instance, on-lends proceeds from bond sales to public agencies, according to Danmarks Nationalbank. Owners can also develop contingent financial instruments, such as guarantees and lines of credit, to insure the private sector against specific payment or performance risks. Indonesia created a specialized institution, the Infrastructure Guarantee Fund, to derisk payment obligations, political risks, and regulatory risks.

Infrastructure investment trusts (InvITs) are another way to lower projects’ cost of capital. InvITs are listed trusts that manage revenue-generating assets and provide a liquid way to earn yields from an asset portfolio. Owners can use InvITs to unlock equity trapped in their existing assets or to raise debt for future investments. Some investors prefer higher liquidity of listed positions to unlisted positions, which are direct positions taken in specific infrastructure projects, such as a placement of equity in a toll road. InvITs also help owners tap small investors that would otherwise not have access to returns from infrastructure projects. For example, the Keppel Infrastructure Trust, in Singapore, gives investors access to core infrastructure projects comprising energy, water, and digital services. InvITs are best used for mature infrastructure assets whose returns are stable and whose owner is unwilling to give up ownership or operating control.

For transportation infrastructure to deliver on its promise, asset owners must overcome a number of challenges. Tackling each will require considerable creativity. But owners that act now can turn these seemingly insurmountable difficulties into fresh opportunities for everyone to win—government agencies, private investors, and entire economies and societies.