Never let a good crisis go to waste.

— Winston S. Churchill

After an exhilarating decade of growth, a hard reality has dawned on companies operating in Brazil. The past three years of economic stagnation are not a mere lull in the Brazilian boom. Recovery will take time. At present, the pace and intensity of that recovery are uncertain. Prolonged stagnation cannot be ruled out. What, then, should companies do to survive and thrive in this new environment?

Many companies will have to fundamentally recalibrate their approach to Brazil. No longer can they count on ever-rising sales and easy credit to power growth.

To generate significant, sustainable value for their shareholders over the medium term, companies must become more efficient at every level. They must radically reshape their commercial approach, enabling their staff to spend more time with clients and squeeze more revenues out of flat market. They must make their operations leaner. They must simplify and streamline their organizations. They must create more win-win arrangements in their supply chains. They must ensure that their capital is put to best use.

Going from a growth-driven model to one that focuses on productivity is no easy task, of course. For many companies operating in Brazil, it will require a major cultural change and a complete transformation of the organization. This will typically be a multiyear effort that involves the entire company, from the leadership down. But adaptation is critical, because the changes in Brazil’s economic landscape since the boom years are deep and structural.

A Reversal of Economic Fortunes

For the first decade of this century, the Brazilian economy seemed unstoppable. Low inflation and declining interest rates owing to previous improvements in public finances fueled a dramatic surge of both foreign and domestic investment. Strong global demand pushed export prices for commodities such as soybeans and iron ore to record highs.

Rising incomes and employment triggered explosive growth in consumption as millions of Brazilian households joined the middle class. (See Brazil’s Next Consumer Frontier: Capturing Growth in the Rising Interior , BCG Focus, June 2014.) The boom translated not only into higher corporate profits and total returns to shareholders but also into some of the greatest improvements in living standards in the world. (See Why Well-Being Should Drive Growth Strategies: The 2015 Sustainable Economic Development Assessment , BCG report, May 2015.)

Since the beginning of this decade, however, the virtuous cycle that once drove Brazil’s economy has turned into a vicious one. Economic growth has ground to a halt. Public finances have deteriorated to the point that Brazil’s sovereign debt has been downgraded by the major ratings agencies, while corporate and personal debt have soared. Investment as a percentage of GDP has plummeted. So has consumer confidence. World prices for Brazilian commodities have dropped. With unemployment reaching a record low in 2014, Brazilian wage rates have grown much faster than productivity, leading to a serious deterioration of the economy’s global competitiveness in manufacturing.

The situation has improved somewhat over the past year with the decline of the real against the U.S. dollar. A steep rise in unemployment, moreover, is allowing companies to extract concessions from unions. These adjustments should help Brazil improve its cost-competitiveness. The economy may recover over time, but returning to robust growth on a sustainable basis will require major changes.

How the Boom Obscured Structural Flaws

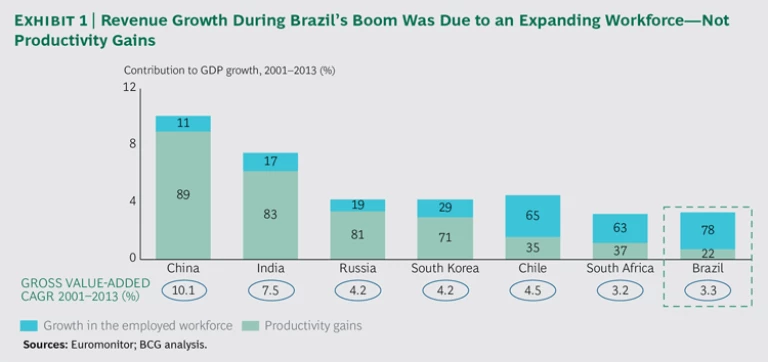

The boom of the previous decade obscured structural flaws in the Brazilian growth story. In emerging markets such as China, India, and South Korea, rising productivity has been the chief driver of GDP growth. In the case of Brazil, however, productivity grew by a meager 1% a year on average from 2001 through 2013, well below the increase in wages over that period. (See Brazil: Confronting the Productivity Challenge , BCG report, January 2013.) Instead, 78% of the nation’s GDP growth from 2001 through 2013 was attributable to increases in the employed workforce. (See Exhibit 1.) These gains were driven by average annual growth in the working-age population of 1.8% and by falling unemployment, which reached a record low of 4.8% in 2014. But Brazil’s population is aging, and annual growth in the workforce through the rest of the decade is projected to drop to 1.4%.

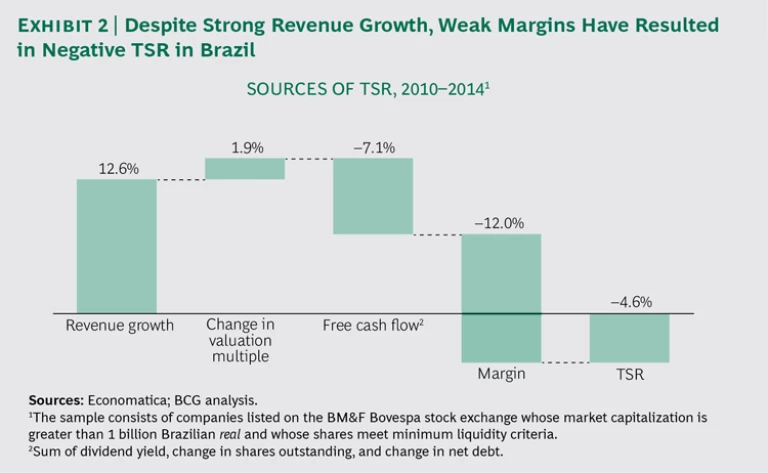

These factors translate into slower growth in most Brazilian industries. That is a considerable problem for many companies operating in Brazil and their shareholders. Our analysis shows that, on average, revenue growth contributed 12 percentage points of the total shareholder return (TSR) generated by companies on São Paulo’s BM&F Bovespa stock exchange from 2010 through 2014. (For an explanation of TSR, see “The Components of TSR.”)

THE COMPONENTS OF TSR

Total shareholder return is the product of several factors. (See the exhibit below.)

The TSR model uses the combination of revenue (sales) growth and change in margins as an indicator of a company’s improvement in fundamental value. It then uses the change in the company’s valuation multiple to determine the impact of investors’ expectations for TSR. Together, these two factors determine the change in a company’s market capitalization and the capital gain (or loss) to investors. Finally, the model tracks the distribution of free cash flow to investors and debt holders in the form of dividends, share repurchases, and repayments of debt to determine the contribution of free-cash-flow payouts to a company’s TSR.

The important thing to remember is that all these factors interact with one another—sometimes in unexpected ways. A company may increase its revenues through an earnings-per-share-accretive acquisition and yet not create any TSR, because the new acquisition has the effect of eroding gross margins. And some forms of cash contribution, such as dividends, have a more positive impact on a company’s valuation multiple than others (such as share buybacks). Because of these interactions, we recommend that companies take a holistic approach to their strategy for creating value.

During the same period, margins deteriorated significantly—offsetting the gains in TSR that derived from revenue growth. This was mainly the result of higher labor costs, excess capacity in several industries, and an overall loss of competitiveness. To finance revenue growth, moreover, companies diluted shareholder value. These were the main reasons for the average negative 4.6% TSR observed from 2010 through 2014. (See Exhibit 2.)

A Call to Action for Companies Operating in Brazil

Creating value for shareholders in a no-growth environment is a relatively new challenge for companies operating in Brazil. Yet it can be accomplished if they focus on productivity. On the basis of our experience working with clients in Brazil, we believe that there are material opportunities for companies to turn around their businesses and boost profitability by systematically streamlining their organizations, rethinking their supply chains, and more efficiently using their capital.

In times of crisis, the need for—and feasibility of—deep change becomes more and more evident. Companies are likely to find a greater spirit of cooperation among stakeholders. Such periods present an opportunity to challenge the way things are done.

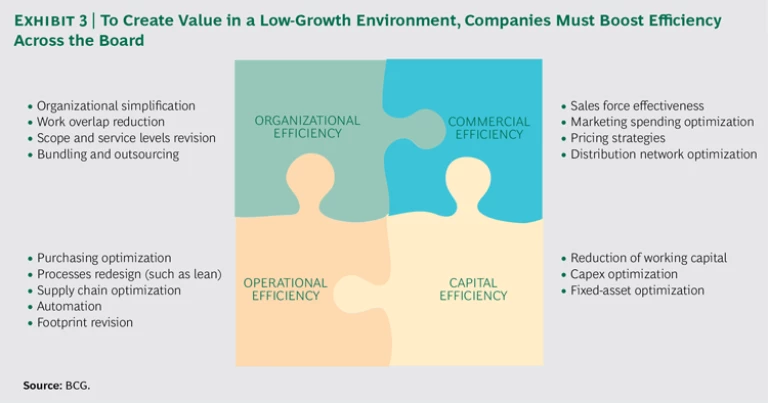

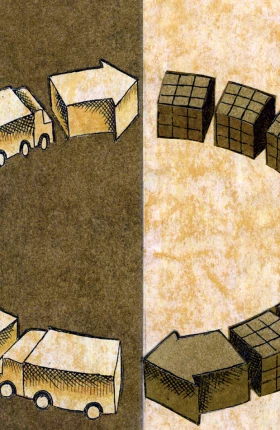

Our approach to efficiency focuses on the four levers of organizational, commercial, operational, and capital efficiency. We believe a holistic approach that makes maximum use of all four levers is not only possible but necessary. (See Exhibit 3.) The intensity with which each lever is applied depends on the specific sector and the state of the company’s operations.

Boosting Organizational Efficiency. As companies scaled up their operations to meet rising demand during Brazil’s high-growth years, many added managers and workers without worrying too much about how they were organized. In general, this is the right strategy when defending or conquering share in a growing market is

a company’s main priority. But with subdued growth, there are substantial opportunities to boost productivity by simplifying organizations, reducing overlapping tasks, revising the scope and levels of service, and, depending on the specific context, outsourcing.

Many companies operating in Brazil have paid insufficient attention to their management structure, resulting in redundant layers and suboptimal spans of control. Optimal staffing depends on the function, the company’s geographic footprint, and other factors. But in an efficient organization, the typical manager may have six to ten subordinates or even more. In a surprising number of cases in Brazil, however, managers have fewer than three employees reporting to them. In an HR department, for example, one manager’s sole responsibility may be to supervise a worker who handles compensation, while another manager oversees an employee who processes benefits.

Not only is this type of arrangement costly, but it also undermines the personal initiative that a dynamic organization requires. In Brazil’s current slow-growth environment, companies need to prune inefficiency from their management structures if they are to achieve sustainable productivity gains.

A case in point is a major Brazilian consumer goods company. This company took advantage of the downturn to analyze its organizational structure and discovered that of 650 managers, more than 50% had four or fewer subordinates reporting to them, a level typically regarded as overmanagement. More than 90 had just one subordinate. The company conducted an extensive reorganization. It reduced the layers of management from 11 to 7 and the number of teams with four employees or fewer to 23%. As a result, costs have been slashed and organizational efficiency has greatly improved.

Boosting Commercial Efficiency. When markets are growing, it’s easy to become complacent. This can erode margins later on, when growth slows. To improve their commercial efficiency, companies operating locally must increase the effectiveness of their sales force, optimize their marketing budgets, review their pricing strategies, and redesign their distribution networks.

Making better use of the sales force is a good place to start.

One Brazilian industrial goods manufacturer discovered that its salespeople spent only about 35% of their time actually meeting with customers and almost 60% on the road and doing administrative work. Part of the problem was inefficient processes. It took 12 days on average to register a new client and more than 20 days to ship the first order. What’s more, salespeople were often competing with their colleagues in the same territories. Not only were they duplicating each other’s efforts, they were also spending a lot of time traveling long distances. This poor time management translated into a waste of sales resources that should have been generating revenue. It was also frustrating clients, which had to wait longer than they should have to receive their goods—a cost to the company on both ends.

To streamline its sales force, the manufacturer remapped the geographic responsibilities of its salespeople, reducing average travel distances by 30%. It also slashed the time spent on administrative chores nearly in half. Salespeople now spend 55% of their time, on average, meeting with customers. Essentially, the company has increased the sales force devoted to winning new business and strengthening client relationships by 60% without adding a single person. The company anticipates that the average time required to register new clients, place orders, and dispatch shipments will shrink to approximately ten days, which should improve customer satisfaction significantly.

Boosting Operational Efficiency. An economic slowdown also encourages companies to more fiercely pursue productivity improvements by streamlining their operations and implementing rigorous controls—things that are difficult to do in periods of breakneck expansion. Many companies operating in Brazil now need to improve purchasing practices, redesign work processes, optimize supply chains and production footprints, invest in automation, and redefine product specifications as a way to optimize costs.

A renewed focus on operational efficiency in Brazil is a task of daunting proportions. As previously mentioned, Brazil’s industrial competitiveness has deteriorated significantly over the past decade. According to The Boston Consulting Group’s Global Manufacturing Cost-Competitiveness Index, Brazil’s competitiveness declined by 25 percentage points relative to the U.S. over this period. Among other factors, this loss was attributed to wages that more than doubled at a time that labor productivity grew by only 12%. Industrial electricity costs also rose 90% during this period. (See The Shifting Economics of Global Manufacturing: How Cost Competitiveness Is Changing Worldwide , BCG report, August 2014.)

One Brazilian consumer products company, which had expanded rapidly owing to strong growth and a number of acquisitions, began implementing lean manufacturing during the downturn to strengthen its margins and become more competitive. It began with a program to reduce material waste and improve labor efficiency at a single plant. Equipment at the plant was poorly maintained: lubrication was inadequate, and components were missing or in need of replacement. Repairs were typically of the palliative type. Many workstations had more employees than they needed. Absenteeism was high in all shifts, and workers were poorly trained. A culture oriented toward results was missing. The plant had no reporting system, no KPIs to track efficiency, and no improvement targets. Many procedures and standards were not followed.

Analysis of the plant’s manufacturing operations revealed that the overall effectiveness of equipment was 20% lower than industry benchmarks. About two-thirds of the losses in equipment effectiveness were due to stoppages over minor events. The plant generated 50% more scrap material than it should have.

The company began its lean transformation with 12 initiatives. It assembled a team of 13 people from various business functions and trained them in lean concepts and practices. Basic lean tools were implemented to identify change and to begin transforming the culture. The company conducted workshops for the labor force, established KPIs to measure costs and manufacturing efficiency, and set up activity boards and visual aids throughout the plant. The company anticipates that the new lean practices will enable it to reduce the plant’s addressable cost base by 30%. It aims to roll out lean at its other plants over three years.

To make an even bigger impact on operating expenses, companies in Brazil should take a holistic and programmatic approach to transformation that encompasses several disciplines. In our discussions with clients in Brazil, six obstacles to improved productivity consistently arise in their organizations.

First, many companies lack clear parameters for achieving operational efficiency goals; an agenda for improvement is not embedded in the organization. Second, companies are unable to establish and execute capability-enhancement programs, such as training, that set a consistent way of behaving. Third, top management lacks the proximity to the shop floor and the knowledge it needs to drive productivity gains. Fourth, companies don’t put enough emphasis on work preparation and on visual displays of performance metrics that help managers drive productivity improvements on the shop floor. Fifth, companies lack programs to achieve cultural change and a spirit of “healthy dissatisfaction.” Finally, many companies do not properly codify all operational efficiency aspirations and support tools into one common “language” that can facilitate a system for continuous improvement.

Addressing each of these challenges will lead to clearer managerial routes and leadership in operational efficiency.

Boosting Capital Efficiency. As interest rates rise and credit becomes tighter, companies that invested heavily to expand capacity during the boom now must improve their capital management. To increase their financial efficiency, Brazilian companies should find ways to reduce their working capital and make optimal use of their capital expenditures and fixed assets.

A thorough review of capital expenditure plans can be particularly valuable. During Brazil’s high-growth decade, companies invested heavily to serve a growing market. In hindsight, it’s clear that many had bet on projects that were not productive and that are now tying up needed cash. These companies must assess their portfolio of ongoing and planned projects and restrict their investments to those likely to create the most value.

A leading Brazilian telecom company conducted such a review of its network investment strategy. Using big data, it looked at every location in Brazil where it had planned to expand and upgrade its footprint, analyzing the demand pattern and revenues that each location was likely to generate. This allowed the company to prioritize its investments at a microregional level and to maximize its returns. The company now has an ongoing capital-allocation system in place for network investments.

The Way Forward

While Brazil’s growth story has stalled, it is far from over. With millions more households still expected to enter the middle and affluent classes over the next decade—and hundreds of cities in the country’s interior still underserved—the nation remains one of the world’s most important emerging markets.

For at least the next few years, however, the most urgent priorities for Brazilian companies are to survive and continue delivering value to shareholders. Companies will need a step change in efficiency if they are to take advantage of current opportunities. Companies that play in the B2B space must also ensure that their products and services help their customers become more efficient. Clients facing challenges will focus increasingly on the total cost of ownership of a company’s offerings, and not only on price. Solutions that reduce overall costs will have an edge.

Companies that act aggressively to improve their efficiency will be ready when Brazil’s economy rebounds. They will be able to anticipate opportunities—be they new openings in the market or shifts in product portfolios—before others. Moreover, in the short term, they will be better suited to benefit from opportunistic M&A activity that will certainly arise from lower valuations throughout the years ahead.

The transformation will require the right tools and well-executed initiatives that are tightly aligned with strategies defined at the top and executed at every level. There is no better time than an economic downturn to get in shape for the intense competition ahead.