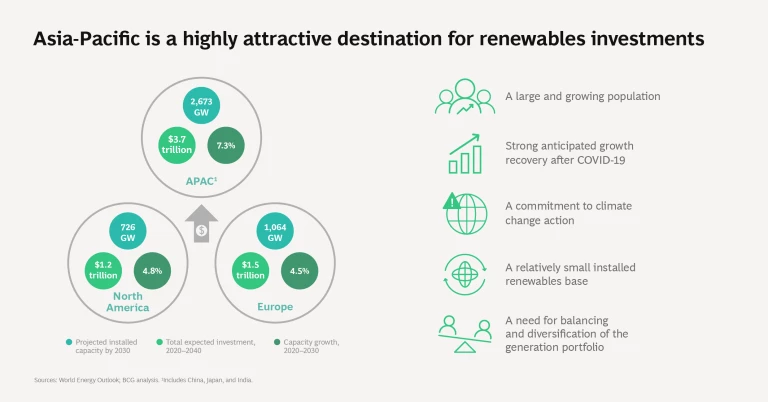

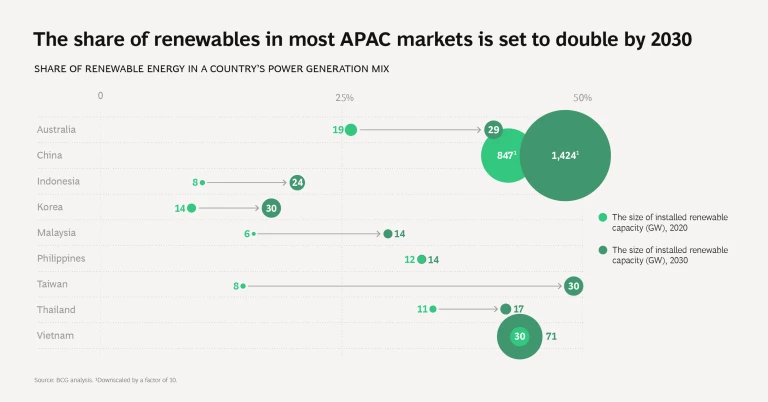

Asia-Pacific is poised to become the key destination for renewable-energy development and investment in the 2020s, with capacity expected to increase by about 2 terawatts by 2030. Demand is growing faster than in any other region worldwide, supported by rising populations, strong economic-growth prospects, and substantial potential due to the low market penetration of renewables. Green postpandemic recovery programs are set to underpin the sector’s continued upward trajectory.

Given the region’s complexity and diversity, an APAC-wide playbook does not provide sufficient clarity and nuance for investors and operators eyeing its renewables potential. Those looking to play in this arena must take a granular approach, understanding country-specific market dynamics and examining the likelihood that a specific technology will gain commercial success in any particular geographic area.

Solar and wind are projected to be the main focus for governments across APAC as they push renewables agendas, as well as for companies expanding their portfolios in this region. We believe APAC could become the second-biggest offshore wind market, with capacity reaching 78 gigawatts by 2030 (a compound annual growth rate of 24%) because of stronger returns—especially in the early phase of projects—and the geographic advantages of some Asian countries.

There are several other factors boosting the impact of renewables on the energy landscape. In APAC, unlike other regions, a decline in the levelized cost of energy (LCOE) is happening hand in hand with an expansion of emerging technologies such as green hydrogen and utility-scale batteries. Japan’s increasing focus on pursuing a decarbonization path provides an opportunity for countries such as Australia to export hydrogen there. The fuel can deliver clean energy for transport and homes.

Granular Insights

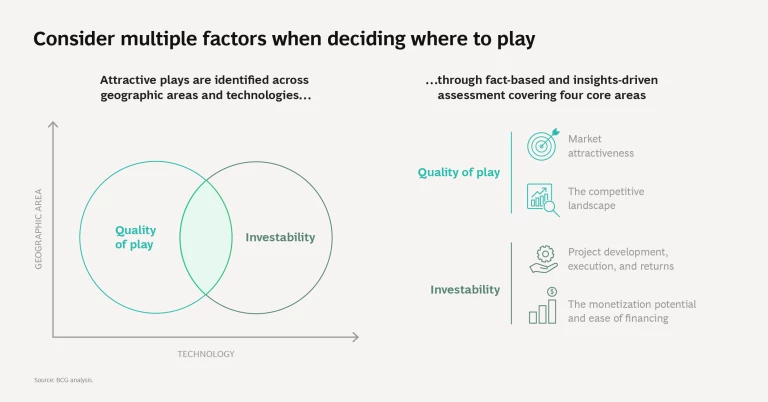

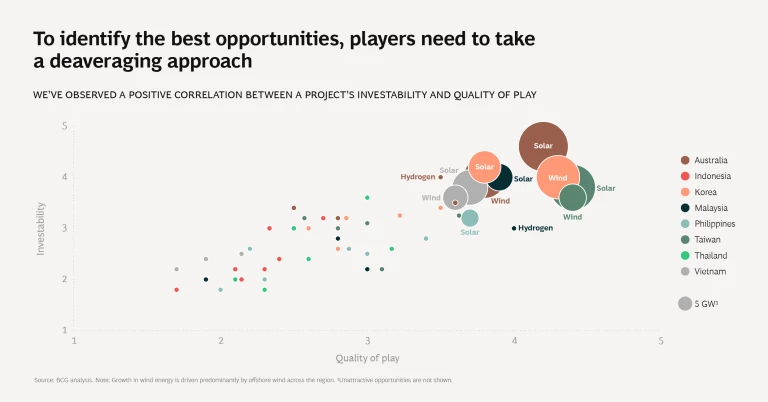

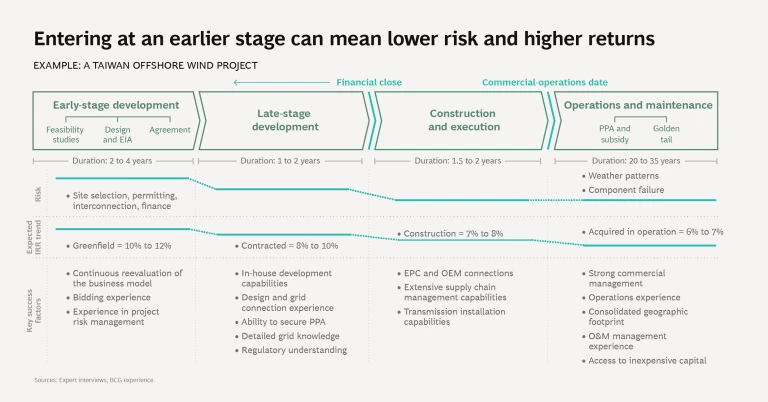

As they gauge APAC’s growing renewables opportunities, companies and investors must apply two lenses to understand specific challenges and key success factors. First, they need to examine the quality of play, including macro considerations such as the regulatory landscape and growth outlook. Second, they need to analyze investability, comprising project-specific considerations such as the potential returns and strength of the supply chain. While publicly available information is important for building knowledge, players will also have to tap insights from a thorough understanding of the region’s markets.

By applying these lenses, we’ve developed a deeper perspective at the intersection of markets and technologies across key APAC areas. For example, although promising opportunities for offshore-wind development exist in Vietnam, South Korea, and Taiwan, each market presents its own set of challenges, requiring specific capabilities and a unique approach to win. The role of government in creating favorable conditions for renewables development is still crucial across the majority of APAC markets.

Consider Vietnam. The country is one of the fastest-growing renewables markets in APAC. But the government needs to address important issues related to grid congestion, the bankability of power purchase agreements, and the country’s continued reliance on coal. For foreign companies and investors to succeed in Vietnam, it is imperative that they form a consortium with local players and obtain state backing in order to navigate administrative hurdles.

In South Korea, the government has set aggressive targets to retire coal and nuclear plants over the next 10 to 20 years, paving the way for the development of offshore wind. Succeeding in South Korea requires robust OEM and development capabilities and involves forging partnerships with strong local construction service providers.

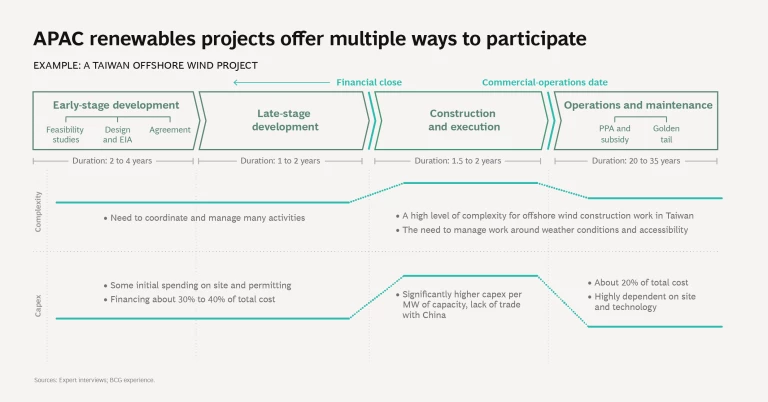

Taiwan is a mature market with its own unique hurdles. Because of geographic conditions and the location of wind farms, offshore developers must comply with stringent industry standards. Players should look at creating value through partnerships that share the capital cost while preserving an exclusive role for them in providing support services.

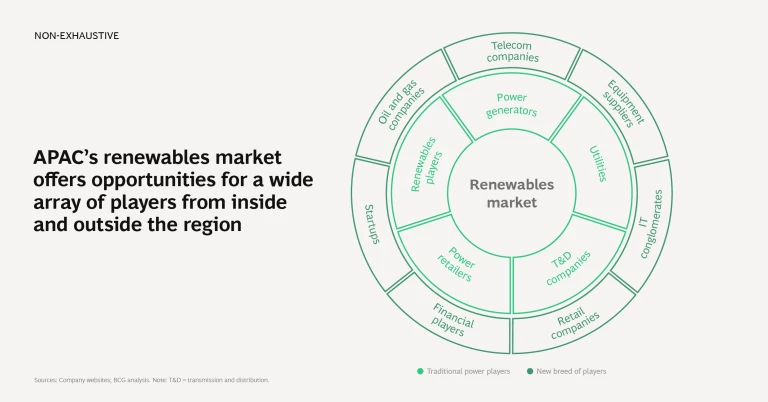

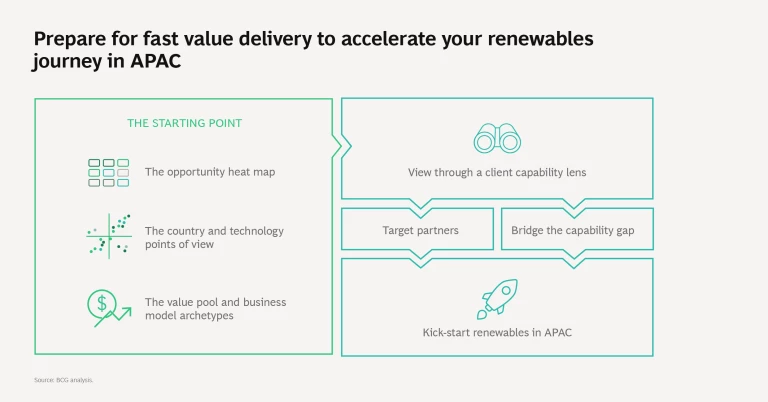

Regional APAC markets are opening rapidly to foreign investors, and the first wave of consolidation could happen sooner than expected. Faced with growing competition, players seeking competitive advantage must develop a comprehensive and strategic understanding of value pools and business model archetypes on the basis of country-level facts and insights. This will require a deep market expertise and access to data, tools, and accelerators, enabling players to develop capabilities and establish synergies so that they can venture successfully into the APAC renewables arena.