After decades of false starts, the idea of flying cars is shifting from a science fiction fantasy to a functioning reality. Projections for the size of the market vary widely, depending on the economics of the underlying technology and how the vehicles will be regulated. Yet there’s broad consensus that a market for the technology will emerge in the next decade, and we believe that the worldwide fleet size could grow to at least 200,000 vehicles.

The worldwide fleet size could grow to 200,000.

For aerospace OEMs and suppliers, the prospect of flying cars represents a significant new business opportunity. Yet actualizing this opportunity will require a dramatically new operating model, with product development cycles that are shorter than those associated with traditional passenger aircraft, a much larger base of potential customers, higher production volumes, and lower price points. But aerospace companies are not ready.

Aerospace OEMs and suppliers should immediately start taking steps to capitalize on this opportunity. Success will require a clear understanding of the nascent market’s characteristics, as well as the first-mover advantages that accrue to forward-thinking organizations.

A Tipping Point in Technical Credibility

For decades, aerospace companies have been trying—unsuccessfully—to create a market for short-range on-demand air transport. A helicopter boom in the late 1970s was the closest the industry has come to realizing the vision of intracity air travel. But high costs, noise complaints, and safety problems limited the aircraft to a tiny number of urban heliports.

Today, the industry is on the verge of creating a workable model for flying cars. Key underlying technologies such as autonomous flight systems, electrical propulsion, and battery-based energy storage have all advanced rapidly and are near a tipping point. Electric batteries likely need one more big step forward—a key capacity milestone is 400 watt-hours per kilogram, which may take up to a decade to achieve. But even conservative estimates project that commercially viable vehicles could be in the market by the mid-2020s. Early prototypes based on these technologies are in development, and some of them have already gotten off the ground for short test flights.

Several trends are coalescing to boost demand for flying cars. First, the transportation infrastructure in many developed-market cities is dilapidated, and there is little appetite for making the kind of investments that are needed to upgrade it. Urban populations continue to grow twice as fast as the overall population, leading to an infrastructure spending gap of $18 trillion, according to the World Bank. Most mobility infrastructure was built for automobiles, yet rapid urbanization has led to traffic-choked roads and millions of frustrated commuters.

Moreover, there is widespread interest and investment in flying cars, from OEMs (both inside and outside the aerospace industry), transportation providers such as Uber, software developers, and venture capital investors. Investment in the technology thus far is approaching half a billion dollars.

Four Scenarios for the Size of the Market

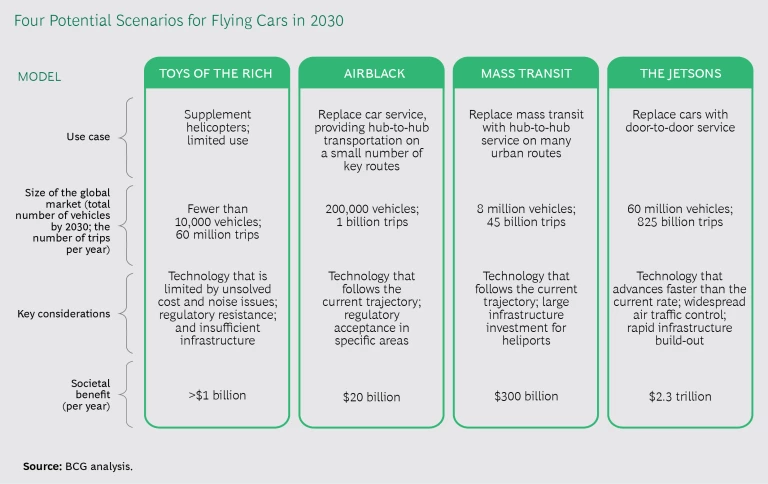

The ultimate market size is still unclear and will depend on the economics of the technology and how regulatory issues (relating to such concerns as airspace, noise, and the ability to build support infrastructure) pan out. We anticipate four potential scenarios by 2030. (See the exhibit.)

Toys of the Rich. In the most conservative scenario, flying cars are considered “toys of the rich” that could supplement today’s helicopter market and would be aimed at an exclusive population subset that is not price sensitive. The result of this scenario is a small market: fewer than 10,000 flying cars in operation worldwide.

AirBlack. In the second scenario, flying cars would replace black-car service in cities. In all likelihood, individuals would not own or operate the flying cars, which would be confined to operating within specific, predefined areas. Total fleet size worldwide: 200,000 vehicles.

Mass Transit. In the third scenario, flying cars replace mass transit as a means for ferrying large numbers of people across high-density point-to-point routes—for example, between neighboring cities or between airports and city centers. This would require a large infrastructure investment for heliports, leading to an overall fleet size of 8 million vehicles.

The Jetsons. At the other extreme is a Jetsons-inspired scenario, in which flying cars replace automobiles as the primary form of personal transportation and a heliport graces every lawn. In this scenario, flying cars transform the concept of transportation, and the worldwide fleet eventually grows to more than 60 million vehicles.

Aerospace OEMs and suppliers must not try to project the size of the market. Rather, they should work to understand the implications for manufacturing and for their business models. Consider that a modest estimate of 200,000 vehicles worldwide is about five times the number of commercial aircraft the industry currently expects to build over the next 20 years. The challenge for leadership teams is to start preparing.

The challenge for leadership teams is to start preparing.

New Requirements for Aerospace Companies: Faster, Smaller, Cheaper

Unlike traditional aircraft, flying cars will require a manufacturing model that is based on high volumes, a low product mix, and affordability. Development, design, and engineering will need to be much faster than those of current timelines for getting certified aircraft to market. Owing to the rapid progression of technology, product cycles are likely to last only a few years rather than the more than 20-year cycles that are typical in the aerospace industry. However, safety and reliability standards will need to be just as stringent.

Moreover, the technologies—electric propulsion, vertical takeoff and landing (VTOL), powerful batteries, advanced sensors, autonomous flight, complex air traffic control, and fleet management systems—required to field a viable product are far beyond the realm of most of today’s automotive and aerospace players.

The industry’s entire supply chain will need to move just as quickly and will involve many participants that have never before been aerospace suppliers. The industry will need to create an entirely new supply chain for this market.

Finally, the business model and commercial approach will be different from those currently in place at traditional aerospace companies. Rather than marketing and selling to airlines (which operate the aircraft and serve as intermediaries between OEMs and passengers), aerospace companies may need to market and sell to new types of fleet operators or directly to end users. They, themselves, may need to serve as fleet operators.

Aerospace companies may also need to be involved in developing the ground infrastructure required to support the vehicles, and they may be called upon to work with policymakers to help set regulations. These dramatic changes are moving the industry’s approach: from a slow B2B mindset to a fast-moving consumer-based model.

The Critical Window for Gaining a First-Mover Advantage

Success requires early leadership. The nascent stage of the market—the next five to ten years—will be critical. During this period, product life cycles will be slower, as companies determine the right design and technological mix. Most innovation will originate with manufacturers—rather than customer feedback—so early movers will be positioned to shape the ground rules of the market in areas such as use cases, infrastructure, regulation, and even product design. (Uber’s influence in the development of ride-sharing apps is a good example.) Brands that can establish themselves in the minds of the market can “claim” the market—as Tesla has in the electric-car space. Finally, technology players such as Google and Microsoft will play roles in the overall value chain.

In addition, barriers to entry will be lower—a situation that is more akin to the auto industry than traditional aerospace. As a result, exploiting the available barriers is critically important. Companies that can generate early production volume will build a cost advantage on the basis of the experience curve, and that advantage can—assuming there are no radical disruptions in technology—become a defendable barrier in the medium term.

All these advantages will be magnified if the initial volume is the result of a few large commercial orders—for example, from uberAIR rather than from individual consumers.

Given this window of opportunity, we recommend that aerospace OEMs and suppliers seize the initiative and take the following steps:

Given this window of opportunity, we recommend that aerospace OEMs and suppliers seize the initiative.

- Make deliberate choices about how to approach the industrial concept. The capabilities to win in the flying-car business cut across several of today’s industries: software and autonomy capabilities that look more like those of Google and defense contractors; electric vehicles that look more like those of Tesla; high-rate production capabilities that look like those of an automobile OEM; and fleet operations like those of Uber and Lyft. Underlying all this, of course, are the strong airframe-engineering and certification capabilities that commercial aerospace players have today. How will aerospace OEMs design the business and build out the capabilities to compete? Partnerships, spinoff entities, and other options are all possibilities, so companies must have a vision, assess possible scenarios, and make choices early.

- Move fast. Make sure that the business has the freedom and latitude to move quickly and is not burdened by overhead or the existing slow pace and processes of traditional aerospace and defense OEMs and suppliers.

- Shape the regulatory landscape. Partner with regulators in a small set of key jurisdictions and lead demonstrations that establish the technology’s social value more broadly as, for example, a means to relieve traffic congestion or boost local economic activity.

- Work with stakeholders. Organize to plan infrastructure for both airspace and physical structures such as landing zones on building rooftops and the ground.

- Invest in agile engineering and product development. Agile can help bring vehicles to market faster and at lower cost than other current approaches. Design and development cycles will be more like those of the automotive industry than those of the aviation industry.

- Use Industry 4.0. Industry 4.0 tools, data, and models can help determine the future cost structures that will be required to generate a profit.

- Invest in the underlying critical technologies. Investment in VTOL, distributed electric propulsion, autonomous flight controls, safety systems, and batteries is critical for suppliers and OEMs, as the respective contribution of value between these two groups is not yet clear.

- Start to plan the new supply chain. Begin to plan the new supply chain that the manufacture of flying cars will require. This will likely be very different from that of traditional aerospace and defense.

- Pursue platform positions. Suppliers must aggressively pursue platform positions. Some may opt to partner with a single OEM early in the game rather than wait for dominant players to emerge.

The flying-car situation is no longer a matter of “if” but of “when” and “how big.” We believe that there is a significant opportunity for aerospace OEMs, provided they recognize the implications for their manufacturing operations and business model. The new flying vehicles are not simply small airplanes. This business will require consideration of and attention to, for example, a new development cycle, marketing, and regulatory input. It’s a big endeavor, but we believe the prize—an entirely new market—is more than worth it. The only unanswered question: whether leadership teams will have the vision to capitalize on this opportunity and the foresight to begin taking the necessary steps now.