Banks often regard the small business segment as relatively unattractive—they see high levels of risk and little potential for growth. They also characterize the segment as costly to serve.

But the opposite can be the case. By implementing the right business model, banks can transform their relationship with smaller companies into one that fits their risk model. And by choosing the right digital strategy, banks can build a smarter sales operation and streamline processes, generating unexpected rewards and gaining significant commercial advantage.

Some players have demonstrated their optimism about the potential for small business banking. Since 2000, financial technology (fintech) providers have directed more than 50% of their investments toward corporate banking, including the small business segment. Meanwhile, many banks have ramped up digital solutions for smaller businesses.

With the competitive temperature rising, incumbents must take action if they want to protect their advantage against nonbank entrants and keep pace with their peers.

The Keys to Winning in This Market

Lending has been the primary focus of many banks, and they have downplayed opportunities in areas such as transactions. In most markets, however, one-half to two-thirds of small businesses have required little or no lending.

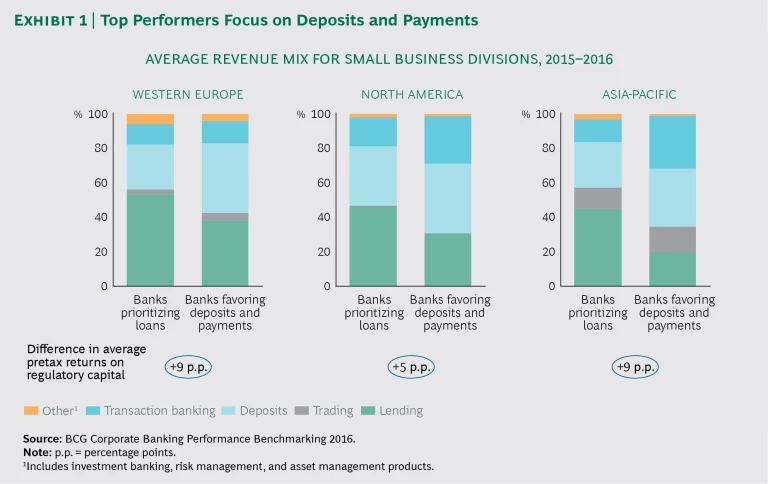

The unwillingness of some banks to change their business model to meet small business needs has hindered their performance. In fact, the most profitable banks have focused less on lending. (See Exhibit 1.) From 2015 through 2016, for example, Western European and Asia-Pacific banks that favored deposits and payments posted pretax returns on regulatory capital that were 9 percentage points higher than the pretax returns of banks that prioritized loans. Banks that are looking to improve their performance should likewise focus on deposits and payments.

In addition, banks need to choose the right digital strategy. A stronger deposit and payment franchise can generate valuable transaction data. By capturing this data and using smart analytics, banks can better understand customer activity, which can lead to more effective service models and better pricing. Analyzing data can also enable banks to significantly improve functions such as credit risk modeling and loan tracking, helping to resolve the historical bugbear of small business banking: high levels of nonperforming loans.

Seizing the Opportunity

Small businesses account for as much as 10% of annual banking revenue, a significant proportion that belies their habitual position at the bottom of the customer pecking order. BCG’s 2016 Corporate Banking Performance Benchmarking showed that banks have a significant opportunity to turbocharge their performance in the sector.

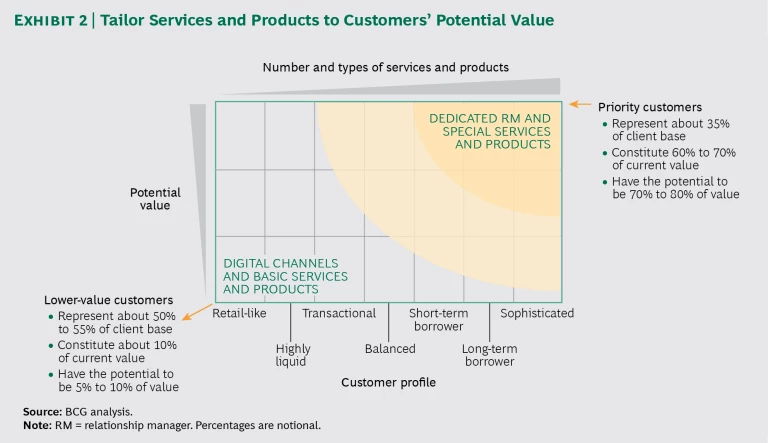

Tailor the service model and product portfolio to small business customers. A bank should segment its small business customers according to the economic value they add, gain a deep understanding of each segment’s needs, and then tailor its service model and product portfolio appropriately.

Banks can take several steps to help their sales force be more effective in serving higher-value customers. Developing better and more-integrated analytics would allow RMs to prioritize higher-value customers, tailor sales scripts and marketing communications, and proactively offer services and products that reflect changes in customers’ needs and credit status. Implementing digital tools that help centralize decision making, enable a more cohesive performance review process, and systematically monitor sales effectiveness would help RMs refine their efforts and spend more time in front of customers. By taking such steps, banks can help RMs increase the number of customers contacted each day by 20% to 25% and lift daily sales per RM by 15% to 20%.

To further improve performance, banks can radically simplify their portfolio to eliminate redundant, overlapping, or low-impact items, such as safe deposit boxes and a multitude of lending products. Simplification will not only reduce operating costs but also increase cross-selling opportunities; a streamlined portfolio makes it easier to create product bundles for specific audiences. For example, a bundle for small businesses with simple needs may include a checking account, a few investment products, overdraft protection, a credit card, and a merchant point-of-sale solution.

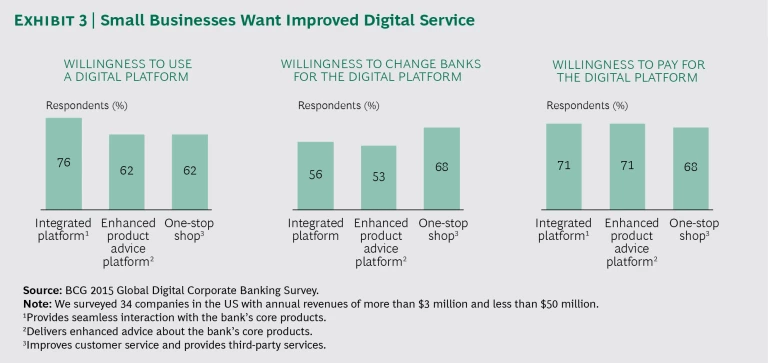

Improve and expand digital platforms. More than three-quarters of respondents to the BCG 2015 Global Digital Corporate Banking Survey said they would like one-click access to products and a single sign-on across platforms. Nearly 70% said they would be willing to change their primary bank, or even pay a premium, to access services through a one-stop digital shop. (See Exhibit 3.)

Given the high demand for digital access, it’s not surprising that many banks already have a one-stop digital shop in place, helping small business customers access products and services, secure fast credit decisions (often within hours and sometimes instantly), connect with professionals (such as accountants and lawyers), and obtain research.

But to remain competitive, banks must improve and expand their digital platforms. They can accomplish this by, for example, tasking internal teams with the job, building a center of excellence or an innovation lab, or seeking acquisitions. Whichever route is selected, the first step is to listen to small business customers, whose perspectives and priorities will inform a detailed roadmap. A leading bank boosted its understanding of small businesses’ needs by conducting a deep ethnographic research program, which informed the bank’s redesign of the customer journey.

Partnerships are another way to advance digital platforms. Some banks are collaborating with fintechs to improve and expand services in areas such as cash management, foreign currency exchange, invoice scanning, and payroll. Other banks are partnering with consultancies to experiment with concierge-style services that include consulting, specialized employee training, and procurement support. Partnering can be mutually beneficial: it can help banks accelerate innovation and launch new services at a lower cost, while giving partners the opportunity to significantly scale their solutions.

Such collaboration also tends to lead to more cross-selling opportunities and higher adoption rates. For example, a fintech partnered with financial institutions around the world to connect 15,000 small and medium- sized enterprises to an online platform where they will find a variety of business services and opportunities. Banks are collaborating on this effort because it will give them access to the fintech’s customers, significantly increasing not only the number of opportunities to cross-sell services and products but also the adoption rate: customers are more likely to buy from their vendor’s partner than another organization.

Optimize pricing and fix disparities. Setting and maintaining realistic prices are major challenges for banks in the small business segment. Anomalous discounting practices, limited pricing transparency, and a lack of benchmarking lead to inconsistent industry pricing. In addition, RMs do not have recourse to compare pricing tables, performance reports, or other pricing data that would help identify normal ranges for segments and products. As a result, it is common to see 20% to 40% leakage on interest charges and 40% to 60% leakage on loan fees. Billing slippage is another outcome: RMs often omit or waive fees, such as management or exit fees. Leakage and slippage can lead to revenue losses that are sizable and fluctuations in sales performance.

To combat suboptimal pricing, banks should initially focus on the long tail, which is the 90% to 95% of customers that represent close to 50% of revenues. Lacking industry measures, internal benchmarks can help generate target prices per product and client. And pilot programs can help determine the best way to manage and control discounting and waivers.

For example, a European bank analyzed the monthly fees and charges paid by hundreds of small business clients and found they were underpaying for services. To rectify the situation, the bank introduced discounts on new product purchases and launched a number of other perks. It backed the effort with a robust communications program, including a brand and marketing campaign. In addition, it offered RMs dedicated tools, such as a net benefit calculator, to help clients understand the value-added features, analyze the new discounts, and compare and contrast migration paths. The pricing optimization program successfully moved about 30% of the bank’s small business clients to higher- priced products and services. The program also led to an increase in revenues from cross-selling.

Short-term actions should be paired with longer-term, technology-based solutions that provide data-driven sales support and price realization metrics. For example, a bank developed a pricing tool that considered customers’ value to the bank, their price sensitivity, and their relative risk. The tool also considered the bank’s minimum requirement for return on risk-adjusted capital per product. Such information empowered RMs to reward good clients with more favorable pricing, fix discrepancies, and avoid making exceptions. Over three months, the tool helped increase the interest rate spread by as much as 40 basis points. It also helped boost lending fees by as much as 25 basis points.

Digitize processes. Internal processes often rely heavily on manual input, which can hinder functions such as sales and increase the cost to serve customers. But by digitizing internal processes, banks can boost the effectiveness of employees and bring more efficiency to a variety of activities, reducing the cost to serve the customer. (See “Using Analytics to Improve Sales.”)

USING ANALYTICS TO IMPROVE SALES

One of India’s largest banks saw its small business banking franchise decline in value by as much as 4% over three years. Its return on assets was less than 0.5%, bad loans reached an all-time high of 10%, and the turnaround time for credit and related approvals stretched to nearly 60 days. Poor segmentation of the customer base and a heavy reliance on paper-based processes contributed to a negative cost performance. In addition, the bank lacked the analytics tools and experts to effectively use its large store of data, including customer and market data.

To turn things around, the bank invested in an integrated suite of analytics tools. A lead-generation engine allowed RMs to prequalify high-potential customers by vetting them through various financial filters. Other tools helped RMs create a pool of customers to target and avoid relying on branch walk-ins. And real-time performance dashboards, developed through rapid prototyping, helped RMs and their managers compare each product’s pricing and sales by client as well as by client location and industry sector. The dashboard flagged instances where pricing and sales deviated from the norm, and a built-in reporting tool enabled RMs and their managers to share important data on a weekly basis, which improved pricing conformance. Star ratings, weekly call-for-action emails, and more robust performance metrics drove up productivity. Since implementing the suite of analytics tools, the bank has generated more than 100,000 qualified leads and has seen a threefold jump in year-on-year growth and productivity.

To tease out which processes to tackle first, banks should look for those that are only partially digitized and thereby create discontinuities for customers. Particular attention should be paid to partially digitized processes that customers use for routine requests. For example, a bank’s online platform may explain how to open an account—including all the documents small businesses need—but require that customers visit a branch to open one.

Banks should also digitize sales activities, which are critical to improving performance. Sales systems can help RMs monitor their pipeline and plan when to follow up with clients. These systems can also track call center engagement and trigger points for outreach initiatives. To speed credit applications, banks can digitize their risk assessment and scoring algorithms and combine them with easy-to-access customer analytics to create early-warning systems that enhance decision making and facilitate credit upselling.

Banks can transform the economics of working with small businesses by introducing improvements in service models and product portfolios, improving digital platforms, enforcing better pricing discipline, and increasing process efficiency. Our research suggests that these four steps can boost revenues, reduce the cost to serve customers, and cut nonperforming loan ratios.

Some banks aren’t stopping there, though. A US bank that was under pressure to reduce the cost of serving the small business “micro” segment (made up of customers with less than $1 million in revenues) not only implemented these changes but went further to ensure success: it increased its reliance on retail bankers and, when appropriate, call centers.

Banks can attain returns that are comfortably over the cost of capital. Those that act, recognizing not only the potential value of the small business segment but also the segment’s importance in shaping the corporate bank of the future, will have a competitive advantage.