In these daunting times, it is critical for wealth managers to determine where they should be investing for growth. For example, should they concentrate on improving existing businesses or on exploring new frontiers? In either area, which should be the priority categories for investment? Should the focus be on the short term (the next 12 months) or on the longer term (the next two to five years)?

Across all regions, our client work and research have revealed some interesting patterns. For example, onshore businesses in North America and Eastern Europe and offshore players in Switzerland plan the highest allocation of resources (71 percent, 63 percent, and 62 percent of their respective investment budgets) to optimizing existing businesses as opposed to expanding into new frontiers. All other regions are allocating slightly more than half of their resources to optimizing existing business.

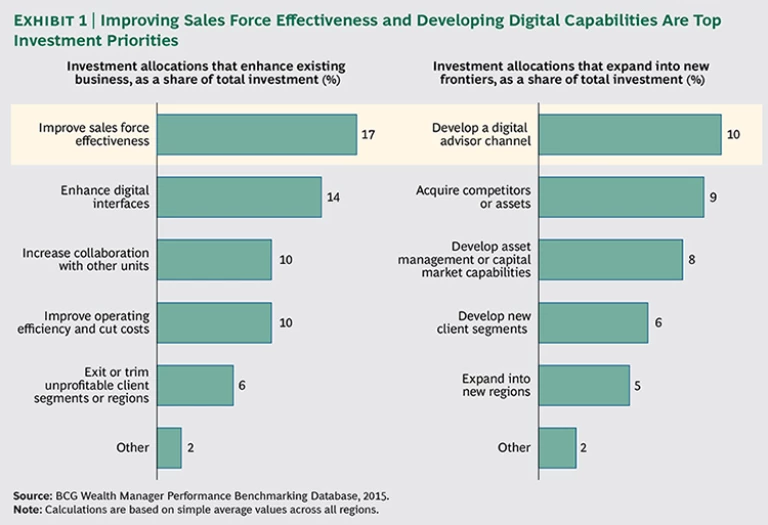

As for exactly where to invest resources to enhance existing businesses, the three highest priorities are improving sales force effectiveness (17 percent of total investment resources), enhancing digital interfaces (14 percent), and increasing collaboration with other business units (10 percent). (See Exhibit 1.) By contrast, the highest priorities for expanding into new frontiers are developing a digital advisor channel (10 percent of total investment resources), acquiring competitors and assets (9 percent), and developing asset management and capital markets capabilities (8 percent).

Read more on this topic

Global Wealth 2015

- Winning the Growth Game

- Five Keys to Consistent Success in Wealth Management

- How Wealth Managers Invest in Themselves

In addition, most wealth managers across all regions are placing equal emphasis on short-term (12 months) and longer-term (two to five years) time horizons.

Of course, each region has its own character, and growth initiatives will be influenced by many factors. Below, we present a more nuanced outlook for individual regions.

North America

For wealth managers in North America, 2014 was a strong year despite some headwinds. The low-interest-rate environment put pressure on banking-product earnings, for example, and ongoing regulatory pressures continued to raise the cost of doing business. (See “Global Regulatory Pressures Show No Signs of Abating.”) Still, robust equity markets provided ample support.

GLOBAL REGULATORY PRESSURES SHOW NO SIGNS OF ABATING

Wealth managers face an increasingly complex regulatory landscape, with more than 100 updates issued daily around the world. The precise details and scope of some measures are not always evident, creating a major challenge for wealth managers. Indeed, as political and economic instruments, some regulations create more confusion than clarity, and place a significant burden on wealth managers from a cost perspective.

Making things even more difficult, litigation concerning regulatory measures has increased significantly, with some sanctions threatening the sustainability of banks and business models. Since the global financial crisis, litigation costs in the U.S. and Europe alone have amounted to $178 billion, with U.S. banks footing roughly two-thirds of the bill and European banks paying the rest. (See the exhibit “Litigation Costs Have Increased Significantly and Become a Part of Doing Business.”) Most of these costs have been in response to steps taken by U.S. regulators.

Overall, there is no denying that regulatory, compliance, and operating risks have come to dominate the day-to-day business of many international wealth managers. And although classic balance-sheet risks such as credit risk and liquidity risk are typically minor, they still need to be monitored. Wealth managers are being forced to adapt to the same level of oversight as universal and retail banks.

On the positive side, a key result of such developments is that regulatory, compliance, and operating risk management have become core competencies that enable wealth managers to differentiate themselves. It is therefore critical that they fully grasp the evolving regulatory landscape and be able to anticipate changes—both for each business line and for each country in which they do business. (See the exhibit “Wealth Managers Must Fully Grasp a Complex and Ever-Evolving Landscape.”)

For example, new regulations on client suitability and market transparency are constantly adding more requirements to the advisory and selling process. And in cross-border wealth management, the number of countries served is a key driver for the complexity of the business model. The size of the bank determines how much complexity can reasonably be handled.

Leading wealth managers are responding to the situation in three principal ways. First, they are establishing regulatory and compliance management as a cross-functional organizational unit that leverages synergies and coordinates lobbying. This unit’s activities include the following:

- Gathering regulatory intelligence

- Calculating the regulatory impact on the business and appropriate responses (both financial impact and strategic options)

- Raising understanding and awareness among stakeholders, clients, and the general public

Second, wealth managers are improving front-to-back operating and compliance risk management. This initiative involves the following:

- Installing a strong risk and compliance culture

- Adopting a front-to-back model with three lines of defense: the front office (sales department), risk controlling, and audit. Compliance and operating-risk management start with the front office.

- Developing an easy-to-use tool kit for managing risk that is integrated into daily processes for all levels of personnel and activity—not just in the risk department

And third, wealth managers are actively reviewing their business portfolios, both by market and by segment, focusing only on those areas with critical mass while deemphasizing and exiting others.

Implementing these steps represents a large cultural challenge for many wealth managers. A full commitment from senior management as well as a dedicated transformation-management team is required for success.

Looking ahead, overall growth and share-of-wallet gains will be targeted both by brokerage and private-banking models, with a particular emphasis on driving organic growth. Indeed, wealth managers of all types are looking for close-to-home opportunities, starting with their existing customer relationships. Brokerages, for example, are seeking to consolidate the investment wallet but also to leverage other areas of the business in order to make inroads into the lending wallet—largely through mortgages and banking products. They are adapting both compensation structures and training programs accordingly, as well as adding specialists to support financial advisors in selling and delivering these products. They are also attempting to create compelling new offerings and enhance service levels in the hope of raising competitiveness and attracting new customers. Private banks, for their part, are continuing to look for ways to drive increased penetration of investment services by bolstering their overall offerings. Increasing capabilities in alternative investments seems to be currently in vogue.

There is also a wide-ranging focus on optimizing resource deployment in order to liberate capacity that can be put toward growth initiatives. Ongoing cost increases and more onerous client-service requirements are prompting players to reevaluate service models and overall economics for low-wealth-band clients and those with limited growth potential. Brokerages, for example, are placing renewed focus on clients with minimum investable assets of more than $250,000. Private banks are reevaluating service models for clients with between $1 million and $5 million in assets, attempting to optimize team structures to match the exact nature and size of the client opportunity. They are taking a hard look at the current assets and future needs of their clients in order to tailor the service model.

Of course, virtually all wealth managers are actively pursuing the next generation of clients, both through new teaming structures and through extending their current business models to tap into younger individuals who may represent the affluent and HNW clients of the future. These new structures are aimed at harvesting clients in the long tail of the RM book and establishing relationships with family members who have (or are likely to have) sizable future assets. One goal is to be able to provide a smooth transition as RMs move on or retire.

For players whose business is primarily in retail banking, leveraging new business models is about profitably addressing the needs of clients and incubating them as their wealth grows. Many such players are evaluating how new technologies can be leveraged to gain competitive advantage.

To a degree, we are witnessing the convergence of brokerage-oriented and private-banking-oriented models. All are pushing toward a more holistic, planning-led advisory approach that includes lending and banking products as well as investment solutions. It remains to be seen whether the regulatory environment will fully converge as well.

The industry is also seeing a continued push toward more-centralized portfolio management, a move driven not only by the search for cost efficiency but also by the commitment to quality. It is paramount to maintain consistency in both investment advice and portfolio performance in an increasingly complex and macro-driven investment environment in which specialized sub-asset classes are more prevalent. Recently, the largest source of alpha generation has been strategic (and tactical) asset allocation, and it is difficult for individual advisors to have enough depth of knowledge (or time) to make macro calls or to navigate allocation across multiple asset classes.

There have been two important consequences of this trend. The first is that standardized, packaged solutions are becoming increasingly prevalent at the lower end of HNW levels, and second, exchange-traded funds (ETFs) have proliferated as not only a passive investment approach but also an efficient way to gain sector exposure. Taken as a whole, such developments are profoundly changing the role of the individual investment advisor.

In addition, limitations on proprietary products and the inability to co-invest alongside the bank because of the Volcker rule is forcing a redefinition of the wealth-manager value proposition in the UHNW space. This development is feeding into the tactical asset-allocation trend as well, as banks can no longer offer proprietary products that are the source of superior investment performance.

Finally, the “robo advisor” trend is catching the attention of many wealth managers. Most have had discussions with one or more robo-advisor platforms about some form of partnership, minority investment, or white-labeling agreement. We expect to see more of this type of activity in the year ahead as traditional wealth managers attempt to navigate the digital landscape.

Europe

European wealth managers—both onshore and offshore—are facing numerous challenges. Regulatory scrutiny has increased requirements for liquidity and capital reserves. Client-protection regulations have continued to become tighter in many European markets, increasing complexity and pressuring margins. Geopolitical topics such as automated information exchange are also on the agenda. Offshore centers, under heavy pressure from governments, are undergoing a transformation related to transparency and the regularization of clients.

Furthermore, we are witnessing relatively slow growth on the market side. The low-interest-rate environment and the weakness of the euro have had negative effects on profitability for some players, and cost pressures are forcing wealth managers to rethink their operating models. The emphasis has been on less complexity and on leaner, more streamlined delivery models.

Challenges aside, European wealth managers are seizing the moment to look ahead and determine their investment priorities for the future. How can they take their offerings to the next level and gain a competitive edge over their rivals? Both onshore and offshore players are reviewing their options.

Onshore Players. For onshore players, investment priorities are a combination of both strategic and tactical measures. On the strategic side, wealth managers are seeking to gain a better understanding of clients and their needs, as well as to develop clearly differentiated value propositions and service models for specific segments and life stages. They are combining elements of traditional face-to-face service with seamlessly integrated digital elements, with a goal of true multichannel excellence.

As in other areas of the financial services industry, forging partnerships with the next generation of challengers such as financial technology companies and niche boutiques is a priority, as is exploring alternative business models such as crowd investing and crowd financing. Many wealth managers are rethinking their overall investment philosophies. There is also the matter of keeping human resources robust by attracting and developing the next generation of RMs—people whose profiles may be vastly different from those of their predecessors.

On the tactical side, European wealth managers are investing in improving proactive client servicing, which requires effective management of client service organizations. They are seeking to take analytical capabilities to the next level to enable more tailored advice, as well as to develop more effective client targeting, cross-selling, and up-selling. Improving collaboration across different lines of business is also a priority, as is continuing to transform pricing models. Of course, strong backing from senior management and sufficient funding for the transformation journey are critical.

Offshore Players. Offshore players in Europe are investing primarily in three areas. The first concerns their strategic ambition, where the focus is on increasing scale and seeking M&A opportunities. They are also actively deciding which markets to continue serving and which ones to exit (with most having realized that trying to be everything to everyone is no longer a winning proposition). Much like onshore players, they are redefining service models for different segments and rethinking which segments to serve.

Second, offshore players are investing in sharpening their value propositions and clarifying their differentiation from competitors in numerous, broad-based ways. The move toward increased digital capabilities is one initiative, and it has multiple dimensions. These include large-scale build-ups of digital private banking as a standalone channel, and enhancement of the client experience by making interactions simpler and providing 24/7 availability.

Simplicity also applies to other parts of the business, and wealth managers are making efforts to tailor their investment offerings accordingly. In addition, they are introducing less complex, more transparent pricing models that show clients exactly what they are paying for.

Finally, offshore players are investing in higher levels of overall efficiency and effectiveness. Major investments have been made in raising front-office excellence and in finding the right people. These may not be new initiatives, but the past few months have witnessed a wave of investment activity.

The new focus is on the middle-management side, coaching team leaders to become truly effective front-office managers, and on building both an activity-based reporting system and a client-centric sales culture. A further objective is to liberate time for RMs to spend on finding and serving the right clients.

Additional investment is being made in optimizing footprints and locations in terms of scale, processes, and minimum critical size for profitability. Players are seeking to streamline their number of offices, with noncore locations being sold or closed and key locations being enhanced and expanded.

Asia-Pacific

Asia-Pacific is and will remain a massive engine of new wealth creation. Market, consumer, and competitive trends are reshaping the regional wealth-management industry. Onshore markets are reaching scale, and the overall economic outlook is rebalancing, driven by a cooling-off dynamic in China. Liquidity and capital are becoming more costly, which is having an impact on banks’ ability to gain funding. With regard to clients, a generational change is taking place, with increasing numbers of financially savvy younger investors. Clearer transparency on the performance of different wealth managers is offering clients the kind of information they need to evaluate providers.

From a competitive standpoint, wealth managers are becoming more sophisticated and moving toward more detailed advisory offerings. Increasingly, commercial banks are also entering the wealth-management space, leveraging their group capabilities and synergies as well as their client access and on-the-ground knowledge of local regulations. There is additional segmentation of core offerings as most wealth managers in Asia-Pacific, like those in other regions, have come to fully understand that one size no longer fits all.

It remains to be seen whether digital attackers will encroach on the wealth management space in Asia-Pacific as they have in other areas of banking and other regions. Such organizations focus on specific ecosystems—for example, industry verticals such as small and medium-size business-to-business enterprises—and on products for life-stage needs such as setting up a new business or planning for retirement. They also try to “own” the flow of information in the target ecosystem and leverage that advantage to provide advice and financial solutions. Such solutions can include lending and investment strategies for smaller businesses or highly customized strategies for retirement savings and income management. Digital attackers are already a reality for lower wealth bands, but they have not yet fully targeted higher segments. Within this overall context, two different models are emerging (and competing): local commercial banks and global specialists. Strong growth remains an imperative for all, although each model has a different approach.

The primary focus of local commercial banks is onshore business, targeted largely at lower bands of wealth, although some players are pushing to build a greater offshore presence as well. Many tend to take a holistic approach in the hope of becoming a one-stop shop. Some players have become adept at leveraging group capabilities—such as those linked to wholesale and investment banking, as well as to asset management—in order to develop advisory models and new products. Such an approach can be self-sustaining, with corporate and investment-banking clients providing investment opportunities for wealth clients, who in turn provide a source of liquidity. On a broader scale, these players are increasingly trying to maximize referrals across different areas of the institution and investing to increase sales excellence.

Upgrading digital capabilities is another key initiative. Overall objectives include lowering the cost-to-serve for lower wealth bands by providing more do-it-yourself functionality (including robo advising), improving RM tools to foster better front-line activity and efficiency, and leveraging big data.

By contrast, global specialists are focusing mainly on offshore business and higher wealth bands, leveraging their global reach and capabilities to offer superior products and advice. Optimizing brand recognition and client referrals for customer acquisition is a priority, as is partnering with local commercial banks to target some degree of onshore business and gain additional sources of customers. These global specialists are also pushing the digitization agenda, with several objectives: improving market understanding and customer access, sharpening front-line efficiency, and engaging customers in the ways to which they have become accustomed with their retail banks and online merchants.

Despite many challenges, the wealth management industry in Asia-Pacific is poised to thrive over the next decade. Profitable growth rightly remains the first imperative for most players.

Latin America

In some Latin American markets, the depreciation of local currencies, disappointing returns from local investments, and doubts about the long-term economic outlook have resulted in an increased percentage of net new assets flowing offshore. Nonetheless, leading local players have been able to sustain strong growth in assets under management and improved levels of profitability, as wealthy families increasingly seek to have their savings managed professionally.

Of course, the priorities for wealth managers vary across the region depending on each market’s level of development. One common dynamic is that customers are becoming more knowledgeable and sophisticated—and therefore more demanding.

In Brazil, for example, leading players have developed highly sophisticated offerings that allow them to gain share and earn substantial profits. They have also managed to build effective sales forces and efficient business models. Some of these institutions have specifically targeted clients with between $5 million and $10 million in investable assets, effectively leveraging their privileged access to new sources of wealth. They have invested in advisory capabilities and in some cases used access to tax-advantaged instruments to gain share. Their main priorities are to develop new channels and enhance digital interfaces.

It is worth noting that Brazil’s central bank raised interest rates in order to address the country’s uptick in inflation in 2014. That step benefited fixed-income investments, especially two tax-advantaged vehicles known as LCIs (Letras de Crédito Imobiliário) and LCAs (Letras de Crédito do Agronegócio).

In Mexico, the onshore wealth-management market is dominated by the largest local commercial banks. These institutions have focused on making delivery models more efficient, optimizing client portfolios, and implementing cost-reduction initiatives. A few players have taken steps toward becoming more customer-centric—opening up product architectures, reducing complexity in their offerings, raising multichannel capabilities, and refining RM compensation structures. Still, many players have a long way to go. In addition, the previous trend toward greater onshore activity has reversed itself, with local-currency depreciation pushing net new money offshore, mainly to U.S. booking centers.

Chile is known for its well-developed and increasingly sophisticated onshore offering. However, Chilean players continue to show significant room for improvement in their front-office efficiency and effectiveness. Their RMs tend to have smaller portfolios and lower productivity than RMs in more developed markets. Improving sales force effectiveness is a priority and seen as key to lifting profitability.

Several types of players dominate in Chile: local investment banks, brokerages, and commercial banks that have invested in developing private-banking offerings. There has also been a recent surge in multifamily offices that promise an unbiased, buy-side offering to UHNW clients. As a result, some of the more established players in Chile, especially those with brokerage-driven models, are rethinking their strategies in order to respond to clients who were disappointed by recent returns and are showing interest in switching their private bank or starting to work with a multifamily office. The evolution from a brokerage model to a pure private-banking model is not an easy path, however, because it involves changing both RM compensation models and the overall sell-side culture. Some private-banking divisions of local banks have been trying to forge more holistic client relationships that incorporate investments, loans, and ties to other businesses such as corporate and investment banking.

Colombia and Peru continue to be predominantly offshore venues, despite recent strong macroeconomic performance. Only a few local players have invested in developing sophisticated private-banking offerings, and traditional offshore players have not yet developed a significant local presence. Wealth managers have an opportunity to rethink their business models and prepare for a phase that could present very attractive onshore growth opportunities.