Does the circular economy make business sense for electric vehicle (EV) batteries? The environmental benefits of recycling or reusing batteries are clear—among them, better use of resources and lower carbon emissions. But the business case is less straightforward.

A BCG analysis found that the economics of EV battery recycling at scale are attractive, but generating profits from reuse—known as “second life” applications—will be much harder. We believe that direct-to-recycling is likely to be the favored route in the circular economy in the near term. Despite the availability of used EV batteries and demand for energy storage solutions, second-life batteries are unlikely to represent an important share of the power supply market for the foreseeable future.

Even so, there are opportunities for OEMs and equipment providers to build viable business models for both recycling and second-life applications as part of broader strategic plays. To make this happen, stakeholders need an in-depth understanding of the revenue potential in the circular economy—an estimated $10 billion in 2030—and how their economics are affected by battery cell chemistry, geographic region, and the specific application. This will provide the foundation for developing strategies to capture near-term opportunities as well as for adapting these strategies as technologies and applications evolve over time.

The End of the Road

As sustainability becomes increasingly important to customers, investors, regulators, and employees alike, automakers are coming to recognize that the next generations of automotive products must be successful both commercially and environmentally. To enhance sustainability, they are making improvements to their products and manufacturing processes. Their products now offer higher fuel economy, higher levels of recycled content (beyond aluminum and steel, which are already heavily recycled), and sustainably sourced materials (such as wood and leather). To lower the carbon emissions of their manufacturing processes, they are producing vehicles by using renewable energy, optimizing energy needs, and reducing waste and the amount of water they use.

The next generations of automotive products must be successful both commercially and environmentally.

EVs are among automakers’ core efforts to be good stewards of the environment. From a sustainability perspective, the success of EVs hinges on three main factors: the carbon intensity of the manufacturing process, the carbon intensity of the electricity used to charge the battery as the vehicle is used, and what happens to the battery at the end of its useful “first” life. Here, we focus on the third factor.

According to a recent analysis by telematics provider Geotab, the average useful life of lithium-ion batteries in EVs on the road today is around ten years. Batteries in newer models should be capable of maintaining performance beyond 20 years, or more than 300,000 miles, judging from their current performance status. Their useful life is dictated primarily by the number of charge cycles, the intensity of those charge cycles, and the quality of manufacturing. And all lithium-ion batteries degrade over time—once they fall below around 80% of their originally rated capacity, they no longer offer a sufficient level of performance to power a vehicle.

Today, more than 32 million EVs are in use globally. These include 8 million fully electric passenger vehicles (battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs)) and 24 million partially electrified vehicles (hybrid electric vehicles (HEVs) and medium hybrid electric vehicles (MHEVs)). We estimate that the batteries of approximately 1 million of these passenger vehicles are currently reaching the end of their first life, equal to four gigawatt-hours (GWh) of remaining battery capacity. Electrified commercial vehicles and two-wheelers add to this pool.

Our research shows that more than 50% of new vehicles sold globally in 2030 will be electrified. Adoption of BEVs, the vehicles with the highest battery capacity, will increase by an average of 25% per year through 2030, and recent evidence shows that sales momentum has not slowed appreciably as a result of the COVID-19 pandemic. By 2030, the number of passenger EVs on the road globally is likely to exceed 300 million. Nearly 4 million EVs are expected to be retired in calendar year 2030, with a combined originally rated capacity of nearly 100 GWh, and that number will increase significantly in subsequent years.

The source mix of this end-of-first-life volume through 2030 is also increasingly clear. BEVs are the prime candidates for having their batteries repurposed; more than 70% of EV lithium-ion battery capacity that is expected to be retired in 2030 will come from BEVs, owing to the larger number of kilowatt-hours (kWh) per vehicle. (The volume and value of EV batteries are measured in kilowatt-hours, which allows for a one-to-one comparison between different types of batteries.) We forecast that EVs in China will account for 50% of the kilowatt-hours of batteries retired in 2030. Another 20% each will come from EVs in the EU and the US.

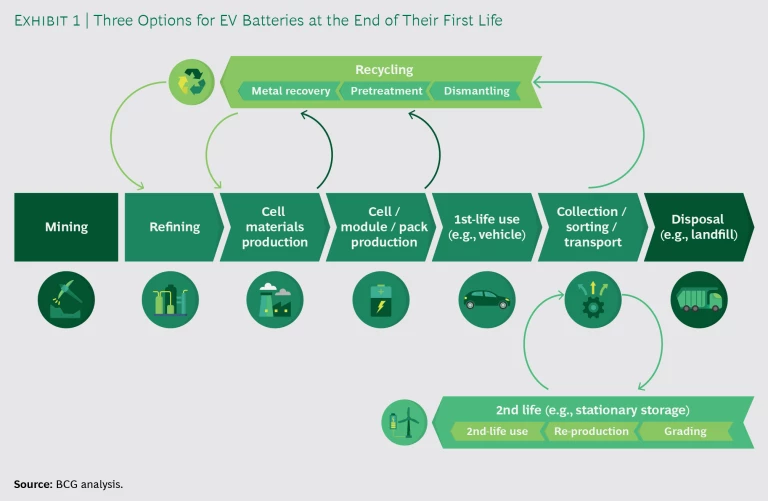

When a battery at the end of its first life is removed from a vehicle, it has three possible destinations: a recycling facility, a second-life application, or a waste management facility.

- In recycling, a specialized company recovers the valuable metals—including cobalt, manganese, nickel, and lithium—from the battery cells. It then sells these materials for use in a future battery manufacturing process. (See the sidebar “A Primer on Lithium-Ion Batteries.”)

- In a second-life application, a specialized company repurposes the battery cells for a new use without dismantling them, often in combination with a new set of power electronics, software, and housing structure. The new application is typically stationary, rather than mobile.

- If placed into a waste stream, the battery enters a landfill or other disposal facility with no recovery of any of its remaining value. Increasingly, regulations are mandating that lithium-ion batteries enter the circular economy rather than being discarded.

A PRIMER ON LITHIUM-ION BATTERIES

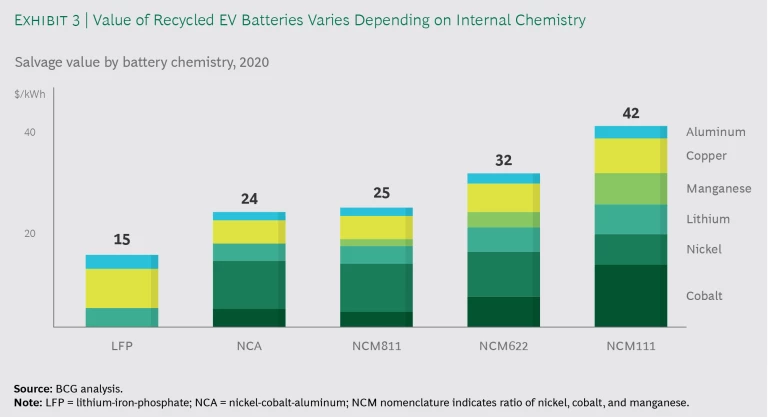

Each of these building blocks can be made from a menu of materials. The cathode contains the most expensive, and valuable—a metal oxide material composed of lithium, oxygen, and some combination of nickel, cobalt, manganese, aluminum, iron, phosphate, or other elements. Its chemistry is typically described using an acronym that also denotes the proportion of its constituent elements—an NCM811 battery, for example, contains eight parts nickel to one part cobalt to one part manganese.

It is this chemistry that determines the battery’s performance—and its residual value. NCM811 batteries are considerably less valuable than NCM111 batteries, for example.

Exhibit 1 places these options within the context of the full EV battery value chain.

The Promise of Recycling

Lithium-ion batteries used in consumer electronics do not have a good track record when it comes to recycling—more than half of them end up in landfills or incinerators. Regulators and industry stakeholders expect that the automotive industry can improve on this record by leveraging the unique characteristics of the market to create a new closed-loop system over time. The EU’s End of Life Vehicles Directive is one such measure to ensure that this happens. Although the nascent EV battery industry does not yet enjoy all the advantages found in the established lead-acid battery industry, the successful recycling of the latter serves as a model. (See the sidebar “Learning from Lead-Acid Batteries.”)

Learning from Lead-Acid Batteries

A number of factors led to the formation and continued viability of this closed loop. Demand for lead-acid batteries has continued to increase over time. Recycled lead is valuable and functionally equivalent to virgin lead. Most of the battery’s weight is composed of reusable lead. There are few variations in cell chemistries and a limited number of different materials that require sorting, which makes recycling technically easy and inexpensive. The distribution routes of new lead-acid batteries and spent lead-acid batteries overlap significantly—for example, a truck can both drop new batteries off at retail locations and pick up old ones. Finally, because lead is highly toxic, most disposal facilities either refuse to accept lead batteries or are legally prohibited from doing so, thus making recycling the only viable option.

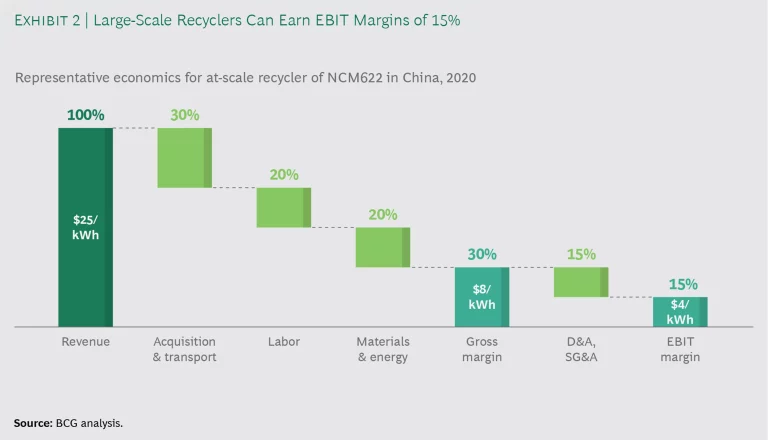

Recycling EV batteries is an asset-intensive business in which high utilization is critical to operating efficiency. Lithium-ion battery recyclers in China are the largest and longest-established companies in the industry. Their performance suggests that the industry’s underlying fundamentals are relatively strong. (See Exhibit 2.) This is especially true for lithium-ion batteries made from nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) chemistries, which are increasingly favored by some automotive OEMs because of their superior energy density.

Profitability is highly dependent on several factors. The most important is cell chemistry: the value of the recovered materials. For NCM and NCA batteries, the value can exceed $25 per kilowatt-hour. In contrast, the metals in a lithium-iron-phosphate (LFP) battery are worth only half of those used in NCM batteries. The value of nickel, in particular, will determine the attractiveness of the business case in coming years, as manufacturers shift to batteries with a higher nickel content. (See Exhibit 3.)

Recyclers’ operating costs, on the other hand, are relatively fixed across all chemistry types. The recycling process consists of the same three primary steps: cell deactivation or discharge (to prevent fire), pretreatment to deconstruct the major components of the cell (aluminum, plastics, and cathode), and recovery of the mixed cathode materials.

Other factors include the cost of acquiring batteries to be recycled and the amount of metals recovered during the recycling process. To date, acquisition costs vary significantly by region. In China, where the recycling market is mature, acquisition costs can be high—up to 50% of the total expected recovered value. Many established recyclers are competing to acquire used batteries, and players on both sides of the transaction have a relatively clear understanding of the economics. In the US and Europe, on the other hand, acquisition costs are effectively zero. There are few experienced recyclers of lithium-ion batteries, and companies participating in the nascent market are still operating at low scale.

Metal recovery rates aren’t so much a function of chemistry type as of the recycling technologies used. Still, recyclers are caught in a dilemma because they must work with multiple chemistries. On one hand, they can maximize recovery rates by tuning the processing steps to a specific cell chemistry. The industry is targeting recovery rates of more than 95% for the most valuable metals, but in practice recovery rates can fall below 50%, depending on the sophistication of the processes used. On the other hand, they can deploy processes that flexibly handle battery packs of different sizes, shapes, and chemistries and thus secure higher throughput and scale. But achieving flexibility adds cost.

Although the fundamentals of recycling look strong, there is no shortage of further challenges to navigate. Spikes or slumps in battery metal prices will continue even as the number of EVs on the road continues to grow. Few recycling facilities outside of China operate at sufficient scale, and both their higher labor costs and stricter emissions requirements affect the cost structure and thus the profitability of recycling. Commercialization of new recycling technologies, such as direct-cathode recycling, could make current technologies obsolete and erode the competitive advantage of established players. Furthermore, the auto industry is not converging toward any one cell chemistry or configuration any time soon. As a result, uncertainty about the best recycling processes will persist for at least the next decade.

Still, taking all these factors into consideration, recycling seems both economically and environmentally sustainable. Recyclers can earn attractive margins, OEMs and cathode manufacturers gain an additional source of materials to feed their supply chains, and recycling the materials generates a smaller carbon footprint than does mining them—except for LFP batteries, whose iron content is more sustainably mined than recycled.

Players in the Recycling Value Chain

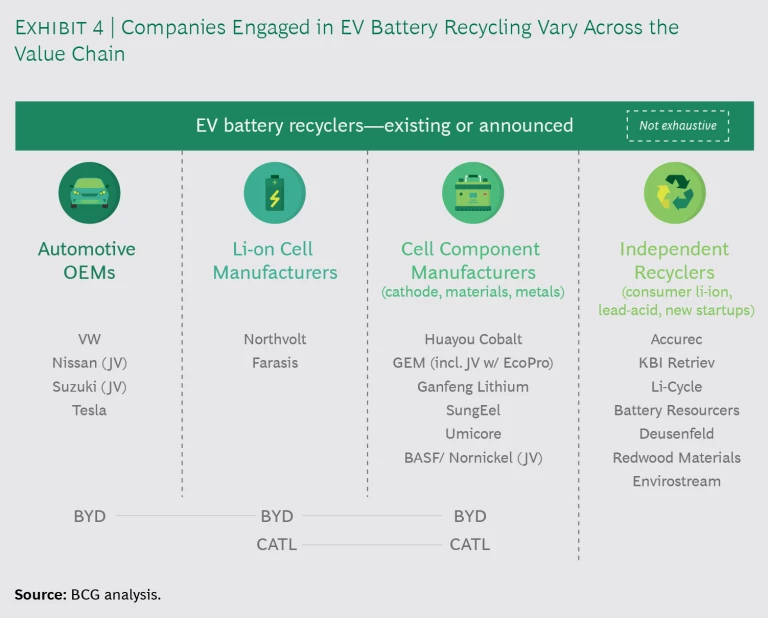

The business of recycling lead-acid batteries is relatively straightforward and is divided between battery manufacturers and independent recycling companies. But the flow of materials in the lithium-ion battery value chain is considerably more complicated and involves more players. Indeed, there is no single emerging archetype of an EV battery recycler. The active players currently include recyclers of lithium-ion batteries for consumer electronics; recyclers of lead-acid batteries; OEMs; cell manufacturers; and cell component suppliers such as cathode manufacturers and metal refineries. (See Exhibit 4.) Each can validly claim that it is best suited to own the recycling step, whether because of its capabilities, scale, access to feedstock, or subsequent use for the recovered metals. As a result, it is not clear which of these players will emerge as the winner, especially as the COVID-19 pandemic has slowed investment and added to near-term cash pressures.

China is the only region today with the scale required to demonstrate how the market will sort itself out. After several years of high fragmentation, a mix of companies with specific models is rising to the top:

- GEM, Huayou Cobalt, and Ganfeng Lithium are all battery material suppliers. Currently, these players have captured the largest market shares.

- BYD, an integrated value chain player, manufactures cathodes, cells, and battery packs as well as EVs themselves.

- Brunp Recycling is a subsidiary of CATL, a cathode manufacturer.

Outside of China, similar models are starting to emerge, though involving a different set of players and without the participation of consumer electronics recyclers (because Chinese companies dominate). Leading players include VW, Umicore (a cathode manufacturer), and SungEel (an independent recycler). Applying a different go-to-market model, Nissan and recycling giant Sumitomo have formed a joint venture named 4R Energy.

Government bodies are increasingly interested in building globally competitive battery production ecosystems.

A robust set of startups—including Li-Cycle, Battery Resourcers, Deusenfeld, and Redwood Materials—is investigating a wide variety of technologies for pretreatment and metal recovery. Potential step changes in performance are still viewed as possible. And to accommodate differences in environmental regulations across regions, companies are pursuing further advances in technology in order to reduce emissions.

Finally, there is increasing interest among government bodies in building globally competitive battery production ecosystems—including recycling—to create jobs and reduce reliance on overseas sources of battery materials. National labs and government awards may prove instrumental in defining the future landscape of the recycling market.

Success Factors in Recycling

To win in this landscape, participants can deploy a set of strategic levers.

- Produce in-demand finished products. To capture more of the available profit pool, recycle battery chemistry into so-called “precursor” materials—ready-for-production compounds of nickel, cobalt, manganese, and other elements—rather than producing intermediate “black mass” products that require further refining. Refine metals to a higher grade for reuse (in a new battery, for example) rather than “downcycling” them for use in less stringent applications.

- Achieve the lowest per-unit plant recycling cost. Invest in technologies that maximize metal recovery and resource efficiency. Build at-scale facilities that reduce per-unit processing costs, such as by deploying manufacturing lines specific to different chemistries or investing in digital technology. Be the first company to build recycling facilities in untried regions to take advantage of job creation incentives and the limited number of permits likely to be available.

- Move upstream. Achieve density in the logistics network, a step that is especially important for transporting heavy, hazardous battery packs to pretreatment facilities. Launch a logistics offering to gain the decision-making power to determine where to direct used batteries—whether to your own facilities or a third party—based on economic factors such as transport costs or plant utilization. Enable easier presorting by chemistry type to flexibly realize operating efficiencies within the processing plant.

- Test flexible business models. To limit exposure to volatility in battery metal prices, experiment with fee-for-service—or “tolling”—contracts, in which you agree to recycle batteries for others, or with spot-buying of batteries outright, then selling the metals when prices are favorable.

Players should deploy these levers in the context of a tailored regional strategy. All signs point to the development of regional hub-and-spoke logistics models, in which old batteries are collected at small dismantling and pretreatment facilities and then sent to large metal recovery operations. Transportation costs for battery packs are high, given their weight, shape, and safe-handling needs. Using the lead-acid battery market as a reference point, a player can be most competitive within a radius of approximately 300 miles between the point of battery pack acquisition and the “spokes” where the recycling activity starts).

OEMs that manufacture cathodes or cells should consider becoming end-to-end participants in the EV battery value chain.

OEMs that manufacture cathodes or cells should consider becoming end-to-end participants in the EV battery value chain, as BYD has. This approach re-creates the highly successful captive lead-acid battery business model used by US battery manufacturer Clarios, among others. But very few companies are positioned to create this end-to-end model in lithium-ion batteries in the next decade. In the meantime, independence is an asset, enabling a company to contract with a wide variety of players inside and outside the automotive industry to gain access to the volumes of recyclable batteries needed to operate an at-scale facilities and distribution network. Here, relationships on both the supplier and customer ends of the recycling process are critical to success.

Second Life for EV Batteries

Whereas recycling focuses on the value of the battery’s metal content, second-life applications focus on the value of repurposing a partially used battery. As noted above, when a battery drops to 80% of its rated capacity, it is no longer suitable for use in a vehicle. Consider what this means for a 60kWH BEV battery pack that is designed for 1,500 cycles. This capacity can still offer 18 MWh of electrical load, or enough electricity to power a typical home for more than 15 years.

We see three categories of second-life applications: as a spare EV battery, in a stationary energy storage (SES) application, or in a compact mobile storage application (such as a forklift). BCG estimates that demand for batteries in the SES market alone will reach 120 GWh annually by 2030, so there is plenty of potential demand for a second-life battery system. However, stakeholders must overcome the current economic obstacles to sustaining second-life battery applications.

In SES applications alone, there are more than a dozen uses—spanning utility, commercial, and residential markets—for which lithium-ion batteries are gaining traction. These applications include power generation support (co-location with another power source), frequency control, off-grid supply, emergency backup, consumption optimization, and charging infrastructure.

From a technical standpoint, batteries manufactured for use in an EV can satisfy most of these applications. In fact, one can argue that EV batteries are overdesigned for use in relatively relaxed stationary environments, as the conditions in which batteries are used in vehicles are far more rigorous.

Despite challenges, second-life solutions offer a unique and compelling value proposition.

From a value standpoint, the benefits of second-life batteries go beyond providing an energy storage option. Second-life solutions offer a unique and compelling value proposition for each of the three stakeholder groups most often involved in an end-of-first-life battery transaction: the vehicle OEM that supplies the used battery; the equipment provider that repurposes and resells the battery in a second-life application; and the customer that uses the second-life battery.

- OEMs. In some countries, manufacturers that supply EV batteries currently have an “extended producer responsibility” (EPR) to recycle, reuse, or dispose of end-of-first-life batteries. In the years ahead, we expect that most countries will adopt an EPR requirement. By using the battery for a second-life solution, an OEM can delay the cost outlay associated with this responsibility or possibly transfer the responsibility to the buyer.

- Providers of SES Equipment. Today, the low availability of second-life batteries means that providers mainly offer SES equipment with new batteries. As more second-life batteries reach the market, however, providers will be able to offer more equipment powered either by used batteries alone or a mix of new and used batteries. This will enhance their flexibility in developing applications that best meet customers’ needs with respect to price, performance, and delivery time.

- End Customers. Customers seek a battery storage solution that provides a clean, quiet, and independent source of energy. Because a second-life product can offer these benefits at a lower price point, it will appeal to buyers that want to save money.

Last but not least, extending the usefulness of a battery via a second-life application maximizes the return on the carbon investment incurred to produce it—so the Earth benefits as well.

Given these opportunities—the variety of feasible use cases, the benefits afforded to multiple stakeholders, and a smaller carbon footprint—a who’s who of automakers and SES providers are pursuing a variety of projects, even if only in the demonstration phase, in hopes of capturing the benefits of second-life batteries.

OEMs have enthusiastically publicized projects in which their batteries are used in second-life applications. Early trials have tended to be for an OEM’s own operations—for example, Audi has repurposed EV batteries for use in forklifts, and GM is powering some of its own facilities with second-life batteries. Although these endeavors offer marketing benefits (by identifying these companies as eco-conscious) and may generate operational savings, OEMs are also seeking to build businesses from second-life batteries.

In this regard, OEMs have several advantages over SES providers. They are likely to have access to a high volume of end-of-first-life batteries—a key success factor—through trade-ins and service provision agreements, among others. They can also apply their in-house design and integration capabilities to the task of repurposing old batteries. And they can use historical data from their vehicles’ battery management system to understand the current and future performance of each battery cell they hope to reuse.

However, OEMs face constraints in developing a portfolio of consumer offerings that use second-life batteries. They can use batteries only from their own vehicles, which creates limitations on potential applications in terms of size and other specifications. OEMs are also less likely to offer all the related equipment needed for a second-life solution, such as the cables, solar panels, or energy management software needed for a hybrid application. SES equipment providers, in contrast, can develop a more complete portfolio of energy storage offerings. They can also leverage their existing relationships with certain buyer segments as well as their understanding of local electrical regulations.

For OEMs, key strategic issues to consider include whether to launch a direct-to-consumer business (Daimler tried this with its home storage offering, but soon exited the business); to supply used batteries to SES equipment providers who then repurpose, market, sell, and service a variety of second-life applications (as Renault-Nissan-Mitsubishi currently does); or to participate at all. Tesla, for example, has indicated that it has no interest in participating in or partnering for second-life activities, currently preferring to recycle all its old batteries.

The Second-Life Economic Challenge

To understand which of these strategic pathways is most likely to win out, we analyzed the economics of second-life batteries on both a standalone basis and as part of the broader second-life ecosystem.

The production process for repurposing a battery is complex. The battery must be disassembled; the cells must be tested, graded, and matched; the casing must be rebuilt; the cells must be integrated with an inverter and software; and the repurposed battery must be reassembled before it can be resold. But manufacturing isn’t the only challenge.

- Labor. Disassembling, grading, and reassembling batteries is a time-intensive, largely manual process, and it is further complicated by limited knowledge about how the battery had been used and its current cell-level performance. Moreover, many batteries depend on nonstandard chemistries and packing designs. Over time, however, digital advances and product standardization may help to reduce labor costs. For example, recent research indicates that the time required to grade a battery pack could be reduced from days to a few minutes.

- Valuation. Questions persist on how to assess the remaining life of a battery and assign a book value to it. The full history of the battery’s prior usage is an important input to calculating remaining value. Yet automotive OEMs have been reluctant to openly share this data, which they see as providing a source of competitive advantage. Over time, the industry will need to develop trusted battery health and valuation platforms to assist in the exchange of used batteries.

- Price. The price that customers are willing to pay for a second-life solution is typically no more than 60% of the price of a new battery solution—and as prices of new batteries continue to decrease, so will those of second-life batteries.

- Liability. Uncertainty as to how a battery was used in its first life may encourage repurposers to overdesign the second-life version to ensure that it meets the specifications for its new use. Moreover, navigating the regulatory codes and certifications needed for specific applications can be more complex with a second-life battery. Finally, whether or not the EPR will be transferred from the OEM to the repurposer, or even the end-user, must also be resolved.

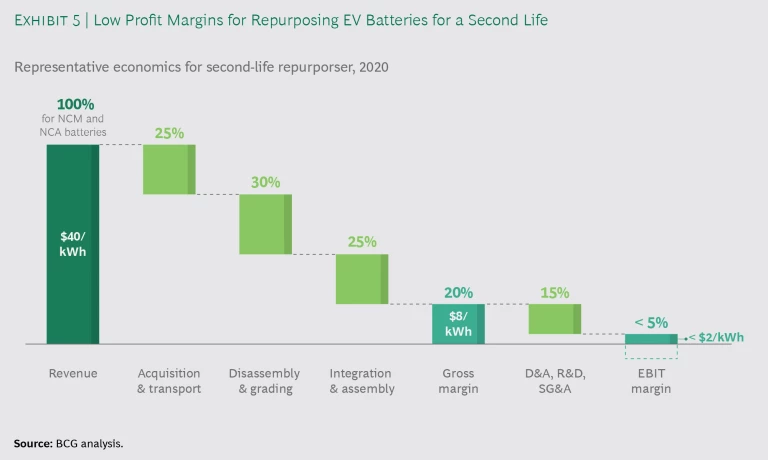

All things considered, our analysis shows that repurposing an EV battery for a second-life application is currently economically challenging on a standalone basis, as the potential profit is too low to make the effort worthwhile (see Exhibit 5).

But the challenges don’t end there. Second-life batteries must also compete with several alternatives.

- First-Life Batteries. In terms of total cost of ownership (TCO), first-life batteries are often more competitive, except for use cases that require a low number of annual cycles. A new SES battery pack represents just 30% to 50% of the total price of the application, so the second-life battery must be heavily discounted in order to significantly lower the total price. Moreover, a second-life battery may use technology that is 10 to 15 years old, placing it at risk of obsolescence given the steady pace of advances in the energy density, safety, and lifespan of new batteries.

- Recycling. Many EV manufacturers are building out their own battery supply chains and ensuring continued access to in-demand materials such as nickel and cobalt. Recycling allows automotive OEMs, for example, to keep used batteries and reclaim these materials, rather than selling them into the stationary storage supply chain.

- Vehicle-to-Grid. There is increasing optimism that over the longer term, second-life batteries (as well as first-life SES batteries) will need to compete against “grid-able” vehicles—vehicles that can store electricity and discharge it when needed for use at home or send it back to the grid without compromising their primary function of mobile transport. Once the number of EVs in use reaches sufficient scale, a vehicle-to-grid offering could effectively reduce the market size for other energy storage needs—making the business case for second-life applications even more challenging.

Because of these challenges, as well as the attractive economics of recycling at scale, we believe that fewer than 20% of batteries will be used in a second-life application before being recycled and that the great majority of first-life batteries will go directly to recycling.

Success Factors in Second Life

We see three strategic levers for companies pursing second-life applications in the current landscape.

- Develop standardized, modular solutions. Create scalable, standardized processes to lower the cost of repurposing. Secure exclusive access to batteries from high-volume vehicle models, learn to test and process the battery pack efficiently, and gain scale in the design, integration, and certification processes. To reduce disassembly costs and cell-matching challenges, design solutions that use the full battery module or full pack. Exclusive access will also support competitive differentiation, which is harder to maintain if rivals are repurposing the same batteries. At the same time, keep a sharp eye out for customers willing to pay for customization or variants of your standard offering.

- Broaden hardware and services offerings. Sell a more complete scope of supply, focusing on where you can build a cost advantage. A hardware offering could include inverters and hybrid energy systems—an integrated system for solar and battery storage, for example. A service offering could involve engineering, wireless over-the-air performance upgrades, and charging solutions. A design offering might include mixing and matching used and new battery modules to optimize the design for specific customer needs.

- Use value-based pricing. Create headroom for pricing through innovative business models that allow you to decouple price from a battery’s remaining useful life. Such models could involve battery rentals and “power by the hour” or other battery-as-a-service offerings.

A company can further minimize costs by creating a local-for-local model in which EV batteries are adapted for second-life applications within the same region. This would limit transportation costs incurred by acquiring and repurposing batteries, then shipping them to customers. Companies can also invest in technologies that reduce the testing effort and increase confidence in a battery’s future performance.

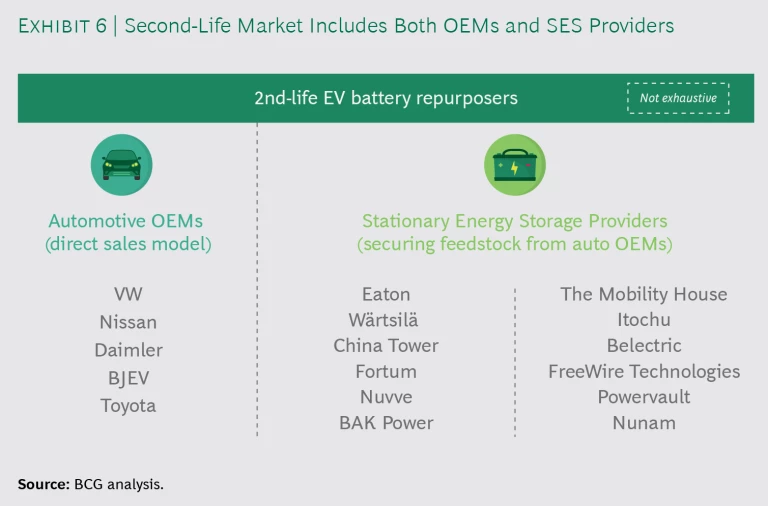

At least in the near term, we expect the dominant model in repurposing batteries for a second life to be OEMs partnering with SES companies. OEMs need to invest most of their time and energy in launching new EV models and managing the transition from vehicles powered by internal combustion engines. We expect cathode and cell manufacturers to steer clear of second-life applications, as these cannibalize their sales to SES markets. (See Exhibit 6.)

As the economics improve, the temptation for OEMs to participate directly will only grow. VW, for example, recently announced plans to use second-life batteries in charging stations. And it is easy to imagine that Tesla could use its own second-life batteries in its branded stationary storage portfolio.

Smoothing the Transition

In the decades ahead, advances in technology will shift value in the circular economy from recycling to second life. EV batteries will be built better and last longer. The useful life of batteries for second-life applications could exceed by as many as five years the useful life of the EV they initially powered. As their remaining useful life increases, the economics of second-life applications will improve.

Under these conditions, the availability of batteries suitable for recycling would decline, and changes in cell chemistries could make recycling even less attractive. By 2030, the materials used are likely to shift from nickel, cobalt, and manganese to more abundant and less expensive elements such as sulfur, forcing down recycling revenues and margins. As a result, recyclers must take into account the key success factors discussed above that will enable them to maintain profitability.

To ensure that the circular economy remains robust as these changes unfold, stakeholders need to promote collaboration and clarity. Companies should jointly take several steps.

- Secure industry support for design principles that optimize EV batteries for the circular economy—including end-of-life considerations in the design of battery cells, packs, and housings and optimizing module size for both first- and second-life uses.

- Develop open-architecture concepts and licensing for historical battery data and cell-level performance to enable third parties to read the data without requesting it from the OEM. This will reduce the labor required to repurpose batteries and the costs associated with overdesigning.

- Clarify the extended responsibilities of battery producers. This could include, for example, instituting regulatory standards that clearly state how liability is transferred when an EV battery is repurposed for a second-life application.

Looking Ahead

All told, there are many encouraging signs for the circular economy in EV batteries, as well as an overriding public desire for EV batteries to be a success story. The 2020s will be marked by continued innovation in battery design, recycling, and reuse; and the higher volumes of the 2030s will likely translate into sustainable profits. Proven recycling and reuse models will have reverberating effects throughout the battery ecosystem, promoting changes in virgin product demand, supply chain cost structures, OEM selling provisions, and strategic partnerships.

By staying on top of the changes and designing strategies that flourish within this circular economy, participants across the value chain can ensure the commercial and environmental sustainability of EV batteries.

The authors are grateful to John Hruska, Arushi Sohi, Yasin Sunak, and Changsheng Yao for their contributions to this report.