Five years after the onset of the global recession of 2008–2009, the sluggish pace of recovery and worries over employment and financial security continue to weigh heavily on consumer sentiment in developed economies. Consumers remain highly concerned about their jobs, personal finances, and economic future.

Yet amid the lingering angst expressed in The Boston Consulting Group’s 2013 Global Consumer Sentiment Survey, there are also encouraging signs. Consumerism has proved to be remarkably resilient. Yes, people from the U.S. to France to Japan said that they plan to forgo some luxuries, eat out less, and save more. But consumers in the world’s richer countries also said that they intend to upgrade their consumption in the product categories that they care about most. Consumers, especially those members of the Millennial generation who are 18 to 34 years old, continue to place a high importance on brands. And they do the same for consumerism: majorities of those surveyed said that buying makes them happy and that spending is good for the economy and society.

Our findings suggest that the fears of a few years ago—that prolonged economic crisis could permanently scar the consumer psyche and usher in a generation of retrenchment—have failed to materialize. It is true that consumers in developed economies are still tightening their belts, and we don’t expect the retail exuberance of 2006–2007 to return in the near term. But this is a symptom of the present economic condition, not some fundamental shift in peoples’ desire to buy or a wholesale rejection of consumerism.

To gauge global consumer sentiment, BCG recently surveyed more than 35,000 people in 20 countries. Among other criteria, responses were segmented by gender, location, generation, and income level.

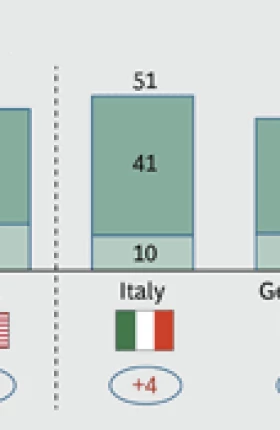

Here we summarize and discuss some of the key findings from responses in nine developed economies: Australia, Canada, France, Germany, Italy, Japan, Spain, the U.K., and the U.S. The survey included around 23,000 respondents or, on average, 2,555 respondents per

The key findings deliver more bad news on consumers’ spending plans, but they also offer a silver lining regarding the near-term outlook in developed markets.

First, the less positive news:

- Pessimism remains pervasive. Fifty-nine percent of consumers in developed economies are anxious about the future, and nearly half do not expect economic improvement in the next several years.

- Many consumers feel at risk. Forty-three percent either do not feel financially secure or believe that they are in financial trouble; 19 to 35 percent said that they feared they could lose their jobs in the subsequent 12 months.

- Forty-six percent of consumers plan to cut discretionary spending. This represents only a slight improvement over responses to the 2012 BCG Global Consumer Sentiment Survey.

- Only 5 to 25 percent of consumers in developed countries believe that the next generation will have a better quality of life than their own. That is a notable decline from the results of the 2012 survey in each nation except for Canada, Japan, and the U.S.

Now for the good news:

- Fifty-four percent said that they are buying less expensive goods and services within the product categories that they care about most, compared with an average of 58 percent in 2012. Seventeen percent of consumers reported trading up in 2013, slightly higher than the percentage in 2012, and plan to do so most often in the categories of travel, major home appliances, housing, and children’s products.

- An average of 40 percent of consumers in developed economies cite brand names as a key reason for trading up to higher-priced products—a 16 percentage-point increase from the 2012 survey.

- Millennials have a significantly higher affinity to brands than do members of older generations in developed economies. Thirty-six percent of young Millennials believe that brands help express their values and who they are.

- Fifty-five to 65 percent of consumers in each developed country surveyed believe that consumerism is good for the economy and society. Fifty-six percent across all developed economies said that buying makes them happy.

These findings show that while global consumers feel fatigued and financially strapped from the prolonged economic slump, most are neither emotionally spent nor bankrupt, except for those in a few particularly hard-hit countries. By and large, people still place a lot of importance on what they buy. They see their choices of products and brands as reflections of their status and as personal expressions.

What has changed since the beginning of the global recession is what we call the “status currency”—the priorities and values of average consumers. Ostentatious splurging has given way to more emphasis on value for money and quality. Consumers are gravitating more toward brands that convey social awareness, environmental stewardship, and a healthy lifestyle, such as natural and organic ingredients, rather than brands that are simply more expensive.

To succeed in this challenging economic environment, companies must move past the doom and gloom. They should tailor their brand campaigns to the new status currency of consumers in different developed economies and of different generations, while being particularly sensitive to the economic circumstances of households in crisis-ridden economies. Luxury brands should continue to put less emphasis on conspicuous consumption and more on experiences, product performance, and artisanship. And companies should aggressively target Millennials now so that they remain engaged with their brands as they enter the stage of life in which they will have both more discretionary income and more control over essential household spending.