This is part of the ongoing BCG series Strategic Procurement in the Digital Age, a comprehensive discussion of practices companies should follow for top procurement performance.

Companies increasingly recognize that applying digital to their procurement processes can yield significant competitive advantage. Indeed, we found that 9 of the top 20 companies on the Fortune 500 list indicated in their annual reports to shareholders that digital technologies are crucial for their procurement operations.

Yet adoption of new technologies has been slow. That’s because the complexity of the technology landscape makes tech selection daunting. There are many different tools and applications that can provide support throughout the end-to-end procurement process, from robots that perform operational tasks such as invoice checking to dynamic cost models that provide guidance on how to find the lowest-priced components. An additional complication is that some technologies are already in use but still evolving, while others are not mature enough to be widely industrialized. As a result, companies that dive straight into technology decisions are likely to leave substantial value on the table.

We believe that firms that ground their digitization efforts in their overall business and procurement goals are much more likely to be successful. Starting the journey with a strategic focus is critical for identifying where to add value and how to pinpoint the technologies best suited for this endeavor. (For a more general discussion of how digital can create procurement value, see the first article of this series, “Delivering on Digital Procurement’s Promise,” BCG article, June 2018.)

Transitions to digital procurement that begin with technology decisions end up leaving substantial value on the table.

Value Dimensions

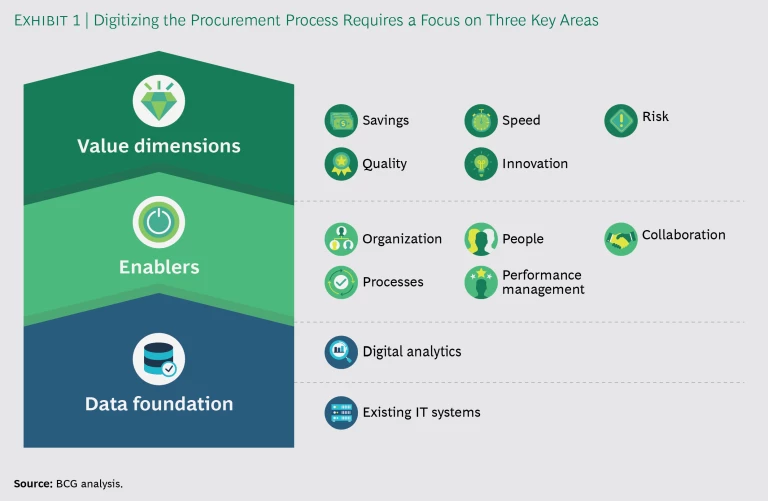

Specifically, companies need to focus on their value dimensions, enablers, and data foundation. (See Exhibit 1.) The starting point for every company is the core value proposition. Procurement can provide value in five areas: savings, quality, speed, innovation, and risk.

Savings

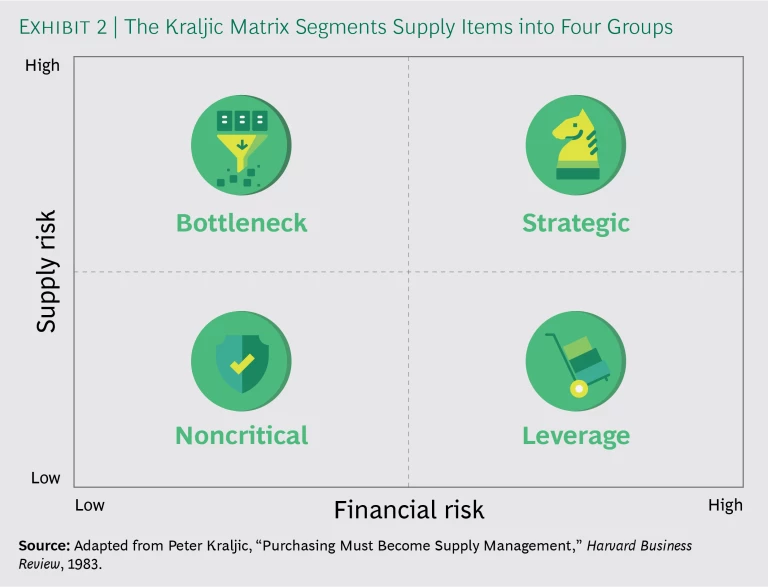

For most procurement departments, savings is the paramount dimension of value. The Kraljic Matrix, a procurement strategy tool, addresses this issue. (See Exhibit 2.) The matrix positions items along two dimensions—financial risk (that is, impact on profit) and supply risk—and categorizes items as strategic, leverage, noncritical, or bottleneck.

Strategic Items. Critical for production/operations, these items have a high impact on value. A good example is electrified automotive powertrains, which are essential components of electric cars. Buyers of strategic items benefit from close supplier relationships through guaranteed access to critical components.

If management sees an opportunity to realize substantial savings, dynamic “should cost” models can be worth the investment. These applications monitor the cost of all inputs to the supplier’s product and compare the total cost with the price the supplier is charging for that product. For example, an engine manufacturer using a should-cost model for an engine part would monitor the total cost of metal, labor, logistics, and energy and compare it with the price that the supplier is asking. With a better understanding of what the supplier’s costs and margins are as well as how much these measures can fluctuate, the buyer would have a clearer sense of when to negotiate and how far to push the supplier while still respecting the strategic importance of the relationship.

Leverage Items. Although these items do not pose a high supply risk, they are important for profitability. To ensure the best prices on these items from suppliers, buyers should always deploy the right negotiation and tendering tools for the specific situation—for example, smart analysis tools that are useful when preparing for conventional face-to-face negotiations or should-cost models that are useful for auctions. But, in reality, most buyers use the same approach repeatedly, regardless of its effectiveness.

Digital technologies can help. Take, for example, BCG’s artificial intelligence (AI)-based Negotiation Coach. This tool runs a decision algorithm to analyze about 20 parameters, such as how many qualified suppliers there are or how transparent the supply situation is for the suppliers themselves. Using game theory, the “coach” compiles a learning tree consisting of tool recommendations for each type of negotiation. Buyers then provide feedback on how well their negotiations went with the particular tool they deployed. Incorporating this input into the learning tree, the coach determines which option of the 1,000 possible is the best choice for a particular situation. Consequently, the buyer can be certain of choosing not just a good option but the best one possible.

A large machining producer that used this approach developed a much better understanding of which tool to use when and thus greatly increased its use of auctions, should-cost analysis, and linear performance pricing. As a result, the share of electronic bids rose from 20% to 65%. Spending dropped by 5% on average, and the time spent on negotiations declined by 30%.

Noncritical Items. These items, which include things like office supplies, aren’t important for profitability and aren’t associated with a high supply risk. Companies often purchase them in bits and pieces, which makes monitoring tough. The challenge is to source them efficiently without overpaying. Some potential methods include:

- E-Catalogs. Standard items can be consolidated into easily accessible online catalogs. Users simply click to select what they want, which results in a touchless purchase order (PO) for the supplier while ensuring compliance with product standards and preferred-supplier lists.

- Digital-Tendering Solutions. Even items that aren’t usually purchased online can be digitally tendered. In the predigital past, one important reason why companies didn’t tender tail spending (numerous low-value purchases) was a lack of data transparency. This is no longer the case, however, thanks to digital tools that automatically extract and combine the needed information from different data sources. In a request for information, suppliers list the items that they can provide. The digital tool allows companies to include up to 10,000 items in one tender, but suppliers see only the items they’ve listed, not all of the items that are out for bid. The tool thus dramatically reduces the complexity of the tender and encourages more suppliers to take part in the bidding process.

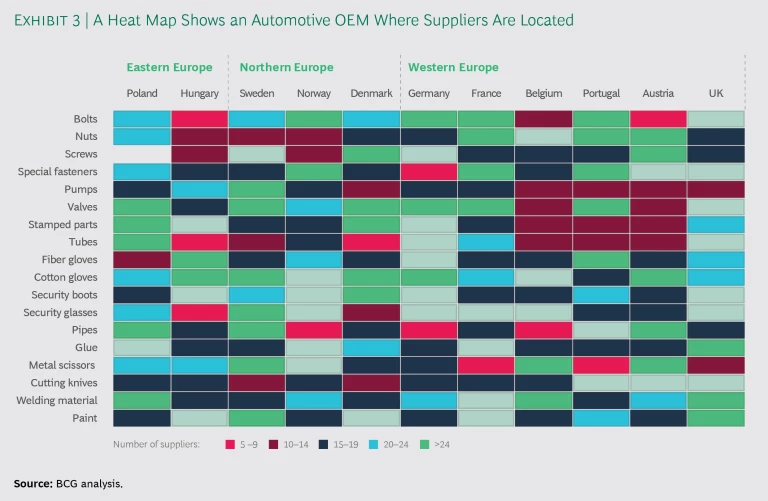

- Heat Maps. Another useful tool is the heat map, which provides an easy way to determine where suppliers are located and how many are in each geographic area. An automotive OEM, for example, used a heat map to determine that a large number of bolt suppliers were located in the UK, but few were present in Hungary. Consequently, the OEM tailored each auction to meet the supply characteristics of the geographic location being targeted. (See Exhibit 3.)

Bottleneck Items. Typically, these items—for example, rare earth materials—are in short supply. So it’s important for companies to secure what’s on hand or find a way to expand the supply. Digital solutions can help by quickly and comprehensively scanning the market for these bottleneck items.

Quality

In a procurement context, quality is related to the standards that procured goods and services need to meet. Given that failures of quality can occur in many different areas, buyers need to determine which areas require the most attention. Digital solutions are a good first step in identifying these areas of concern because they pinpoint where past quality failures led to increased costs. Quality teams then use this data to design a system that highlights the areas where quality failures are most likely to occur and that are therefore most in need of supplier audits and other preventive measures.

Digital solutions are a good first step in identifying areas of concern because they can pinpoint where past quality failures led to increased costs.

Companies can also use dedicated systems that stringently monitor the quality of goods received. Employees assess the quality of the components or services using mobile apps, which then convey that feedback to the procurement department and the supplier in real time.

Take, for instance, a large oil and gas provider that faced significant quality issues with the spare parts and maintenance services provided by many of its business partners. To resolve the problem, the company asked all partners that delivered supplies to one of its drilling stations to install a small app on their mobile devices. An onsite engineer provided feedback on every supplier delivery. All of this feedback was incorporated into a comprehensive overview for the buyer who managed the various supplier relationships, and was then shared directly with the suppliers via a portal. As a result of this approach, the quality levels measured in parts per million (PPMs) rose by more than 20%, and perceived supplier quality improved as well.

Speed

Realizing value from increased speed requires companies to reduce the time needed for two sets of processes: those required to set up a new sourcing solution (source to contract) and those that go from a purchase requisition to an order (PR to PO).

AI-based negotiation and supplier selection tools can shorten the time to contract after the requests for information and requests for quotation have been completed. These tools enable faster and more accurate analysis of criteria such as savings, risk exposure, and innovation potential.

Digital tools can be especially helpful in the multistep PR-to-PO process. Operational procurement employees must manually check and approve the validity of a requisition. The procurement team then needs to confirm the category code, ensure that the person placing the order is allowed to purchase the item in question, and identify an appropriate set of suppliers for the employee to choose from when making the purchase.

Often things don’t go smoothly. For example, the requisition form may be missing important information because the format was developed for use across the company rather than for a specific product or service. This means that a procurement operations employee needs to follow up to get that information, verify that the person who ordered the item is allowed to do so, and check to ensure that the person hasn’t ordered the item too often. Then the request needs to be brought to the market: inexpensive items can be acquired directly from the supplier, while expensive items must have a tender. Each of these steps adds time to an already lengthy process.

The use of digital tools can help accelerate the overall procurement process in variety of ways.

Digital solutions can accelerate the PR-to-PO process in a variety of ways. They can tailor requisition formats to the product or service being purchased. In addition, they can use multiple buying channels, each of which defines the exact approval and ordering steps for a different category group. Bots can then automatically fill out POs with relevant product and commercial information. And AI tools can be deployed to check the inputted information and transmit POs directly to suppliers. To ensure that these touchless orders meet compliance requirements, we recommend checking a certain portion of them manually (for example, every 17th or 37th order).

A midsize construction materials manufacturer offers an example of how these digital solutions can work. The company’s PR-to-PO process was quite sluggish, often taking many weeks and sometimes leading employees to buy goods on their own. Management realized that the inability to make purchases in a timely manner could have strategic implications as innovation cycles in the industry accelerated.

To solve the problem, the company invested in e-catalogs and programmed PR-to-PO bots to automate many of the tasks that buyers had been performing manually. The e-catalogs covered the purchasing of concrete products and services, which amounted to 75% of spending. For the remaining 25%, robots first verified that the requester was allowed to order the particular product or service, and then filled out the PO form and transferred it to the buyer. All told, the move to e-catalogs and robots reduced the average PR-to-PO time from 15.6 days to just 2.

Innovation

Increasingly, innovation has become an important dimension of value. Procurement can support innovation objectives by identifying and securing suppliers that possess key technologies and by inducing the supply base to develop innovative offerings. Digital platforms can help the engineering departments of the buying and supplying companies work closely together to complete tasks and generate new ideas. In addition, platforms can enable both these engineering departments to see what additional initiatives the other is working on at the moment.

For example, a large food producer wanted to adapt to shorter innovation cycles, especially in the dairy market, where rapidly changing customer demands made it necessary to develop new products more quickly than before. But this would mean frequent changes to the types and volumes of supply items, which in the past forced suppliers to make last-minute—read expensive—changes in production.

The solution: an innovation and planning platform that gave suppliers a clear view of new products in the pipeline. With the ability to anticipate upcoming production changes, suppliers could now adapt their own procurement strategies as needed. Perhaps even more important, they could use the platform’s comment function to suggest new ways to modify products and potentially reduce costs. The comment function—linked directly to the food producer’s R&D department—greatly facilitated communication and innovation efforts. As a result of these changes, the food producer’s average innovation cycle dropped from one year to just seven months.

Risk

Reducing supply risk is critical for optimizing value. Digital tools that are used to decrease this risk are generally either preventive or reactive.

Preventive digital tools cluster risks into different categories, establish which are most likely to occur, and determine how to predict or prevent them. For example, one solution analyzes the financials of suppliers to monitor core suppliers in danger of bankruptcy. In the past, companies seeking such information had to rely on financial data that is typically more than a year old. Now, however, they can use a single comprehensive predictive algorithm that is based on more current information gleaned from the market development of the supplier’s product as well as from internal quality reports.

In contrast, reactive measures ensure that the procurement department is prepared to respond in case a risk becomes reality. Here, contract management applications play a critical role. While contracts were traditionally kept on paper and only a PDF version was stored in one of perhaps many databases, today all relevant contract parameters are automatically read out and stored in a central database. This makes it easy to retrace every step of the approval process. If a risk materializes, the buyers can easily establish their legal position and develop counterstrategies.

For example, a leading automotive OEM, which had an indirect department of approximately 1,000 employees and indirect spending in the tens of billions of euros, faced a challenge in its auditing process. The department couldn’t immediately locate several supplier contracts to share with the auditor; moreover, no one knew who had approved those contracts. After two weeks of searching, the department found most of the contracts; but the file names lacked any kind of nomenclature that could identify what was in them, and the approvers remained a mystery.

Predictive algorithms now provide a better, more reliable way of monitoring core suppliers in danger of bankruptcy.

To remedy the situation, the department put in place a platform for managing contract development. The platform automatically reminded people when it was time to approve the next step in the contract approval process and recorded each interaction to ensure that it was possible to retrieve every interaction that occurred. The automated follow-up reduced the contract setup time from five weeks to two. In addition, the tool saved all core contract parameters in separate fields, which made the information easier to access. With just one click, it was possible to see the specific payment terms of each contract; the contracts that had been agreed to, for example, with suppliers in low-cost countries; and the service line agreements that had been made in a certain supplier segment.

All these changes were easy to implement for new contracts. But thousands of preexisting contracts, which provided useful information on things like previous payment terms, remained inaccessible because they were still stored in PDF format in the old system. So the company deployed an automated readout robot that extracted the core information from the PDF of each contract and transmitted it to the central database. As a result, four employees in India were able to analyze 17,000 existing contracts in just six weeks.

Enablers

Enablers, the second area of focus, are critical for delivering—and maintaining—the highest level of value. CPOs, therefore, need to have a good understanding of which enablers best support the value dimensions that are deemed most important for the procurement strategy. If, for example, speed is paramount, the company should place a heavy emphasis on streamlining processes; if innovation is a strong focus, internal and external collaborations are crucial. As noted with value dimensions, the deployment of enablers should begin not with technology considerations but with strategic priorities. There are five types of enablers: organization, processes, people, performance management, and collaboration.

Organization

Digital technologies will fundamentally change roles within the department and, therefore, the organizational setup as well. Robotic process automation (RPA) and AI will take over a large proportion of the repetitive tasks that operational buyers typically perform, so there will be less need for these positions.

Strategic buyers, by contrast, perform a wide range of nonrepetitive tasks. In the near future, digital technologies will have little impact on the activities that are truly strategic, such as developing category strategies.

Digital will fundamentally change employee roles as well as the organizational structure.

But digital will affect many other tasks normally performed by strategic buyers. Structured data lakes and big data analytics will eliminate the need for buyers to consolidate data sets and conduct basic analyses such as LPP; in the long term, such activities will be fully automated. AI-based technologies will be important because they will help buyers involved in negotiation preparation and supplier selection make good decisions. Thus, strategic buyers will need to develop AI-related skills.

At the same time, digital will create the need for new roles. To enable AI-based decisions, the procurement organization will need to set up a central master data and advanced analytics team dedicated to digital analytics. It will also be necessary to create a small group that will program and maintain the robots required for automation tasks. Procurement organizations will need to develop different role descriptions for these employees and provide them with digital training. No less important, they will have to identify and attract digital talent, especially data scientists. The function will likely shrink in size, but the greater number of digital experts will create much higher value.

Processes

The overall procurement process consists of three sets of actions:

- Planning-to-strategy (P2S) covers the foundational strategy work, beginning with the allocation of resources and ending with the defining of the category strategy.

- Source-to-contract (S2C) begins with the defining of individual projects and their needs and ends with the signing of supplier contracts.

- Procure-to-pay (P2P) starts with the decision to buy a good or service and ends with delivery and payment.

We predict that the S2C and P2P processes will see major digital changes in the next ten years. All types of technologies—automation, AI, and cognitive agents—will be important. But AI will have the biggest impact on S2C processes because it will help buyers make the best decisions for maximizing savings as well as innovation goals. And automation will play the largest role in the P2P process because automated order-processing solutions for tailored buying channels will save much time. In our view, it also has the potential to reduce the number of full-time staff needed for transactional tasks by up to 50% over the next two years—and by an even larger percentage in the long term as new robotic solutions are introduced.

People

Employees’ capabilities, which are obviously critical for realizing value of all kinds, can benefit greatly from digital solutions. Buyers, for example, can use online solutions to assess their skills in areas such as analytics, strategic thinking, and negotiation tactics. In some cases, managers can add their perspective to these assessments. This material forms the basis for capability-building plans that buyers can tailor to their role. Whenever they complete a course in the curriculum, their performance profile is updated accordingly. Although skills like analytics can be taught online, negotiation techniques are taught more effectively in person.

Although digital helps people enhance their skills in some ways, it also requires them to dramatically adapt their skills to the new technology landscape. Given the declining need for conventional operational roles, these buyers will need to learn how to deploy digital technologies to boost various dimensions of value.

Performance Management

Generally speaking, performance management systems provide: (1) an overview of the main parameters that the procurement department uses to manage and communicate its performance to stakeholders; and (2) important information on how much individual employees have contributed to the department’s overall goals. Performance management systems can be used to support all five dimensions of value (savings, quality, speed, innovation, and risk). The key is that the types of performance that are measured, and the metrics deployed, must target the dimensions deemed most important.

Performance management systems can be used to support all five dimensions of value.

Digital tools have made a vast difference in what performance management can accomplish. In the past, companies weren’t able to obtain accurate numbers for procurement performance. Now key performance indicators (KPIs) can be drawn automatically from the company’s systems and tailored to specific roles. New performance management tools can pull the relevant metrics, such as order speed or supplier quality performance, from the company’s systems and post them on dashboards for broader groups of stakeholders. The ERP supplies most performance data, such as that used to measure speed or savings effects. But companies can also use add-on tools—for example, collaboration platforms that measure the number of onboarded suppliers and capability systems that monitor the progress of employees’ skill levels.

In addition, digital tools can help companies measure the impact of procurement performance on the P&L. New tools can match procurement impacts on specific categories (for example, savings on steel) to real P&L results and then allocate these results to the appropriate P&L accounts of the different business units. This type of matching tool thus is able to eliminate distortions between procurement performance and P&L performance.

Take, for example, a buyer who makes purchases for a number of different business units. Each unit has its own budget that links to the P&L, but when the buyer achieves a procurement savings, it’s not immediately clear which budget should be credited with the savings. The new matching tool automatically allocates the right proportion of the savings to each business unit and adjusts (that is, reduces) its budget accordingly.

Collaboration

Effective collaboration is critical for realizing different types of value—innovation, quality, and even savings. A good procurement department collaborates with two kinds of partners, internal teams and external suppliers.

Product development is where collaboration provides the greatest benefit. For the procurement staff to share ideas effectively with internal groups and with the company’s suppliers, the flow of information needs to be guaranteed, especially when technical products are in development. Joint idea generation and collaboration platforms allow the procurement department, internal partners, and suppliers to analyze data and refine ideas collaboratively using virtual flipcharts. We suggest deploying these platforms only with the suppliers involved in critical areas of product development.

Production systems are another important collaboration tool. They link suppliers’ and buyers’ ERP systems to ensure a timely flow of information that allows suppliers to undertake better demand planning, thus preventing shortages and bullwhip effects along the supply chain. Such information sharing can avert the kind of crisis that the automotive industry experienced in 2008, when OEMs could see that sales volumes were plummeting, but suppliers were still ramping up production because they didn’t have access to this information.

Data Foundation

At the heart of any successful digital procurement strategy is the data foundation, which consists of new digital analytics and existing IT systems. Each aspect of the foundation provides crucial support for the value dimensions and the enablers alike.

Digital Analytics

Companies can use digital analytics to detect patterns in existing data and predict future developments. The result: insights that enable buyers to make much smarter business decisions than in the past.

With the insight provided by digital analytics, buyers can make much smarter business decisions than in the past.

For example, one company’s buyers often purchased identical parts, or similar parts with the same material weight, at very different prices. The root of the problem was that spending data was dispersed across the systems that different business units used, so it was inaccessible to many employees.

To address the problem, the company stored all the relevant documents—POs, invoices, and technical data sheets—in one central location. Algorithms read out and combined the relevant data with the information already in the ERP systems. Digital analytics such as variance analysis and linear programming then made it possible to determine if the parts had been purchased at different prices.

This company’s approach can also be used to support other value dimensions besides savings. Take financial risk, for example. A procurement function can assess whether a supplier is at risk for bankruptcy by using an algorithm to analyze data collected from reports on quality, invoices, and the supplier’s P&L. This is a much more reliable way to forecast supplier bankruptcies than traditional financial monitoring.

To use data analytics effectively, companies first need to decide whether insights pertaining to savings, quality, innovation, or risk are the most important. This will determine which data needs to be stored and which types of digital analytics need to be conducted. An advanced analytics team should be created to implement these decisions and provide supplier and market insights. These special units should be kept small (3% to 5% of full-time procurement employees at most) and staffed with high-caliber employees.

Existing Systems Landscape

No digital procurement strategy would be complete without addressing legacy IT systems, which act as a backbone not only for data generation but also for nearly all new applications, including digitally driven activities such as the automated PR-to-PO process. Typically, this backbone provides all data used for deeper analysis and hosts the main process and data stream of the department. The vast majority of digital applications—whether robots, analytics, or collaboration tools—need to access the legacy systems and provide their inputs without hindering or harming the systems’ functionality. Given the foundational role of legacy systems, it’s important to make improvements on an ongoing basis to keep them up to date.

Setting Out on the Digital Procurement Journey

Over the next few years, digital procurement will likely rise to the top of most CPOs’ agendas. But digitizing the procurement function is not an easy task. To be successful, companies need to base their digitization strategy on the dimensions of value, enablers, and the data foundation that are most relevant for their specific competitive context.

With these goals guiding the way, companies can take further steps to put the digital strategy in place, assessing digital use cases in light of their sp ecific business needs and implementation requirements and developing a comprehensive implementation roadmap. These steps will be the subject of later publications in our digital procurement series.

Clearly, digital technologies afford many opportunities to boost procurement value. But only procurement departments that choose their digital tools strategically will be in a position to take their operational performance to a whole new level—and help their companies meet their long-term strategic goals.