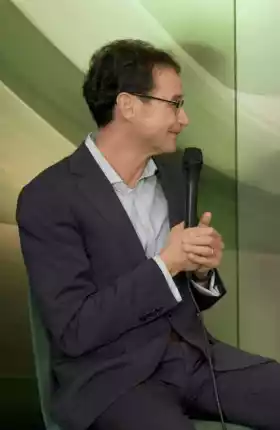

Tawfik Hammoud

Managing Director & Senior Partner;Chief Client Officer & Chair, Industry Practices Toronto

Education

- MBA, Harvard Business School

- BA, École Supérieure de Commerce de Paris

Tawfik Hammoud is Boston Consulting Group’s Chief Client Officer and Industry Practices Chair. He serves on the firm’s Global Executive Committee, and is also a member of BCG’s Operating Committee. He was previously the global head of BCG’s Principal Investors & Private Equity practice, which he helped launch in 2015.

Since joining BCG in 2005, Tawfik has worked extensively with clients in Europe, North America, and Asia, helping transform their businesses. He has also worked with private and public institutional investors around the world. Tawfik advises clients on all aspects of business strategy, mergers and acquisitions, corporate finance, operations, and family business and governance. He has also spent a significant amount of time in the broader digital space.

Prior to joining BCG, Tawfik worked in consulting, investment banking, and tech in the US, Canada, and France.