No industry has escaped the ravages of COVID-19, but the impact on retail has been more complicated than most. The crisis has accelerated channel shifts and changed the way consumers shop. E-commerce and click-and-collect, for example, are on the rise: our research shows that more than 40% of online grocery shoppers during the pandemic are using e-commerce for the first time, and 90% of those doing more shopping online were comfortable with their e-commerce experiences. Customers are also making fewer trips to stores and spending more on each trip. In addition, they are limiting their purchases to a few trusted retailers and substituting grocery store purchases for restaurant dining. In nonfood segments, such as health and beauty, customers are planning more, making lists, and following them.

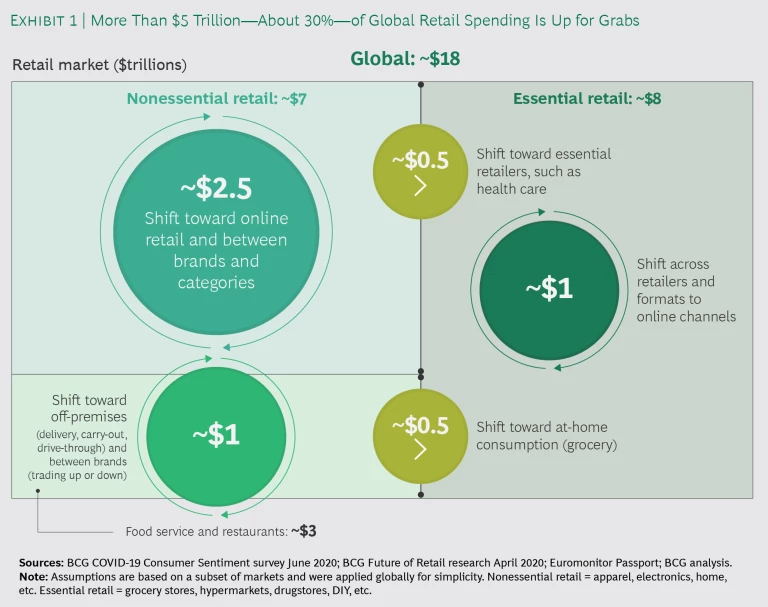

All in all, consumers are rethinking their relationships with retailers at an unprecedented rate. Our research indicates that more than $5 trillion, or 30%, of annual global retail sales is up for grabs as the market shifts. (See Exhibit 1.) The specific opportunities and challenges vary by retail segment, and longer-term questions—once we truly flatten the curve and move from fighting the pandemic to living in the new reality—continue to loom large. Which consumer changes will be permanent? How do retailers in each segment stay relevant? Where will growth come from? What kind of new competitors and business models will emerge?

More than ever, retailers need a good compass to guide their efforts, one that points to the true north of future growth and provides a strong strategic filter for commercial decision making. BCG has been perfecting such a compass for more than a decade while helping more than 200 companies build successful growth strategies. We call this compass demand-centric growth (DCG), and it has proven to be powerful in the retail sector: Before the pandemic, one North American discount retailer increased same-store sales by 11% during pilots of its new DCG strategy in 1,000 stores. A US restaurant chain delivered more than 25 consecutive quarters of growth in same-store sales while the market was mostly flat. A US grocery chain used DCG to reduce assortment by more than 20% while increasing sales transactions by 2%. A European home improvement company increased sales and profit by 60% over three years by refocusing its stores and online offerings using DCG.

Here’s how DCG can help retailers seize their share of the $5 trillion and emerge stronger from the COVID-19 crisis.

Shifting Shoppers

Traditional approaches to understanding consumers, such as customer-level segmentation, no longer deliver (if they ever truly did) the level of insight that companies need. In a postpandemic environment, it will be critical to understand why shoppers choose certain retailers and formats for individual purchases—and what needs they are addressing when they do so. Retailers will also need to understand the changing contexts in which consumers are fulfilling these needs.

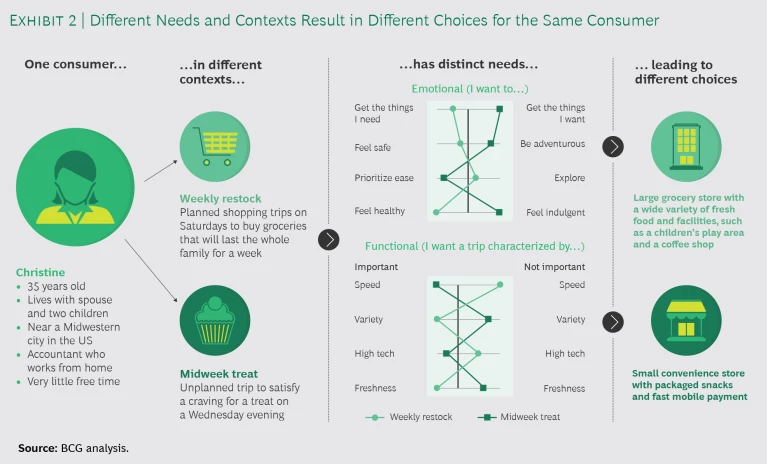

Consider the example of Christine, a fictional 35-year-old woman living with her spouse and two children near a Midwestern city in the US. She is representative of a group of shoppers with constant demographics; if she loses her job, things might fluctuate a bit, but she is well educated and skilled and therefore likely to find another position. Her shopping behaviors have changed because of the pandemic, however. She now works from home, the kids are there around the clock, and her free time has evaporated. She plans her week with extra care and makes the most of every trip to the store because she doesn’t want to go more often than necessary. She buys a lot more online than she used to and takes advantage of auto-replenishing services, since she particularly values ease and convenience these days. She has not shopped for apparel or bought anything indulgent for months, although she used to be a regular at both the mall and her favorite discounters. She has taken to buying housewares and kitchen supplies online since she is cooking more. She finds click-and-collect useful for some items but still wants to buy fresh foods in person so she can judge the quality herself.

Christine’s new routine offers some useful information for retailers, especially those that have amped up their e-commerce capabilities. But what about the underlying factors that influence her purchase decisions as well as the way those decisions can change depending on the context at the time of purchase and on the range of options available? What about the fact that Christine has totally different needs—both emotional and functional—that she is trying to satisfy, whether she is shopping to restock household basics for the family or making a quick trip to purchase an item or two she craves for herself? (See Exhibit 2.)

Ultimately, the retailers that will be in the best position to grow will be the ones that come to understand what drives Christine’s decision making on different purchase occasions. Rather than try to meet all of her needs all of the time, they will instead target the specific demand spaces where they have an advantage and can win share over competitors. These companies will think less about what they are trying to sell and more about what Christine wants to buy—as well as when and why she wants to buy it.

Scrambling Retailers

Retailers are scrambling to deal with all sorts of behavioral changes. They are trying plenty of strategies to reignite demand, and they have identified long lists of strategic priorities spanning virtually all areas of the organization, from the in-store experience to pricing to such digital initiatives as personalization and e-commerce.

Consider safety and cleanliness, for instance, which were previously taken for granted but are now becoming differentiators that drive decisions. BCG’s recent consumer sentiment research showed that virus safety measures continued to be a top driver of decisions in July 2020 for US consumers deciding where to shop. Many grocery and mass retailers thus focus on providing a clean and safe in-store experience. They are also fulfilling a surge of e-commerce and omnichannel orders. To handle the latter, they have implemented new models, such as dark stores and curbside pickup, virtually overnight and started partnerships with delivery firms to increase capacity quickly. Specialty retailers, many of whose physical stores have closed, are attempting to migrate demand online with varying degrees of success and experimenting with new tactics to win customers back during reopening. Restaurants, plenty of which have also been forced to close for sit-down dining, are shifting to delivery or takeout services while reimagining the dine-in experience for reopening and exploring innovative ways to grow share of wallet, such as through so-called pantry sales of ingredients.

As they set their strategies for the future, retailers risk falling into two traps. The first is pursuing too many actions without a set of strategic criteria for what best fits their customer value proposition and will help them differentiate. This takes time and resources away from mission-critical initiatives. The second is adopting a near-term focus on boosting sales without a longer-term vision that informs priorities for the future. This is why they need a compass.

Finding the North Star

Retailers can reframe the way they analyze their market in the same way that many consumer packaged-goods manufacturers, travel companies, and others have done: by moving from customer segmentation as a basis of growth strategy to understanding the unique consumer needs that drive demand and typically occur in distinct, identifiable contexts. BCG’s DCG approach uses quantitative consumer insights derived from research, artificial intelligence, and large-scale analytics to define a mathematically rigorous view of consumer needs and demand. It serves as a sophisticated compass that can direct a company toward the most promising routes to growth and guide all of its growth efforts, from innovation to expansion and from screening acquisition candidates to executing in the marketplace.

Defining consumer needs and understanding the context in which demand is created (occasions, attitudes, and demographics) yield powerful insights about where retailers should play and how they can win. Rather than assign a customer to a single segment—value-conscious millennials, for example—DCG recognizes that such a millennial can be in multiple demand spaces at different times under varying circumstances. It can also predict when and where he or she has varying needs—much like our fictional friend, Christine.

This approach has very practical applications for retailers. For example, in grocery and mass retail, the store is a collection of different categories potentially serving different needs, and it will face different competitors. The needs for “fresh” and “exciting” in produce, for instance, are very different from the needs for “safe” and “informed” in health care. The retailer must design the overall customer experience to meet the target demand space it is has decided to serve. This requires determining the consumer needs and contexts that can drive a differential volume of traffic, and then translating this determination into all elements of the customer experience, including marketing, assortment, pricing, and promotion.

In the quick-trip retail market, a key driver of when and where specific needs occur is whether the purchase will be consumed or used immediately or later on. “Craveability” is critical to win purchases for immediate consumption, while value is much more important for purchases with deferred consumption. (Aside from age in certain retail segments, demographic variables are rarely meaningful predictors.)

The demand-centric approach benefits retailers in a variety of ways relative to traditional customer understanding, including traditional segmentation. First, it is lasting. A true understanding of needs and contexts provides more sustainable advantage than demographic or customer-based segmentation.

Second, DCG is comprehensive: it takes into account the needs and occasions for both customers and noncustomers and does so from the consumer’s point of view—creating a map of demand for the entire market, not just where a retailer currently plays. And it evaluates all of the retailers a consumer might consider for the same need, not just a particular company’s usual competitive set.

The beauty segment, for example, contains a diverse set of retailers: department stores, pharmacies, pure-play companies, online operators, and mass and grocery retailers. DCG enables a company to frame this entire set of competitors and understand where each one has strengths and weaknesses. Department stores, for example, are often rooted in emotional-pleasure-related beauty needs (such as sampling or purchasing lipstick or perfume for oneself) while consumers look to mass retailers for more functional needs (such as buying skin care products, soap, and shampoo for the family). Yet convenience stores, as we saw with Christine, compete with several different retailer types, depending on a consumer’s needs and shopping mission. Immediate-consumption trips pit convenience stores against quick-service restaurants, while “shop for later” trips are split among big-box retailers, grocery stores, and drugstores.

Third, DCG drives tradeoffs, helping brands determine their competitive set for each demand space and identify one or more target spaces in which a retailer’s existing assets and equity position it to win disproportionate share. To choose their demand spaces, retailers need to assess the attractiveness of a particular target (both currently and in the future), determine their expectation of success (given customer perceptions, current share, and competitive dynamics), and estimate the ease of execution. No surprise that this is often a big strategic debate—which can be a useful exercise in and of itself.

Fourth, DCG provides quantifiable outcomes. It measures needs, occasions, and growth trajectories to deliver an accurate estimate of the value of targeting one demand space or bundle of needs over another.

In all of these ways, DCG serves as an actionable strategic filter, the North Star for the entire organization, that management can use to further a growth mindset and build a culture of customer centricity. DCG drives real tradeoffs, such as where to differentiate and win, since no retailer can be all things to all people. The process of defining this North Star also allows retailers to understand which spaces are more resilient to crisis and which elements—such as e-commerce—are more vulnerable to disruption through new entrants or competitors using new channels. The result also creates a rallying cry and contributes to a culture of customer centricity for the organization.

One discount retailer identified the smart-decision demand space as its principal target, allowing it to leverage its existing value associations. The move also helped the company clarify the need to focus on well-priced private-label offers in staples—as opposed to the branded products, high-low pricing, or special-buy models employed by competitors that were targeting other demand spaces, such as treasure hunt. Especially in the current environment, with value top of mind for many consumers, understanding how assortment, pricing, and promotions factor into the value proposition to target a particular demand space helps inform where to invest.

A health care retailer identified an opportunity to expand in a demand space that required a strong need for trust. This decision led the company to station advisors throughout its stores, build an informational website, emphasize trust in marketing materials, and put up clear signage on shelves to explain products and their purposes.

Near- and Long-Term Growth

DCG generates immediate results as it shapes a retailer’s long-term decisions. Near-term table stakes actions—addressing such issues as cleanliness, aisle design, food quality, and service levels—can help retain customers. Marketing and customer relationship management (including one-to-one offers) that are based on a demand-centric understanding of why consumers make particular choices can spur demand. Pricing and assortment moves that are guided by a demand-based approach can save costs and boost sales. A deeper understanding of consumer needs can produce insights into store staffing and service requirements.

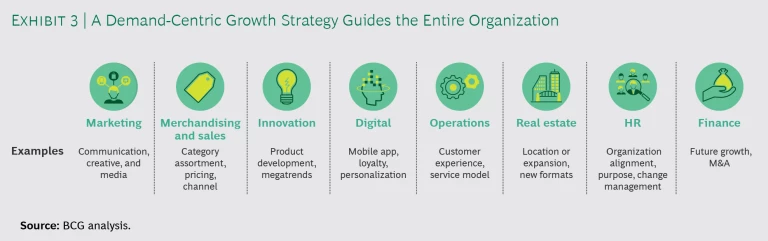

In the longer run, DCG will provide the strategic context with which any retailer can rethink everything from merchandising to real estate to finance. (See Exhibit 3.) In this regard, it is worth noting that previous BCG research has shown that companies’ reactions to downturns have often been defensive, delayed, and insufficient. But in the past four downturns before the pandemic, an average of 14% of companies actually increased both the rates of their sales growth and their earnings before interest and taxes (EBIT) margins despite the challenging circumstances. These companies grew revenue by 14 percentage points more, and improved their EBIT margins by 7 points more, than the 44% of companies that declined in both metrics. DCG is exactly the type of offensive strategy that can enable retailers to be among the postpandemic outperformers. Smart retailers will act now.

Retailers face unprecedented challenges, and many companies are already developing innovative solutions. They must be careful, however, not to overload their already-stretched teams with a smorgasbord of top-priority initiatives. Too many to-dos dilute team focus, delay execution on the topics that matter most, and potentially confuse consumers. Identifying a North Star that guides retailers’ efforts is more important than ever. DCG should be a part of every retail company’s arsenal as it adapts to changes in consumer behavior and captures growth, starting immediately, in the new reality.

The authors are grateful to their colleagues Venkat Raman and Lee Robertson for their insights and assistance. They also thank Kelsey Almaguer, Kosmo Karantonis, Allison Kelley, Megan Mantaro, Mark Meyers, and Allison Zeller.