Crises focus the mind, and COVID-19 concentrated corporate management’s attention on a number of critical issues. First and foremost may have been costs, but forward-looking leaders soon looked to broader needs affecting their companies’ futures, such as resilience, digital transformation, and customer relevance. Little surprise that 2020 saw innovation rapidly ascend the list of top management priorities.

CEOs are ramping up their companies’ efforts and investment, recognizing that innovation’s power to boost resilience and drive advantage is more important than ever. We see a risk, however, that their hopes will not be realized because their companies are not ready. They have yet to build the systemic ability—the underlying processes and capabilities that drive innovation—to transform ambitious aspirations into real results.

The good news is that companies can meet the challenge and radically improve their readiness, but not simply by throwing more budget or talent at existing programs. Our research and experience indicate that in most cases a few targeted changes in strategy, operating model design, and organizational capabilities can unlock significant benefits.

This year’s Most Innovative Companies report looks at what we call the innovation readiness gap. We analyze the factors contributing to the divide and consider measures that companies can adopt to address them—both in the C-suite and on the frontlines. And, of course, we identify the companies that rank as the top global innovators one year into the COVID-19 pandemic.

Ready to Commit?

The pandemic has clearly accelerated ongoing trends for some companies and reshuffled priorities for others. Our 2021 survey of 1,500 global innovation executives found that, for most, the COVID-19 experience has spotlighted the critical importance of innovation. This year’s survey showed a 10-percentage-point increase, to 75%, in executives reporting that innovation is a top-three priority at their companies. A third of them point to it as the number one priority. Results were consistent across industries and geographic regions.

This increased emphasis has translated into larger budget allocations. More than 60% of companies plan to boost investment in innovation, one-third of them significantly. This finding holds true in hard-hit industries (58% of firms in industries such as travel and tourism and transportation plan to increase their innovation spending, 18% significantly) and in industries facing less adversity, such as pharmaceuticals and software (64% plan to increase their innovation investment, 20% significantly). Almost half of all companies (49%) qualify as what our 2020 Most Innovative Companies report termed committed innovators; that is, they named innovation as one of their CEO’s top-three strategic priorities, and they have backed up this ambition with commensurate investments in innovation.

Almost half of all companies named innovation as one of their CEO’s top-three strategic priorities, and backed up this ambition with commensurate investments.

But commitment and investment alone are not enough to guarantee success. In addition, companies must be ready to achieve a return on innovation investment, meaning a well-tuned innovation system that can transform good intentions into real value. Companies that are both committed and ready are up to four times as likely as those that aren’t to generate a greater share of sales from new products, services, and business models.

Mind the Readiness Gap

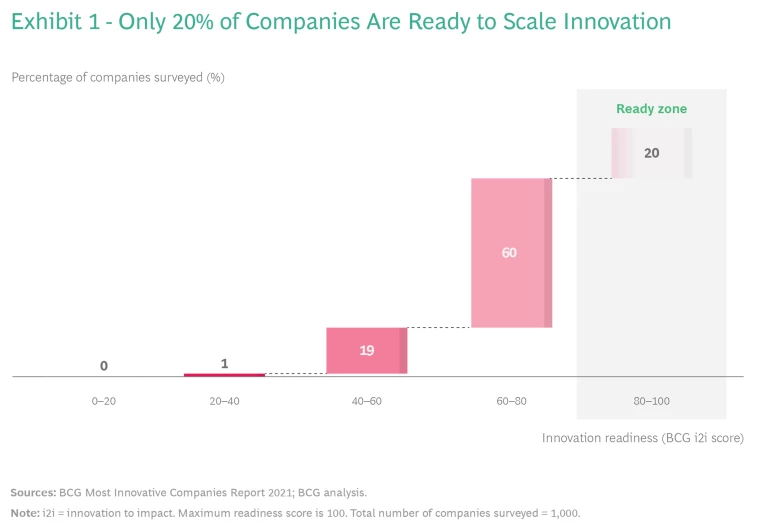

BCG’s innovation-to-impact (i2i) framework helps companies measure the readiness of their innovation programs to operate at a consistently high level of efficiency and effectiveness. The framework allows companies to assess their relative strength on ten essential factors related to their processes and capabilities. Scoring is based on a 100-point scale that reflects best-practice maturity. We consider organizations that earn a of score 80 or above to be ready to realize their innovation aspirations.

Gaps in readiness exist even among committed innovators, suggesting that many companies may fail to realize their ambitions.

By that metric, only about 20% of companies are ready. (See Exhibit 1.) Companies made progress on both dimensions in 2020, indicating that progress is possible even within a short time frame and under difficult circumstances. Still, large gaps are apparent between industries. This matters because, as we reported last year, more innovation now takes place across industries, rather than just within a single sector, with numerous top-50 companies transcending traditional industry boundaries (see Amazon, Bosch, Target, and Sony).

A deeper dive reveals worrisome gaps in readiness even among committed innovators (those that invest significantly in their priorities), suggesting that many companies are likely to fail to realize their ambitions. (See Exhibit 2.) Although they score a bit better as a group than non-innovators, 74% of them are still not ready, according to our metrics. The largest gaps tend to involve what we call innovation practices—capabilities related to moving a portfolio of projects to impact. But we also see some significant gaps in innovation platforms, which set ambitions, define innovation domains, delimit roles, shape portfolios, and measure and reward performance.

These differences show up in performance, as demonstrated by the shareholder returns that members of BCG’s past 50 most innovative companies rankings have generated. The members of our pre-pandemic top 50 from 2020 have outperformed the index by a staggering 17 percentage points in the past year; and even if you remove the high-flying tech giants (Apple, Google, Amazon, Facebook, and Netflix), top innovators still beat the index by 13 percentage points.

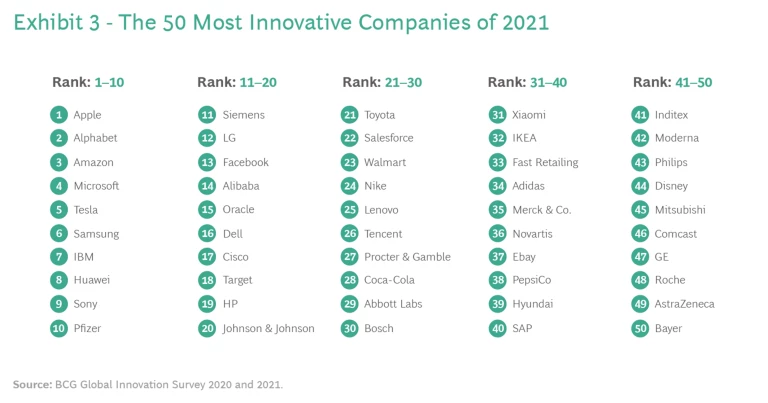

The Year’s 50 Most Innovative Companies

A tour of this year’s 50 most innovative companies underscores the power of commitment and readiness. (See Exhibit 3.) Start with Pfizer (number 10), the innovation story of the year, along with Moderna (number 42)—in which Merck (number 35) has been an early investor. Commitment and readiness helped Pfizer, in partnership with BioNTech, not only to cut the innovation time for a COVID-19 vaccine from a decade or more to less than a year but also to ramp up production capacity to deliver much-needed vaccines. Abbott Labs and Bosch (numbers 29 and 30, respectively) were early movers in developing testing kits and equipment for COVID-19. Target (number 18) and Walmart (number 23) benefited from deep investments in e-commerce and omnichannel capabilities to handle spiking demand. Amazon (number 3) rode consumers’ desire for safe online shopping and fast home delivery to new heights.

In other industries, big consumer products companies such as PepsiCo (number 38) took new routes to market, going directly to consumers to explore and test early customer sentiments. Industrial companies such as Siemens (number 11) and GE (number 47) found new uses for data and advanced technologies such as AI. Siemens’s mobility division is connecting critical railway infrastructure and train data in its cloud software solution to allow customers to better manage operations for safety, efficiency, and flexibility. GE is using AI to reduce downtime and increase the output of its equipment. Apparel and fashion companies such as Adidas (number 34) adopted fully digital design processes to shorten time to market and support effective collaboration in a year of mostly remote work.

There was little change in the ranks of top-ten innovators. Apple and Google parent Alphabet retain the top two spots. But in addition to 33 holdovers from last year (whose continued presence shows the enduring qualities of serial innovators), the 2021 list contains 11 companies that have returned to the top 50 after an absence of at least one year, and 6 firms that are new to the rankings.

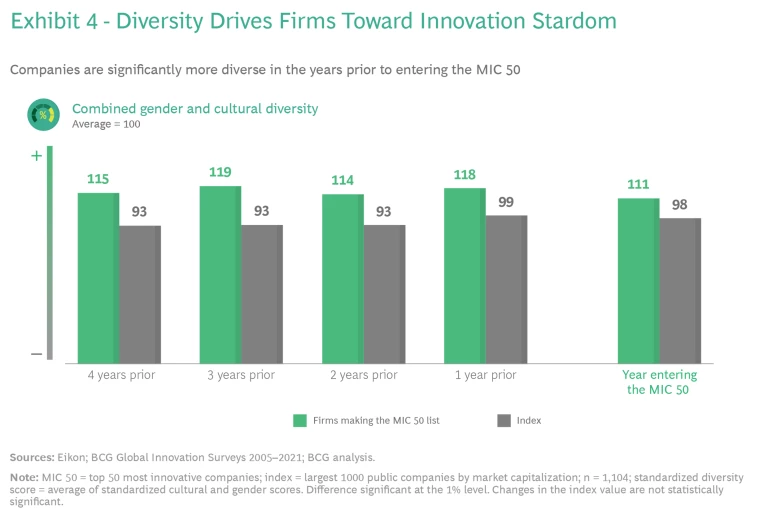

Companies in the top 50 tend to exhibit higher gender and ethnic diversity in their leadership.

Companies in the top 50 tend to exhibit higher gender and ethnic diversity in their leadership—as shown by companies like Microsoft, Alibaba, Cisco Systems, Philips, and Novartis, which beat their peers in both gender and ethnic diversity. But which way does the causality run? Looking back at the companies that entered our top list each year since 2005, we see that they were more diverse prior to making the list than a broad index of the largest 1,000 companies. We don’t see robust evidence, though, that top 50 innovators further increase diversity after attaining a top 50 ranking. (See Exhibit 4.) This dynamic suggests that while gender diversity and cultural diversity may help foster innovation, being more innovative does not cause firms to attract even greater diversity.

Ready in Five

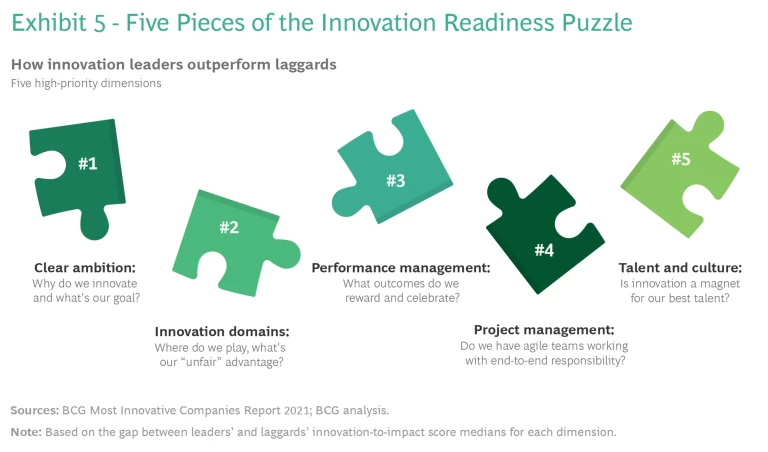

Our analysis indicates that five factors are especially important to innovation readiness. (See Exhibit 5.) These factors are where the biggest gaps between leaders and laggards occur in our i2i scoring system—indicating that they are the ones most likely to make a difference—yet they are also areas where leaders still have ample room for improvement.

Clear Ambition. Top innovators pursue their objectives with clarity and consistency. They set aspirational goals that align with corporate strategy, and they establish value creation targets that rally talent to invent better ways to serve customers and society. Company leadership quantifies, appropriately resources, and drives the innovation agenda from the top.

The best innovators define clear opportunities for customer benefit that the organization then aspires to own.

Innovation Domains. Deciding where to play is essential. The best innovators define clear opportunities for customer benefit that the organization then aspires to own. They ground the innovation strategy in deep customer insight and adjust nimbly to shifting opportunities. They focus on a limited number of innovation domains in which they can leverage a unique strategic asset or capability, such as superior customer access, that others cannot match.

Performance Management. Moving the innovation needle quickly entails linking ambition to measurable KPIs that faithfully report performance on the true drivers of success. Moreover, these KPIs must be tied to incentives. Metrics and incentives should reward both predictable, incremental progress and successful step-change innovation. They should recognize leaders who not only push promising new ideas but also recognize and ditch failures early in the process.

Project Management. Effective innovation today requires empowered, multidisciplinary teams that bring external market and customer insights to bear in shaping value propositions. Such teams have a clear view of the company’s strategic advantage, and they put that advantage to use in new product and service development. To be effective, they must be small yet functionally diverse and able to act autonomously and make their own decisions.

Talent and Culture. Leaders foster an organizational culture that grants prestige to innovation roles and values openness and thoughtful challenges to the status quo. They assign their very best talent, including true business builders, to the most ambitious innovation challenges.

Two themes are common to these five pivotal capabilities: exercising leadership and bringing teams together. A strategy-led, CEO-driven, data-informed innovation culture is central to putting the five pieces in place. A cross-functional, customer-centric organizational approach brings multi-capability innovation teams together to share ideas and develop insights. We explore both of these themes in the remaining chapters that make up this year’s report.

This article is the first chapter in BCG’s Most Innovative Companies report for 2021, Overcoming the Innovation Readiness Gap. Continue reading the second chapter, “The CEO Innovation Agenda.”