After decades of refinement, it seemed that global companies had gotten supply chain management down to a science. By orchestrating complex, international networks of suppliers, factories, and logistics providers, companies had been able to squeeze out cost, get goods to distant markets with remarkable efficiency, and keep inventory to a minimum.

Companies had already begun rethinking their far-flung supply chains in response to changing labor costs, advances in automation, rising protectionism, and external shocks, such as natural disasters. But it took the COVID-19 pandemic to more fully expose structural flaws that have prompted organizations to fundamentally reassess their approach to global manufacturing and sourcing. Factory lockdowns, transportation disruptions, and panic buying led to shortages of everything from medical supplies and household necessities to critical automotive and electronics components. The crisis also heightened geopolitical tensions, trade restrictions, and nationalist policies aimed at promoting domestic industry that are likely to continue reshaping the global business landscape.

With massive value at stake, global enterprises are seeking to mitigate risk and secure better access to supplies and markets.

Now, companies are exploring various ways to build more resilience into their manufacturing and supply networks—even if that resilience leads to extra costs. With massive value at stake, global enterprises are seeking to mitigate risk and secure better access to supplies and markets. They are exploring options for diversifying and regionalizing their manufacturing and supply networks, adding backup production and distribution capacity, and reoptimizing inventory. Companies are also seeking to improve their supply chain flexibility, risk-monitoring capabilities, and capacity to respond rapidly to new shocks.

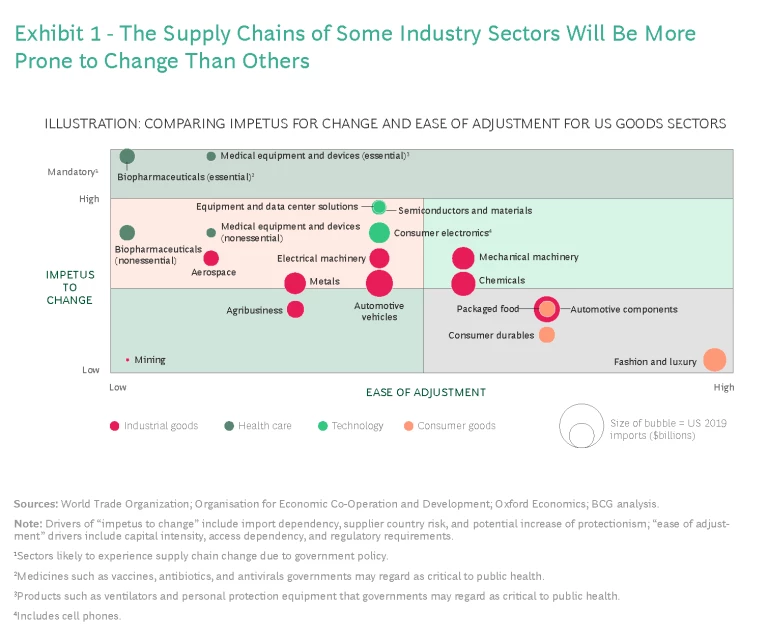

Exactly what a future resilient supply chain looks like will vary by industrial sector, location, and the type of sourcing and manufacturing network that best fits each organization’s strategic objectives. Company decisions will largely be influenced by two key factors—what we call the “impetus to change,” such as economic and political pressures, and “the ease of adjustment,” such as the difficulty of replacing certain suppliers and the capital costs associated with moving to new locations. Companies that make the right adjustments will create supply chains that put them in the best position as they shift from fighting the pandemic to winning the post-COVID-19 future. Below, we offer a six-step approach to adapting supply chains and establishing competitive advantage.

A Shifting Global Sourcing Landscape

Many of today’s worldwide supply chains were developed during the high tide of globalization from the late 1980s through the first decade of the 2000s, when falling trade barriers and transportation costs removed friction in international commerce. Traditionally, supply chains were designed primarily to meet two overarching objectives: cost efficiency and optimal service levels. Manufacturing footprints and sourcing networks have been built largely to take advantage of differences around the world in factor costs—such as labor, materials, and energy—and on the ability to fulfill customer needs within a particular time and at a specified quality standard in given markets. Over the past few years, concerns over market access, resilience, and environmental sustainability have gained in importance in some sectors.

Well before the COVID-19 outbreak, geopolitical, technological, and economic forces had begun to redefine globalization.

Well before the COVID-19 outbreak, however, geopolitical, technological, and economic forces had begun to redefine globalization. Companies have been realigning global supply chains in response to shifting manufacturing cost structures, improvements in advanced manufacturing technologies, tariff wars, and rising protectionism. Many global enterprises have been moving toward regional manufacturing and sourcing footprints in order to be closer to end markets. Their factories in China are increasingly targeting the huge, still growing domestic market and nearby countries, while factories in North America and Europe concentrate on local markets.

The trade war between the US and China accelerated shifts in procurement. Trade between the two economies dropped by 16% in 2019. US auto-part imports from China fell by 17%, but rose by 10% from Turkey and 24% from Southeast Asia. And while US imports of consumer durables from China shrank by 19%, they increased sharply from Japan, South Korea, India, Brazil, and Southeast Asia. Samsung moved smartphone manufacturing from China to India and Vietnam, for example, while LG Electronics shifted refrigerator production for the US market to South Korea.

Even larger production changes have been announced since the outbreak of the pandemic. Taiwan Semiconductor Manufacturing, the world’s leading silicon wafer foundry, said it plans to build a $12 billion plant in Arizona in order to serve its many US customers, for example, and Mazda has shifted manufacturing of some auto components from China to Mexico.

At the same time, governments have started to intervene more aggressively in order to promote domestic manufacturing. German economic minister Peter Altmaier has called for localizing production of medicines, while the US government is investing directly in companies developing vaccines and medical supplies. The US announced it will invest $138 million in a partnership with ApiJect Systems, for example, to produce hundreds of millions of inexpensive, prefilled plastic syringes that could be used to inject possible COVID-19 vaccines. Bipartisan support is also growing in the US Congress for billions of dollars in federal subsidies for domestic semiconductor manufacturing. India has launched Atmanirbhar Bharat Abhiyan (Self-Reliant India Mission), an initiative that seeks to make the nation more self-sufficient in key economic sectors.

As a result of these geopolitical, economic, and technological forces—as well as shocks such as pandemics—resilience and access to critical supplies and markets are emerging as rising priorities.

Which Sectors Are Most at Risk

These pressures will not affect all industrial sectors equally. In some segments of the biopharmaceutical and medical device and equipment sectors, for example, changes in supply chains may be needed if governments mandate local production in the wake of COVID-19. In many other sectors, adjustments will require balancing a number of tradeoffs.

To understand which supply chains are likely to experience the most significant change, we created a matrix that plots 16 industrial sectors along two axes. The first is impetus to change, an index of supply chain risk. Factors include a high dependence on imports, the reliability of key supplier countries, and exposure to potential government trade restrictions.

The second axis is ease of adjustment, a measure of how easily companies can adapt their supply chains. Factors include the sector’s capital intensity, the level of regulatory challenges that could constrain adjustments, and the availability of alternative suppliers. (See Exhibit 1.) In some sectors and product categories, for example, China is virtually irreplaceable because it enjoys an overwhelming advantage in terms of the scale and depth of its capabilities—or because capacity is limited in other nations. An upcoming Boston Consulting Group article will explore more deeply the high reliance of key US industries on China for critical components and raw materials.

Where individual companies and products within each industry segment land on the impetus to change/ease of adjustment matrix will vary, of course, depending on the markets they serve or their supply chain configurations.

The semiconductor sector illustrates some of the tradeoffs companies will need to consider. Relocating production is constrained by the immense capital costs of building state-of-the-art silicon-wafer fabrication plants and requirements for highly skilled workers. In both the US and China, however, there is strong impetus for change. Although US companies dominate most segments of the industry, the US imports about 65% of its semiconductors, primarily from foundries in Asia where they are fabricated and from US firms’ own offshore plants. The risks to US industries and national security from supply disruption are high. Therefore, pressure is mounting to increase domestic production. The impetus to change is also high in China: its manufacturers import 86% of the semiconductors they use to make electronic devices—at a time when the US government is exploring tougher technology trade restrictions.

In other industries in which countries depend heavily on imports, supply chains are less likely to see major changes because the impetus to change is low, even if the ease of adjustment is favorable. The US imports most of its luxury goods and apparel from the EU and Asia, for example. But governments do not regard these sectors as strategically important, and overconcentration is not a major risk because supply chains are fairly simple and there are many potential source countries for products.

Defining and Measuring Resilience

The first step to improving resilience is to gain a clear view of supply chain risks at the company, business segment, or product level, depending on which level is like to be actionable for a given organization. Companies should measure their exposure to disruption on an absolute basis and against their competitors. Supply chain resilience should be measured for all three portions of the value chain:

- Source. Key metrics for gauging the resilience of a company’s supply ecosystem include the degree to which goods are imported, the percentage of suppliers that are concentrated in certain countries, the share of supplies that are sourced regionally and are close to end customers, the availability of backup suppliers for critical components, and the inventory levels of key inputs.

- Make. Companies can evaluate their manufacturing resilience by looking at the percentage of capacity concentrated in certain countries, the amount of production that is outsourced, and whether they have backup production capacity at existing locations in case of contingencies or qualified backup facilities in different locations.

- Deliver. Metrics for assessing the resilience of downstream channels that get products to customers include the share of revenues coming from markets that could be affected by sharp tariff hikes, how much of the distribution network is covered by a single partner, the average lead time for moving a product from a factory to a customer, and inventory levels in the end market.

Options for Achieving Resilience

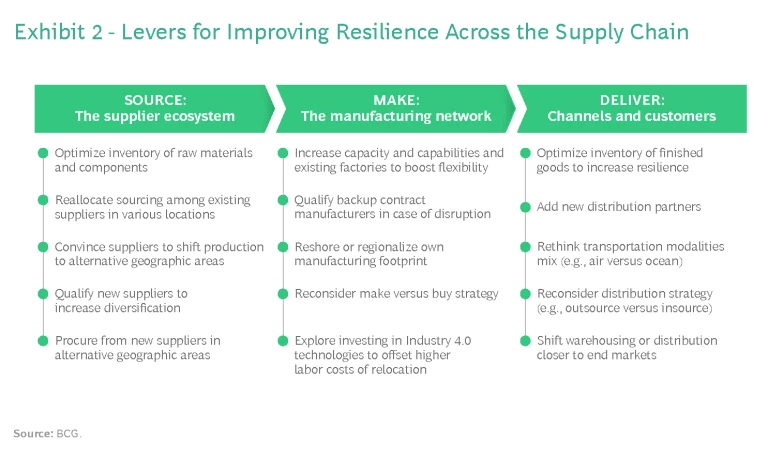

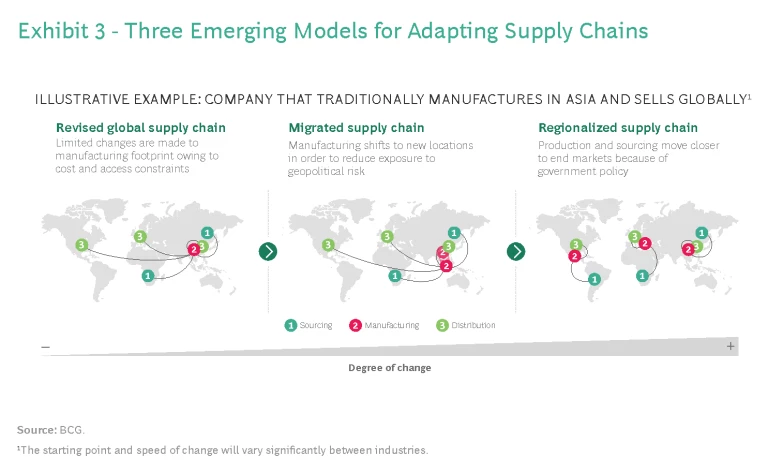

If the supply chain risk is deemed to be high, an array of remedies is available for companies to improve resilience along each of the three value chain dimensions. (See Exhibit 2.) Where a business sector and specific product sit on the impetus to change and ease of adjustment matrix will likely influence the levers that companies deploy to achiever their ultimate supply chain configuration. In particular, a company may conclude that it can best meet its strategic objectives by revising, migrating, or regionalizing its supply chain. (See Exhibit 3.)

To illustrate how companies can deploy different strategies, we provide a few examples. A company that makes low-value motors in a highly automated plant in China may find that it needs to make only small, but strategically important, adjustments. To increase its resilience, the motor manufacturer might add redundant capacity and qualify parts suppliers in more locations while also maintaining production in China in order to keep costs low and serve the Chinese market. It could also take actions to improve real-time visibility into its supply chain and strengthen its risk management.

An apparel or consumer electronics manufacturer, on the other hand, may decide the best approach is to migrate its supply chain by shifting a portion of production to Vietnam, India, or other countries that are not the target of high tariffs or trade uncertainty, although it would still have to weigh this against the cost, capacity, and efficiency advantages of keeping production in China.

A biopharma company that supplies the world from Asia may conclude it needs to regionalize its manufacturing footprint in order to mitigate the risk of supply disruptions. Production capacity in Asia would concentrate on serving regional markets, while plants in North America and Europe would focus on demand in those regions.

There are many ways companies can improve resilience in each dimension of the value chain. In terms of sourcing, for example, they can reduce the risk of geographical overconcentration of their supply base by reallocating procurement within their existing global supplier networks in order to be closer to end markets. They can also convince vendors to shift all or some of their production to alternative locations. Manufacturing networks can be made more resilient by expanding capabilities at existing factories and adopting a contingency strategy that prequalifies other factories within their networks and backup contract manufacturers that can quickly take on work if some facilities experience disruptions. To improve delivery resilience, companies can reoptimize inventories and stock goods closer to end markets.

Adapting Supply Chains

Even for companies with extensive experience in global manufacturing and sourcing, the COVID-19 crisis has created a need to restructure supply chains. We suggest companies take the following steps to assess and adjust their supply chains:

- Align design principles with the new reality. Begin by assessing whether your supply chain is adequate given the new economic and geopolitical realities. Identify exposure to high-level risks and the tradeoffs involved in optimizing the supply chain.

- Segment the portfolio by supply chain risk and understand performance drivers. Define key segments within your business portfolio and assess supply chain risks on the basis of many factors, including product, geographical footprint, technology, and exposure to potential policy change. Gauge the current performance of your supplier and manufacturing networks on dimensions such as cost and service levels.

- Identify levers and options at the segment level. Evaluate all applicable levers for supply chain optimization according to the profile of each segment and where in the supply chain the largest risks lie. Determine the level of effort required for each action and the impact it is likely to have on supply chain capabilities.

- Evaluate supply chain design options for each segment. For each potential lever, analyze the tradeoffs between geopolitical risk and factors such as production costs, logistics, duties, market access, and resilience. Then select an appropriate approach to supply chain optimization. Identify key KPIs for resilience: a company could, for example, decide it wants at least 30% of key products or inputs to come from three or more qualified manufacturing sites in different geographic areas and would like to keep its capacity utilization under 85%.

- Pressure test design choices across the company. Aggregate contemplated changes at the segment level and evaluate the resulting internal and external network at a company level. Then analyze what would happen to the redesigned supply chain under a set of scenarios—such as an escalating US-China trade war, a financial crisis that bankrupts key suppliers, or another pandemic—that could lead to business disruptions.

- Put the network redesign in place and monitor performance. Draw up a plan for implementing the new supply chain design and a system for monitoring the performance of the enterprise-to-enterprise network as the macroeconomic and geopolitical environment evolves.

The global supply and manufacturing networks that have served multinational enterprises well for decades have required substantial investments, hard-earned experience, and relationships that took years to build. But they have also been premised on many assumptions of the way the world works that are fast becoming outdated. To thrive and win in the post-COVID-19 global economy and beyond will require building supply chains that are resilient to disruption and flexible enough to capture new sources of competitive advantage.