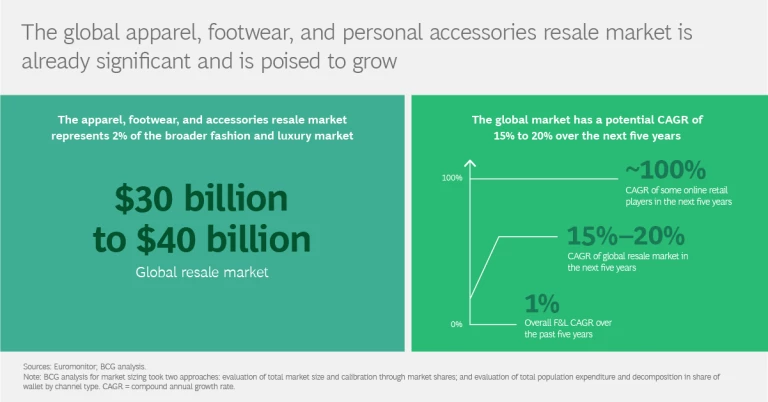

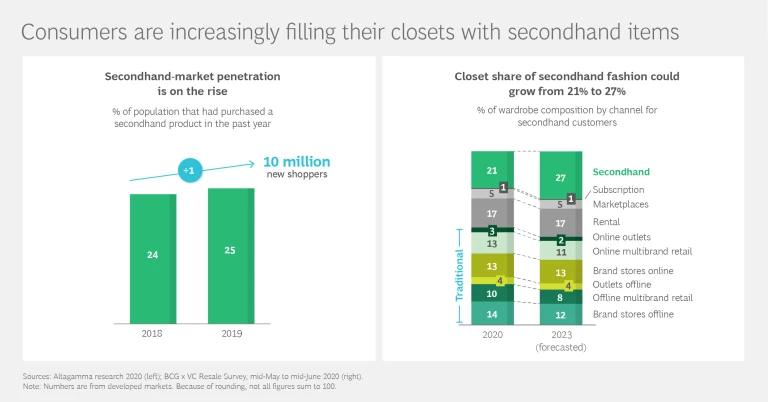

Increasingly, consumers are realizing that it is possible to shop affordably and sustainably for exclusive, high-quality, and on-trend items. A new fashion and luxury market is growing fast: secondhand apparel, footwear, and accessories represent $30 billion to $40 billion in value worldwide. And although the number of fashion purchases and the size of closets have decreased during the pandemic, the share of preowned items in shoppers’ wardrobes will likely continue to rise in the coming years.

A recent BCG survey of 7,000 individuals from six countries—powered by data from Vestiaire Collective’s consumers—has uncovered deeper insights into the trend. It suggests that the global secondhand market will likely grow over the next five years by a compound annual growth rate (CAGR) of 15% to 20%. Developed markets may see even greater gains, and some online resale players could potentially experience 100% year-on-year growth.

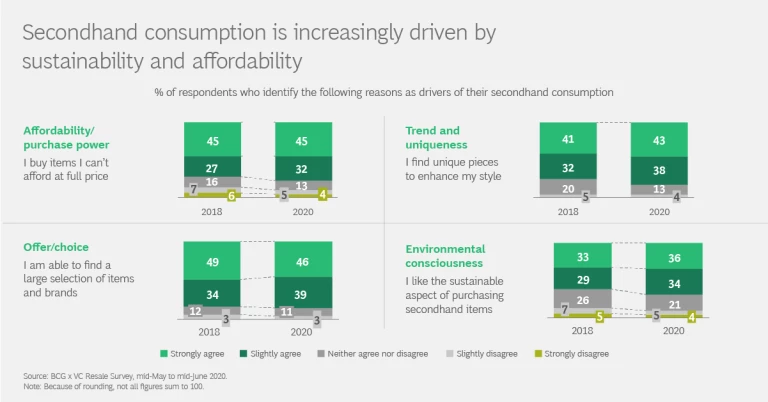

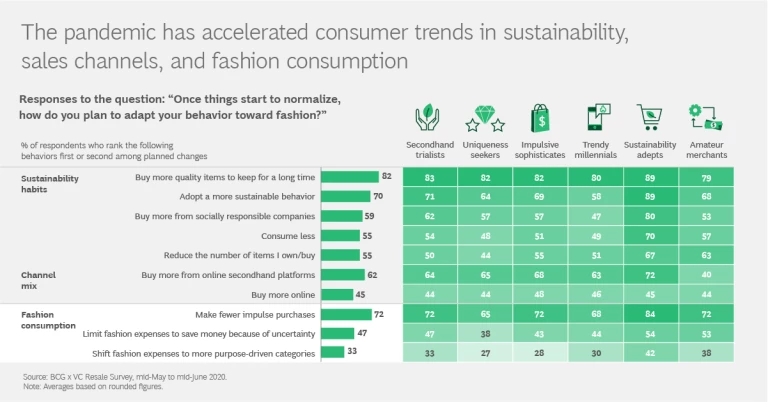

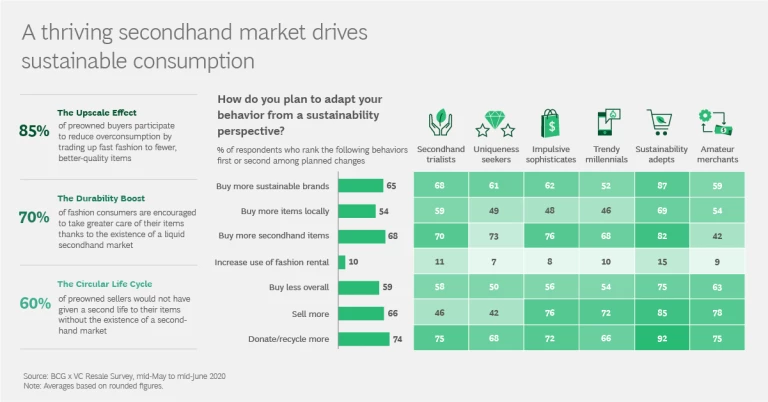

Although affordability, selection availability, and item uniqueness are key drivers of the secondhand market, consumers’ mounting environmental concerns also contribute to its growth. Today, 70% of preowned buyers “like the sustainable aspect” of secondhand consumption, compared with 62% in 2018. Shoppers hope to own fewer, though better items, to reduce overconsumption, and to take better care of what’s in their closets; the presence of a thriving preowned market encourages all three goals.

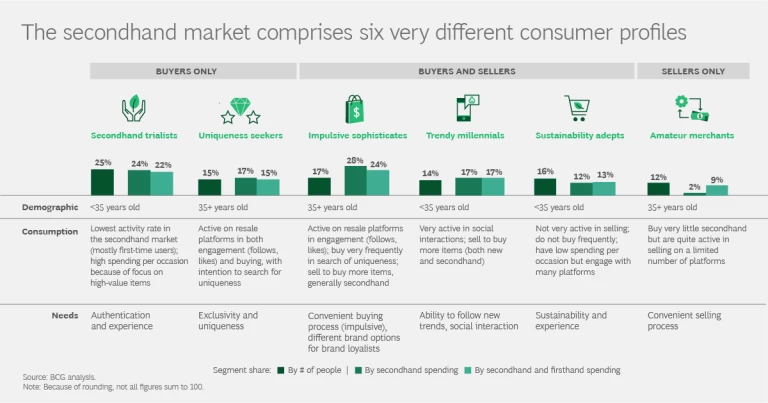

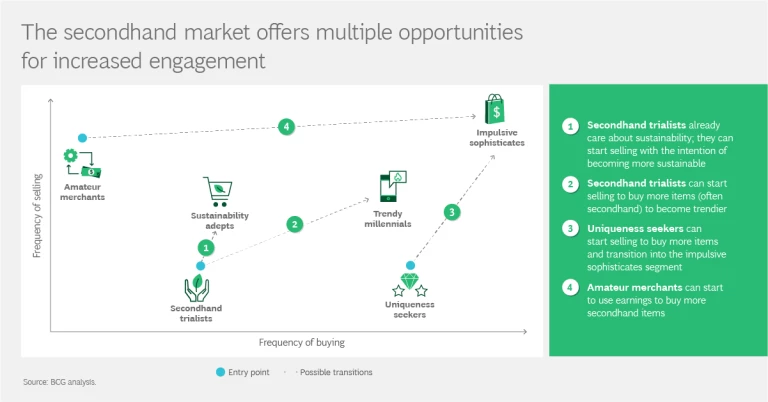

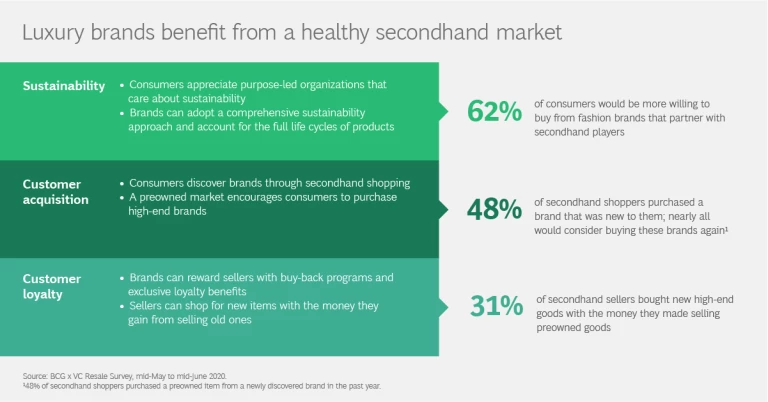

We’ve looked beyond general preferences to identify six consumer segments representing the variation in participants’ engagement with the secondhand market, including their motivations, the frequency with which they buy or sell items, and their preferred marketplaces. To better understand the shoppers of today and tomorrow, brands should take stock of these segments and, just as important, recognize how secondhand consumers may evolve—from occasional shoppers of luxury items, for example, to full-fledged brand loyalists. In the past year, nearly 50% of preowned shoppers tried a new brand. Clearly, preowned consumption is a key driver of customer acquisition.

There are many ways brands can capture value from the growing market. They stand to gain as much as their customers from the new circular economy, but reaping the full benefits requires understanding where the opportunities lie. Brands should explore such options as selling secondhand themselves, developing their own resale platforms, instituting buy-back programs (making it easy for customers to sell their items), and partnering with existing resale platforms to leverage outside expertise. According to the BCG-Vestiaire research, 62% of consumers would buy more from fashion brands that partner with secondhand players.

The bottom line for brands is that the preowned market is here to stay. To fill their wardrobes in a sustainable way with unique, value-friendly items—consumers are shopping secondhand. They will continue to do so in the years ahead. For those brands that capitalize on this trend, the rewards are numerous.

Learn more about the growing secondhand market—and the wide-ranging motivations of its participants—in the slideshow below.