The Rise of Fintech in Indonesia

Indonesia’s fintech landscape is booming, driven by increasing digital penetration and positive investor engagement across this high-growth nation of nearly 300 million citizens. This is a market with huge fintech potential, with large underserved and underbanked populations, low access to finance in MSMEs, and an open and encouraging government dialogue about leveraging fintech capabilities to bridge the financing gap.

In order to understand this landscape, Boston Consulting Group (BCG) has gathered the voices of key stakeholders, including in-depth interviews with 20 industry leaders, backed by comprehensive surveys of customers and small- and medium-sized enterprises (SMEs) to build a clear picture of the current ecosystem, and its expected evolution.

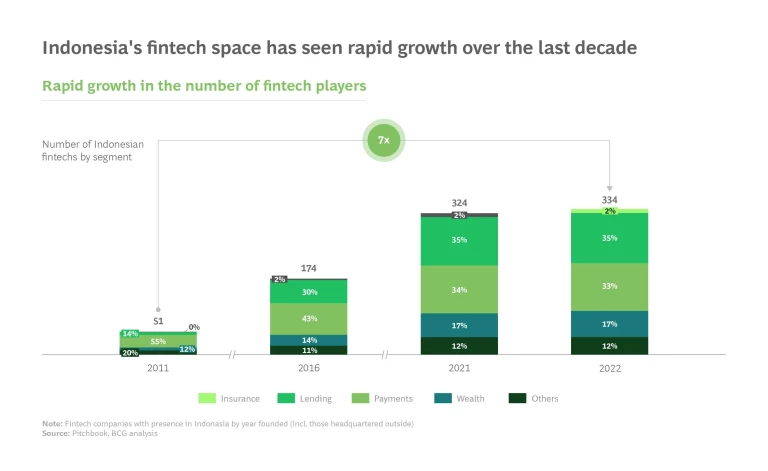

The number of fintech players in Indonesia increased six-fold over the last decade, rising from just 51 active players in 2011 to 334 in 2022. While the first wave of growth was dominated by the payment segment, the vibrant modern ecosystem is a diverse landscape driven by lending, payments, and wealth. Wealthtechs, fintech-focused software as a service, and insurance activities now represent a new, emerging driving force, with a number of fresh entrants operating in these segments, showing Indonesia’s fintech ecosystem is maturing beyond payments to include increasingly sophisticated products and services.

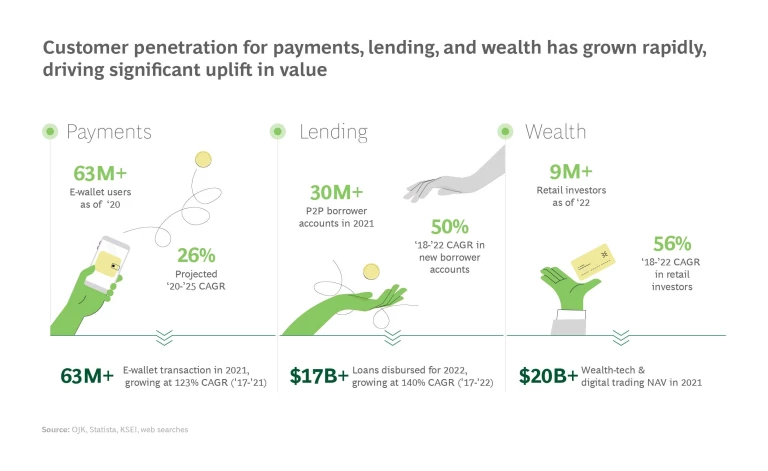

Customer engagement with fintech offerings continues to surge In particular, the payment segment boasts over 60 million active users and is expected to grow at a rate of 26% annually between 2020 and 2025. Meanwhile, in the lending space, there are more than 30 million active peer-to-peer (P2P) borrower accounts. Additionally, the wealth segment is thriving with over 9 million retail investors. Fintech SaaS is also experiencing a surge in adoption, with six million SMEs now using SaaS platforms. This marks a remarkable 26-fold expansion over the previous three years.

Transaction values also continue to grow, with more than US$20 billion of e-wallet transactions in the period 2017–2021, a remarkable 123% CAGR. Over US$17 billion in loans were disbursed between 2017–2022, while a net asset value of over US$20 billion in wealthtech and digital trading took place in 2021.

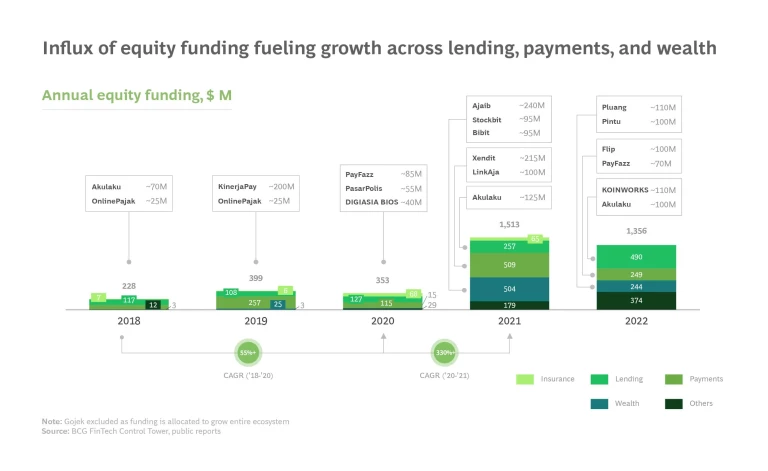

Investor sentiment remains encouragingly bullish for Indonesia’s fintech journey. Equity funding into fintech soared to US$1.5 billion in 2021. While a significant portion of funding went towards payments and lending players, 2021 also represented a breakout year for wealthtech players, who received over US$500 million in funding. While the year 2022 saw a slight decline in the overall funding value—with global macro-economic concerns affecting investor sentiment—Indonesia still attracted funding of almost US$1.4 billion, demonstrating the resilience of the ecosystem.

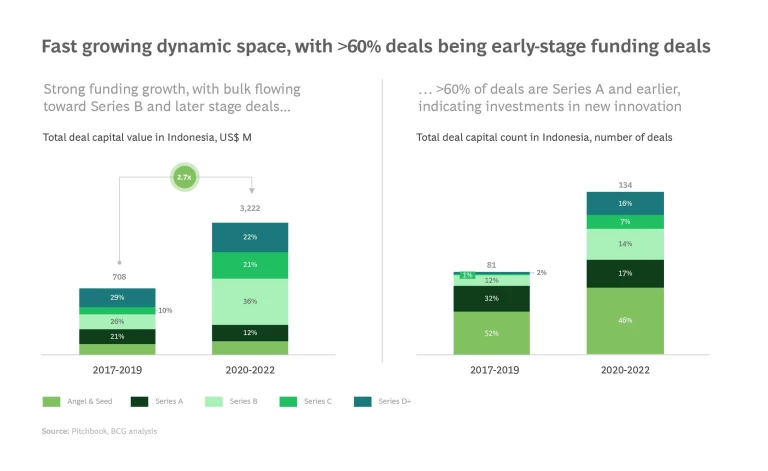

Investment into fintech in Indonesia in the period from 2020–2022 reached US$3.2 billion, 4.6X the funding seen in the period from 2017–2019, demonstrating strong investor commitment. While a large share of the funding has flowed to more mature companies, 60% of the deal volume has flowed to early-stage companies indicating a strong desire to invest in emerging innovation.

Investment trends also echo the diversification of Indonesia’s fintech market, with lending and payments no longer being the primary areas of interest. While lending and payments remain important, there is increasing investment into wealthtech, insurtech, and fintech SaaS. Fintech in Indonesia is a rapidly expanding space, with emerging players existing alongside more established products and operators.

A VIBRANT AND FLOURISHING ECOSYSTEM

There are a number of strategic reasons for this integrated fintech approach. In the first instance, digital ecosystem players can improve customer retention and reduce friction at the point of sale through embedded financial products. Secondly, it expands the share of wallet spend by existing users, and helps digital ecosystem players diversify beyond core business products and services towards higher margins and improved product monetization. Indonesia’s buoyant digital ecosystem offers some key examples to represent this:

- Exemplar 1:

- Exemplar 2: e-Hailing. Indonesia’s dynamic e-hailing platforms offer numerous financial products, including B2B lending (working capital loans for drivers), B2C lending (buy-now-pay-later), and insurance (travel insurance).

Digital banks have seen phenomenal growth over recent years, as accelerating adoption rates drive increasing market value. SeaBank Indonesia—owned by Singapore-based tech conglomerate Sea Limited—enjoyed 207% year-on-year growth in total assets in 2022, reaching US$1.4 billion in 2022. Home-grown success story Jago offers another compelling story of growth, with customer numbers rising 71% year-on-year to reach 2.3 million as of the second quarter of 2022. Jago also delivered 3.5X year-on-year growth in loan disbursements, reaching US$485 million in 2022, thanks to strategic delivery through partnerships and wider digital ecosystems.

There is now a clear trend of traditional banks leveraging fintech partnerships and deploying capital to promising fintech and technology enterprises. This is driven by careful strategic consideration, as legacy financial institutions seek to strengthen and scale existing business lines. Clear examples of this can be seen in the case of multiple BUKI IV banks—those with core capital greater than IDR30 trillion—partnering with e-commerce platforms and P2P lenders to acquire customers for loan products.

Establishing new business lines is also a strategic imperative for legacy banks. For example, through partnering with emerging players such as Ayoconnect, banks can establish open banking and BaaS business lines. In addition, fintech partnerships also allow existing players to build and enhance internal capabilities. For example, banks can leverage credit scoring and digital know-your-customer (KYC) players to improve risk management capabilities and customer journeys.

The Voice of Fintech

We engaged in discussions with over 20 fintech executives occupying C-suite positions or higher, in order to gain insight into the current sentiment surrounding industry priorities, as well as potential developments in the future. Through our research, we have uncovered compelling narratives that offer valuable insights into emerging business priorities, perspectives on partnerships, and the regulatory landscape in Indonesia.

With tightened market liquidity, there is increasing focus on profitability and sustainable unit economics. In this context, startups are rethinking how they do business, moving from growth at all costs to value-based growth. This will have important implications for future expansion. Business strategies will need to adapt to optimize distribution models and ensure more cost-effective customer acquisition.

There is also increasing competition in the market, not only from other fintechs, but also established tech firms expanding into the fintech realm, as well as traditional banks looking to provide fintech solutions. Larger tech firms such as Grab, Shopee, and GoTo have the benefit of an established ecosystem, captive user bases and stronger financial means to rapidly scale their presence in the fintech space. Traditional banks have deep coffers and the benefit of lower cost of capital (and higher margins), and offline presence. In the face of increasing competition, fintechs will need to double down on strengthening their unique value proposition. Partnerships in the broader ecosystem are especially valuable to strengthen distribution and allow for stronger defensibility.

The other important priority going forward will be to plan for talent. In Indonesia, hiring and retaining specialized tech talent has historically been a challenge. As the fintech landscape matures, hiring specialized talent especially in areas such as risk, artificial intelligence and machine learning will be especially important. Similarly, internal governance and senior management roles continue to be difficult to fill. Fintechs must carefully plan their hiring roadmap and integrate sage talent management practices to win in this landscape.

Across this evolving paradigm, fintech regulation has a very important role to play. Regulation in Indonesia continues to be progressive, nurturing growth through the introduction of initiatives such as the national SNAP standards, as well as fresh regulation to offer guardrails to evolving digital asset adoption. As the industry matures, a progressive setup is expected to support continuing fintech innovation.

Deep Dive 1:

—CEO at a late-stage wealthtech.

“Early-stage fintechs are also experiencing this shifting dynamic. Our runway to find product market fit is much shorter and the burden of proof is much higher to secure growth funding.”

—CEO at an early-stage wealthtech.

“Multi-product lines expansion has become the norm in the industry, as fintechs are diversifying towards higher-margin products for monetization.”

—CEO at a lendtech.

With liquidity in the market having tightened, investors have started focusing much more on profitability versus growth at all costs. Investors are increasingly looking for profitability at a company level rather than only at a unit economics level, which is leading to a higher focus on lifetime value per customer, customer acquisition cost and retention rates. As a result, startups are rethinking how they do business as a company. This has important implications for the path forward for Indonesian fintechs, with a strategic need to optimize distribution models and double-down on cost-effective, high-impact routes to access customers.

For early-stage startups, a higher focus on profitability implies that the runway to realizing product-market might need to be shorter. They will need to be a lot more thoughtful, practical, and oriented towards monetization from the get-go. Later-stage fintechs will need to re-evaluate both their product and go-to-market strategies. Product diversification as well as lower-cost acquisition and retention will be critical to realize better unit economics.

Overall, startups will need to establish cost-effective customer acquisition approaches, and focus on high-value customers. Leveraging the broader ecosystem, especially through partnerships, will become especially important in allowing for lower-cost expansion, while facilitating the shift to higher-margin products and diversification of product lines. They’ll need to optimize their distribution models beyond digital-only channels and establish cost effective routes to customers to compete with larger players such as banks and financial institutions.

Deep Dive 2:

—CEO of a wealthtech organization.

“Some sectors continue to operate in 'grey-zones' and would benefit from strategically designed frameworks, for example areas which have to deal with multiple regulators like open banking and wealthtech.”

—CEO at a wealthtech.

“We see a need to shift from ad-hoc participation models to more structured mechanisms (e.g., direct access, forums) to further unlock participatory evolution.”

—CEO at a Lend Tech.

“There’s an opportunity to focus on enablement-based regulations around data sharing, customer data ownership and fast-track approval for new products would enable next-gen product building and advance the overall ecosystem.”

—CEO at lendtech.

Regulators are increasingly receptive to the emerging ecosystem, with forward-looking regulation that positions Indonesia as one of the most progressive landscapes in the region. Current regulatory structures have fostered growth and innovation across fintech subsectors.

The Indonesian Payment System Blueprint 2025 roadmap and the SNAP national standard have opened up opportunities for innovation in the open banking landscape. This has spurred the rise of several startups in the fintech space, including Brick, Ayoconnect, Finantier, and Brankas, which have collectively secured over US$70 million in funding. These developments have facilitated API cooperation and improved interoperability, which is crucial for fostering collaboration between fintechs and legacy financial institutions.

One of the key benefits of the SNAP standard is that it has made it easier for fintechs and legacy financial institutions to work together by standardizing API cooperation in the payment system. This has helped level the playing field for innovation, enabling startups to compete more effectively with established players in the market. Additionally, the fast payment system BI-FAST has also played a significant role in creating a conducive environment for innovation. Its real-time transactions and cross-border interoperability have enabled fintechs to offer innovative solutions to their customers.

The Indonesian government's cryptocurrency regulations have also contributed to a more welcoming landscape for fintech startups. With authorization for crypto asset trading and standards for crypto exchange, the regulations have paved the way for startups such as Pintu, Tokocrypto, Reku, and others to secure over US$300 million in funding. Fintech founders have recognized the opportunities for further regulation to create a more conducive environment for innovation in the sector. Overall, supportive government policies and regulation has been a key catalyst in the growth of the fintech industry in Indonesia.

Deep Dive 3:

—CEO of a lendtech organization.

There are encouraging signs with regard to partnerships between fintechs and incumbent players. For instance, banks are now more open to partnering with fintech companies in established areas like lending, as well as emerging sectors such as cryptocurrency. Challenger banks, in particular, are actively seeking partnerships with early-stage fintech startups to gain a competitive advantage.

For successful partnerships, startups must adapt their operating models to accommodate for cultural differences and working styles of established players, which may differ from those of startups. Moreover, startups may have to adjust their operating model to leverage the benefits of such partnerships. Simultaneously, incumbent players must make an effort to comprehend the imperatives and difficulties faced by startups when they seek to enter such partnerships. This approach will lead to longer-lasting and more fruitful collaborations.

Overall, there exist numerous opportunities to enhance the fintech ecosystem and establish thriving partnerships across the industry. Fintechs and established players alike are displaying an increasing eagerness to engage and collaborate with one another. Looking ahead, we anticipate a growing number of such partnerships with substantial value creation for both fintechs and incumbents.

The Voice of Retail

Gaining a comprehensive understanding of Indonesia's fintech retail customer landscape is crucial for assessing the broader ecosystem. To this end, BCG conducted an in-depth consumer survey of over 1,000 representative respondents from Indonesia.

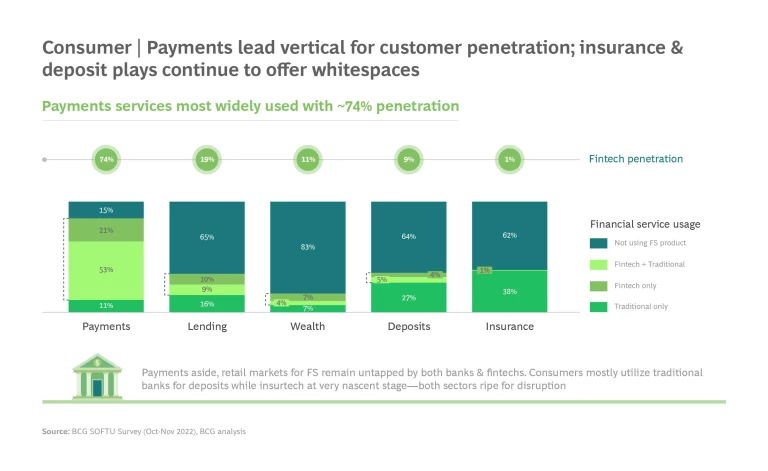

Overall, we see digital payments as the leading vector for customer penetration in Indonesia, with almost three-quarters of respondents utilizing a fintech product. However, the broader retail market for financial services remains largely untapped for both fintechs and traditional financial institutions, with over 60% of respondents not using any lending, wealth, deposits, or insurance products. Despite significant growth in the usage of fintech products, especially in the post-COVID landscape, there is still a significant opportunity to increase overall consumer awareness and adoption.

Customers utilize traditional banks as their primary provider for deposits and insurance products, with 9% and 1% adoption of products in fintechs for these respective segments, compared to 27% and 38% for traditional banks. This presents a generational opportunity for fintechs to capture share away from banks—particularly given evidence that young consumers are more receptive to adopting fintech solutions—with both sectors offering significant disruption potential.

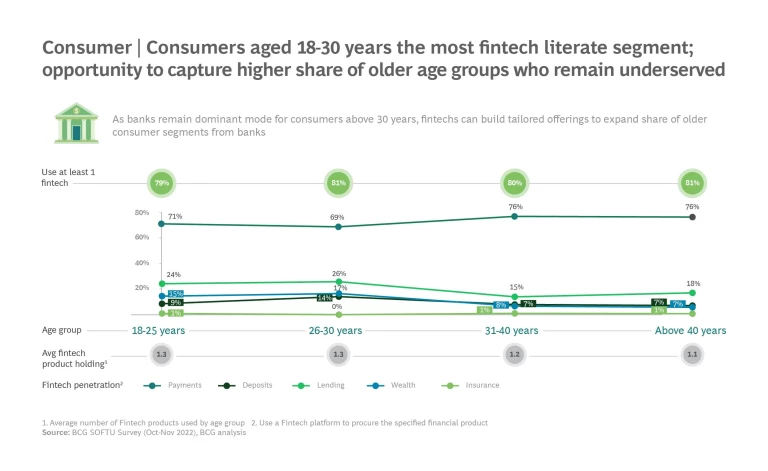

Consumers aged 18–30 years comprise the most fintech-literate segment today. This does present an opportunity for fintechs to capture higher shares of older age groups, particularly in verticals beyond payments.

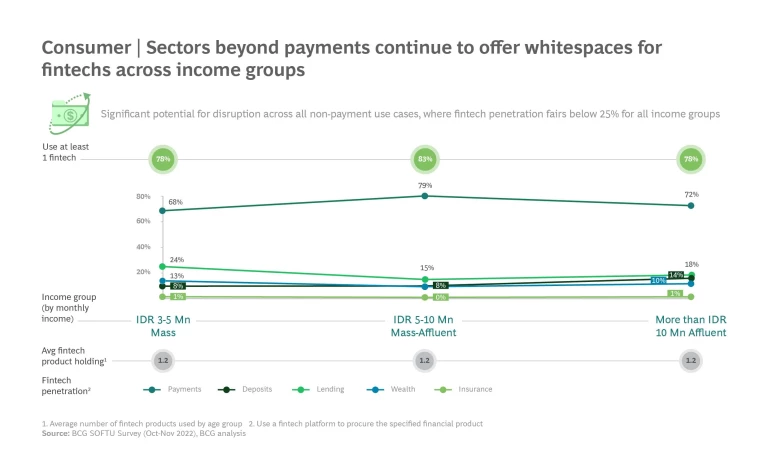

This demographic reality suggests older consumers remain relatively underserved by fintechs, whose target segment—and by extension value proposition—is mainly angled towards the millennial and Generation Z groups. Fintechs should consider building tailored offerings to capture a share of older consumer segments from traditional financial institutions. Analysis of the income group distribution of fintech penetration also demonstrates a clear white space for fintechs to capture outside the payment segment, with penetration across these verticals standing at less than 25% for all income groups.

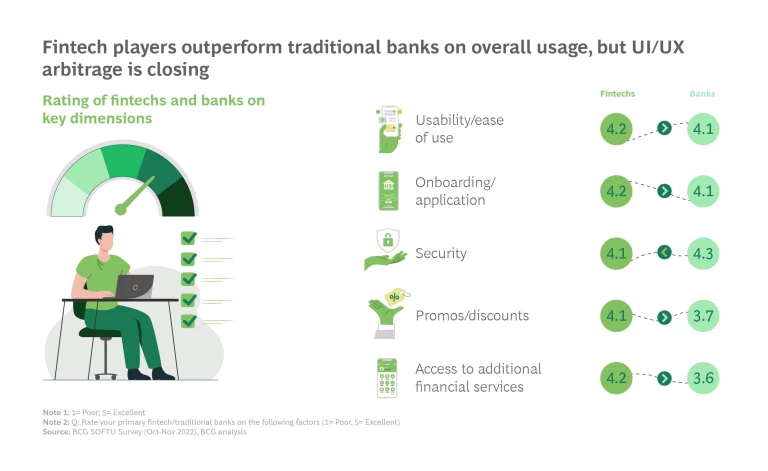

Given the relative penetration of fintech and banking products across demographics, it’s important to consider how key product and customer experiences differ across key dimensions of ease of use, onboarding, security, promotions, and access to additional financial services.

Fintech players have a slight edge over traditional banks in terms of overall usage. They also surpass banks in providing financial incentives, such as promotions and discounts, as well as access to additional financial products through cross-selling and value-added services. While an edge in cross-selling is a source of competitive advantage that fintechs should aim to maintain, overreliance on incentives could undermine the long-term view of the industry, and non-incentivized usage may be much lower for fintechs.

Our research also indicates that the user interface and user experience gap between fintechs and banks is narrowing. Banks are catching up in customer experience metrics where fintechs had previously outperformed them, such as seamless onboarding journeys. To preserve their lead over banks, fintechs need to adopt a more innovative approach to user-friendly delivery while reducing their reliance on incentives and product promotions.

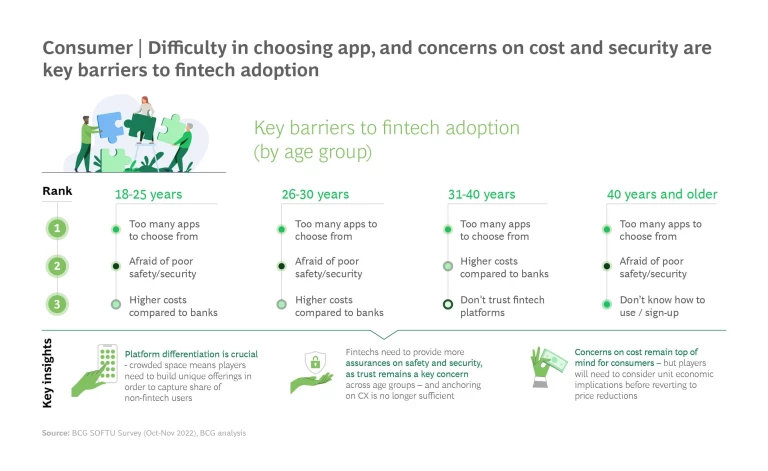

Encouraging new user adoption is a critical factor in fintech growth. Our research identifies three key barriers that must be addressed among retail customers:

- Too many apps to choose from. Customers face initial challenges in selecting the appropriate platform to begin, with a wide array of choices and lack of meaningful differentiation.

- Concerns over safety and security. Customers lack trust in non-traditional institutions, particularly when it comes to holding funds.

- Higher costs compared to banks. Customers associate fintechs with higher costs, and would prefer to stick to perceived cheaper alternatives provided by traditional players.

In addition, to drive greater adoption, fintech companies must take into consideration the desires of their customers. According to our survey, consumers have three key aspirations :

- Assurance on security. 40% of consumers would like to see concrete assurances on the safety of their funds.

- One-stop-shop. 21% of customers want their financial needs addressed in a single app.

- Attractive financial incentives. 26% of consumers want to see lower costs for services through fintechs.

These findings illuminate some important imperatives for the future growth of Indonesia’s fintech industry. Firstly, investing in platform safety and security should be a top priority to instill confidence in consumers and alleviate any apprehensions they may have regarding the trustworthiness of financial service providers. Secondly, fintech companies must adopt a multi-product strategy and work towards offering a comprehensive range of financial services to cater to diverse customer needs. Lastly, consumers continue to expect attractive financial incentives from fintechs, and therefore there continues to be a play wherein finechs can grow their user bases through aggressive pricing.

However, eventually fintechs will have to strike a balance between being attractive through incentives and maintaining sustainable unit economics. While low prices may make fintechs attractive to consumers, it is unlikely that such pricing strategies can be sustained in the long term.

Deep Dive 1:

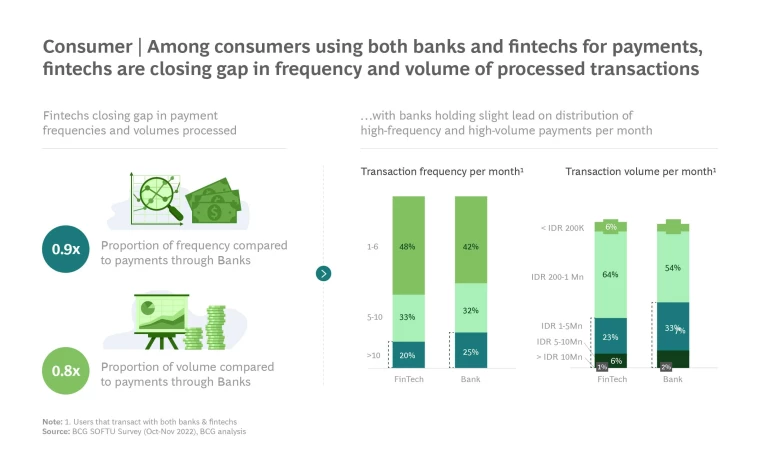

Fintechs are now closing the gap in the volume and frequency of payments processed among consumers using both banks and fintechs for payments. The number of monthly payments processed by fintechs has now reached 90% that of banks, while the volume of payments processed has reached 80% that of banks, for those customers who use both provider types. The rapidly accelerating adoption and acceptance of e-wallet and Quick Response Code Indonesian Standards (QRIS) payment methods by merchants in Indonesia has contributed to this narrowing gap.

Banks still retain a slight lead on distribution of high-frequency and high-volume payments, however. The proportion of customers who undertake transactions over 10 times per month through bank accounts make up one quarter of bank account transactions, but just 20% of fintechs. The proportion of customers transacting over IDR1 million per month stood at 42% of bank accounts, and 30% for fintechs.

E-wallet players continue to capture the highest usage for fintech payments, owing to widespread acceptance of these payment formats among merchants, backed by fine-tuned customer acquisition and retention models. Enabling smooth bank account transfers has emerged as the next competitive frontier in recent years. Players such as Oy! and Flip have embraced this as a core value proposition, and e-wallet players are also entering this space as customers continue to experience friction in using bank-branded apps for account transfers.

Deep Dive 2:

Of the 21% of respondents using BNPL, more than half use fintech only, with roughly a quarter using both fintech platforms and traditional channels. In contrast, just 5% of total respondents utilized fintech solutions for other loan products. However, while existing penetration for fintechs beyond BNPL is low, we see a significant opportunity for expansion for fintech players in other segments through disrupting traditional lenders which typically offer lower ease-of-use and limited flexibility.

Deep Dive 3:

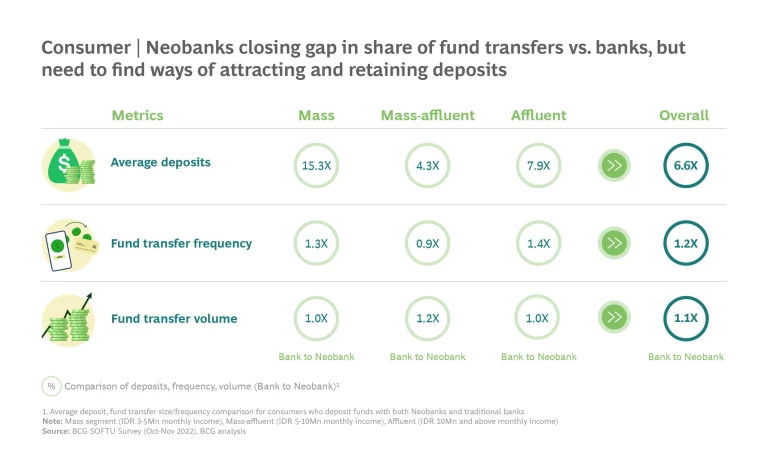

While neobanks are catching up with banks in terms of fund transfer frequency and volume, the average deposit in banks is still 6.6 times that in neobanks. In order to compete with traditional players, neobanks need to explore new ways to attract and retain deposits. Fintechs and digital banks need to create an enticing proposition beyond offering a superior customer experience and attractive rates in order to capture a higher share of deposits.

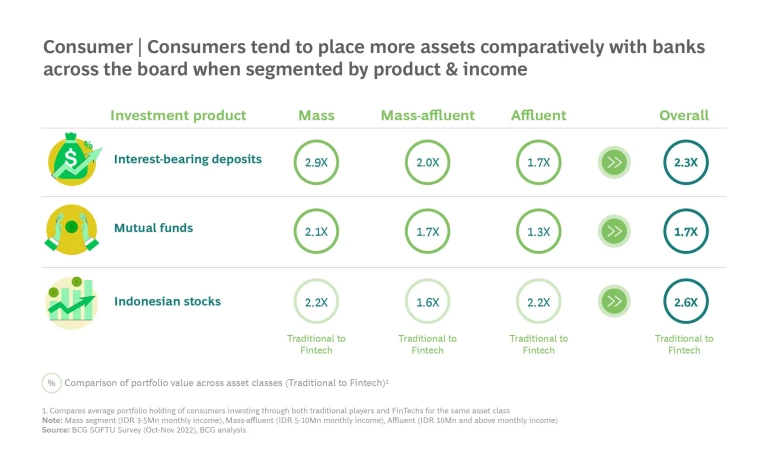

Although banks are preferred when it comes to traditional services, fintechs excel in areas such as cryptocurrency and foreign stock investment where banks are more restricted by regulation. For example, banks are the preferred option for customers investing in conservative asset classes such as gold in wealth management. However, fintechs are currently the only channel for global stocks and cryptocurrencies due to regulatory limitations, and thus are the only channel for investment in these asset classes. While traditional banks are well-positioned to challenge fintechs' share in these neo-asset classes if regulations evolve, fintechs' early advantage can lead to an enduring disproportionate share in these asset classes.

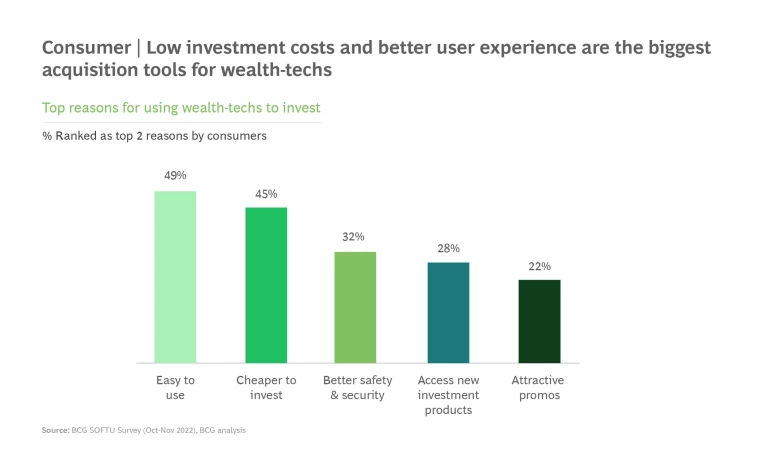

Consumers today attribute their usage of wealthtech platforms primarily to ease-of-use and lower investment costs. Nearly half of all consumers (49%) attribute their usage of wealthtech to its user-friendly experiences and simple-to-use features, which are often lacking in traditional core banking journeys. Lower investment costs also drive consumers to use wealthtech, as brokerage fees with banks can be prohibitively expensive. Investment apps with zero or minimum brokerage fees have become increasingly popular due to consumers' aversion to high fees associated with banks' investment services.

Interestingly, 32% of consumers rate better safety and security as a key factor in their decision to use wealthtech platforms. This is noteworthy as banks are traditionally viewed as more secure institutions than fintech products. Despite this, the wealthtech segment has managed to build consumer confidence in their safety and security, which has contributed to their success.

As wealthtechs continue to grow, their focus must shift from primarily chasing user acquisitions to strategically prioritizing and increasing assets under management (AUM). To achieve this, platforms must focus on developing features that encourage regular investments and change users' inherent investment behavior. These features may include automated trading functions, analyst recommendations, and the ability to follow and copy the trades of successful users to guide decision making. By prioritizing such features, wealthtech platforms can drive user engagement, increase AUM, and ultimately achieve sustainable growth.

The Voice of SMEs

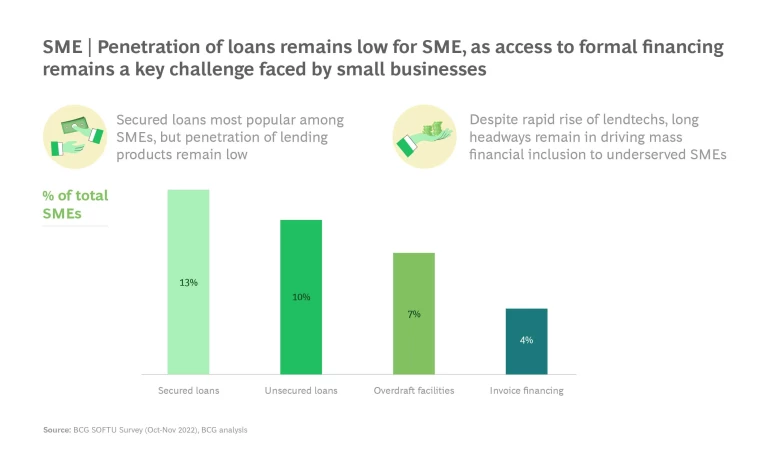

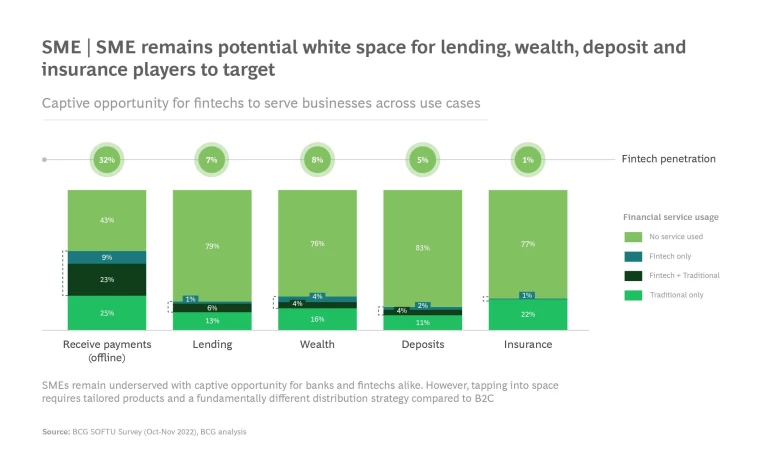

Fintech adoption among SME consumers is still in its early stages, especially beyond payments, creating significant opportunities for lending, wealth, and deposit players to target untapped markets.

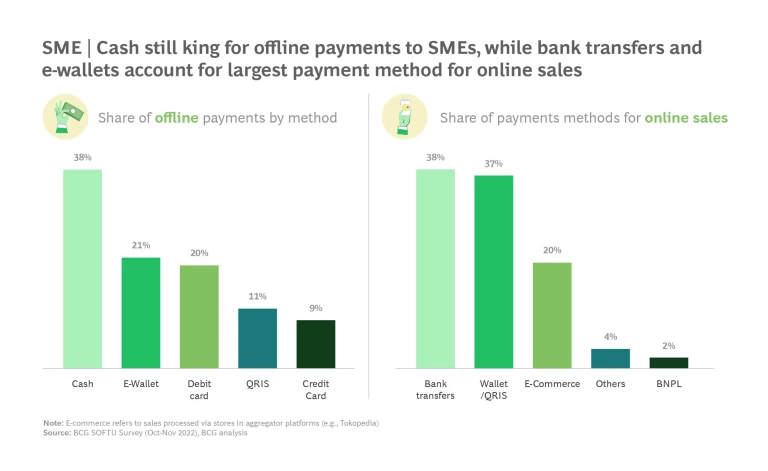

Compared to the consumer market, fintech players have yet to fully penetrate the SME market, adoption rates in categories other than payments being below 10%. Even in payments, fintech penetration is only about a third of the overall base.

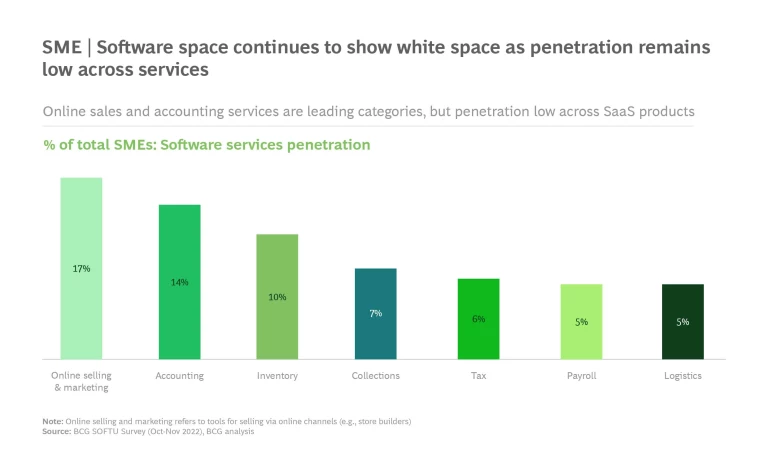

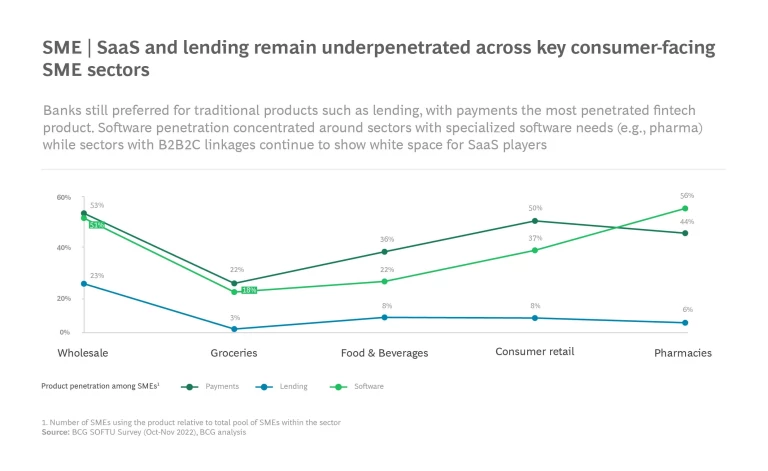

Lending and fintech SaaS products have yet to significantly penetrate across key consumer-facing SME sectors. The lending sector offers the most consistent picture of low adoption, with a high of 23% in wholesale sectors, to lows of 3% in groceries. There are some more encouraging signs in the software space, although adoption is concentrated around sectors with specialized software needs such as pharmacies, while sectors with B2B2C linkages such as wholesale, and groceries, continue to demonstrate large gaps with value to capture for SaaS players.

In order to successfully expand in the SME space, fintech players need to rethink their value propositions and deploy tailored products and fundamentally different distribution strategies than those used in B2C verticals. The path to wider adoption is likely to be through wider adoption of digital payments and away from cash. Interventions should focus on digitizing consumers and SMEs in parallel, as both sides of this dynamic will need to be enabled to support and guide a transition from cash to digital payments. In lending, providers must innovate to overcome inherent risks with regard to lending to SMEs, particularly in less economically mature regions. In the fintech SaaS space, providers will need to educate SMEs on the potential benefits of fintech solution and actively encourage early engagement with products, particularly in online sales and marketing, and accounting solutions.

Deep Dive 1:

In the online payments space, bank transfers and wallet/QRIS are the most frequently used methods for online sales at SMEs, while e-commerce platforms are gaining increasing popularity. Although BNPL has been rapidly adopted in recent years, only 2% of consumers use this service for online channel sales.

The top barriers limiting fintech adoption revolve around cost of service and security concerns. These remain top-of-mind for SMEs, with challenges around balancing price considerations with sustainability.

Almost half (49%) of SMEs attribute higher costs of services compared to those offered by banks as the primary reason for not adopting fintech payment solutions, and 17% cite concerns around safety and security. This highlights important implications for fintechs, indicating that encouraging a shift to fintech adoption will require players to address cost and security concerns as a priority.

Focusing purely on costs can create added pressures, as fintechs need to ensure they maintain a sustainable cost model. Players need to actively show SMEs that potentially higher costs—setup costs, transaction fees on inbound payments, or similar—come with wider ecosystem benefits, such as a boost to sales or market potential.

Deep Dive 2:

To achieve this, fintechs must focus on adopting innovative approaches and use of alternative credit scoring techniques for lending to SMEs, particularly in tier 2 or 3 cities, where fragmented data currently hinders access to credit. Access to adjacent, complementary datapoints—either through industry data sharing or from government bodies such as BPIS—will be critical in driving financial inclusion. Lendtech platforms and regulators will need to collaborate to jointly drive this necessary data proliferation.

Deep Dive 3:

Our survey reveals that 30% of SMEs are willing to spend on SaaS services. Of these, micro- and small-sized enterprises make up 84%. Of the SMEs willing to spend on software solutions, more than six in ten of those businesses are willing to spend less than IDR 5 annually. These findings reveal that the appetite to spend on fintech SaaS services remains modest at best.

To unlock demand, it will be crucial to educate SMEs on the benefits and efficiencies offered by these software solutions, particularly among smaller sized businesses. This will require fintechs to enhance their outreach efforts by deploying larger salesforces and adopting tactical approaches, such as providing free trials, interactive demos, training, and support to entice hesitant SMEs.

Strategic Imperatives for the Fintech Ecosystem

Indonesia’s vibrant fintech ecosystem is a sleeping giant with barely tapped potential. Realizing that opportunity could unlock significant value for ecosystem players, economies, and the customer base, boost financial resilience and enhance financial inclusion.

Informing and steering a future path to sustainable growth will require deep ecosystem understanding, and careful consideration of the strategic route forward to maximize value and maintain competitiveness in this rapidly evolving space. That could, and should, be guided by key learnings from successful implementations around the globe.

Through our comprehensive research of financial ecosystems and interventions in markets around the world, we have identified critical imperatives for fintech players, incumbent operators, and regulators.

Strategic imperatives for fintech players

- AI/ML models to drive cross-selling, hyper-personalization, and optimization of incentives

- Automation of manual tasks to improve cost structures

- Enhanced fraud models to prevent leakage

- Integration with multiple additional data sources to drive better risk management

- Deep understanding of market landscape, customer segmentation, revenue, and profit pools

- Tailored products embedded deep into existing user flows (B2C) and business processes (B2B)

- Sophisticated 'what-if' modelling to game out impact of business cycles on unit economics

- Strategic design of the operating model to align cost structures with planned scale

- Build innovative partnerships that drive organic traffic

- Explore offline networks and distribution models

- Leverage social or viral campaigns, particularly in the B2C and at-scale B2B spaces

- Create smart and hyper-personalized gamification to drive engagement

Potentially enter into opportunistic M&A for talent and skillset. Specialized talent in areas such as AI, data analytics, and risk management is increasingly important to scaling and maintaining superior products. Players should consider appropriate partnerships or corporate acquisitions to keep pace with the speed of change, minimize shortage of critical positions, and ensure a strategically aligned skills and talent base. This will require a clear and robust assessment of the current talent pool, and identification of gaps where additional talent is required. A tailored approach in pursuing M&A should be leveraged to ensure prudent target-firm assessment and a seamless post-integration journey, considering areas such as cultural fit, operational synergies, and similar.

Strategic imperatives for incumbents

- Early engagement of senior leadership

- Building partnership strategy as part of an overall organizational roadmap

- Deeper understanding of the fintech unit economics and the key enablers needed

- Defining the right operating and organizational structures, for example establishing the right teams to coordinate with partners

- Adapting critical business processes, such as adapting risk management processes with new credit scoring tools

- Aligning technology enablers and embedding them into existing tools

Capturing the banking opportunity. With significant revenue and profit pools to be captured from BaaS, and growing appetite from fintechs to leverage ready-made banking solutions to expand services, incumbents need to ensure their APIs are ready to integrate with potential partners to seamlessly leverage shared data. This will require significant effort to develop the right technology architecture necessary to connect and compete in an open finance ecosystem—allocating dedicated resources to support testing, compliance review, and standards for data sharing.

Regulatory frameworks for clarity. It is critical that incumbent operators design for an agile and digital-ready workforce by institutionalizing digital governance, revamping support functions, and designing for next-generation technology and delivery. Senior leaders need to establish new ways of working, as companies embrace agile and adopt a ‘test and learn’ culture to ensure workforces can adjust speedily to changing priorities, while adopting new tools to deliver superior services.

Regulatory enablers

Forums for collaboration. The last few years have highlighted the need, and the benefits, of regulators and fintech players working and interacting closely to create enabling structures for new business models. Efforts should be engaged to formalize these structures, build structured forums that provide equal and open access to all players, and also empower inter-regulator collaboration to help drive effective and sustainable ecosystem growth.

Open and interoperable networks. Global exemplars such as UPI, as well as local innovations like QRIS, have shown the power of open networks to transform customer experiences. With upcoming innovations like SNAP and IPI, it is essential to establish governance that enables and ensures participation across industry stakeholders while driving consumer adoption to generate critical mass.

Sandboxes to enable innovation. The success of regulatory sandbox programs across developing markets has become a proven model for enabling controlled experimentation and nurturing innovation. Expanding sandbox access to early startups across all categories will be critical to accelerate pace of innovation. In addition, implementing a two-door policy where sub-optimal results can be easily rolled back will allow regulators to control risk while widening room for additional experiments in the sandbox pipeline.

These strategic recommendations provide a roadmap for achieving success in the financial services market, as industry players, government bodies, and regulators work towards strengthening the financial ecosystem in Indonesia, Southeast Asia's largest economy.

Ongoing innovation and dynamic customer habits will continue to transform the fintech ecosystem, meaning that an ability to adapt—for both operators individually and the ecosystem as a whole—will be critical to sustainable success. As Indonesia’s sleeping fintech giant continues to stir, the value that can be captured within this ecosystem is bound to increase. The key question is which of the incumbent operators and emerging fintechs will position themselves at the forefront of this financial evolution and emerge as leaders.

HOW BCG CAN HELP

BCG combines cutting-edge technical and functional expertise in areas such as risk management, data science, analytics, and AI, backed by deep industry expertise and a multi-disciplinary team to deliver solutions through world-leading management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive. Our experience includes a diverse range of high-impact projects across Southeast Asia:

- Conceptualized and built industry-leading payments app in Southeast Asia that now boasts >US$2 billion valuation

- Designed growth strategy for major regional fintech player to unlock super-app ecosystem with profitable growth

- Built automated ML-led pricing models for a leading APAC e-commerce platform with >5% revenue growth

- End-to-end conceptualization and build of a personalization engine to drive cross-selling for regional fintech player

- Designed and built advanced risk management platform to drive neobank lending program with 50% to 60% improvement in non-performing loans

- Built and launched multiple digital banks and lending propositions within six months of initiation, with positive unit economics (risk adjusted return)

- End-to-end design and app build of a retail wealthtech app achieving two million user acquisitions in one week

- Drove integration of two Southeast Asian startups with >US$10 billion valuation, working across all integration planning efforts, including setting up of synergy workstreams, defining E2E operating model for joint holding company, and ensuring change management plan in place

- Completed a digital wealth business build and launch for a leading diversified financial services company in India

BCG’s extensive Southeast Asian practice also incorporates deep insights into the regional consumer, SME, and corporate landscape. As part of the survey for this report, we captured detailed data on the lending and investment patterns of both retail and SME customers, providing rich insight on needs, trends, and expectations across the region. We invite any interested parties to reach out to the authors directly if you are interested in accessing additional data on any of the topics or learnings highlighted in this report, or learning about other opportunities to partner with BCG to enhance your strategic business direction.

HOW AC VENTURES CAN HELP

ACV’s in-house team has extensive experience in building and scaling successful startups, which they use to help their portfolio companies navigate growth challenges. The team’s expertise in fintech and related sectors, such as e-commerce and logistics, helps startups stay ahead of the curve.

ACV’s vast professional network of investors, regulators, and industry experts is invaluable for fintech startups. This network helps startups secure partnerships, navigate regulatory hurdles, and access new markets. ACV also provides resources such as talent, marketing support, and strategic guidance to help fintech startups achieve early scale. The firm's team works closely with portfolio companies to identify opportunities for growth and develop strategies to capitalize on them.

It has a deep understanding of the local market and is well-positioned to identify promising investment opportunities. It has a track record of successfully investing in Indonesian fintech startups, giving it credibility with institutional investors looking to deploy capital in the region. ACV can help these investors identify promising opportunities, conduct due diligence, and provide ongoing support to their portfolio companies. The firm also offers its limited partners the chance to co-invest in elite fintech startups.

Currently, ACV has over US$500 million in assets under management, invested across multiple funds, spanning a portfolio of more than 120 companies, including category-leading fintech names such as Xendit, KoinWorks, Stockbit, ALAMI, Payfazz, and more. The firm has a team of over 35 professionals, led by Adrian Li, Michael Soerijadji, Helen Wong, and Pandu Sjahrir, with offices in Jakarta and Singapore.

METHODOLOGY

Qualitative: Qualitative assessments through interviews with fintech leaders

Qualitative research was conducted through in-depth interviews with C-level leaders in the fintech space to understand their perspectives on industry and regulatory trends within the landscape.

Among the key topics discussed were strategic imperatives in today’s business climate, key priorities and challenges for senior stakeholders, partnership and collaboration opportunities with traditional banks, and insights on upcoming regulatory changes.

BCG and ACV interviewed over 20 senior leaders across sectors spanning from lending, payments, open banking, wealth to software, spanning startups of different stages of maturity.

Quantitative: Quantitative assessment through surveys

Quantitative insights reflected in this report were gained through two comprehensive surveys targeted towards Indonesian consumers and SMEs respectively.

The surveys sought to assess the usage of financial products by consumers and SMEs across Indonesia, while identifying key learnings as to the types of channels (fintech vs. bank) used to procure financial services, platforms used, assessment of current platforms, product usage and barriers, and levers for fintech adoption.

Consumer survey

Over 1,000 respondents across Indonesia participated in the consumer survey. Respondents were selected to capture a diverse range of age groups, wealth bands, occupation, and geographical areas. The consumer survey respondent pool is derived from the proportion of Indonesian population who are smartphone users. Additionally, respondents were selected to maintain a baseline threshold of financial literacy, with all participants using at least one form of financial product to ensure relevance to our study.

SME survey

Over 600 SME owners across sectors and regions in Indonesia, covering micro-, small- and medium-sized businesses, were covered by our survey. The SME survey respondent pool is derived from an overall market size of ~15–20 million SMEs, reflective of the number of SMEs in Indonesia with a digital presence. Respondents were similarly selected to maintain a baseline threshold of financial literacy, with all SMEs surveyed using at least one form of financial product.