Telecommunications companies have been the unlikely, and unsung, backbone of the fight against the economic paralysis caused by the COVID-19 pandemic. Even as the demand for voice and data communications has risen to unprecedented levels, telcos have responded with urgency, technological savvy, and purpose, providing a dependable lifeline for communications—particularly wireless and internet connectivity. Telecom operators have supported governments and health care systems by providing high-speed connectivity, devices, and data-based insights on people’s movements to tackle the spread of the disease. They have extended network capacity rapidly to support remote work by businesses and enable academics to teach in virtual classrooms. And they have connected people to offices, information, entertainment, and, above all, other people.

But the unrelenting pressure on telcos since the beginning of the year is likely to take a toll on their performance. Many telecom providers have realized that the pandemic has accelerated several trends that were gaining ground even before the current crisis began. Business will need to be more virtual in the future, companies will increasingly be able to engage with customers only through online channels, and larger numbers of employees will prefer to work remotely. Companies will need to be increasingly digital and data driven and foster more flexible and agile ways of working in order to cope with a volatile, uncertain, complex, and ambiguous environment. Little wonder, then, that many telcos are treating the COVID-19 crisis as a forcing function to accelerate their digital transformations so that they can survive, nay thrive, in the new reality.

Only the telcos that harness the full potential of AI tools will thrive.

Artificial intelligence (AI), our studies suggest, should be central to the telcos’ transformation because it will help deliver superior performance in the short and long term. Telecom companies will be better able to cope with fluctuating demand levels, adjust to supply chain disruptions, and adapt to sharp shifts in consumer confidence and priorities. To be sure, telcos will have to obtain the support of employees—whose anxiety is mounting about the combined impact of the pandemic, economic slowdown, and technological change on their careers and lives—as the companies deploy AI. When operators elicit buy-in, we find, employees come to accept AI as a productivity tool rather than worry about losing their jobs. Many telcos have started using AI technologies, but only those that harness the full potential of these tools will thrive tomorrow.

The Telcos’ Four Challenges for the Future

Over the next 12 to 18 months, telcos across the globe face challenges on four fronts. The challenges are interlinked, and AI can help tackle all of them. Let’s shine the spotlight on each of them by turn.

Demand. At the outset, telcos must reinvent the customer experience by providing extreme personalization, immersive experiences, and better product bundles for both consumers and businesses. Doing so will be crucial; demand trends are rather mixed at present.

The bad news is that operators are seeing a fall in demand for new devices and roaming services and could run into payment issues, especially with B2B customers, in the near future. They will also have to continue service to residences and small businesses, even those that are unable to pay their bills.

The good news: customer churn rates are dropping—40% to 50% less than usual in the case of a leading telco in Europe in March 2020, for instance. Both B2C and B2B customers will need stable connectivity and higher bandwidth even after governments relax social-distancing and self-quarantining recommendations. With more people working from home, using digital entertainment services, and relying almost exclusively on online channels to make purchases and stay informed, the need for higher bandwidth is unlikely to go away.

As a foundational technology, AI can help telcos reinvent customer relationships by identifying personalized needs and engaging with customers through hyper-personalized one-to-one contacts. It can help configure fixed-line and mobile-network bundles that combine VPN, teleconferencing, and productivity apps. These bundles will be particularly attractive to commercial customers whose usage of telecommunication services has shifted from offices to homes and from demand in the field to fixed-line demand. AI also enables operators to forecast demand more accurately, anticipate network load, and adjust capacity and throughput automatically.

By way of illustration, after the COVID-19 crisis began, one telco in an emerging market deployed a hyper-personalization tool based on reinforcement-learning algorithms. These tools adapt quickly to fast-changing contexts, require extremely limited human interactions with customers, and can be applied to customers of both prepaid and postpaid services. Consequently, the telco succeeded in boosting revenues from prepaid services by about 12%. The company was also able to develop personalized promotional campaigns 24-7 by using the tool. It created segments of one, according to individual preferences and contexts, so that it could respond rapidly with one-to-one touch points across channels. As a result, the telco tripled product uptake rates and increased the lifetime value of customer portfolios.

Supply. Telcos need to execute a data-based reconfiguration of their supply chains, push ahead with the rollout of 5G cellular systems, and make use of smart manufacturing.

Starting the creation of a bionic supply platform by launching a data-based reconfiguration should be the first step; supply-side risks will continue to be high for telcos in the foreseeable future. Because of the global disruption of supply chains, equipment and devices have both become harder to secure. Connectivity and AI will play a role at every step of the supply chain in the future, from smart manufacturing to the Internet of Things to autonomous transportation.

By using onshoring and near-shoring—optimized by the global supply chain—telecom providers can boost the speed of new system deployments and improve network resilience. They can employ self-enabling cognitive supply chain modeling to optimize network performance and decentralized, on-demand 3D-printing nodes to replace parts in real time. As they turn the supply chain into a bionic supply platform, telcos should make use of blockchain-based protocols and AI to protect their IP.

As they turn the supply chain into a bionic supply platform, telcos should use blockchain-based protocols and AI to protect their IP.

Several telcos are expecting delays in expanding and upgrading their networks to 5G. They are handicapped by reduced employee capacity, limited access to offices, and regulatory holdups. AI will be essential to mitigating the delays. Even before the COVID-19 crisis erupted, automated planning was helping many telcos optimize fiber and 5G network planning and deployment. It has helped several operators switch from site-centric rollout planning, based on engineering guidelines, to a customer value-centric rollout that identifies priority sites by using advanced models that link terabytes of technical, customer experience, and financial data and factor in regulatory-approval timelines and local-vendor delays.

In the same way, telcos can deploy value-based rollouts (VBRs), an AI-driven capability that changes the way operators manage capital expenditure, to speed up 5G implementations. One European telecom company has shifted away from using engineering guidelines, such as building when 80% capacity is reached, because the impact on customer experience and revenues was hard to quantify. It now uses an AI-based, quantifiable link between network investment actions and projected revenues. Planning by the network, businesses, and finance departments, which was previously siloed, has become a more aligned investment-cum-commercial process with the use of a common fact base and methodology. And manual planning has turned into an automated, end-to-end process that, because of its speed, allows for the evaluation of ten times more scenarios than before.

Network Operations and Customer Service. Telcos have no choice but to automate network maintenance and customer service so that they can accelerate the move toward automated predictive operations and services.

Telecom companies will find it challenging to provide service and maintenance, either through call centers or field forces, because of staff shortages, limited access to sites, and a lack of component supplies. In many countries, call center service providers are closing down or reducing the scope of operations even as call volumes are rising significantly. And overloaded networks will exacerbate these factors, so the pressure to resolve faults will increase substantially.

That’s why using AI-driven analytics and automated service is the only option. Telcos must incorporate numerous data points—such as incidents per network load and previous issues with similar customers—to provide sharp, focused support for higher-value customers. AI technologies will also accelerate the rethinking of customer interactions to improve the customer experience. These tools allow providers to deliver service that supports remote customers faster and more efficiently through chatbots and smart search.

Deploying AI-based service is usually a four-step process:

- Provide simple self-service menus, using search technology and AI-powered chatbots on all channels.

- Offer digital interactions, such as chat with human agents, ensuring that the transition from bot to human is seamless.

- Deflect the remaining voice calls by using text or deploying the AI bot over voice.

- Use the voice channel to tackle complex issues and offer premium services, both of which require human agents.

Combining new technologies to reduce incoming customer calls can generate significant savings. Telcos can ensure a call deflection rate of 20% to 40% with the proper strategy, in our experience, resulting in a 10% to 20% decrease in call center costs.

Similarly, AI-powered solutions will enable the automated management and maintenance of networks, relieving pressure on the field force. A South Asian telco, for example, has been using AI to reduce response times for B2B customers. Its system provides greater transparency on equipment orders and provisioning while allowing customer-facing employees to devote more time to sales and account management. At a challenging time for customer service staff and field forces, AI has helped decrease the time employees spend on simple tasks and refocused them on the most pressing issues.

Business Operations. Telcos must build crisis-proof processes in functions such as sales, customer experience, and delivery. This will help their organizations become more flexible and agile, which will allow telcos to recover faster from disruptions.

Protecting employees’ morale, motivation, and health must be every telco’s top priority. AI can contribute to increasing employees’ satisfaction and well-being. For instance, it can help with upskilling people for the postcrisis rebound by aiding in the creation of remote boot camps and identifying cross-skilling opportunities. Adopting AI-powered tools to streamline interactions between teams will help reduce the friction between marketing, sales, ordering, delivery, and after-sales support. Too many of these interactions are reactive at present, resulting in errors and wasted time and increasing costs. Using AI also enables employees to perform more value-added work while machines do the repetitive and routine activities. For instance, AI can arm call center staff with insights that assist them in quickly improving the customer experience.

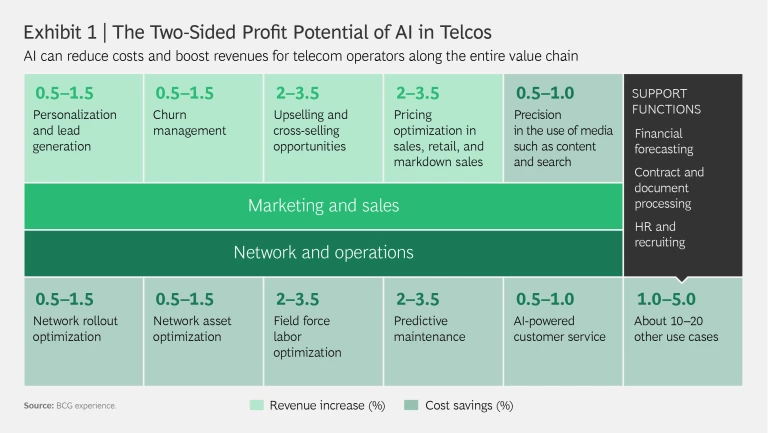

Opportunities to use AI at scale are available all along a telco’s value chain, as Exhibit 1 captures. Collectively, these measures can increase the average telecom company’s revenues by up to 10% and simultaneously reduce its costs by as much as 20%. Clearly, AI is a necessity, not a luxury, for telcos today. The issue then becomes how best to execute an AI-based transformation.

Lessons from the AI Leaders

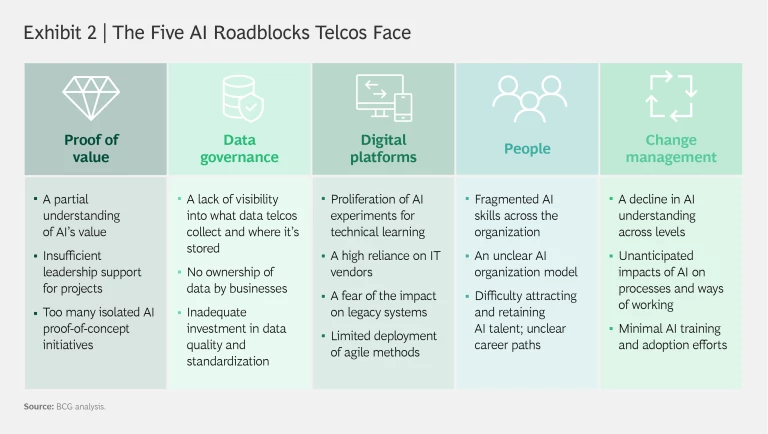

In recent years, several telcos have invested in AI. Most have launched limited proof-of-concept experiments to address pockets of problems such as churn reduction, personalization, or customer service. The toughest challenge most telecom operators face is scaling the initial trials to create operational visibility and generate financial impact. (See Exhibit 2.)

To implement AI at scale, telcos need to mount a team-based, cross-functional transformation. They must create dozens of teams, each imbued with the attitude of a startup, to tackle key processes that cut across silos. Rigid procedures are another challenge in implementing AI at scale. Most telecom companies have tried to limit the cost of failure by imposing well-meaning rules, approvals, and other time-consuming requirements, particularly on their network staff. Those procedures must be reduced to facilitate the use of AI. Getting organizational buy-in can be tough, with no dearth of AI skeptics in most companies. Telcos also face talent-related challenges, with data scientists and engineers in high demand everywhere.

The challenges, while real, can be resolved. Here are six takeaways from the AI leaders in the telecommunications industry.

Embed AI at the core. The early winners in the telecom industry have reinvented themselves by embedding AI at the very heart of not just their products, but their key processes. Telecom companies must first identify priorities by determining where AI will create the highest value. Then they should roll out use cases from end to end in those priority areas so that they can optimize their processes and provide more value to customers. Consider, for example, an operator in India that now regards AI as one of its basic building blocks. The company has reshaped its internal processes to address the customer experience in new websites, relying primarily on the recommendations provided by an AI-based tool. The system recommends where the operator should deploy the new websites to maximize revenues, complemented, if necessary, by human judgment.

Telcos should start by deploying AI in their core business—that’s where the potential for returns is highest.

Telcos should start by deploying AI in their core business—that’s where the potential for returns is highest. They should use the technology to reimagine the existing operating procedures in every function, such as network operations, internal processes, and customer service, in order to deliver a better customer experience and more value at a lower cost.

Most telcos can utilize the data and analytics capabilities they possess to reduce the risk of being treated as a cost-plus utility. Using those capabilities, they can build new business models and create ecosystems in which they can participate or lead. AI often provides telcos with the opportunity to drive growth in adjacent areas such as health, media, entertainment, third-party analytics, and other digital services. Companies can grab market share by using their best-in-class data assets, the data scientists they employ, and the platform they have created. Doing so will reap numerous benefits, but telcos must be careful to avoid the risks to customer privacy that may wipe out years of building customer trust.

Make the C-suite own AI. Using AI at scale requires a new employee mindset and culture, so it’s important to prepare your people for change. To do that, getting the C-suite to own the AI deployment process is critical. One way of ensuring AI ownership at the top is to make the company’s executive committee members accountable for delivering outcomes and value throughout the AI journey. Companies can assist the executives by creating a shared resource, such as an AI center of excellence, that all the functions can use.

A telco in Asia ensured that its executives became AI’s strongest advocates by insisting that one of them sponsor every AI use case. The sponsors not only monitored projects but also had to explain to the affected teams the solution’s benefits, why AI’s adoption in day-to-day operations was essential, and what structural changes were necessary. In addition to ensuring a smooth AI rollout, the exemplary involvement of senior executives had another beneficial impact: it accelerated the demolition of organizational silos. Having to meet cross-functional objectives to achieve a common goal whetted the top-management team’s appetite for collaboration and increased its willingness to persuade teams that working cross-functionally would be the only viable option in the future.

Unleash the power of agile. Agile methods of working are a catalyst, if not a prerequisite, for telcos to unlock AI’s power. Agile allows the adoption of a flexible and value-driven approach and enables working across functions—capabilities that are necessary to scale AI. Telecom companies, which are fairly advanced in using agile ways of working, must build cross-functional, agile teams focused on one or two tangible AI-driven products or processes. They can scale the teams at the same pace as they do AI usage to ensure that they have sufficient resources for both along the way. That will catalyze the rapid adoption of AI in the organization.

One European operator we studied relied on an agile approach to build a next-best-action tool that recommended products and services, using the most suitable channel, to customers. It formed cross-functional teams with representatives from sales, marketing, network, channels, and HR. Each operated in three-week sprints, with everyone—from newly recruited agents in stores to the executive suite—adopting the final solution. Employees embraced the tool because it increased their productivity. The telco, which has used the same agile approach for all its AI projects ever since, then embarked on an agile transformation at scale.

Rethink the employer value proposition. There’s a lot of competition for digital talent globally. To become more attractive workplaces, some telcos have rewritten their employee value propositions, revised their HR and promotion policies, and made work more flexible. One Asian telecom provider, for instance, revamped its employee value proposition entirely. It guaranteed that the talent it hired would work on projects that would have the greatest impact on the company and its customers. It also introduced flexible HR policies inspired by those of digital giants such as Amazon and Google.

The company provided a sense of purpose by enabling recruits to work on topics that would benefit society at large, not just those that would add to the company’s bottom line. Finally, once the telco’s data and digital assets matured, it was able to attract data scientists by providing them with assets they could experiment with. The net result: the telco has become one of the most attractive employers in the country on par with Amazon, Apple, Facebook, Google, and Microsoft.

Invest in employees to root change. In these unsettled times, employee fears can slow, and even derail, the adoption of AI. Because of their daily interactions with frontline employees, managers in the lower rungs are in the best position to reduce concerns and explain AI’s benefits. But the managers may themselves have anxieties about the future. To overcome this hurdle, telcos must invest heavily in communications, skill building, and on-the-job training for frontline employees and managers.

In Europe, one operator created AI champions, who led the deployment of use cases and received credit for the results. The company shared success stories across the organization, and the top AI champions were promoted to new roles. Doing so enabled the telco to generate enthusiasm around AI, which made its adoption across functions and countries easier. The telecom provider also launched a company-wide program to train frontline employees in AI. While the length and depth of the training varied, acquiring a basic knowledge of AI helped most employees adapt better to the new ways of working. It also signaled that the telco cared about its employees, which made all the difference.

Future-proof data and systems. Telcos should ensure that their data and technology assets are ready for AI. That requires two elements: establishing a data governance structure that will ensure the data is usable, consistent, and valuable and revamping the IT architecture to make it more flexible and robust. That will enable AI-driven telcos to break down the siloed complexity of legacy IT systems and scale their AI applications.

For example, a large European telecom company created a common data governance structure, with a single source of truth, for each type of data across all its functions. It then designed a modular IT architecture by relying on a central data platform based on a data lake that gathers data from all the company’s systems, cleans and structures the data, and stores it. The platform makes data available to other systems any time it is needed, interfacing with legacy systems through APIs. The telco stores AI algorithms in the analytical layer of the data platform so that it can share them with use case teams to foster their reuse. That allows the operator to take advantage of the knowledge it already has to build new applications quickly, reducing the tendency to reinvent the wheel and refining its AI algorithms.

Undoubtedly, AI has the potential to help the world’s telcos tackle the current crisis so that they can attain their strategic and financial goals once it ends. That’s why telecom companies need to accelerate their AI transformations right away. The COVID-19 pandemic is a moment of reckoning, and the only telcos that will come out of it stronger will be those powered by AI at scale.