Confidence about personal financial security is high—but so is concern about inflation.

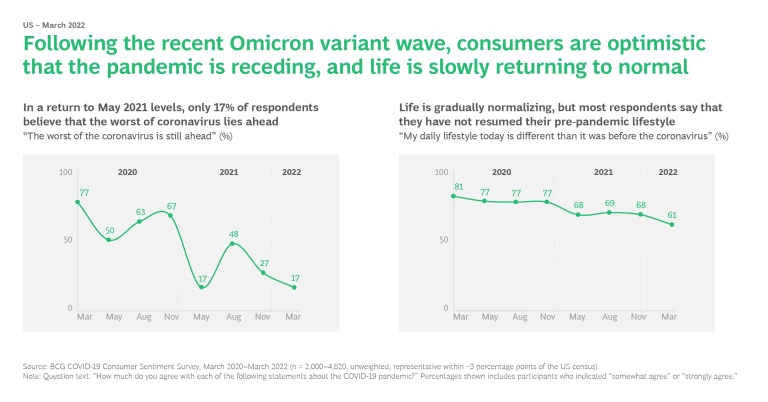

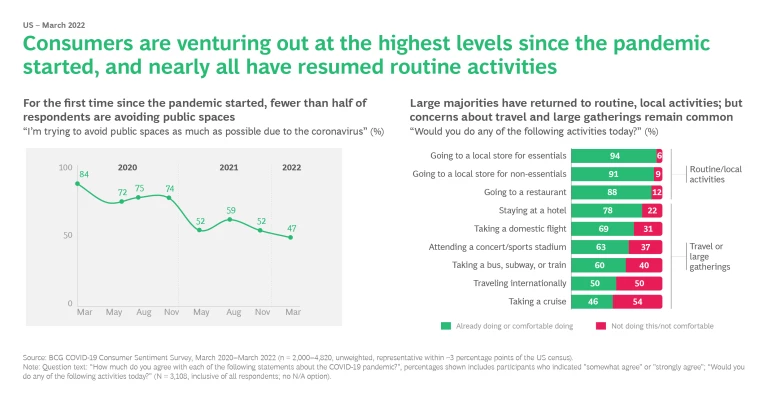

Whatever COVID-19, in its seemingly infinite variety, has in store for them, many US consumers seem inclined to declare it over. Our most recent survey, conducted in March 2022 as the Omicron variant wave ebbed, shows that the vast majority of US consumers have resumed everyday activities such as in-store shopping and restaurant dining. For the first time in two years, fewer than half of survey respondents reported that they were trying to avoid public places as much as possible, and just 17% said that they thought the worst of the coronavirus still lies ahead—tying the low mark previously established in May 2021.

Here are some highlights from our most recent COVID-19 Consumer Sentiment Survey.

In addition to registering a record-tying low of respondents expressing extreme pessimism about the future course of the pandemic, our March survey found that 61% of participants agreed with the statement “My daily lifestyle today is different than it was before the coronavirus”—still a high number, but one that is trending downward. All of our previous surveys had yielded agreement in a band ranging from 81% in March 2020 to 68% in May and November 2021.

Just 47% of survey respondents say that they are keeping their exposure to public spaces to the bare minimum. Percentages of store shoppers and restaurant goers range from 94% to 88%, although long-distance travelers and large-event attendees command somewhat smaller numbers (from 78% for “staying at a hotel” to 46% for “taking a cruise”).

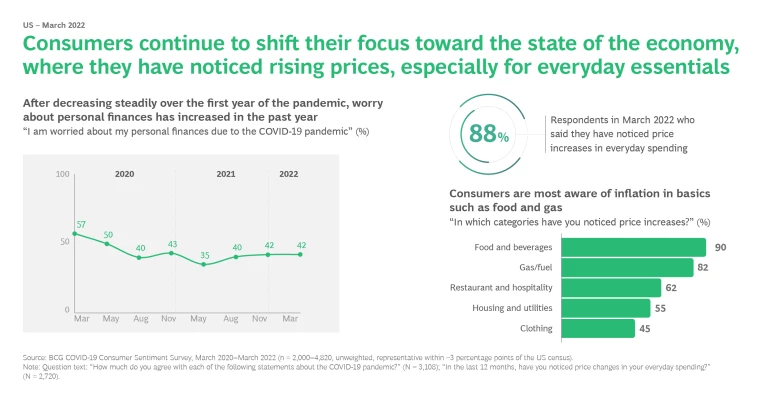

Inflation continues to displace COVID-19 as a primary domestic concern among US consumers. In particular, survey participants have noticed price increases in such categories as food and beverage (90% of respondents), gas/fuel (82%), and restaurant and hospitality (62%).

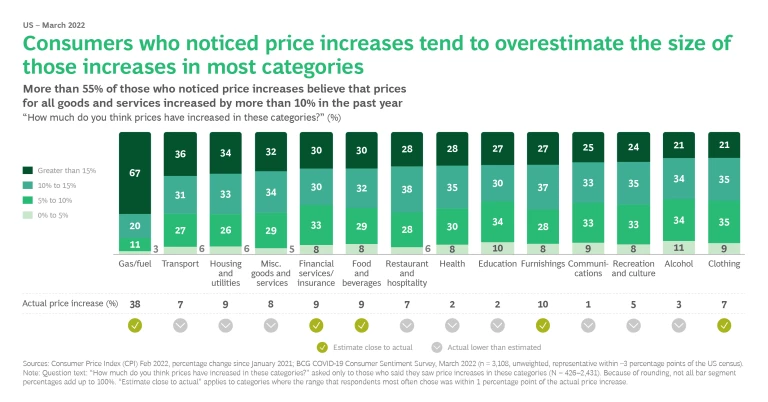

When asked about where they had noticed price increases and how large they thought those increases were, many respondents overestimated them. Of 14 consumer categories tracked, most participants estimated only 5 fairly accurately. In all other categories, at least half of respondents thought prices had risen at a substantially higher rate than had actually occurred.

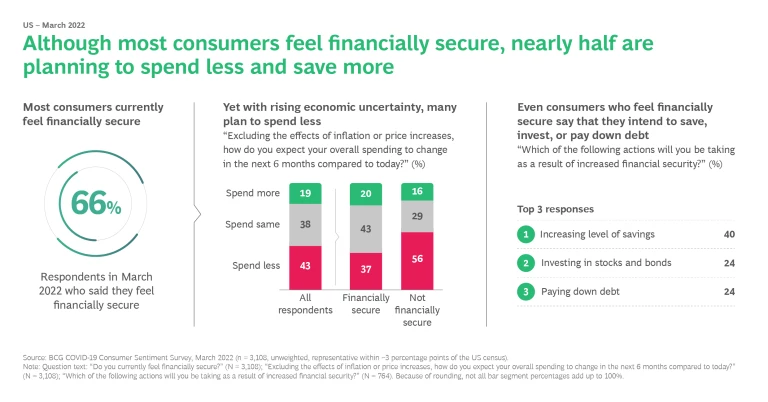

Two-thirds of our survey respondents reported feeling financially secure despite the economic uncertainty of the moment. The main effect of that uncertainty—and of widespread consumer pessimism about the trajectory of inflation—seems to be an inclination among many consumers, regardless of their level of financial security, to plan to spend less over the next six months than they spend today.

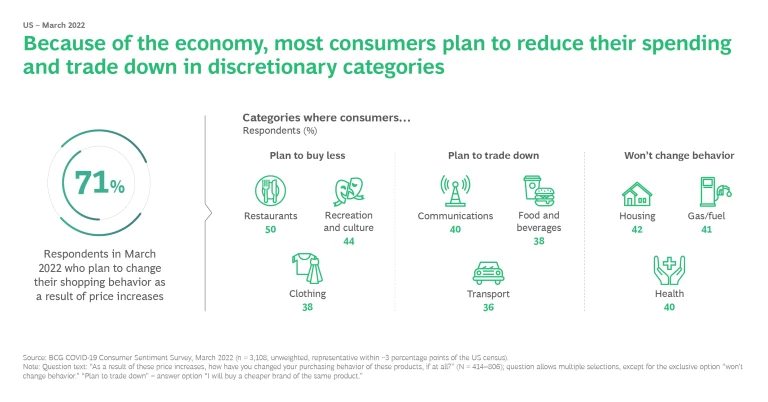

On a more granular level, consumers say that they plan to buy less or trade down in such categories of discretionary spending as restaurants, clothing, food and beverages, and transport, but to maintain their current consumption patterns with regard to such necessities as housing, gas/fuel, and health.

The picture of US consumers that emerges from our March survey is of a population ready to move on from an era in which concerns about the pandemic severely constrained their everyday choices about where to go, what to do, and how to buy. Although they see inflation as a significant issue for the national economy, many consumers also express optimism about their personal financial security. Having ridden out multiple waves of an unpredictable pandemic, consumers must be prepared to show similar resilience in navigating possible future economic turbulence.

About the Snapshot Series and Research

Our Snapshot series began in March 2020 and includes more than twenty articles and slideshows delivered periodically over the ensuing 18 months. The series tracks sentiment and spending changes due to COVID-19.

The series is based on data drawn from an online survey of consumers that has been conducted regularly since early March 2020 across multiple countries worldwide. Each Snapshot highlights a selection of insights from a comprehensive ongoing study that BCG provides to clients. The survey is produced by the authors, who are members of BCG’s Center for Customer Insight (CCI), in partnership with coding and sampling provider Dynata, the world’s largest first-party data and insights platform. The goal of the research is to provide our clients and businesses around the world with periodic barometer readings of COVID-19-related consumer sentiment and actual and anticipated consumer behavior and spending to inform critical crisis triage activities, as well as rebound planning and decision making. A team composed of BCG consultants and experts from CCI completes the survey analytics.

November, 2021: Lingering

The sense of immediate danger may be abating, but US consumers remain uneasy and frustrated, with inflation a new source of concern in the continuing disruption.

August, 2021: Lasting Impact

The summer surge in COVID-19 cases due to the Delta variant has led to a sharp drop in consumer optimism, but a concurrent rise in vaccinations has encouraged many people to increase their out-of-home activities anyway.

May, 2021: Opening Closed Doors

Emerging from the isolation of the past 15 months, US consumers express optimism—some cautiously and others confidently—about resuming their pre-pandemic activities.

November, 2020: Snapshot Key Charts

Good news/bad news is the order of the day. On the upside, efforts to develop an effective vaccine against COVID-19—a major milestone in consumers’ assessments of when they will feel comfortable engaging in activities outside their homes—have produced extremely promising results in late-stage testing, suggesting that immunity from the coronavirus is almost within reach. On the downside, the daily new infection rate is climbing rapidly in many countries, and the approach of winter in the Northern Hemisphere is exacerbating conditions for further rapid spread.

September, 2020: Snapshot Key Charts

Consumer behavior remains fairly steady in the face of unpredictable and somewhat volatile new COVID-19 case numbers as autumn approaches.

August, 2020: Snapshot Key Charts

After a rough July, consumers are regaining their equilibrium—and their optimism—as they look toward resuming activities that COVID-19 has forced them to forgo.

July, 2020: Snapshot Key Charts

The pandemic’s recent resurgence has increased concerns about the riskiness of many activities—but activity levels remain surprisingly stable.

EXPLORE PREVIOUS SNAPSHOTS IN THE CONSUMER SENTIMENT SERIES

Lasting Impact: August 2021

Opening Closed Doors: May 2021

Snapshot Key Charts: November

Snapshot Key Charts: September

Snapshot Key Charts: August

Snapshot Key Charts: July

Snapshot Key Charts: June

Snapshot #13 | OCTOBER 19, 2020 | Picking a POTUS

Snapshot #12 | JUNE 08, 2020 | The Pace Car

Snapshot #11 | JUNE 02, 2020 | Getting to the Other Side

Snapshot #10 | MAY 18, 2020 | The Trip Back

Snapshot #9 | MAY 11, 2020 | A Lighthouse to Navigate the New Reality

Snapshot #8 | MAY 04, 2020 | A Glimpse of the Horizon

Snapshot #7 | APRIL 27, 2020 | Retracing the Old Normal

Snapshot #6 | APRIL 20, 2020 | Hitting the Straightaway

Snapshot #5 | APRIL 13, 2020 | A Story for the Ages

Snapshot #4 | APRIL 06, 2020 | Fighting in the Dark

Snapshot #3 | MARCH 30, 2020 | Turning the Tide

Snapshot #2 | MARCH 23, 2020 | Racing the Clock

Snapshot #1 | MARCH 17, 2020 | Setting the Baseline

Special Feature Articles

COVID-19 Consumer Sentiment Snapshot: Special Feature—Asia-Pacific

How Marketers Can Win with Gen Z and Millennials Post-COVID-19

Legal Context

About the Research Study Leaders

Acknowledgments

In addition, we would like to thank Suryashree Nair, Gaurav Bajpai, Ashish Chadha, and Saurabh Chaddha for their contributions.

We appreciate the generous support that the following people have provided in producing COVID-19 research, the associated article series, and key charts:

- Practice leadership: Rohan Sajdeh, Jean-Manuel Izaret, Tawfik Hammoud, and Niki Lang

- Knowledge team: Kelly Kutas, Priyanshu Praveen, Christian Leavitt, Douglas Fung, and Andy Reilly

About BCG’s Center for Customer Insight (CCI)

About BCG

To succeed, organizations must blend digital and human capabilities. Our diverse, global teams bring deep industry and functional expertise and a range of perspectives to spark change. BCG delivers solutions through leading-edge management consulting along with technology and design, corporate and digital ventures—and business purpose. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, generating results that allow our clients to thrive.