In its relatively short history, the shared services center (SSC) has become something of a fixture in the global corporate landscape. By BCG’s count, most companies listed on the major stock exchanges of the developed world have some type of SSC. And for good reason: shifting various transactional and largely rote functional-area processes (or any of their component activities) to an SSC can yield savings of anywhere from 25% to 60%, depending on the starting point.

Increasingly, smaller and midsize businesses, decentralized international companies, and even NGOs (many of which have shoestring administrative budgets) are adopting SSCs to cut costs and capture efficiencies in their HR, finance, IT, facilities management, and other functions. In addition, a growing number of users are expanding the scope of work in their SSCs beyond chiefly transactional activities (such as payroll) to encompass full-service, higher-value activities such as benefits analysis and baseline analysis. Practitioners and neophytes alike recognize that the potential benefits of SSCs go well beyond cost savings to include a simplified process, stronger governance, speedier execution, and an improved end-customer experience.

Yet despite widespread acknowledgment of the benefits of SSCs, many companies remain naïve about what establishing one involves. Business leaders are generally adept at making the business case for an SSC, but they typically underestimate the considerations involved—or have no idea where to start. They do not realize the level of detail needed to analyze the proposition. Which processes should the company offload to an SSC, and which should it keep onsite? What individual activities make up each process? How feasible is it to shift these processes and activities offsite? Where does one begin looking? And what specifically should one look for in a viable location? Not only do leaders tend to overlook the complexity of the analysis, but also they frequently overlook the HR requirements altogether.

Understanding which functions and processes are prime candidates for an SSC calls for a thorough examination of the existing operation. (See Breaking Free of the Silo, BCG Focus, November 2013, and “To Centralize or Not to Centralize?,” BCG article, December 2015.) And determining what resources and capabilities the company needs to have in place to handle those functions and processes and where best to locate the SSC calls for considerable research.

HR: The Critical but Often Overlooked Consideration

Although decision makers commonly focus on telecommunications and IT infrastructure, HR capability is one of the most important considerations. By HR capability we mean far more than the labor arbitrage benefit. The key criteria for location selection are the quality, process efficiency, and end-customer experience that the company can expect to achieve there. These outcomes depend on the skills and quality of the regional workforce, as well as on factors that characterize the employment environment, such as vacation time, sick-day standards, and labor law requirements and restrictions.

The lack of rigor we encounter with regard to HR activities and capabilities is in part due to data inadequacies. Companies lack comprehensive databases, available data isn’t organized conveniently, and often the data is inconsistent. As a result, comparison can be difficult—but it is not impossible. Most of the relevant data is publicly available, so the project team charged with setting up the SSC should perform the analysis, with support if possible. Expert review of the data is always a good idea.

In any successful company, five core HR activities are critical to supporting its daily business operations—and these activities are just as critical to an SSC, which functions as a standalone operation. In fact, we believe that in many cases they are more important to the success of an SSC than any other contributing factor, and therefore should constitute the key criteria used in identifying and vetting viable locations.

- Workforce Planning. This strategic planning process deals with managing personnel supply and demand, and ensuring that the skills of available workers match business requirements.

- Employee Transfers and Reorganization. Companies must have in place a well-developed process for handling the layoffs and redeployments that arise from corporate reorganization or other change initiatives.

- Codetermination Management. In countries with strict labor laws, HR departments must provide information to and negotiate with the relevant labor organizations and government bodies regarding business changes that affect the workforce.

- Training. Planning, organizing, and holding training programs, such as for leadership development and employee education, are standard HR fare.

- HR Controlling and Administration. Operations and HR management, including issuing contracts and maintaining employee data and databases, must take place for the SSC, just as they do for the core enterprise.

Like the core enterprise, the SSC needs to be able to conduct all of these activities to sustain operations and ensure compliance. But the activities require numerous wide-ranging capabilities and resources. Unless leaders take a structured approach to the task, they may find that comparing the relevant HR factors across prospective locations becomes a frustrating and flawed exercise, fraught with subjectivity and undue complexity. A data-driven approach, in contrast, can enhance analytic rigor while greatly simplifying the assessment process.

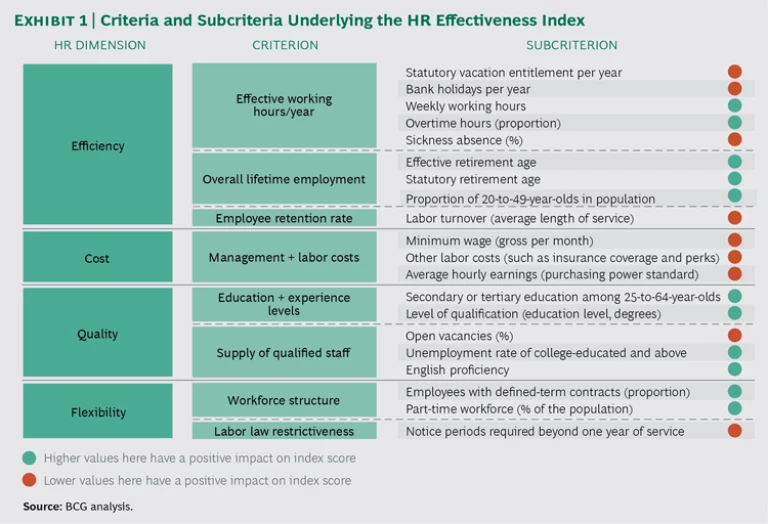

Using four dimensions of HR performance, companies can create an HR profile for each country, thereby making comparisons among countries possible (see Exhibit 1):

- Operational efficiency: effectively a time-based measure of productivity, consisting of working hours per year, years of work (until standard retirement age), and retention rate

- Cost: salaries and wages

- Quality: a combination of education levels, experience levels, and the supply of qualified employees

- Flexibility: workforce structure (the proportion of contract versus part-time versus full-time workers) and labor law restrictions

In seeking the best candidate countries, a company would begin by weighting each dimension according to its importance as a business requirement—for example, 25% efficiency, 40% cost, 10% quality, and 25% flexibility. Cost might be less relevant than quality for an IT SSC or a legal SSC, whereas for an NGO’s SSC, it might warrant a majority weighting, regardless of function.

Each dimension receives a score computed as the average of its component criteria. For example, the efficiency score reflects the average of effective working hours per year, overall lifelong working time of the employee, and employee retention rate. Each of these three criteria in turn consists of subcriteria ranked on a scale of 1 (least effective) to 10 (most effective). Effective working hours per year is a function of the statutory vacation requirement, number of bank holidays, weekly working hours, overtime hours, and sickness absences permitted. The average of the subcriteria rankings constitutes the single score for the relevant criterion. An increase in weekly working hours, for example, would raise a country’s HR efficiency score (because it raises productivity), while an increase in the number of bank holidays would lower the score.

The dimensions are then weighted according to their importance to the company. Using the scores for the four dimensions with their adjusted weightings, a company can compute a single grade—its own individual HR Effectiveness Index ranking—to determine how well each country under consideration would meet the company’s needs. The resulting index ranking makes the relative strength of different SSC locations easy to identify.

(This index has other applications beyond SSC location selection. For example, a company might use it to help identify promising locations for an R&D center.)

A Shortcut to a Short List

Because attempting detailed research on more than three prospective locations at any one time can be both ponderous and complicated, developing a short list is an important step in the location selection process. The HR Effectiveness Index assessment simplifies the task of whittling the list of candidates down to the two or three most promising contenders.

To illustrate, let’s use our default weighting of 25% efficiency, 40% cost, 10% quality, and 25% flexibility. This weighting of the scores of the underlying subcriteria and criteria would generate a list of various attractive locations in Europe, including Turkey, Cyprus, Poland, Romania, Bulgaria, Latvia, Spain, Portugal, and the UK.

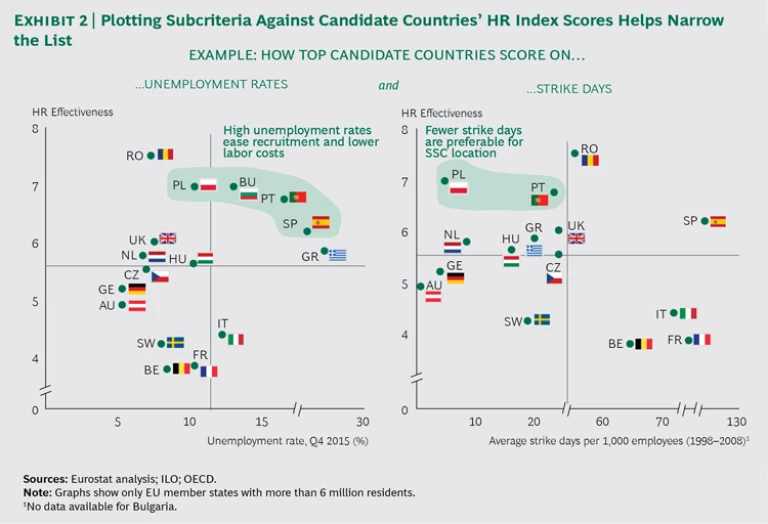

To narrow the list, we might evaluate specific factors related to the individual subcriteria and then plot the candidates, using their HR Effectiveness Index ranking as the y-axis and their standing on the specific subcriterion as the x-axis.(See Exhibit 2.)

Exhibit 2 graphs factors affecting HR cost and efficiency. The left-hand matrix plots unemployment rates against each country’s overall HR Effectiveness Index score. High unemployment in a country where job skills and capabilities are also high makes recruitment easier and reduces labor costs. On this factor, Poland, Bulgaria, and Portugal rank as the most attractive options. The right-hand matrix plots average number of strike days, a reflection of (negative) efficiency or productivity. There again, Poland and Portugal emerge high on the list of top-ranking nations. By starting with the countries that rank highest when weighted to your company’s profile, you can perform a detailed analysis according to other important criteria and in this way identify the handful of best candidates.

Granted, the picture can vary from city to city or even from industry to industry within a given country. Across industries, differences may result from different collective bargaining agreements, and these can be considered in the analysis. City-to-city comparisons require a greater level of granularity, of course, and the availability of such data is spotty, so across-the-board comparisons are not always feasible.

A Springboard for Further Analysis

With a short list in hand, a company can evaluate each prospective location according to the business case, looking at setup and operating costs as well as at the cash-flow impact in the initial years of operation. These details give companies a more complete basis on which to make an informed location choice.

Company leaders who don’t relish the thought of performing extensive up-front analysis may feel differently if they consider another important benefit of the HR Effectiveness Index. Once the SSC is in operation, companies can use the index and its analytical elements to monitor the HR landscape. In volatile regions and in a fast-changing world, these additional indicators can help decision makers seize greater opportunities and avert serious risks.