Since its founding in 1689 as a firearms factory, Swedish-based Husqvarna has manufactured all manner of machines and tools, from motorbikes and meat grinders to sewing machines and stoves. Today, Husqvarna is a leading name in power tools and products for forest, park, and garden care, best known for its chainsaws, mowers, and gardening systems. The company also produces cutting equipment and diamond tools for the construction and stone industry markets.

Prior to 2007, Husqvarna had enjoyed a long period of growth and profitability. In 2000, it was a roughly SEK (Swedish kronor) 24 billion business within Electrolux; by 2007, the company was standing on its own as a listed company with sales of SEK 33 billion. But then revenues suffered across product lines, and profits weakened as consumers shifted to lower-priced products: from 2007 to 2011, Husqvarna’s sales fell 9% and its EBIT plummeted from 11% to 5%. Although the general market slowdown—approximately 6% to 8%, depending on segment—certainly affected the company, Husqvarna’s decline was even more the result of internal challenges. Its market capitalization contracted from SEK 25 billion to SEK 18 billion, and its TSR during the period averaged –15%, versus an average of 0% for other large-cap Nordic companies.

Facing a New Market Reality

Husqvarna’s leaders realized that they must implement wide-ranging efficiencies and structural changes in order to stabilize the company. Achieving stability would be a particular challenge for a company whose businesses relied not just on economic growth but on largely seasonally driven and weather-dependent product sales.

Over the next few years, company leaders undertook a major reorganization, along with process improvements, focusing on manufacturing, sourcing, and the supply chain. For example, they lowered Husqvarna’s factory capacity by 20%, moved production to low-cost countries (such as Poland), and reduced the supplier roster by 25%.

Gearing Up for Profitability

In 2013, with its newfound savings and efficiencies in hand, Husqvarna was ready to lay the foundation for a profitable future. Leaders launched the Accelerated Improvement Program to return the company to its precrisis profit levels. One of the most important aspects of the program was a renewed focus on Husqvarna’s two core brands, Husqvarna and Gardena, and within them, a focus on the product areas with the greatest profit potential (such as professional handheld equipment and robotic lawn mowers). In practice, this meant phasing out several low-volume, low-margin product categories. Among the program’s other initiatives were an operational excellence effort and new, differentiated channel strategies for retailers and dealers.

In 2015, Husqvarna embarked on the final phase of its turnaround journey: reorganizing divisions by end-user segments to optimize growth. To complement the company’s Husqvarna and Gardena brands, leaders created a consumer brands division and a construction division that also serves the stone industry. Despite being a lower-margin business, the consumer brands division has a distinct edge over many of its competitors, thanks to its access to technology innovations from the company’s professional product units.

The Way Forward

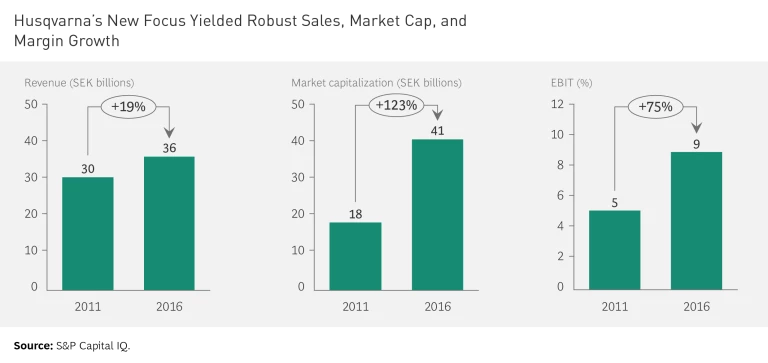

By 2016, Husqvarna had made an impressive comeback. Its revenues in 2016 surged to record-high levels (SEK 36 billion) and its market capitalization more than doubled over five years, from SEK 18 billion in 2011 to SEK 41 billion in 2016. (See the exhibit.) Husqvarna also saw its profitability almost double, as its EBIT margin grew from 5% in 2011 to 9% in 2016.

The future looks bright for the new Husqvarna. In emerging markets, mechanization is growing; in developed markets, ongoing productivity pressures give sophisticated, high-value machinery an edge; and in consumer and professional products, increasingly stringent emissions and noise-control regulations make the company’s innovative products especially attractive. With its digital products and features, battery-powered equipment, and pioneering robotic mowers, Husqvarna is strategically positioned for success as new technologies and environmental challenges transform the company’s industries worldwide.