The digital revolution is having a dramatic impact on retail commerce and how consumers make purchases. The e-commerce market continues to grow rapidly. Estimated at $1.1 trillion globally in 2013, up from $0.5 trillion in 2002, it is expected to grow by 15 percent per year even in mature economies such as the U.S. and the U.K. And few product categories are “store advantaged”—just about anything that can be bought in a shop can also be bought online, and often far more conveniently for consumers.

In this environment, merchants with a brick-and-mortar presence are seeking to defend their market positions from purely online retailers by using their physical assets to create differentiated cross-channel offerings. Their aim is to merge digital elements with their physical stores. In its simplest form, this can mean allowing customers to buy online for in-store pickup or order in-store for delivery at home. Leading retailers are taking things further by means such as sending targeted offers to customers’ mobile phones and streamlining the checkout experience with tablet-based systems at the point of sale.

In order to facilitate the creation of an enhanced multichannel experience, many merchants are revamping their back-office systems to break down existing silos. They aim to create broad inventory visibility across their stores and e-commerce sites. In the same spirit, more retailers are looking to work with a single payments provider across all channels. All of these dynamics are fostering new opportunities for payments players—and generating new revenue pools.

New Revenue Pools

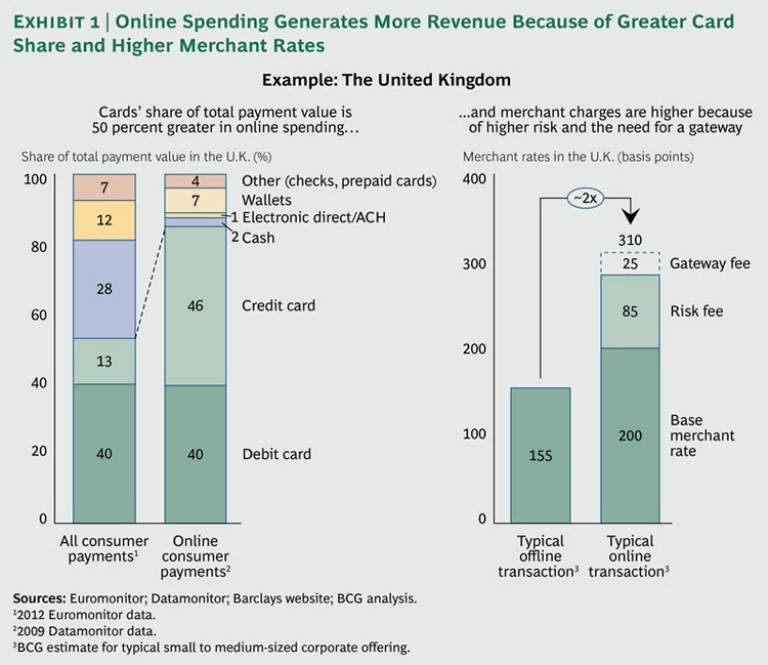

Relative to offline transactions, online spending typically generates two to three times more revenue for payments providers. (See the exhibit below.) This higher revenue is due both to the payment mix—because cards rather than cash or checks dominate online—and to the additional services, such as fraud management, associated with each transaction.

Intensifying Competition

As payments players look to defend their current positions or build new ones, they are pursuing M&A opportunities. Activity has been heavy in recent years, with the major payments schemes, acquirers, and providers of terminals all buying payment service providers (PSPs). In addition to these moves across the value chain, there has been regional consolidation at each individual step.

We expect to see significant M&A activity continuing as the industry moves toward a new equilibrium structure. Indeed, institutions all along the value chain will need to explore acquisitions, partnerships, and organic investments in order to gain the capabilities they need to thrive in a world increasingly composed of open payments ecosystems. Our overall belief is that there will ultimately be a small number of business models.

For example, small acquirers will need to partner with regional service providers such as traditional hardware suppliers and standalone PSPs in order to gain the capabilities that they will require. These banks will be unable to justify investments in multiple areas—such as in new technology and fraud protection—to develop the necessary capabilities in-house. Moreover, the importance of achieving scale on core technology platforms will mean that only a few regional and global service providers will survive to serve the small acquirers. These providers will also have the opportunity to partner directly with the largest merchants, especially the cross-border ones.

By contrast, large acquirers will be able to afford the heavy investments needed to develop key capabilities in-house, either organically or through M&A. More than a few large banks will likely take this route. Our view, however, is that relatively few will do so successfully. In the end, the winners will have to create the organizational structure needed to achieve multiple tasks: enable innovation, reach the volumes required to justify large investments, deliver a differentiated product to merchants, and extract value from merchants outside of the pure payments-processing relationship.

Moreover, small independent PSPs will survive in two niches. The first is in serving the higher-risk, primarily online-only segment (such as digital-goods or online-gambling concerns) in which they have specific expertise and strong customer relationships. This segment is not of interest to mainstream acquirers. The second niche is in offering a highly differentiated product to a specific set of merchant segments—for example, by offering strong integration with specific enterprise resource planning (ERP) software or focusing on a specific industry.

The Need to Act Now

In order to thrive in the new environment, all types of players will need to adapt—to sharpen their strategies, build scale, and continue to drive improvement in their offerings and operations. Acquirers will need to make the most changes. And while the steps that each must take will depend on their current market positions and capabilities, we see four no-regrets moves.

- Develop a clear strategic plan for where to build in-house versus where to partner. This principle holds both for go-to-market matters—local acquirers still have very strong merchant relationships, for instance—and for technological capabilities such as fraud-management solutions. A clear strategy is particularly important for banks that are reinvesting in acquiring as an anchor point for broader corporate-banking relationships. Some will look to build capabilities in-house and drive differentiation, such as one Asia-Pacific bank that has invested heavily in PSP and mobile-based point-of-sale systems. For many, however, particularly those that lack scale, partnerships with existing PSPs and systems integrators will be the best option.

- Carefully identify the customer segments in which you want to win—and offer the services needed to do so. Merchant requirements are becoming increasingly diverse, which implies the need to tailor and differentiate in order to deliver optimal solutions. Players may need to make moves along the value chain in order to control key elements of the customer experience. An example might be a PSP taking increased financial risk to improve control of the on-boarding process.

- Build the IT organization and capabilities needed to work within an open, evolving ecosystem. Institutions may need to create distinct teams to allow a flexible, iterative, developmental approach for the “consumer” IT experience. At the same time, they will need to ensure strong continuity in core IT skills such as speed, security, and stability. Technical capabilities, such as those needed to create APIs that allow third-party developers to integrate easily, will also be critical.

- Focus on improving the retailer and cardholder customer experience. There is much to learn from new market entrants. For example, while we are skeptical about the economics of microacquiring (processing transactions for micromerchants), especially in an EMV world, we believe that microacquirers have changed the game in terms of simplifying and speeding up the merchant setup process.

The global evolution toward more online payments is therefore playing a central role in driving growth in payments-industry revenue pools. In Europe, the revenue pool for payment service providers alone is expected to reach around $1.5 billion by 2016, compared with about $0.8 billion in 2012.

While intensifying competition among payments players will certainly create pricing pressure, higher revenue pools will be supported both by greater complexity in the industry and by merchants’ willingness to pay for ways to avoid that complexity. For example, merchants are willing to pay for features such as closer integration into their back-office systems, multichannel tokenization capabilities, and support for mobile-payment application program interfaces (APIs). International merchants, for their part, require currency conversion capability, greater fraud prevention, and access to local payments schemes and networks of acquirers (which process card transactions for merchants).

Also, particularly in Europe, acquirers are taking advantage of new online-payment capabilities to help merchants overcome the challenges they face in their physical stores. For example, some acquirers are beginning to offer cross-European solutions with consistent reporting and smart transaction-switching.