Current market dynamics are pointing increasingly to wholesale transaction banking as a key lever for improving return on equity in the global banking industry. In 2012, wholesale transaction-banking revenues were about $220 billion, or roughly 15 percent of the total corporate-banking revenue pool. Nearly $140 billion was from transaction-specific fees and current-account-related revenues, and another $80 billion was from value-added services, such as information reporting and trade-related services. (See Exhibit 1 of Global Payments 2013: Getting Business Models and Execution Right.) Transaction fees and account revenues combined are projected to grow at a CAGR of 10 percent through 2022, reaching more than $350 billion. This expansion will be driven by modest but steady growth in the developed economies, continued strong growth in RDEs, and margin improvements as the yield curve rises and steepens.

Indeed, especially in developed markets, the combination of deleveraging and a higher cost of funding has led banks to focus increasingly on attracting stable transaction deposits from their wholesale clients. At the same time, a depressed return on equity is emphasizing the need for improved fee-business and deposit generation—as well as greater liquidity—to compensate for reduced trading and sales revenues.

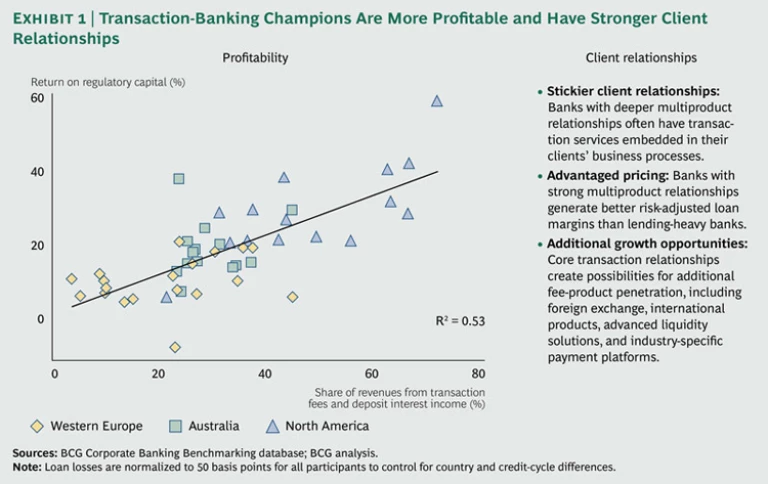

Banks that excel at wholesale transaction banking—institutions that we refer to as transaction-banking champions—have been able to gain a significant advantage over their peers in this environment. They generate higher profits, form deeper client relationships, leverage pricing to their advantage, and seize growth opportunities rapidly. (See Exhibit 1.) Most important, they have created a stable, reliable business.

These banks have also achieved better loan-to-deposit ratios (under 125 percent) and a lower cost of funding. Their diversified revenue mix, with more than 40 percent of revenue originating from noncredit businesses, has allowed them to achieve a significantly higher return on equity. The strong transaction relationships that these banks have developed with their clients have also opened significant possibilities for additional fee-product penetration beyond transaction banking, such as FX and trade-related products.

True transaction-banking champions possess a clear sense of their strategic strengths and boundaries, as well as a relentless focus on execution excellence. Roughly 25 percent of global revenue pools in wholesale transaction banking are linked to large multinationals and financial institutions. This is the realm of a select number of global banks that combine universal reach with continuous product innovation and a high level of customization.

Nonetheless, 75 percent of revenues are concentrated in cash management products and services for small to midsize corporations in the banks’ home markets. Tapping these revenue pools does not require sophisticated value propositions with global access and highly innovative products, but rather an obsessive focus on execution: how to sell, how to price, and how to organize the servicing model.

Making the Sales Machine Hum

Leading transaction banks have realized that best-in-class sales processes still make the difference in the market. They focus on identifying high-potential clients and maximizing contact with them. They are highly analytical in the way they uncover pockets of opportunity.

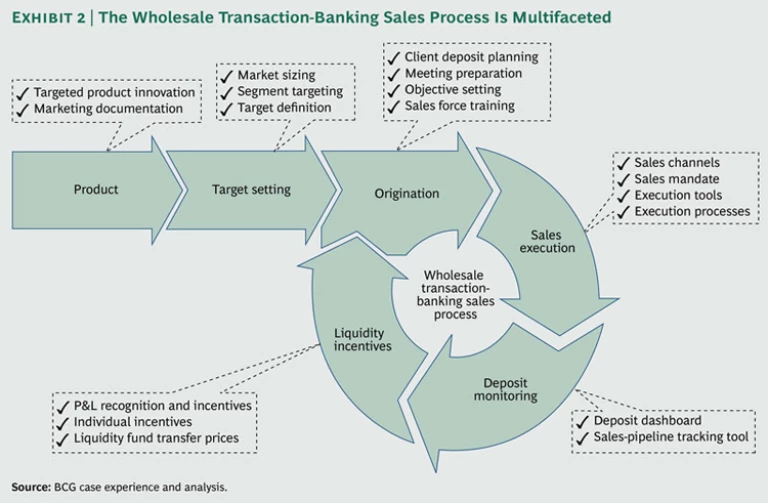

There is no silver bullet for excelling in sales. But the leading banks seem to be highly disciplined at aligning and executing all elements of the sales cycle, cutting across traditional silos. They focus efficiently and effectively on product development, target setting, origination, sales execution, deposit monitoring, and liquidity incentives. (See Exhibit 2.)

Product Development. The importance of product innovation differs significantly among segments. For high-end corporate clients, there is clear value in tailored solutions and innovative products. For midmarket clients, the emphasis should instead be on how products are assembled and brought to market. Robust and user-friendly interfaces will remain a key lever for locking in clients and broadening share of wallet. Improved channel offerings that include new tools for assisting client decision-making will increasingly allow customers to self-select their best product solutions. Finally, for the smallest clients whose individual value typically does not merit the intervention of product specialists, leading banks are increasingly bundling products into more standardized solutions in order to enable generalist relationship managers to cross-sell more efficiently.

Target Setting. Transaction-banking potential is not equally distributed among clients, and sales resources are scarce and expensive. Yet many banks still use only basic client segmentations. The most advanced transaction banks use powerful analytics to differentiate their approach as a function of client needs and the client’s full potential for bank products beyond cash management. They are able to translate the results of sophisticated wallet-sizing models into simple metrics that are easy for the sales force to understand and use. They allocate resources and set targets in line with sales potential. We often see this process result in specific commercial strategies based on industry verticals (such as retailers and traders) and client size.

Origination and Sales Execution. Client coverage matters, but there is no single best way to organize the coverage model, which is highly dependent on each bank’s specific situation with regard to targeted segments, market share, and penetration. What sets transaction-banking champions apart is the clarity of their coverage model, which enables the sales force to focus entirely on execution. The roles of both product specialists and relationship managers in the sales process are clearly defined, with a strong emphasis on collaboration across silos. Product specialists are assigned to specific client segments, reinforcing the focus on pockets of untapped potential. For example, many leading transaction banks are creating separate roles for “hunters” and “farmers” in their product-specialist teams, with portfolios kept as homogeneous as possible.

Deposit Monitoring. Few would disagree that granular monitoring of volumes and margins is critical to managing the transaction-banking business. Yet it is often the operational difficulties in consolidating information from multiple sources that prove to be the biggest hurdle to transparent reporting. The transaction-banking champions that we have observed have succeeded in combining internal and external information into highly actionable dashboards, providing granular volume and margin evolution, flagging important deviations at the client level, and using this information to manage risk and understand client needs. For example, account activity can reveal seasonal sales trends, predict client borrowing requirements, and help banks monitor specific loan covenants.

Liquidity Incentives. Depending on their specific context and business strategy, banks will vary the ways in which client deposits are recognized on the P&L and how incentives are set up internally. Some will focus on maintaining margins above all else, and others will set up mechanisms for enabling tactical pricing on key deals. Yet product specialists and relationship managers should be measured in the same way if true collaboration across silos is to be achieved. It is particularly important that in setting transfer prices, treasury departments properly balance the funding profile of the bank with the regulatory treatment of operating-account balances. Specific deposit strategies will emerge from this interaction.

Seven Best Practices in Pricing

It is easy to see why many wholesale banks have not yet capitalized on the pricing opportunity when their clients are typically large, sophisticated buyers with stringent procurement processes. Nevertheless, as difficult as it may be to reprice spread-based products (including FX), pricing initiatives can bring excellent results in fee-based products for which the long-term relationship is key. This is especially true with smaller customers for which the bank may be a primary provider.

Based on our research, transaction-banking champions respect seven best practices in the way they price their cash-management products.

Full-Cost Pricing. Banks with high fixed costs focus on incremental revenue to defray those costs. Nonetheless, if the incremental revenue covers only marginal costs, banks can accumulate a large number of clients that do not meet overall margin thresholds. Hence, banks need to set prices on the basis of fully loaded costs in order to avoid margin dilution.

Deliberate De-averaging. Wholesale contracts allow individual clients to be priced according to their competitive intensity and bargaining power. In order to do this effectively, banks must robustly segment clients on the basis of size, stickiness, bargaining power, and the like—and also effectively classify them by revenue contribution (such as gold, silver, and bronze levels) and offer commensurate service.

Smart Bundling. Bundled pricing tends to help cross-sell more products. But poorly structured bundling can cause the provider to lose substantially, such as when clients stop buying the more profitable products but the “bundle price” is maintained on the other products. Control of a client’s primary operating account allows the opportunity for credit-offset pricing models in which customer balances can be used to pay for other banking services.

Reversible Volume Discounts. Discounts are a valuable tool for expanding share of wallet, but they should be tiered according to volume ranges—and volumes should be closely tracked. Any declines in volume over time should be met with corresponding adjustments in the pricing structure.

Full Charges. It is common to see “service creep”—higher levels of service with no extra revenue. As much as 50 percent of revenue can be lost due to leakage (not billing for billable services rendered) and slippage (not charging at all for certain services). Service levels must be carefully monitored and managed in sync with price realization.

Updated Pricing. For the banks that we have observed, almost 20 percent of client contracts were more than 10 years old, with some contracts dating back 20 years. On the basis of inflation alone, prices—and costs—may have risen sharply over those periods. It is important to review all contracts on a regular basis and build in indexation clauses where possible.

Margin-Based Incentives. Including pricing or margin criteria in sales incentives avoids the pursuit of market share at the expense of lower prices (and therefore lower margins).

The Service Model as a Differentiator

Transaction-banking champions have turned the service model into a commercial weapon. There are many ways to optimize the model, but leading banks consistently improve their front-to-back processes, cutting across silos and explicitly considering links between the retail and wholesale franchises of the bank (such as payments and trade finance). They deliberately design customer service models to free sales time—and solicit customer feedback that can be used to enhance products or enrich commercial discussions.

On the one hand, this allows differentiated service levels that are explicitly linked to pricing policies. On the other, efficient delivery models avoid squandering product specialists’ valuable time on basic servicing tasks.

More broadly, as critical as it is to become a transaction-banking champion in today’s wholesale-banking environment, the goal cannot be reached simply through deposit gathering or prompt service. Building a best-in-class transaction bank takes time and stamina. Most of the leading banks that we have observed have charted a clear road map and spent years fine-tuning their business, operating, and service models.