Digitization continues to recast telecommunications, presenting both risks and opportunities to industry participants. A potentially sizable opportunity for many players resides in the provision of digitally based support services to traditional, brick-and-mortar-based industries. Telcos possess assets—namely, access to a large customer base, a degree of control over the growing number of smart mobile devices that their customers use, and significant related data—that can help retailers, banks, and a host of other businesses increase the efficiency of their marketing and sales efforts. By making these assets and related services available to these companies, telcos can help them drive business growth while securing for themselves entirely new revenue streams. To seize the opportunity, telcos will have to overcome two challenges. The first is addressing consumers’ sensitivities regarding the use of their personal data. The second is building the organizational skills and capabilities necessary to identify, develop, and support these new, highly innovative services. Today’s telcos are quite good at delivering on their raison d’être—the efficient, large-scale provision of connectivity. But many lack the entrepreneurial spirit and agility necessary to successfully build these new businesses, which fall decidedly outside telcos’ main focus.

Digitization continues to recast telecommunications, presenting both risks and opportunities to industry participants. A potentially sizable opportunity for many players resides in the provision of digitally based support services to traditional, brick-and-mortar-based industries. Telcos possess assets—namely, access to a large customer base, a degree of control over the growing number of smart mobile devices that their customers use, and significant related data—that can help retailers, banks, and a host of other businesses increase the efficiency of their marketing and sales efforts. By making these assets and related services available to these companies, telcos can help them drive business growth while securing for themselves entirely new revenue streams.

To seize the opportunity, telcos will have to overcome two challenges. The first is addressing consumers’ sensitivities regarding the use of their personal data. The second is building the organizational skills and capabilities necessary to identify, develop, and support these new, highly innovative services. Today’s telcos are quite good at delivering on their raison d’être—the efficient, large-scale provision of connectivity. But many lack the entrepreneurial spirit and agility necessary to successfully build these new businesses, which fall decidedly outside telcos’ main focus.

Telcos’ Value Proposition

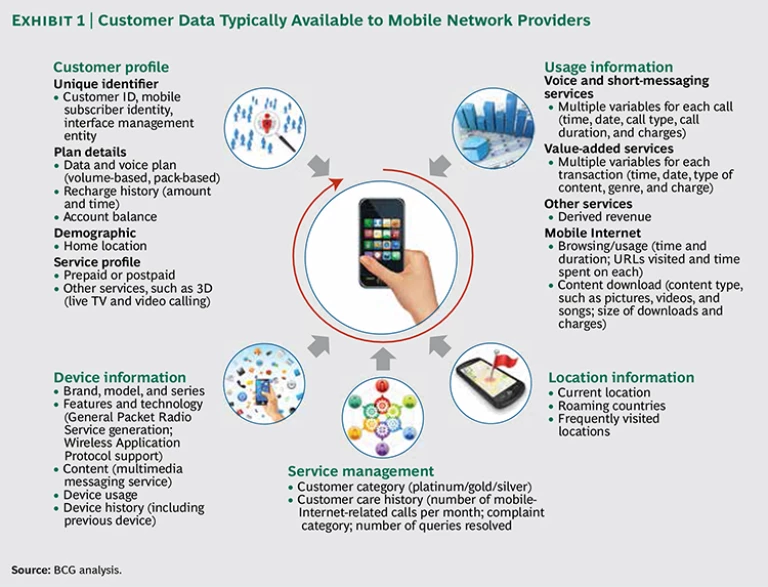

For most companies, maximizing the payback on their marketing and sales investment is a perennial quest. That investment is indeed vast: we estimate that the retail, insurance, banking, and travel industries in the U.S. and Europe alone spend more than €500 billion annually on marketing and sales. Telcos’ vast connections with, and knowledge of, their customers can prove a powerful aid to these companies, providing the foundation for a much more targeted and nuanced approach than most companies currently employ. (See Exhibit 1 for a snapshot of the data typically available to mobile network operators.)

Specifically, telcos can provide services that help traditional companies on three fronts. (See “Telcos Can Support Traditional Companies in Three Ways,” below.) One is in the generation of marketing insights. Companies’ existing customer data can be augmented and recontextualized by the data that telcos hold. This enables a greater understanding of what drives consumer behavior and a commensurately greater ability to seize the identified opportunities. The use of subscriber geolocation analytics based on telcos’ network information, for example, allows a retail company to analyze footfall and conversion rates in a given outlet or branch far more easily and efficiently than through conventional analysis. It also provides a degree of specificity (for example, conversion rates by consumer segment) not possible by conventional means.

TELCOS CAN SUPPORT TRADITIONAL COMPANIES IN THREE WAYS

Telcos can use their assets to provide services that help traditional companies in three ways: generating marketing insights; improving and expanding companies’ ability to communicate with customers and prospects; and shifting purchasing transactions into the digital space. Below are examples of industry-specific applications.

Generating Marketing Insights

- Advertising: pay-per-view-based out-of-home advertising with compensation, determined by footfall, to companies that host advertisements

- Aviation: revenue management based on actual route demand

- Consumer Goods: event- and location-specific consumer surveys

- Public Sector: real-time supply planning for public transportation

- Retail: segment-specific share-of-wallet analysis based on store footfall

Improving and Expanding Communication with Customers and Prospects

- Advertising: crowd-specific ad content on digital billboards

- Aviation: customer satisfaction surveys during idle travel phases

- Consumer Goods: retailer-agnostic, brand-specific loyalty cards

- Retail: customized offers delivered to shoppers and targeting of consumers at multichannel crossing points

Shifting Purchasing Transactions into the Digital Space

- Aviation: context-based offerings and transacting of ancillary services

- Banking: enhanced risk assessment of consumer creditworthiness at point of sale

- Consumer Goods: second-screen shopping apps that support TV ads

- Insurance: short-term policies priced according to a consumer’s personal risk profile

- Retail: online followup and deal closure after a customer’s visit to a store

A second way that telcos can help traditional, brick-and-mortar companies improve their marketing and sales efforts is by improving and expanding communication with customers and prospects. A telco’s customer base within a given geographic region is likely to be second to none in terms of size, and these companies are in regular contact with and conduct ongoing transactions with their customers. Telcos also enable their customers’ smart devices and have a strong understanding of customer usage patterns and user preferences (including downloaded apps).

Together, these two assets allow telcos not just to provide a powerful link between traditional companies and consumers in aggregate but also to facilitate tailored, “segment of one” communication.

Some telcos have already dipped a toe in the provision of such services. Verizon Selects, for example, enables participating retailers, advertisers, and other companies to deliver targeted marketing messages to Verizon customers who opt in to the program and agree to share their personal information, such as location, app usage, and browsing data. (AT&T Alerts is a similar offering.) Verizon is planning to take the idea a step further by offering its customers discounts on their phone or pay-TV bills if they agree to have ads delivered on their mobile devices. The company is also developing a scheme to auction space on the home screens of customers’ mobile devices to advertisers.

A third way that telcos can help drive traditional companies’ marketing and sales efforts is by shifting purchasing transactions into the digital space. NTT Docomo and Tokio Marine Nichido’s One-Time Insurance service, for example, allows Docomo subscribers to use their mobile phones to quickly secure discrete amounts of insurance for travel and special events, such as auto insurance for an uninsured driver who borrows a friend’s car for a weekend trip. (Participating insurers, in turn, leverage available subscriber and context data to calculate and price risk for each transaction.) The service represents a new sales channel for participating insurers and has also spawned new insurance products.

From the perspective of traditional companies, telcos’ value proposition on these fronts stands to be quite compelling. The challenge for telcos will be to deliver on it.

Overcoming Consumers’ Concerns and Leveraging Possession of the “Bit Pipe”

In order to provide a credible offering to traditional companies, telcos will need to address consumers’ concerns about the use of their personal data. Indeed, our research indicates that fully 70 percent of consumers are concerned about this issue. (See “The Value of Our Digital Identity,” BCG article, November 2012.) Telcos will also need to ensure that consumers view the “loan” of their personal data as not just safe but also advantageous to themselves.

To clear both hurdles, telcos will need to design services with several objectives in mind. One is trust. Consumers must be convinced that their personal data will be secure and not used to their disadvantage. Another must-have is transparency. Consumers need to know which personal data will be accessible to a given company and how it will be used.

Additional imperatives are control and convenience. Consumers must be allowed to see and use “their” data. The service must also make it easy for them to opt in—or out—of the agreement and control which specific data is shared. And the service must be simple to use and understand.

A final necessary element in the design of such services is real benefits. In today’s model, consumers usually get a service, such as a “free” e-mail address, in exchange for the use of their data. The value of the service to consumers is potentially far less than the value that the company derives from the use of their data. Telcos can help consumers and companies understand the data’s real value, with the aim of compensating consumers fairly—possibly with a direct monetary payment or a credit to their account.

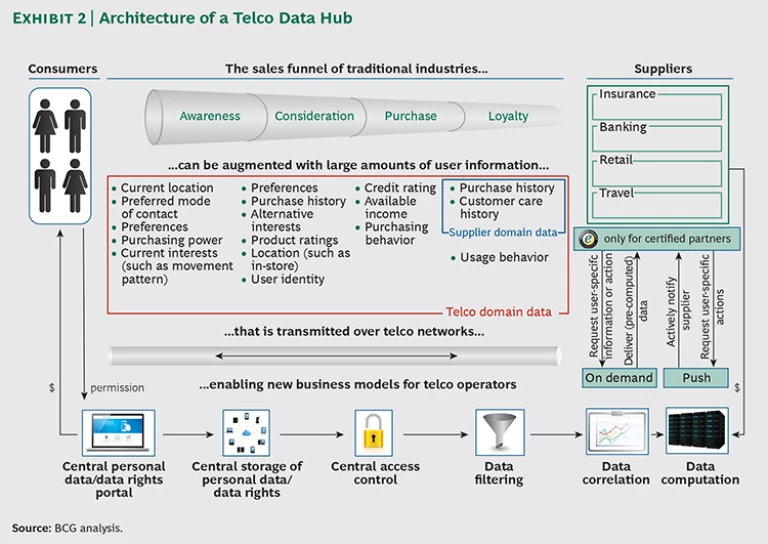

Provided it meets these imperatives, telcos’ offering to traditional companies could actually become a win-win-win, because consumers will reap advantages as well. By acting as an exchange, or data hub, that facilitates the use of personal data by both consumers and companies, telcos would be filling a void and adding considerable value for multiple stakeholders. (See Exhibit 2 for an illustration of what a target architecture might look like.)

Other players could establish similar, competing services. But telcos have two compelling advantages here (beyond their access to a large customer base and related data). First, they sit on the “bit pipe” through which all the data flows. This allows telcos to control which data (for example, a consumer’s browsing history) actually reaches third parties. Second, as our research shows, telcos often enjoy a relatively high degree of trust among consumers, especially relative to “over the top” (OTT) players, or Internet service providers. The combination affords telcos a powerful competitive edge in developing winning new products and services. Telcos could, for example, offer fully encapsulated security mechanisms that limit the use of any personal data collected by OTT players. They could also, with consumers’ consent, offer services that use personal data for specific purposes.

Taking the Idea Forward

Success in this new arena will call for an orientation and abilities (including great speed and flexibility) considerably different from what telcos’ traditional business demands. It is therefore likely that telcos will need to establish dedicated units to seize the opportunity. These units should have both considerable independence and access to the telco’s core assets, which are what create the opportunity in the first place. Instituting the necessary organizational structures and ties between the unit and the core business, and striking the right balance between autonomy and support, will prove challenging for many telcos.

Telcos will also need to adopt a wholly different mindset (and enact a number of supporting organizational and operational measures, including new suites of KPIs, governance processes, and resource allocation mechanisms) as they weigh the unit’s contribution. The lens applied to telcos’ core business is inappropriate for gauging the potential worth of an entity tasked with the launch of small, rapidly growing services—services whose payback period will be years.

In our experience, the best way for these units to create the envisioned new services is through a combination of venture investments, acquisitions, and incubation. Each approach has its advantages and challenges, and the optimal plan of attack will differ depending on the environment—what works best in an emerging market might not be right for the U.S. or Western Europe. (See Through the Mobile Looking Glass: The Transformative Potential of Mobile Technologies, BCG Focus, April 2013.)

Venture investments in third-party startups can be an effective means of establishing the new services, assuming telcos manage to augment these ventures by linking them with their core assets. A key disadvantage of venture investments, however, is that telcos must cede a fair amount of control.

Acquisitions are a viable alternative and give telcos complete control over the acquired companies. Acquisitions are particularly well suited to quickly gaining technology and market access. The main downside is that the price tag for those gains can be relatively steep compared with the cost of securing them through venture investments.

The third option—incubation—is less familiar to most telcos and therefore involves a steeper learning curve, but it offers a number of advantages. A critical one is that it gives the telco, through direct involvement in development, a thorough understanding of the new service’s potential value and a better chance to realize that value in full. Incubators can also deliver quickly: our case experience confirms that they can take an initiative from ideation to market launch within six months if the effort is executed properly.

Also critical to a speedy, successful launch by means of incubation is alignment between the telco and its brick-and-mortar partners early in the process. The telco’s role in this arrangement is to provide the basic technology, data, and access to its subscriber base; its partners’ role is to ensure that the new services address specific industry problems, thus preempting the possibility of creating overly generic or complex platforms.

Telcos must also work closely with their brick-and-mortar partners to identify concrete opportunities. In the past, some telcos built technical platforms first and then searched for ways to deploy them. But now it is important for telcos and their partners to jointly develop the opportunity right at the outset.

Telcos’ assets provide these companies with an exciting opportunity to generate new revenues—and, in the process, create a win-win-win among themselves, traditional businesses, and consumers. Getting there will entail surmounting several hurdles, however, foremost among them being the need to address consumers’ concerns about the use of their personal data and to build the necessary organizational capabilities and structures to support the new business models.