Corporate banking might seem far removed from the digital disruption that has rattled industries including music, retail, and travel. Hashing out eight- or even ten-figure lending and transaction arrangements, facilitating cross-border payments, and providing financial-management advice to businesses that dot the globe present a scale and complexity that may seem ill suited to the sleek simplicity of the point-and-click Internet world.

Although some corporate banks have offerings that go well beyond a basic Web presence, most of the industry has been slow to put in motion the deep, transformative digitization that other sectors, including retail banking, have started to embrace. The business case for the resource-heavy internal change needed to operate at the level of Amazon, Apple, and Google may not have seemed justified in an industry that has traditionally operated as a relationship business.

But The Boston Consulting Group’s recent survey of corporate-banking customers worldwide reveals that the industry is on the cusp of a far-reaching digital shakeout. Business clients are not only open to transacting and liaising with relationship managers (RMs) over digital platforms but also the majority are willing to switch—and even pay a premium—to work with banks capable of delivering the type of integrated, omnichannel service they’ve grown accustomed to in other spheres.

That should serve as a wake-up call, not least because digital allows customers to bypass traditional banks in the two areas that have long underpinned the industry’s relationship model. Both lending and transactions can now be funded and processed by nonbanking entrants. Corporate banks that go digital only gradually could be fighting for their place in the market before the decade is out. Our data indicates that over the next five years, laggards could see profits drop by as much as 15% to 30% relative to fast-moving competitors.

Already, a handful of banks and nontraditional players with advanced digital platforms are gaining share with real-time, low-cost cross-border payments; preapproved credit; and superior foreign-exchange rates. In the process, they are generating 3% to 6% more in annual cross-selling revenues than their peers. That reinvestment potential combined with the momentum and experience gained by being early movers will make it significantly more difficult for slow-moving peers to acquire the talent and resources to catch up.

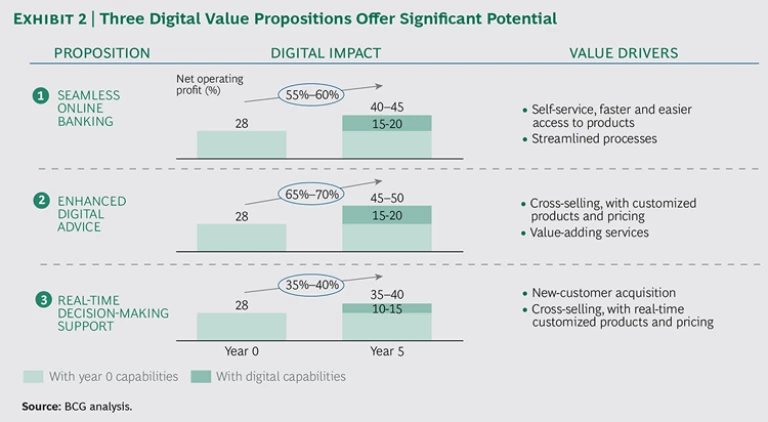

To close that gap, corporate-bank management needs to coalesce quickly around a clear digital strategy and move decisively to build critical skills and capabilities. Three digital value propositions show particular promise: seamless online banking, enhanced digital advice, and real-time decision-making support. Our models suggest that over a five-year period, these strategies can enhance revenues by 15% to 40% and improve cost-income ratios by 7 to 15 percentage points. But each strategy requires a certain level of upfront investment.

In this article, we describe the results of our multicountry customer survey, the implications for corporate banks, and the three digital value propositions that can help position banks for success.

Digital Is Driving Higher Expectations

In an effort to help corporate banks understand how digital is reshaping customer expectations, BCG surveyed 660 companies in 13 developed and emerging markets and 23 industries. The responses revealed that business customers are not only eager to engage digitally with their corporate-banking partners but also that most expect at least a baseline level of digital service. See “Survey Highlights.”

SURVEY HIGHLIGHTS

BCG’s global banking survey revealed that business customers expect higher levels of digital service than many corporate banks are currently able to provide. Key findings include the following:

- Digital capabilities rank among corporate-banking customers’ top selection criteria.

- Customers in emerging markets make up the largest user group of digital banking services, especially for foreign exchange and derivatives.

- More than 90% of midsize and large organizations use online channels to process payments, request financing, and engage with relationship managers.

Part of the reason for this is that many corporate-banking customers have shifted to digital banking for their personal-banking needs. Of the 85% of respondents who conduct their personal banking online, 95% said that they expect the same capability for their corporate-banking needs, and nearly 90% indicated that they’re interested in engaging with RMs remotely. The 15% of respondents who do not use online banking in their personal lives have correspondingly lower digital expectations of their corporate-banking partners.

Self-service, convenience, efficiency, and strong data security top the list of customer demands. More than two-thirds of those surveyed want to access needed information with fewer than three clicks—especially to complete routine tasks, such as reviewing bank statements and submitting documentation. Straight-through processing is another must. If in their personal banking, customers can be preapproved for mortgages, model their investment portfolios, and transfer funds in a matter of minutes, they expect no less from their corporate banking. In line with that, having to log in more than once and respond repeatedly to information requests are among the biggest customer turnoffs.

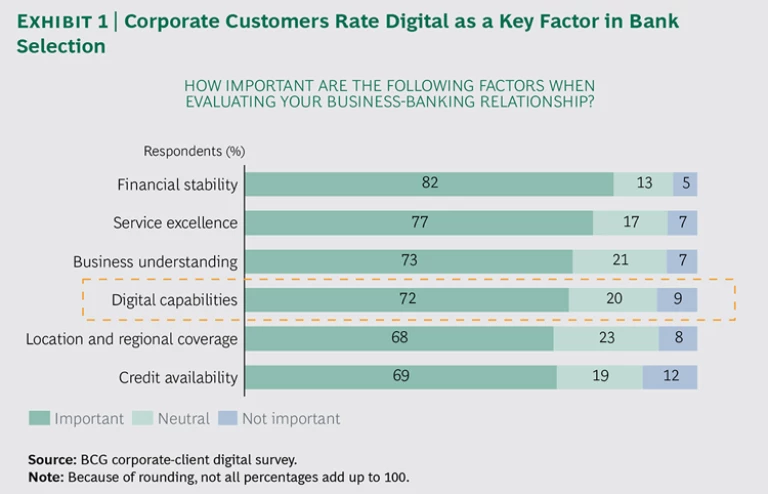

Such digital capabilities are playing a significantly greater role in the selection process. After financial stability, service excellence, and business understanding, customers rated digital capabilities the most important factor in evaluating their business-banking-relationship requirements. (See Exhibit 1.)

Human interaction with RMs remains important—especially when it comes to more complex questions and advice—but across segments, banking clients expect those one-on-one relationships to be complemented with smart, tailored, digitally enabled service. In addition, certain regional, segment, and sector findings also surfaced.

- Emerging markets are the heaviest users of digital corporate banking, especially for foreign exchange and derivatives. Nonbanking digital offerings were also popular: 22% of emerging-market respondents use digital for payments and transactions compared with 18% in the rest of the world.

- Midsize and large companies are the biggest adopters of digital. More than 90% of midsize and large organizations (those with revenues greater than $50 million) use online channels to process payments, request financing, review balances, and engage with their RMs using e-mail or online dedicated chat. That compares with about 84% of small companies (those with $3 million to $50 million in annual revenues) and 68% of microorganizations (those whose annual revenues are less than $3 million).

- Technology and retail companies are the biggest industry users, especially for transactional-banking products, approvals, and alerts. Industry characteristics are a factor here since the retail and tech sectors may have a greater need for daily transactions and deposits. Meanwhile, the construction industry, for example, may need them only periodically.

Banks Are Under Mounting Pressure to Respond

Competition from a cadre of nontraditional-banking entrants is also shaking up the status quo. Players such as Syncada, Ripple, and Earthport

Unchecked, their growth risks eroding trade finance and transaction-banking profits. Those slow to adjust may find themselves locked out of certain niches as fast-moving peers with innovative offerings corner lucrative market subsets. Some competitors are already offering integrated financial-management platforms tailored to the specific needs of various sectors, including health care and insurance.

Digital leaders have an additional advantage: they can easily attract digital talent and reinvest incremental revenues to fund new sources of growth, making it harder for their peers that are slow to move to find traction.

Three Customer-Centric Value Propositions

Despite our sobering call to action, we believe that there is significant opportunity for corporate banks that are serious about advancing their own digital strategy. Our modeling shows that three distinct digital customer-centric value propositions have the potential to deliver substantial performance and revenue benefits. (See Exhibit 2.)

Seamless Online Banking. Businesses will expect all corporate banks to offer this baseline level of service. Core capabilities include single-sign-on processes, credit preapproval, hassle-free integration across devices and channels, easy virtual access to RMs, and straight-through processing of routine tasks to push as much functionality as possible to the client, with the fewest number of clicks. Client self-service allows RMs to spend more time with customers. In addition, greater automation and integration reduce administrative loads, speed cycle times, and lower the number of required back-office full-time employees. Our analysis suggests that with an upfront investment of approximately 5% to 6% of income, this seamless strategy can allow corporate banks to grow net operating profits by as much as 55% to 60% over the course of five years.

To improve its digital offering, for example, one bank launched an online portal with a customizable front end that allows clients to populate their dashboard with traditional services, such as credit and account information, as well as nonbanking services, such as payroll and health account data. The initiative has proved enormously successful. Since its launch, the portal has helped grow the bank’s customer base by 20% and improved cross-selling by 5%. (See “Going Digital Can Pay Off.”)

GOING DIGITAL CAN PAY OFF

Leading digital banks will be able to take advantage of several performance levers to improve productivity, efficiency, sales, and overall profitability. They include the following:

- Growth in customer acquisition and retention due to more relationship-manager (RM) time and improved targeting

- Higher sales volume in nonlending categories that stems from greater RM attention and a more customer-centric platform

- Better risk assessment as a result of big data and transaction data and predictive risk modeling

- Improved cost performance resulting from greater automation and superior process efficiency

The exhibit below illustrates scenario models and their potential effects.

Enhanced Digital Advice. This model turns data into targeted advice to improve client service and retention while generating significant new revenue sources. Transaction histories and account data can help banks develop predictive risk models to improve credit assessment, expand supply chain financing, and provide more tailored advice, such as optimizing a client’s cash-management structure. Other online offerings include payroll and invoicing tools for SMEs and specialized products to help manage working capital, tax planning, and treasury. According to our analysis, over a five-year period, banks will have the potential to generate as much as 65% to 70% in cumulative net-operating-profit growth for an initial investment of 7% to 8% of income and annual maintenance of roughly 2% of income. Furthermore, the introduction of predictive risk modeling—with which banks dynamically analyze transaction account and other data to improve credit risk management and streamline processes—can liberate 20% to 30% of banks’ RM capacity.

One bank created a social-media platform dedicated to helping small businesses connect to exchange best practices. That focus generated a 20% gain in mobile-account penetration, making the bank—with more than 1 million SME users—the market leader in small business.

Real-Time Decision-Making Support. Here, the focus is on robust analytics and decision-making tools—such as those that facilitate automatic reconciliation—to help clients generate needed information faster and make real-time adjustments to improve working capital and cash management. Dynamic modeling lets clients optimize their liquidity and investment management, and specialized algorithms help customers perform in-depth analyses across spending categories. Banks can also use analytics to make real-time offers. With supply chain financing, for instance, banks can leverage real-time insights acquired by automating the entire invoice-to-payment cycle to offer financing with lower risk exposure.

These three value propositions could dramatically enhance an existing corporate bank’s offering to its clients. Taking it to its ultimate conclusion, one can even envision a direct-only corporate bank in which all client-RM interaction takes place through video and phone, but digital interfaces are used for everything else. This may turn out to be an extreme vision, at least for many clients who will continue to value face-to-face advice from their trusted banker. Whether or not there will be an adequate number of clients comfortable with direct-only models—even in small-client segments—remains to be seen. If existing corporate banks mobilize and digitize their major processes, direct-only attackers may not be able to gain traction. But incumbents need to get moving down the digital path sooner rather than later.

Customers Are Poised to Jump

Our data shows that customers are willing to switch—and even to pay a premium—to move to a banking partner capable of offering high-value, digitally enabled service.

When our three value propositions were tested with customers, more than 60% indicated that they would be willing to switch to a bank offering such services. And more than two-thirds said that they would be willing to pay for access to the services offered. The ability to meet those needs gives digitally enabled banks a rare opportunity to markedly change their growth trajectory.

Start by Defining a Clear Digital Strategy

To achieve even the most basic level of digitization, banks must lay out a clear vision predicated on their current level of digital maturity. It also requires a sustained commitment to redesigning systems and processes: simply adapting technologies to the current banking environment will not work. This may seem to be a tall order, but it is less daunting when broken into phases. The following guidelines can help leaders plan their approach:

- Set a clear strategy. Management consensus on the desired digital positioning is essential. Success requires alignment, commitment, and investment across leadership ranks. Senior management must share in the discussions and agree on the overall business and customer objectives, roadmap, and performance criteria.

- Establish a baseline. Understanding which capabilities are required at each stage of growth is key to formulating a realistic and measurable implementation plan. Those capabilities should be mapped to the organization’s current digital capabilities.

- Build the business case. Assessing the digital opportunity (and opportunity cost of moving too slowly) requires analysis, benchmarking, and scenario modeling to determine the required level of investment, profit potential, and impact on key financial ratios.

- Align the organization and culture. Digital needs to be seen less as a channel for pushing through traditional banking products and more as the core around which new banking and customer-facing initiatives are developed. Banks need to reshape organizational priorities, reporting chains, and performance incentives. Leading banks are developing so-called agile organizations consisting of autonomous, multidisciplinary squads, each overseeing the end-to-end implementation of a specific customer-related mission.

Corporate banks are more vulnerable to digital disruption than many realize. Nontraditional banking entrants have already started to shake up the status quo, but whether they can be sustainably successful has yet to be seen. However, first movers have already demonstrated that digital offerings can sharply improve the quality of client service, introduce new revenue streams, and create greater cross-selling opportunities. In an industry characterized by long-term relationships, it should serve as a call to action that nearly two-thirds of banking customers indicated that they would be willing to move their business to gain efficient online access; a portfolio of customizable, easy-to-integrate services; and enhanced data-enabled decision making. The upside, in the form of high double-digit operating-profit growth and client retention, makes that call all the more persuasive.