For the past few decades, the scramble for competitive advantage in manufacturing has largely revolved around finding new and abundant sources of low-cost labor. Rapidly rising wages in most big emerging markets are bringing the era of easy gains from labor cost arbitrage to a close. A little more than a decade ago, for example, Chinese labor costs were around one-twentieth of those in the U.S. Today—after accounting for productivity, logistics, and other costs—the manufacturing cost gap between China and the U.S. has nearly disappeared for many products that are sold in the U.S. (See U.S. Manufacturing Nears the Tipping Point: Which Industries, Why, and How Much, BCG Focus, March 2012.)

As a result, manufacturers the world over are under intensifying pressure to gain advantage the old-fashioned way: by improving their productivity. This imperative came through loud and clear in our 2014 BCG Global Manufacturing Cost-Competitiveness Index, which revealed changes in direct manufacturing costs of the world’s 25 leading manufacturing export economies from 2004 to 2014. In the economies where cost competitiveness improved or held steady during that period—such as Mexico, the Netherlands, the UK, and the U.S.—productivity growth largely offset increases in such direct costs as wages and energy. Economies whose productivity did not keep pace with rising costs—including Australia, Brazil, China, and most countries of Western Europe—either lost ground in manufacturing cost competitiveness or faced increasing pressure. (See The Shifting Economics of Global Manufacturing: How Cost Competitiveness Is Changing Worldwide, BCG report, August 2014.)

Even though the shift toward automation has been a driver of productivity improvement for decades, advanced robots will help to accelerate this trend and will boost productivity even further in a number of ways. Robots can complete many manufacturing tasks more efficiently, effectively, and consistently than human workers, leading to higher output with the same number of workers, better quality, and less waste. Robots will free up skilled workers to focus more of their time on higher-value tasks. Because advanced robots often can perform many tasks autonomously, moreover, they can keep working through the night as human workers sleep, in effect serving as a third production shift.

To estimate the potential productivity gains from wider adoption of robots, we calculated the savings in total manufacturing labor costs over the next decade under the conservative assumption that machines will perform at least one-quarter of the manufacturing tasks that can be automated, compared with a global average of around 11 percent today. We adjusted our model for differences in robotics adoption rates by economies and industries, as well as projected increases in factory wages.

We estimate that, as a direct result of installing advanced robots, and depending on the location, output per worker in manufacturing industries will be 10 to 30 percent higher in 2025 than it is today. This increase will be over and above the productivity gains that can be expected to come from other measures, such as lean production practices and better supply-chain management. The impact on cost is likely to be just as dramatic. We estimate that, because of wider robotics use, the total cost of manufacturing labor in 2025 could be 16 percent lower, on average, in the world’s 25 largest goods-exporting economies than they would be otherwise.

All manufacturers and economies will not share these benefits equally, however, because adoption rates of advanced robotics will vary sharply. The basic economic trade-off between the cost of labor and the cost of automation will continue to be a primary consideration. So will the technical capabilities of machines to replace manual labor. Labor laws, cultural barriers to substituting machines for humans, the availability of capital, the foreign-investment-policy environment, and the age and skill levels of workers are also important considerations.

To get a fuller picture of advanced robotics’ potential to boost productivity, therefore, it is important to assess the opportunities and challenges industry by industry and economy by economy.

The Impact on Industries

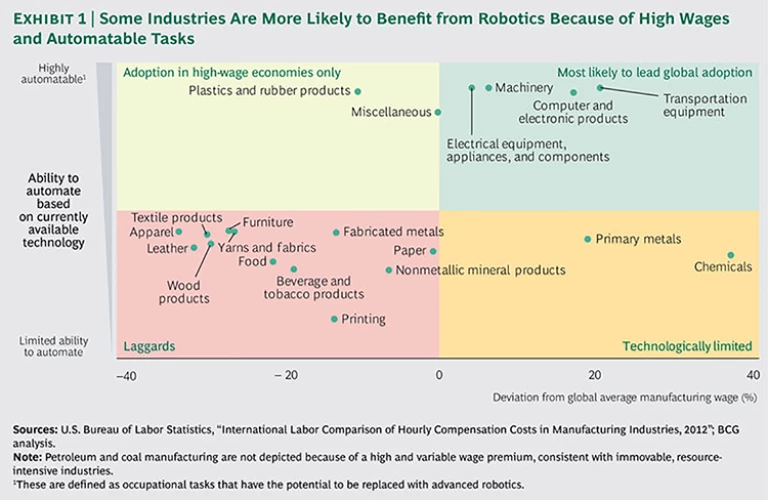

Two key considerations will heavily influence how widely robots are deployed in industries. How cost-effective is it to substitute machines for human labor? And how easy is it to automate production tasks? (See Exhibit 1.)

Manufacturing industries in which labor accounts for the highest portion of costs are generally the most likely candidates for automation, although it will be more challenging for some industries than others. Labor costs range from around 15 percent of production costs in typical chemical, food-product, and steel plants to approximately 30 percent in apparel, furniture, fabricated-metals, electronics, and printing facilities. Location is also important, of course. Industries concentrated in a low-cost economy—such as India, where manufacturing wages adjusted for productivity averaged $5.25 per hour, with benefits, in 2014—will be less likely to adopt automation than those based in a high-cost economy, such as Australia, where hourly productivity-adjusted labor costs average $55.70. But there are also major cost differences among industries. Whether manufacturing for the petroleum and coal production industries takes place in a high-cost economy or a low-cost one, for example, the median wage is about double that for all manufacturing industries. In the apparel industry, wages are 32 percent lower, on average.

The technical limits of wider robotics use will also vary by industry. Each industry has its own set of job roles—such as material handlers, welders, assemblers, and quality inspectors—and each role has its own set of tasks. Some of these tasks are potentially automatable, while others are not. Furthermore, different production tasks call for different robotics functions—some of which will require more expensive robotics systems than others. A machine that simply lifts materials of the same shape and size from one place and moves them to another may be far less costly than one able to visualize and feel nonuniform materials. What’s more, some industries have tasks, such as picking up pieces of cloth to be sewn into apparel, that simply are not robot friendly and therefore will likely be done, for the most part, by workers in low-cost locations for at least the near to medium term. The growth potential of robots in these industries is more limited. If a way could be found to automate such processes, however, robotics could transform the clothing industry from one in which manufacturing is done globally to one that is more local.

We calculated the costs of robotics for 21 industries by aggregating all of the production tasks and types of robots required by those industries. We then adjusted those costs for expected improvements in performance and projected them over ten years. Finally, we amortized the investment in robotics systems over five years to arrive at a cost per hour in U.S. dollars and compared that amount with the projected labor costs in each economy. On the basis of these cost-performance projections and automatable tasks, we developed estimates for robot adoption for the next decade in each of the 21 industries.

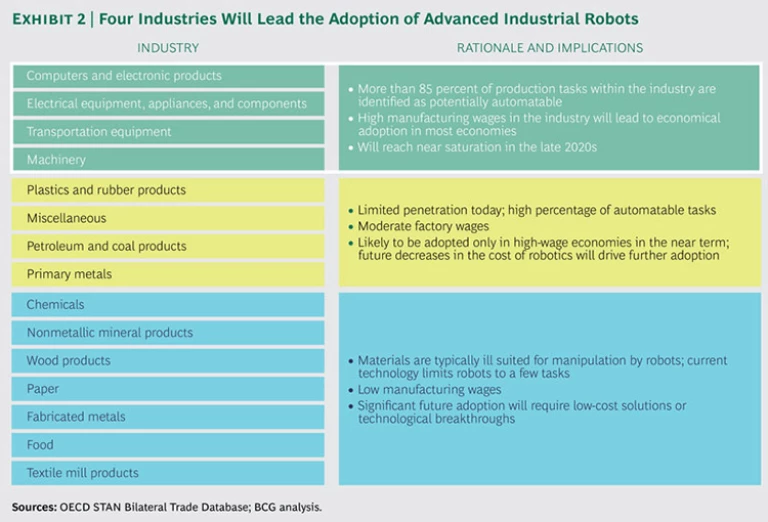

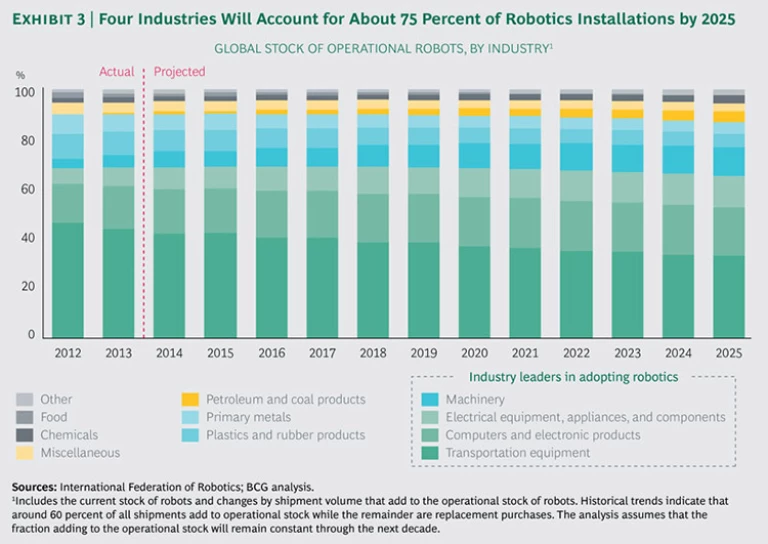

The four industry groups that currently account for the vast majority of global robot use will remain in the vanguard: computers and electronic products; electrical equipment, appliances, and components; transportation equipment; and machinery. (See Exhibit 2.) According to our projections, these four industry groups will account for around 75 percent of robot installations globally through 2025. (See Exhibit 3.) Currently, at least 85 percent of the production tasks in these industries are automatable. Most tasks involving assembly and the tending of machines, for example, are highly repetitive and involve rigid materials, so they can be performed by relatively basic robots. Wages in these industries are also relatively high because many tasks require highly skilled workers. Global wages in the transportation and computer industries, for example, are roughly 20 percent higher than average global manufacturing wages.

As a result, in many economies, investments in robotics systems in these industries are likely to generate a return on investment in the near term. Robotics systems currently cost around $10 to $20 per hour, on average, to own and operate in the U.S. in these sectors—already below the cost of human labor—and will decline further over the next decade. We project, therefore, that robots will perform 40 to 45 percent of production tasks in each of these industries by that time, compared with fewer than 10 percent today.

In another cluster of industry groups, robots will most likely be adopted in high-wage economies in the near term, and wider adoption will occur as the costs and performance of systems improve. These groups include plastics and rubber products; petroleum and coal products; and primary metals. We project that robots will perform 10 to 20 percent of tasks in these industries globally by 2025. Economics will be the main limitation. Although around 86 percent of tasks in plastics and rubber-products plants can be automated—such as material handling, assembly, welding, and machine operation—manufacturing wages are expected to remain relatively lower. This will limit the financial benefits of automation, especially in low-wage emerging markets.

A number of industries will remain a poor fit for robots in the near term. Chemicals, wood products, paper, fabricated metals, food processing, and textile products are prominent examples. We project that robots will perform only about 1 to 5 percent of tasks in these industries a decade from now. Global manufacturing wages in these industries are low because they tend to have a smaller portion of automatable jobs and because the economic tradeoffs don’t justify broad robotics adoption, at least for now.

Technical impediments to widespread robot use also exist in certain industries. As mentioned previously, the biggest hurdles for machines in apparel manufacturing are the abilities to pick up single pieces of cloth and then align them so that they can be cut and fed through a sewing machine—tasks that are still better done by humans. As a result, the hourly cost of owning and operating a robot in a U.S. apparel, textile, chemical, or paper plant ranges from around $40 to $47. By 2025, that cost is projected to drop to around $20 to $25 per hour, which would still not be competitive with labor in apparel factories in many countries. In other industries, many of the tasks that can be automated—such as handling heavy or hazardous materials—are already performed by machines.

The Impact on Economies

Robotics will penetrate the manufacturing sector to different degrees in different economies as well. The mix of industries in each economy will be one of the variables in assessing robot penetration. Another will be regulations that make it difficult and very expensive for companies to replace workers; economies with such regulations will probably adopt robotics at lower rates. Other variables include the cost, supply, and flexibility of labor and the availability of investment capital.

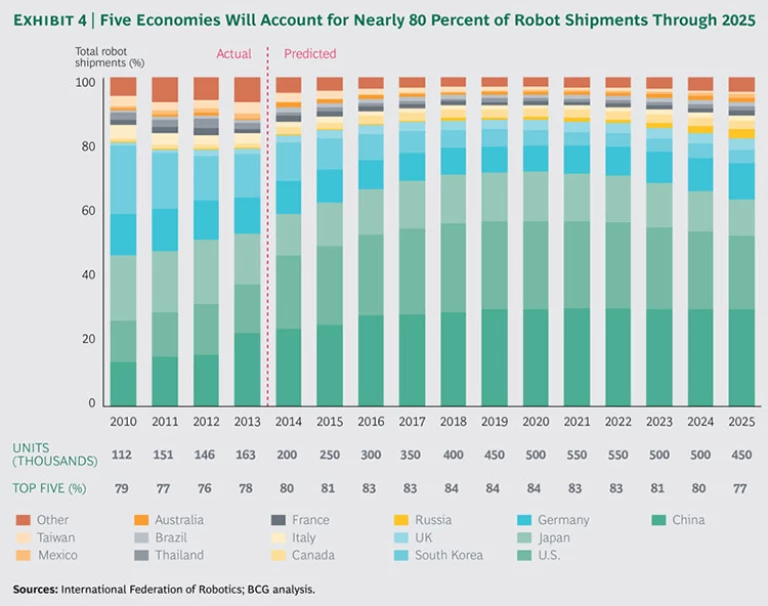

On the basis of these factors and current trends, our projections show that five countries—China, the U.S., Japan, Germany, and South Korea—will account for around 80 percent of robot shipments over the next decade; China and the U.S. alone will account for around half of those shipments. (See Exhibit 4.)

We found that industries in certain economies are embracing robots much more energetically than we would expect, given the underlying economic factors. In other economies, robotics adoption is lagging even though the economic rationale for automation seems compelling.

To get a sense of who is in the vanguard, we analyzed the world’s 25 biggest manufacturing export economies. These economies, which account for around 90 percent of goods exports, are included in the 2014 BCG Global Manufacturing Cost-Competitiveness Index. We grouped these economies into four categories of robotics adopters: aggressive, fast, moderate, and slow. (See Exhibit 5.)

Aggressive Adopters. Indonesia, South Korea, Taiwan, and Thailand have been installing more robots than would be expected given these economies’ productivity-adjusted labor costs. South Korea, for example, is installing robots at a pace that is about four times the global average. As a result, robots in South Korea are projected to perform around 20 percent of tasks—considered the takeoff point for adoption—by 2020 and 40 percent of tasks by 2025. Thailand’s manufacturing sector is installing robots at around the same pace, while companies in Taiwan and Indonesia are installing them at about twice the rate of average economies. In developing economies, such as Indonesia, one motive for installing robots faster than might seem warranted is to help factories achieve the same quality standards as those in developed economies. If these trends continue, robots in some developing economies will perform around 50 percent of tasks by 2025, and adoption will reach the traditional market-saturation point for technology—approximately 60 percent—in 15 to 20 years.

The high adoption rate is partly explained by the fact that all four economies are experiencing higher-than-average wage growth, have some of the lowest unemployment rates in the world, and have workforces that are aging fast. South Korea has even launched a new five-year plan to expand its intelligent-robot industry and promote widespread adoption. The plan calls for $2.6 billion in public and private investment; a tripling of annual revenues, to $7 billion; and $2.5 billion in annual exports by 2018. Forward-looking businesses, therefore, are investing in robots when they build new capacity. What’s more, workers can be dismissed with relatively little severance pay under current labor regulations, making it easy to replace humans with robots in these aggressive-adopter economies.

Fast Adopters. Canada, China, Japan, Russia, the UK, and the U.S. are all witnessing rapid adoption that is in line with their economic outlook. Industries generally ramp up automation when using robots becomes 15 percent cheaper per hour than employing humans. We project that robots in some of these economies will perform 30 to 45 percent of tasks by 2025 and that adoption will reach the saturation point in 20 to 25 years.

Manufacturers in the fast-adopter economies often incur limited costs when dismissing employees. Government approval typically is not required for layoffs, although some economies, such as China, are starting to toughen their policies. Severance benefits, if required at all, usually range from two days to one month per year of service. Most fast-adopter economies also have relatively high labor costs, when adjusted for productivity, and several economies have rapidly aging workforces.

Nevertheless, companies in China are installing robots in new factories even though wages in most of China remain relatively low. This may be because companies anticipate that the rapid rise in Chinese wages over the past decade will continue for the foreseeable future. They could also be anticipating that skill shortages in several provinces will worsen. In fact, robot purchases in China rose particularly sharply in 2013, when it more closely fit the pattern of an aggressive adopter. In that year, robot shipments increased by 59 percent—to 37,000 units—far outpacing China’s 11 percent expansion in manufacturing output and 6 percent growth in hourly productivity-adjusted wages. If China continues on this more aggressive adoption path, average total labor costs in manufacturing could be 30 percent lower in 2025. If it remains a fast adopter, however, costs are expected to be 24 percent lower.

Moderate Adopters. Australia, the Czech Republic, Germany, Mexico, and Poland are installing robots at a measured pace that is in line with those countries’ economic growth. Industries are ramping up automation investment more moderately than fast adopters when they reach the inflection point of 15 percent cost savings over workers. Robots are expected to perform 30 to 35 percent of tasks by 2025, and adoption is not likely to reach market saturation before 2035, at the earliest.

Labor regulations that require employers to justify work dismissals and disburse severance pay slow down robot adoption. Restrictions on foreign ownership and government control over market interest rates in several economies also deter investment in automation.

Slow Adopters. Austria, Belgium, Brazil, France, India, Italy, the Netherlands, Sweden, Spain, and Switzerland are installing robots at the slowest rate among the top 25 manufacturing export economies. This is despite the fact that, with the exception of India, these nations have some of the highest labor costs, when adjusted for productivity. They also have aging workforces and are expected to face serious skill shortages. If this trend continues, robots will perform at most 15 percent of tasks by 2025, and it will take several decades to reach market saturation. This will make it harder for the slow adopters to compete with the faster ones.

Regulations in some economies that prohibit replacing workers with robots are among the biggest barriers to automation. Companies must often negotiate with governments to dismiss workers and then must pay high severance packages to those former employees—in some cases equal to more than two years of wages. In India, for example, companies with more than 100 employees require permission from the ministry of labor and employment to fire someone. This lack of flexibility not only hinders the automation of existing factories, it also discourages new long-term capital investment in production facilities. In other economies, heavy government control of interest rates and restrictions on foreign ownership and investment are additional deterrents to slow adopters.

These differences in robotics adoption may seem small and less noticeable now. But over time they are likely to lead to significant gaps in productivity gains and manufacturing costs among leading export economies—especially as more and more industries reach the inflection point and investment in robots accelerates. Indeed, we believe that as wage gaps between low-cost and high-cost economies continue to narrow, robot adoption could emerge as an important new factor that will contribute to redrawing the competitive balance among economies in global manufacturing.