This is an excerpt from Transportation and Logistics in a Changing World (BCG report, October 2016). In the coming years, the transportation and logistics (T&L) industry will most likely be significantly altered by several megatrends that are reshaping the business environment. As these megatrends change the industry, leading players will capture the new opportunities by reacting faster and more decisively than their competitors. The most successful companies will start preparing for these changes today.

Six Critical Megatrends

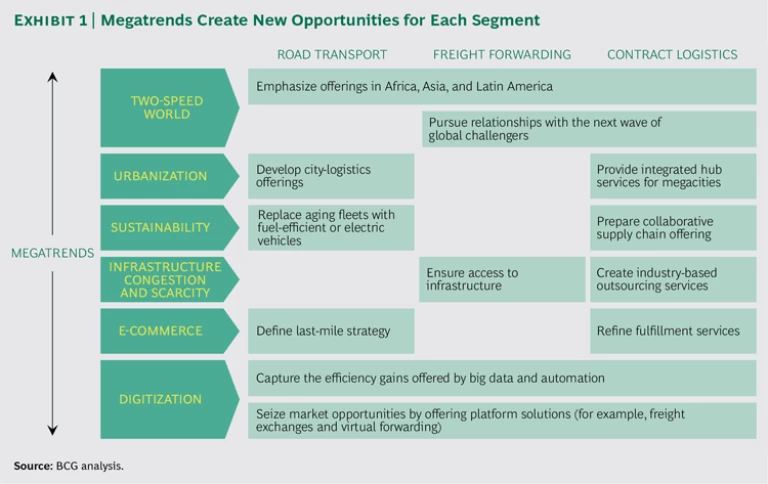

Our discussions with T&L CEOs have highlighted six megatrends that will exert the strongest influence on the industry. These trends will affect T&L segments in different ways. Some segments will encounter headwinds (for example, road and air transport will see higher costs as companies meet sustainability objectives), while other segments will gain advantages (for example, rail transport stands to benefit as a “greener” mode of shipping). In all cases, the megatrends will create business opportunities that players should be prepared to address.

A Two-Speed World. Global economic development is progressing at two speeds. Emerging economies are expanding rapidly, while growth in developed countries is stagnating. The fast growth of emerging economies will further increase trade flows within and among Africa, Asia, and Latin America. As consumption increases in rapidly developing economies (RDEs), so too will production. As a result, companies from these countries will become large global players. (See Allies and Adversaries: 2013 BCG Global Challengers, BCG report, January 2013.)

All T&L segments will benefit from the increase in transport volumes resulting from the high growth rates of RDEs. The biggest beneficiaries of the increase in long-distance global transport will be the sea and air transport segments—as well as the infrastructure and freight-forwarding segments that provide services related to long-distance transport. The greater complexity of transport chains will also create demand for logistics advisory services and contract logistics.

Urbanization. As the large-scale migration from rural areas to urban centers continues, more megacities will evolve and create new demand patterns among consumers that affect logistics players. These companies will need to cope with the greater complexity of logistics within cities and with consumers’ increasing expectations for convenience.

The segments that stand to benefit the most from urbanization are road transport and CEP delivery, as well as hinterland terminals and warehousing. The contract logistics segment will also see increased demand. Rail and air transport and the related infrastructure segments will benefit to a lesser extent as players offer more point-to-point connections between cities.

Sustainability. More stringent regulations and greater resource constraints make it imperative for logistics players to find new ways to reduce energy consumption. Additionally, the increased awareness of sustainability issues among consumers will mean that “green” transport will have greater value.

Sustainability will create winners and losers among the T&L segments. Rail will benefit, because this transport mode is environmentally friendly, as will the related rail network providers and other segments that help to make transport more efficient, such as hinterland terminals. Air, sea, and road players will face increased burdens for regulatory compliance, such as having to upgrade or replace fleets to meet new emission standards. Logistics services companies may also be under pressure from their customers to pursue a green agenda.

For many T&L companies, the critical challenge will be to identify business opportunities related to sustainability rather than focusing on how sustainability will affect operations. Capturing the opportunities will require developing business models to provide new services—such as logistics services that address the complexity of sustainably transporting food throughout the supply chain.

Infrastructure Congestion and Scarcity. Infrastructure is increasingly becoming a bottleneck for business. Congestion and the related cost increases (such as higher landing fees) will impose additional burdens on logistics providers and could potentially disrupt service offerings, such as just-in-time delivery. Congestion and scarcity of infrastructure will be especially critical challenges in areas with high population density. Logistics players will need to overcome these constraints when developing solutions for their customers.

The logistics infrastructure segments will benefit, as players in highly congested regions where customers have few alternatives will have an opportunity to increase margins, while execution segments will face the prospect of diminished market power. The freight-forwarding and contract-logistics segments stand to gain, as companies earn higher margins by reselling capacity on congested routes. These players can use their broad perspective on the market to identify which routes will have the most significant capacity constraints, secure capacity on these routes, and offer it to customers at premium prices. The logistics advisory segment also will benefit, as players provide advanced solutions for planning routes, helping customers identify bottlenecks and achieve greater efficiency.

E-Commerce. Trade volumes are shifting away from physical retail outlets to online and mobile platforms. As consumers increasingly buy products through ubiquitous offerings on the web, the flow of goods through the transport network has already become more complex. Direct deliveries to homes are replacing deliveries to retail stores. Logistics players need to broaden their end-to-end services and prepare for aggressive competition from new companies specializing in fulfillment and last-mile delivery, as well as retailers establishing their own logistics operations.

Segments related to parcel delivery will benefit from the continued growth of e-commerce. These segments include not only CEP delivery but also others, such as road transport and contract logistics providers, that have companies capable of last-mile fulfillment. The postal-delivery segment is already benefiting from this trend, but these gains are often not sufficient to offset the loss in business caused by electronic communications.

Digitization. This megatrend affects the T&L industry in two ways. First, companies have significant opportunities to apply big data and automation to improve operational efficiency, quality, and costs. For the past several years, T&L players have made increasing use of IT solutions for tracking and tracing shipments and advanced analytics for route and network optimization. They have also implemented IT systems to replace paper-based processes for pricing, booking, and billing. Second, digitization has enabled the emergence of new business models. These primarily relate to platform solutions, such as cloud-based transport management systems, advanced freight exchanges, and virtual-forwarding offerings made available by Transporeon, Flexport, Cargomatic, and other companies.

The Implications for Companies in Key Segments

To help T&L players get ahead of the changing industry landscape, we examined how the megatrends will affect companies in three segments—road transport, freight forwarding, and contract logistics—as well as the initiatives they should take. (See the exhibit.)

Road Transport. Urbanization creates new opportunities for road transport players to develop offerings that reduce customers’ higher costs stemming from the complexity of logistics in congested cities. Such offerings include hubs for bundling less-than-truckload shipments and efficient delivery networks. Road transport companies should also consider designing a last-mile fulfillment strategy to capture opportunities at the intersection of urbanization and e-commerce over the long term.

Road transport players will need to prepare for the impact of more stringent sustainability regulations, as well as for the effects of increased fuel costs, and, potentially, carbon taxes. Successful players will replace their aging fleets with new, fuel-efficient vehicles to comply with regulatory requirements and to lower operating costs. To capture opportunities related to sustainability, companies can develop such offerings as green transport using electric vehicles to help customers reduce their carbon footprint.

Freight Forwarding. To prepare for a two-speed world, freight-forwarding companies in particular should develop offerings tailored to the trade flows within and among the African, Asian, and Latin American markets. The growth of these trade flows will help offset stagnating trade in developed markets. Freight-forwarding players also need to build a strong presence in attractive markets, such as RDEs, identify the fast-growing companies early on, and prepare to win their business, as these up-and-comers represent the next wave of global challengers and large-scale customers. Competitive cost bases and aggressive expansion plans will be essential for success in this effort. In addition, ensuring access to infrastructure in congested regions will be critical to prospering in the face of urbanization and overall infrastructure scarcity.

Contract Logistics. To address the increasingly complex city logistics resulting from urbanization, contract logistics players, like road transport companies, can offer hub services for efficient operations in cities. To respond to infrastructure congestion, contract logistics players can invest in and control critical infrastructure points, which will allow them to offer services at a price premium in some markets. Contract logistics providers can also invest in their own manufacturing facilities (such as for outsourcing the final assembly of products) and their own infrastructure to benefit from the congestion in megacities and the scarcity of infrastructure overall.

E-commerce also presents opportunities for contract logistics providers. As small e-commerce players proliferate, there will be greater demand for fulfillment offerings, such as product distribution, reverse logistics (that is, transporting returned products back to the seller), and value-added services (for example, repackaging and payment processing). Proprietary logistics expertise will allow leading players to offer know-how and unique value-added services to customers. As providers integrate their expertise and offerings into customers’ supply chains, a broader array of opportunities will arise.

Which companies will be leaders in the T&L industry a decade from now? Those that start preparing for change today. By proactively addressing the opportunities created by these megatrends and avoiding losing ground to new players, incumbents can emerge as winners in the long term.