Manufacturers have taken advantage of markedly increased demand for durable goods over the past five years, rewarding shareholders by creating substantial value during a broad economic recovery worldwide.

The 2017 Consumer Value Creator Series

- North American Airlines Take Off

- Can Traditional Retailers Counter the Online Threat?

- Capitalizing on the Demand for Durables

- Why Consumer Goods Companies Need to Build, Buy, and Broker

In 2017, The Boston Consulting Group conducted its annual analysis of total shareholder return (TSR), looking at 2,343 companies across 33 industry sectors, including 59 companies in consumer

If durables companies are to continue that strong performance, however, they will need to keep generating consistent, sustainable, and profitable sales growth, which is historically the biggest contributor to value. We believe three objectives will be particularly important in creating such growth: investing in digital product and service innovations, identifying pockets of consumer growth that are outpacing the rest of the recovery, and tapping into long-term trends in emerging markets.

The Top Ten

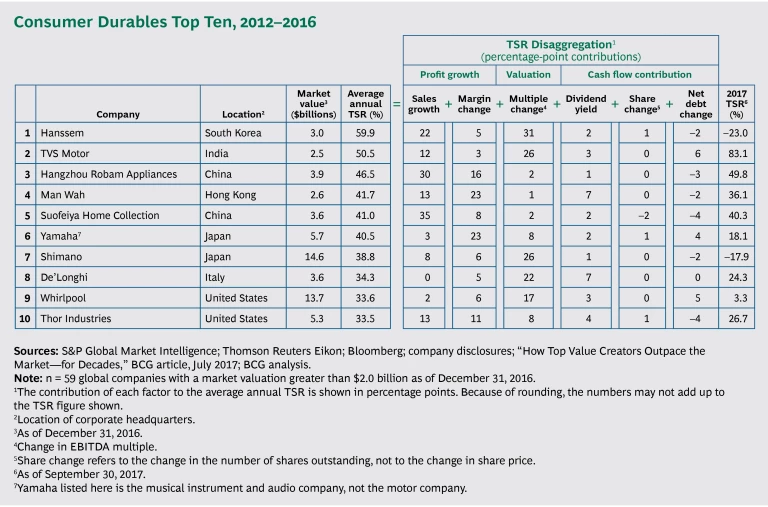

Of the durables companies in our analysis, the top ten delivered an average annual TSR of 41% from 2012 through 2016. The biggest factor contributing to this strong TSR performance was sales growth, at 12 percentage points (along with multiple expansion at 12 percentage points and margin improvements of 7 percentage points). Among the top ten value creators in the durables sector, six generated at least 10 percentage points of their total TSR from sales growth over the period of our analysis.

The robust sales growth in the sector is thanks to several encouraging trends during the past five years. Mature economies have stabilized, with a strong recovery in housing starts, sustained retail growth, and historically low interest rates. In the US, for example, housing starts in the third quarter of 2017 were 50% higher than they were five years ago, and existing home sales were 16% higher. This pent-up demand for housing has led to a positive growth environment for durables manufacturing companies such as Whirlpool—which finished ninth over the period of our analysis—as homeowners buy new appliances and renovate their homes after purchase. (See the exhibit for a full list of the top ten, as well as factors contributing to TSR.)

Along with the vigorous sales growth, emerging markets have helped to drive value. After a sharp spike in economic growth—and a subsequent return to earth—many developing markets are now on a trajectory of strong and sustainable growth. Four of the durables top ten are based in emerging markets:

- Hanssem, based in South Korea (finished first)

- TVS Motor, India (second)

- Hangzhou Robam Appliances, China (third)

- Suofeiya Home Collection, China (fifth)

In developed countries, the environment for discretionary purchases is increasingly favorable—particularly in the leisure category—courtesy of growing populations of people at or near retirement. Examples of companies benefiting from this environment include two Japanese firms, Yamaha (which finished sixth) and Shimano (seventh), as well as US-based Thor Industries (tenth).

A variety of tailwinds are likely to benefit the sector over the next several years. In developed markets, millennials are entering their prime years for home ownership, and people in most other demographic groups are continuing to nest—investing in their homes thanks to favorable interest rates. And in emerging markets, rising incomes have led to an expanding middle class that has a growing amount of disposable income. Both developed and emerging markets are likely to see a continued increase in demand for durable goods.

The Goal: Strong and Sustainable Sales Growth

Historically, sales growth has been the biggest contributor to value in durable goods as well as in most other sectors. Our analysis of these companies revealed three objectives that we believe will be important to generating sustainable increases in the demand for durable goods going forward.

Invest in digital product and service innovations. Digital technology is leading to dramatic improvements not only in durable products but also in new digitally enabled services that enhance the customer experience following the initial product purchase—and can lead to additional revenue streams. For instance, connected-home technologies have created new business models and ecosystems in many categories—from smart appliances to home automation to home energy management—and are changing what it means for companies to deliver a seamless purchase experience for consumers.

Hangzhou Robam Appliances is a good example. The company is rolling out new range hoods that include screens to display recipes. In addition, Hangzhou Robam offers technology that can automatically adjust the fan speed and burner temperature settings to match the recipe a customer chooses. And the company is exploring a grocery-shopping app that links to a logistics company that will deliver recipe-specific ingredients to a customer’s doorstep.

Identify pockets of consumer growth that are outpacing the rest of the recovery. The continued expansion of developed markets has made consumers more optimistic about trading up and making discretionary purchases. This has led to pockets of unexpectedly rapid growth, even in relatively mature markets such as the US. Take Thor Industries, which makes RVs. The company has seen its sales increase rapidly as customers upgrade to premium RVs with higher price tags.

Tap into long-term trends in emerging markets. Despite periods of turbulence in some emerging markets, the long-term demand fundamentals in countries such as China and India remain extremely attractive. Some multinationals have scaled back their investments in these markets, but local champions like Suofeiya Home Collection in China have been able to ride a wave of growth by developing products tailored to an expanding middle class that is making more discretionary purchases of home and leisure goods. Based in Guangzhou, Suofeiya posted extremely strong growth over the five-year period we analyzed. Of the company’s 41% average annual TSR, 35 percentage points came from sales growth, more than any other company in the top ten (and greater than most firms in all sectors we analyzed).

Similarly, TVS Motor in India—which makes motorcycles, mopeds, and scooters—is taking advantage of macroeconomic growth in Indian markets. The company’s sales have boomed, not only during the five-year period of our analysis but also into 2017. In the second quarter of 2017, the company increased its revenue by 18%, and before-tax profit grew nearly 27%.

Traditionally, the durable-goods sector has been a slow and steady performer in terms of value creation, but over the past five years, it has dramatically outpaced other consumer goods sectors. The leading durables companies in this year’s analysis offer a clear model for all manufacturers to follow. Strong and sustainable sales growth—in both developed and emerging markets, frequently through investments in digital innovation—is the key to creating long-term value for investors.