Don’t underestimate the power of mobility platforms. With digital interfaces in play, urban transport solutions will be delivered and consumed as a service in the future, accelerating the shift away from personal-vehicle ownership. They will also bring order to the plethora of mobility offerings, each with its own app, that are available today in many cities. And cooperation among different mobility players will be the key to their success.

Cooperation among different mobility players will be the key to their success.

Private transport companies, such as ride-hailing and e-scooter services, will link up with public mass-transit operators in order to establish intermodal platforms that give end users choice, simplicity, and a seamless travel experience, regardless of where they are located around the world. Savvy city planners will get in on the act, mining the travel data of individuals and vehicles collected by platform providers to meet municipal goals such as reduced traffic congestion and lower emissions.

But even with the best collaborations, someone needs to take the lead. Urban mobility platforms will be a global phenomenon but will develop differently in different regions. In the US, entrenched mobility providers such as transport network companies and ride-hailing firms will be in the vanguard. In Europe, individual cities will be the front-runners, helped by neutral integrators. And in China, Asia’s biggest market for new mobility solutions, local public-private partnerships will emerge.

These players will determine the future shape of the mobility landscape in their region, influence how various travel options are used, and ensure that there is a balance of public and private transport modes.

Mobility and technology providers that want to be part of this revolution in urban transport will need to adapt their strategies in response to regional differences. They will have to decide what role they want to play in the local mobility ecosystem and take proactive steps to achieve their ambition.

Urban Mobility Through a Regional Lens

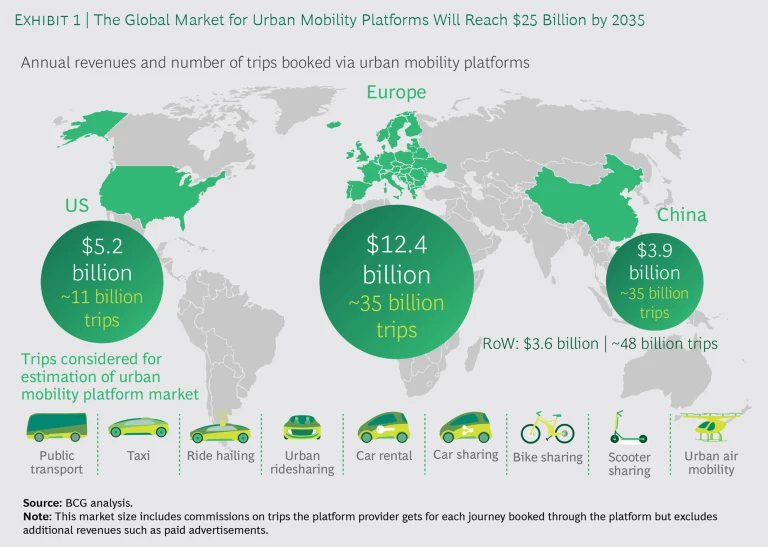

We estimate that the market for urban mobility platforms will be worth about $25 billion by 2035, split mainly between the US, Europe, and China. By 2035, end users in each of these regions will, on average, select and purchase tickets for about 400 trips a year via an urban mobility platform. (See Exhibit 1.)

Although platforms will be only a small portion of the global mobility-as-a-service industry, they will play a key role in urban transport systems, enabling providers to control the customer interface across multiple travel modes and steer customers toward different transport options.

The market for urban mobility platforms will total about $25 billion by 2035, with end users buying tickets for an average of 400 trips a year via these platforms.

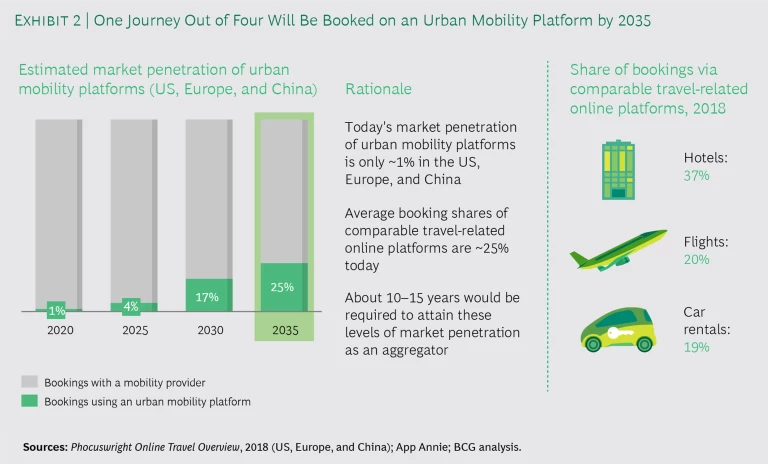

Here’s how we expect urban mobility platforms to develop in the key markets worldwide. (See Exhibit 2.)

US: An Amazon of Transportation. In the US, large mobility providers such as Lyft and Uber are expanding into new transport areas outside their traditional businesses. For example, Lyft purchased Motivate, the biggest bike-sharing operator in the US, a year ago and has rolled out electric scooters in several cities. Uber acquired bike-sharing startup Jump in January 2019, using part of its $1 billion investment budget. It has also expanded into the freight market. In May, Uber announced that customers in Denver would be able to pay for tickets on the city’s public buses and trains via the Uber app. And in recent months, CEO Dara Khosrowshahi has spoken publicly about how, by turning itself into a platform company with multiple mobility offerings, Uber could become the Amazon of transportation.

The endgame for such players is to offer users nationwide a variety of city-based public and private mobility options via their apps. The options will be optimized for individual travel preferences, real-time traffic situations, and weather conditions and will include last-mile transport, which takes travelers from their local bus or train station to their doorsteps.

By providing a comprehensive selection, these companies will become the de facto platform providers in cities across the US—though not, in our view, worldwide. Establishing market dominance will give them control over the customer interface and enable them to dictate the pace of future development. Municipal authorities, attracted by these providers’ compelling propositions, robust market positions, and strong brand loyalty from users, are likely to select the companies as preferred partners to develop new platform-based transport offerings in their cities. In time, these platform companies may share data—for a fee—that enables cities to meet their transport-related goals.

Strong US players will be prepared to cannibalize part of their core ride-hailing businesses in order to achieve the bigger goal of becoming a platform provider. They will leverage their customer bases in cities across the US to rapidly scale up their intermodal platforms and introduce high service standards in the process. Other mobility companies will join these platforms to access a growing pool of customers and will be drawn by the high standards offered by the platforms.

Given that the new platforms will be an attractive route to market for other mobility operators, we expect platform providers will be able to make money by selling their own transport services as well as charging other players a commission for being on the platform.

Europe: Cities as Mobility Orchestrators. European municipal authorities have watched from the sidelines as their cities have become swamped by new mobility offerings. In Berlin, for example, users can select from more than 20 services, including shared electric bikes, cars, kick scooters, and electric scooters. But many cities are now realizing that they need to take the lead in organizing these services into a cohesive and interconnected ecosystem in order to avoid chaos on their streets, simplify life for end users, and reduce the large volume of private cars in urban areas.

Europe’s heterogeneous nature—with diverse regulations, data standards, and priorities—will make it hard for large mobility providers to make significant inroads into the region. Furthermore, these players are likely to face strong resistance from city authorities worried that the companies will favor their own mobility offerings on the platforms at the expense of those offered by competitors.

European municipal authorities have watched as their cities have become swamped by new mobility offerings.

Instead, city authorities will value neutrality. They will select software companies that can impartially integrate different mobility players on a bespoke digital platform, leaving the authorities to decide how the platform will operate, who can join, and how to balance public and private transport modes. In 2016, for example, Helsinki chose Finnish technology startup MaaS Global to build an app-based mobility platform that simplified the commuter experience. The company has since rolled out its Whim platform to Amsterdam and Birmingham, England.

Successful platform providers will develop a white-label software product that caters to a city’s specific transport requirements and policies and carries its branding in order to succeed in the world’s biggest market for urban mobility platforms. Masstransit and new mobility companies will join such a platform because of its localized characteristics and appeal to a distinct customer base. But platform providers will design their products using standardized components that can be customized for different city archetypes so that their platforms can be more easily duplicated in new regions and urban areas.

The platform provider, on its own or in partnership with a city’s main mass-transit company, will operate and maintain the platform on a daily basis. In Berlin, Berliner Verkehrsbetriebe (BVG) is partnering with Trafi, a Lithuanian technology startup, to run the city’s Jelbi platform. Cities that operate their own urban mobility platforms will be the exception because they typically lack the necessary capabilities.

We expect the neutral platform providers that will dominate the European market to make the bulk of their revenues by providing software solutions to cities on an as-a-service basis. They may supplement their income, however, by charging mobility operators a commission and providing value-added services (such as location-based advertisements about nearby entertainment and recommended restaurants) to end users.

China: Public-Private Partnerships with Local Technology Giants. New Chinese mobility solutions have attracted huge private investments in recent years. But, for several reasons, urban mobility platforms in China will develop along a different path than they have in Europe and the US.

China’s government has prioritized the creation of smart cities that apply digital solutions holistically to deliver better transportation and other urban services. Chinese technology giants are investing in smart-city technologies, such as sensors and camera systems. For example, leading technology players are participating in the development of Xiong’an, an area in China’s northwest that is a flagship hub for several initiatives. As a result of this holistic approach, mobility platforms won’t evolve as a discrete business area but instead as part of a comprehensive smart-city agenda that will include digital infrastructure.

Chinese urban mobility platforms will develop along a different path than they have in Europe and the US.

Another reason for the differing dynamic: a handful of large domestic technology players—led by Baidu, Alibaba, and Tencent—dominate the Chinese urban mobility market. These same companies are also big investors in China’s online-payment providers, whose apps users access to pay for bike and scooter trips. For example, Alipay, a leading Chinese digital-payment service, is owned by Ant Financial (an Alibaba affiliate), while Alibaba is an investor in ride-hailing company Didi. Because a small coterie of private companies controls both mobility offerings and payments, Chinese companies face less market pressure to develop city-based platforms that combine these two functions across transport modes.

We expect these technology companies will lead the development of new mobility-related technology solutions, including intermodal platforms, as part of their ambition to become the preferred partner for the Chinese government’s smart-city agenda. They will form public-private partnerships with leading Chinese cities to develop, finance, and roll out the new solutions. Foreign companies (including software firms that provide routing or ticketing functionalities) will need to form deep supplier relationships with China’s technology giants, such as through equity investments, in order to be able to access the country’s mobility market.

Signs suggest that key players are putting in place the building blocks for future platforms: Baidu Maps and rival online-mapping service AutoNavi, owned by e-commerce giant Alibaba, have started to beef up their offerings. The companies, which already allow users to access a variety of ride-hailing services within their apps, are integrating more and more public transport options.

The Chinese companies that emerge as platform providers will generate revenues by charging retailers that want to advertise on their platforms or by providing fee-based value-added services to end users.

For a discussion of different ways that leading companies are changing urban mobility systems around the world, see the sidebar, “Three Current Approaches to Solving the Urban Transport Challenge.”

Three Current Approaches to Solving the Urban Transport Challenge

Three Current Approaches to Solving the Urban Transport Challenge

Leading regional players are adopting different solutions, and prioritizing different goals, as they seek to improve urban mobility systems.

Uber—a Player with Bold Ambitions

Uber has defined its own strategy for urban mobility by developing a closed platform that controls the options available to users. Founded in 2009, the company has moved far beyond its initial beginnings as an app-based automobile ride-hailing service, adding car sharing, electric bikes and scooters, mass-transit tickets, and freight services. The additions are in line with its ambition to become the global leader in mobility platforms. Unlike neutral platform providers, however, Uber selects which transportation companies’ mobility offerings are available on its platform in order to limit competition with its own offerings. Uber’s plans are unlikely, therefore, to include a shift to a fully open and neutral intermodal platform.

Whim—a Neutral Integrator for Cities

Helsinki-based MaaS Global’s Whim is one of only a handful of platforms that aim to integrate the full range of public and private mobility options within a city. Users can access these offerings via a single app. This combines both booking and payment, allowing users to select and purchase tickets for different types of transport through a digital interface. Whim also features a variety of pay-as-you-go and flat-rate fare options, including weekend and 30-day travel passes. The company’s stated aim is to reduce private-car ownership in European cities by encouraging city dwellers to use alternative forms of transport. Currently, users of the platform can choose between public transport, taxis, car rentals, bikes, scooters, and ridesharing.

Alibaba—a Technology-Driven Smart-City Partner

Alibaba is part of a small group of Chinese technology companies that are competing to provide smart-city services in China. Hangzhou in eastern China has implemented Alibaba Cloud’s City Brain project, and Kuala Lumpur and Macau have adopted similar Alibaba technologies. City Brain combines sensors with big data and artificial intelligence to analyze real-time traffic data and reduce congestion, improve travel times, and accelerate response times from municipal emergency services. By monitoring passenger density across the city, it enables mass-transit operators to match the supply of vehicles with the demand. Cities maintain ownership and control of their data, which is stored on Alibaba Cloud’s secure platform. In the medium term, the company could leverage its established infrastructure, data management capabilities, and experience in city planning to become an aggregator of urban mobility services and help manage city transport infrastructure.

Five Lessons for Platform Providers

Although mobility platforms will develop differently in different regions, our experience in the sector suggests that urban mobility platform providers will face several common obstacles in their efforts to establish a dominant market position. These will include reconciling the often conflicting agendas of participants in the urban mobility ecosystem, integrating mobility operators’ varied pricing models and approaches, consolidating legacy IT systems and data formats, customizing their platforms for local users while also replicating them in other cities, and finding ways to monetize their business model in an emerging global market where platform providers are still struggling to achieve profitability.

We believe that five imperatives are the key to tackling these challenges:

- Focus on users. Successful platforms will make urban mobility as simple and convenient as possible by offering a smart and seamless end-to-end travel experience.

- Remain impartial. Platform providers that act as unbiased brokers will gain the support of municipal authorities and mobility operators.

- Take an open approach to IT. Providers should keep the barriers to entry low and use common APIs (application programming interfaces) in order to encourage mobility operators and other stakeholders to join.

- Customize for local stakeholders. To flourish, platform providers need to tailor their offerings to local requirements by using a city’s branding and adapting to its transport systems and regulations.

- Facilitate scaling. Providers should adopt a standardized, modular approach to IT so that their offerings can easily be scaled up in new locations, and they should deploy cloud-based IT solutions that can be replicated elsewhere.

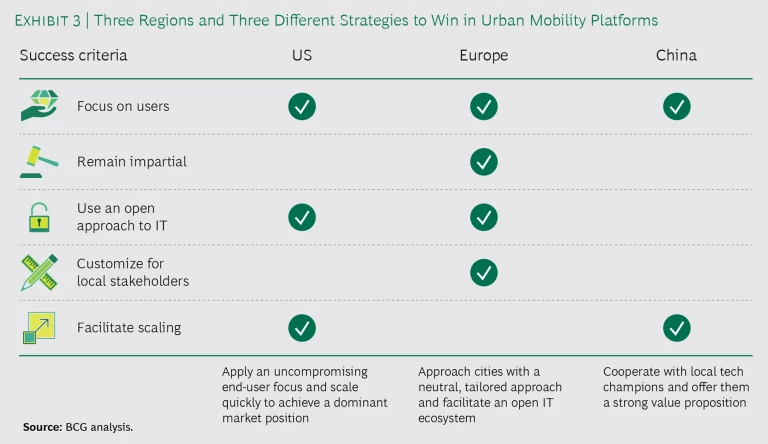

The relative importance of these factors will vary depending on the region, however. (See Exhibit 3.) In the US, where we expect established mobility players to dominate, maintaining a laser-sharp focus on end users and scaling rapidly across major cities will be especially important to building a strong market position. Because of European cities’ role as orchestrators of the urban mobility ecosystem, successful platform providers in that region will need to offer individual cities an impartial platform solution that is tailored to their needs, promotes an open IT architecture, and ensures full integration with existing public and private transport options. And to prosper in China, providers will need to combine every aspect of platform functionality in a fully integrated offering, prioritize user requirements, and build platforms that can easily be scaled up as necessary.

What It Will Take to Succeed in the Mobility Ecosystem

To be sure, these are only rough guidelines. Nevertheless, all players in the mobility ecosystem—not just platform providers—will need to adapt their strategies to local and regional dynamics depending on their current position and where they want to play in the future.

Cities. In Europe, cities aiming to be mobility orchestrators will need to actively shape the mobility landscape. They will have to build expertise and skills in areas where these are often lacking. For example, cities will need to learn how to effectively direct and regulate an array of new mobility providers, foster innovation, and resolve conflicts between players with differing agendas. They will also have to select private companies to partner with so that they can achieve their goals. In China, cities are already in a strong position to orchestrate the mobility ecosystem in partnership with domestic technology companies.

Mass-Transit Operators. Although city transport planners will decide platform priorities and balance private and public transport options, traditional mass-transit operators will continue to be the backbone of transport networks in most cities around the world. They should start a dialogue early with the key stakeholders in their region—whether these are US mobility players, European software providers, or Chinese technology giants—to ensure that future solutions maximize the benefits for users and that the necessary public funding and capabilities are in place.

Mobility Startups. New mobility operators should be prepared to adapt their business models so that they can achieve profitability even when they integrate their offerings into a city- or regionwide platform, relinquishing exclusive customer access. Scaling rapidly across multiple cities and establishing a firm market position will strengthen their ability to collaborate effectively with successful platform providers in their region.

Software Companies. Software developers of white-label platforms can also take proactive steps. They need to prioritize the countries where they can best succeed (particularly in Europe), identify cities that are potential customers, and work with them to create partnership and monetization models that will benefit the city and themselves. Developing a more modular offering and quickly replicating it across cities and countries will allow them to build scale and momentum.

Car Makers. Automobile manufacturers will need to prepare for the day when cities are a no-go zone for private cars owing to a combination of congestion fees and regulations. They will have to decide what role to play in the mobility ecosystem of the future. Leading car makers have the advantage of global footprints and large customer bases and could adopt a different strategy for each region so that they are an attractive partner for platform providers. For example, one option would be to operate and maintain large fleets of shared, autonomous vehicles in some cities.

Mobility platforms are the future of city transport. We expect platforms that aggregate public and private transport offerings will become an integral part of urban transport systems over the next decade. Different participants will need to be clear about the role they can play in an urban mobility ecosystem built around a digital platform. They must also be proactive and take the necessary steps to achieve their ambition. But without a global solution, players will have to be sensitive to fluid regional factors and dynamics. They must think locally, take a flexible approach, and be open to partnerships if they are to come out on top.