There has never been a better time to be a travel consumer, as new brands and innovative offerings continue to emerge all the time. But there has also never been a tougher time to be a travel executive—especially at incumbent companies. Those new offerings? They come from wave after wave of disruptive new entrants. In today’s environment, the traditional approach to understanding consumers—which focuses primarily on demographics and basic behaviors—no longer delivers the level of insight that companies need. Instead, companies need to understand what the underlying factors that influence a purchase decision are and how that decision can change, depending on a consumer’s context at the time of purchase and on the range of options available. Ultimately, companies will be in a better position to grow if they think less about what they’re trying to sell and more about what customers want to buy.

Over the past several years, companies in a number of other industries—most notably Identifying the Sources of Demand to Fuel Growth—have applied this approach, which we call demand-centric growth (DCG). Increasingly, travel and tourism companies are using DCG to crack the code of a more dynamic market characterized by greatly expanded consumer choice. The concept has broad implications for new products and brands, loyalty programs, M&A, and other key areas of company strategy. For incumbent travel and tourism companies, it offers a clear way to address a tough market that is changing faster than they can.

Traditional Solutions No Longer Work

By most metrics, the travel industry is thriving overall and continues to grow, but the news is not all good. Supply has exploded, due to growth among incumbent companies and recent entrants that offer a wider set of options—some entirely new to the industry. In the cruise industry, supply will outpace demand within the next several years. In the lodging industry, Airbnb and other shared-economy entrants have changed the rules of the game by putting private apartments and homes on the market, thereby reducing the demand for hotel rooms.

Established companies in all travel and tourism segments—airlines, cruise lines, and hotels—are struggling to tap into new growth or wrest market share away from competitors. They have tried various strategies, with little success so far. Here are some common examples:

- Choosing Quantity over Quality. Some companies have put near-term growth ahead of all other objectives, to the point where they can’t deliver a consistent experience.

- Overrelying on Unsustainable Advantages. Other companies have attempted to aggressively control supply—as when some airlines hold gate slots at airports in order to limit competition—giving themselves a high share of booking customers not because the customers prefer them but because the customers have no choice. It’s only a matter of time before regulations evolve and supply again increases to meet growing demand.

- Stretching the Brand Too Far. Still other companies try to be all things to all consumers—and end up being nothing to anyone because they lack a clear and differentiated position in the market. Think of a resort that offers guests a party scene but also touts family-friendly vacations. It’s hard to satisfy the full range of consumer preferences, especially conflicting ones. Companies that have tried to do so end up not being able to maintain any clear emotional connections to consumers.

- Joining the Race to the Bottom. It’s tempting to gain share by offering price discounts, but that game is expensive and difficult, and it is rarely sustainable. Price wars usually result in lose-lose outcomes—confusing customers and dissolving any nascent brand loyalty when brands inevitably try to recover by raising prices.

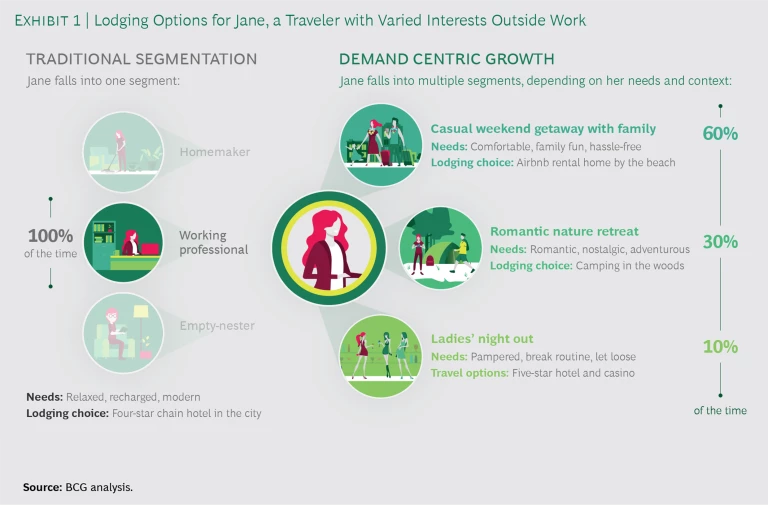

The common flaw in these strategies is that they lack a deep understanding of what consumers want, how their needs may vary from one occasion to another, and where they may look to meet their needs. (See Exhibit 1.) Often, customers have more options than companies think. For example, the Delta Shuttle connecting New York, Boston, Washington, and Chicago competes not just with other airlines but also with Amtrak. Airlines in Asia and Europe compete with high-speed rail lines. Cruise lines compete with each other and also with land-based vacations. A hotel company can no longer afford to focus exclusively on other hotels as its competition; it must also consider owner-rented homes as potential rivals. Evidently, the traditional frames of reference in travel and tourism are broken.

Clear Advantages from a New Approach: DCG

To understand how consumers make choices on the basis of their real-world frame of reference, companies need to look at customer behavior in a fundamentally new way. Specifically, they need to understand how demand can fuel growth, either by taking market share from competitors or by unlocking new sources of revenue. DCG establishes this broader consideration set by examining choices through the lens of demand versus supply. It takes into account the set of underlying consumer needs that companies may or may not be meeting despite the choices consumers make in response to available supply. In a supply-constrained world, for example, travelers flying from a hub city typically turn to the dominant airline—not because they want to, but because the airline’s more convenient flight schedules and connections effectively force them to. Finally, DCG appreciates that consumers’ needs and interests are not static, and it analyzes the unique circumstances that may drive travelers to make different decisions when planning different trips.

The DCG approach has several qualities that incumbent travel and tourism companies will find advantageous:

- Lasting. Unlike demographic-based marketing, DCG helps companies understand how and why individual consumers make their choices about travel, leading to a far more accurate and enduring picture of the market. At times, it can illuminate factors that even consumers themselves can’t articulate. The result is a much more sustainable approach to growth—one that is built on a simple yet comprehensive view of demand.

- Holistic. DCG looks at demand holistically, considering both existing and prospective customers, and both traditional and disruptive competitors. This encourages companies to devise a forward-looking growth strategy grounded not just in what is, but in what could or should be, shedding light on missed opportunities and potential white spaces in the market. In addition, by replacing a traditional brand-based market perspective with an outside-in approach, DCG provides an objective, customer-centric view of where a company stands relative to its competitors.

- Quantifiable. DCG helps companies quantify the opportunities that potential initiatives present, by assessing latent demand and competitive intensity. Only through this lens can companies understand their potential share of a consumer’s wallet and begin to shape a winning, customer-centric strategy. (See the sidebar “IHG’s New Hotel Brand Addresses an Unmet Need Among Budget-Conscious Travelers.”) By describing the opportunity in terms of actual numbers, DCG brings science to the art.

IHG’s New Hotel Brand Addresses an Unmet Need Among Budget-Conscious Travelers

IHG’s New Hotel Brand Addresses an Unmet Need Among Budget-Conscious Travelers

IHG, the parent company of such hotel brands as InterContinental Hotels & Resorts, Kimpton Hotels & Restaurants, Crowne Plaza Hotels & Resorts, and Holiday Inn Express, was looking for new growth in a portfolio that was already strong. Management was concerned about being fully saturated in the company’s largest markets. It used demand-centric growth to identify a clear unmet need among hotel customers: a mass offering that provided reliable quality in the form of a great night’s sleep in a clean, well-designed room at a fair price. (Current alternatives in the market were either at a price point higher than consumers desired for this type of travel or very unreliable in terms of quality and consistency.)

IHG repositioned its existing brands and offerings to minimize overlap, and then invested in the new hotel brand, which it called avid hotels. Key features include: rooms designed for sound sleep, featuring a “best in class” mattress and sleep experience; high-quality, complimentary grab-and-go breakfast with 24/7 bean-to-cup coffee; and public spaces with fresh, modern designs. This brand is designed for travelers who want a hotel stay that finally meets their expectations for the type of hospitality they value most—the basics done exceptionally well—at a per-night rate expected to be about $10 to $15 less than IHG’s industry-leading Holiday Inn Express brand.

IHG launched the new avid hotels brand in September 2017, less than a year after the start of brand development—an accelerated pace in the hotel industry. Today, there are over 170 executed licenses with franchisees to build and open hotels across the US, Canada, and Mexico, and IHG recently announced plans to expand to Germany. Credit Suisse described avid hotels as the “most significant addition to IHG’s brand stable in over 25 years” and upgraded the stock to “outperform” as a result.

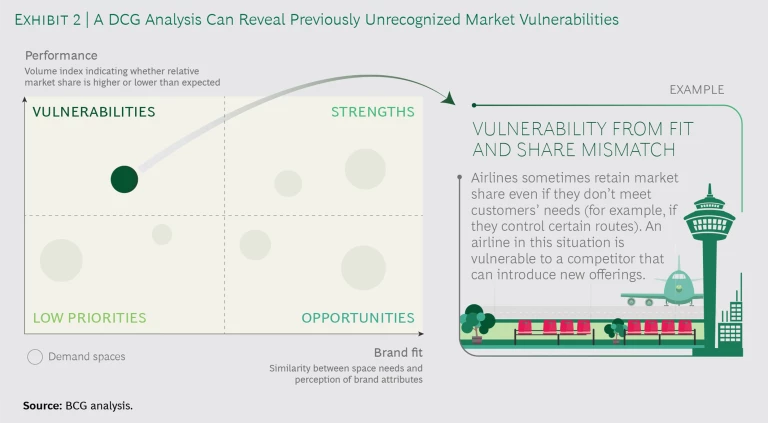

- Foundational. Establishing a baseline understanding of demand gives companies a north star and a common language to use in aligning the entire organization. It is not just a consumer strategy but a company strategy. After assessing the demand landscape and analyzing sales volume and brand fit, management might decide to launch a new route or a new service offering, acquire a competitor that has a stronger position relative to that target, or shift investment to areas where a brand may be vulnerable to attack. (See Exhibit 2.) Every touch point in the customer journey should reinforce the brand’s positioning. And the company should align every one of its internal aspects and functions—from pricing to sales and marketing to capacity planning to organizational structure—to execute the strategy successfully.

- Transformational. Finally, DCG helps companies assemble portfolios of complementary brands. As a result, they can determine what the right M&A strategy is, whether to launch a new brand, or how to design their loyalty program. (See the sidebar “Alaska Airlines Integrates a Customer-Centric Merger.”)

Alaska Airlines Integrates a Customer-Centric Merger

Alaska Airlines Integrates a Customer-Centric Merger

After Alaska Airlines’ parent company bought Virgin America in 2016, it faced some key questions about the postmerger organization. Should it keep Virgin’s brand (licensed from Sir Richard Branson’s Virgin Group) or operate under the 85-year-old Alaska Airlines brand? Should it strive to become a nationally relevant brand or stay focused on the West Coast, where Alaska and Virgin America were both well known? And how should it position the brand vis-à-vis the competition? The stakes were high: the $2.6 billion Virgin America acquisition was costly in relation to Alaska Air Group’s market cap of about $10 billion. As a company that has always centered around the customer, Alaska knew that it couldn’t make these decisions in the boardroom alone. Management needed to understand its customers.

The Alaska management team used demand-centric growth to identify several key insights. First, a deep customer analysis showed that Alaska had industry-leading customer retention and loyalty once customers got to know the brand, whereas Virgin America was stronger in customer acquisition but somewhat less sustainable long-term. (Virgin America did appeal strongly to some customers, but they were a relatively narrow segment overall.) That led Alaska to announce that the Virgin America brand would be phased out over time; the distinctive red and white aircraft would eventually all display Alaska’s smiling Eskimo. In terms of the route network, Alaska had very strong brand affinity among West Coast travelers, and its customers cared deeply about route coverage in those markets. Armed with these insights, the company ran some economic simulations that pointed to a clear answer: focus on the West Coast.

Second, the company looked at the landscape of demand and implemented a new customer strategy centered on the concepts “feel good” and “refreshed”—a differentiating positioning that leverages the strength of both the Alaska Airlines and the Virgin America brands while balancing what existing customers already love with areas for potential innovation.

To activate this strategy, after conducting a robust conjoint analysis with target customers, the company rolled out a campaign with the slogan “Different Works” and reprioritized investments into experiential aspects that airline customers truly care about: feeling good and refreshed. Elements of the campaign included everything from new loyalty policies to bolder entertainment investments to music in airport ticketing and check-in areas. The company also empowered employees to ensure that customer interactions were positive, caring, and true to Alaska’s core.

In 2018 Alaska Airlines—the only legacy US carrier to have avoided bankruptcy throughout its 85-year history—ranked highest in the J.D. Power survey of customer satisfaction among traditional carriers for the 11th consecutive year.

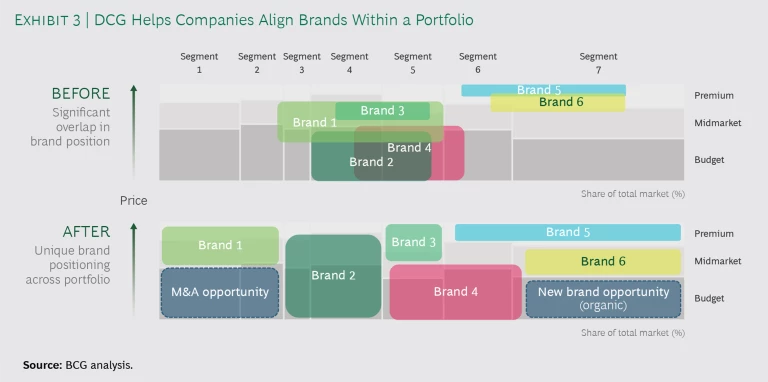

It can also give companies critical guidance on the optimal way to enter a new market. The approach goes beyond assessing the performance of individual brands to show how a portfolio fits together. When brands within a portfolio lack differentiation from one another, parent companies risk confusing customers and cannibalizing sales. (See Exhibit 3.) At the same time, portfolio companies often miss out on clearly identifiable white-space opportunities. Brands compete internally for resources, too, and misaligned incentives often exacerbate disputes. A demand-centric growth approach sets up brands to compete together, rather than against each other.

The travel and tourism industry is ripe for customer-focused innovation—and so far, new entrants are getting there faster. As choices proliferate and consumer behavior becomes more complex, traditional demographic-based marketing will no longer suffice. Incumbent companies can continue to focus on price or supply, and suffer disruption from new entrants, or they can start taking steps to become more customer-centric, starting with developing a better understanding of what truly drives their customers’ decisions. Demand-centric growth provides a foundation for that understanding by clarifying what consumers want at the moment of purchase—and why.