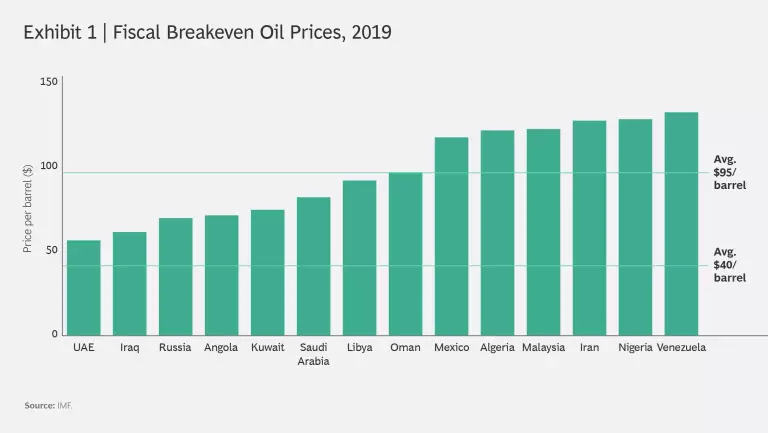

The collapse in the price of crude oil is putting immediate and severe financial pressure on producers that are heavily dependent on revenues from exports. None of the OPEC states balanced their budgets at below $50/barrel in 2019, with a number requiring more than twice that amount. (See Exhibit 1.)

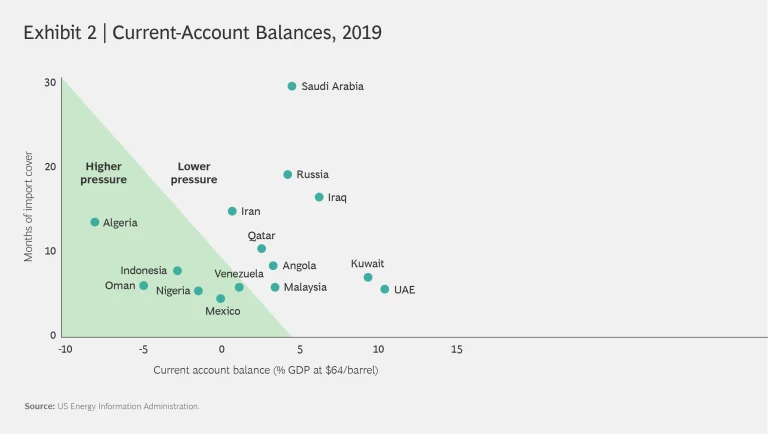

The price decline is also putting pressure on the balance of payments of many nations, especially those that were already running significant current-account deficits at $64/barrel. (See Exhibit 2.)

Many countries will therefore be forced to introduce significant budget cuts this year, and those with the scope to do so will lean heavily on foreign reserves to compensate for lost export revenue. The result will be an economic slowdown (and probably a recession), especially in countries where the public sector is a driver of growth in nonoil sectors. Moreover, foreign investors face the prospect of delays in payments and the cancellation of major government projects, including in the oil and gas sector.

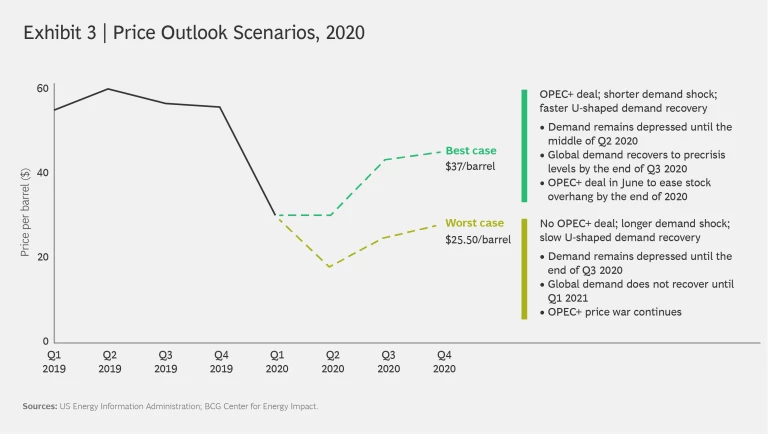

The short- to medium-term economic and financial outlook for oil-producing states will depend heavily on how quickly prices recover, which will in turn depend on whether OPEC and Russia can reach a new agreement on cutting output that reduces the supply overhang. (See Exhibit 3.) An OPEC+ agreement, even a massive one, is unlikely to restore prices to precrisis levels in the short term, given the scale of the demand shock that has occurred. Demand has fallen by as much as 15 mmb/d, and this figure has the potential to grow further in the near term.

Nevertheless, a major cut by mid-June, combined with a shorter-cycle economic and health impact of COVID-19, could see prices restored to more than $40/barrel by the third quarter of 2020, leading to an average price of around $37/barrel for the remainder of the year. By contrast, the absence of any action by OPEC+ and a longer-cycle crisis would continue to weigh heavily on prices for the rest of the year, with the average likely to be around $25/barrel—significantly below what countries and companies need in order to stabilize their finances.

About the Center for Energy Impact

The Center for Energy Impact (CEI) aims to engage a changing industry in new and different ways by providing challenging ideas to drive performance. We shape thinking about the future availability, economics, and sustainability of the world’s energy sources—and the implications for energy companies and their portfolios.