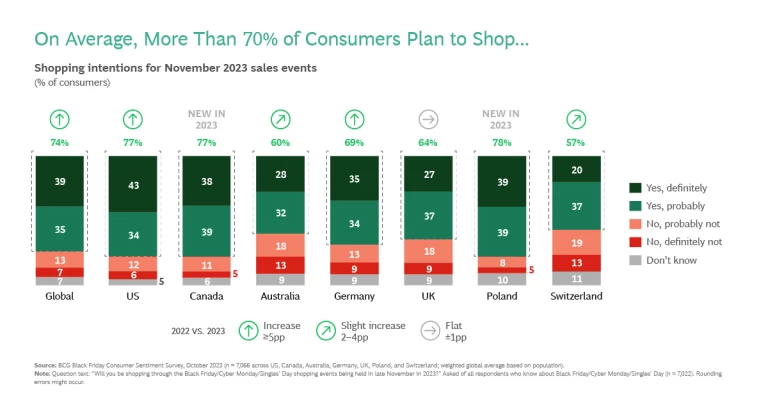

With the cost of living still pinching household budgets, 74% of consumers intend to take advantage of deals in November sales events this year—an increase of 7 percentage points over last year.

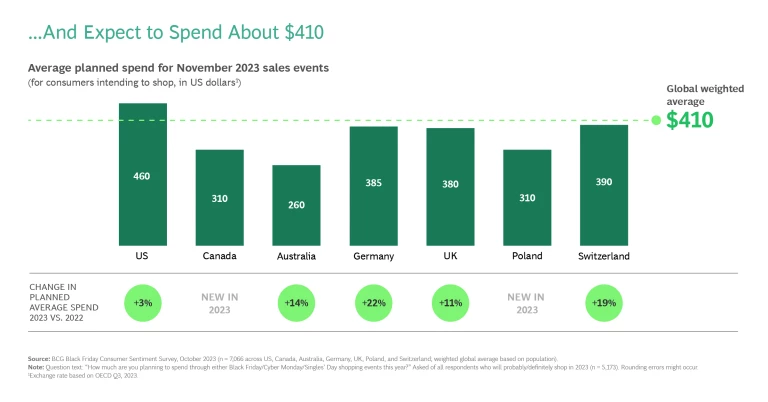

Over the course of Black Friday, Cyber Monday, and Singles’ Day, US consumers plan to spend the most ($460 per head, on average), followed by Switzerland ($390), and Germany ($385).

The average outlay is expected to exceed 2022—in some countries by as much as 22%. This record spending, while partly driven by year-on-year inflation, also reflects a growing focus on deal-hunting as consumers shift December holiday shopping to November.

BCG’s 2023 Black Friday consumer sentiment survey, released today, is based on the spending plans of more than 7,000 people in Australia, Canada, Germany, Switzerland, Poland, UK, and the US.

The So What

As many as 68% of consumers who intend to shop during November 2023 sales events will be looking for holiday gifts.

“Retailers should be aware that Christmas will again come early this year,” says Julia Hohmann-Altmeier, an associate director in BCG’s Marketing and Sales practice, and a coauthor of the survey. “The end of the season, just prior to the holidays, is likely to be muted. If you're not prepared for Black Friday this year, this will hurt you twice.”

Spending is not just expected to be higher than last year—BCG’s survey shows consumer behavior is shifting too:

- More than 50% have cut back on non-essential purchases in the past three months, 49% check and compare prices more frequently, and 41% buy more based on deals and promotions.

- November sales events are used less for discretionary or high-price purchases and more to cover basic needs. While adult clothing and consumer electronics are the most favored product categories, interest in the latter has fallen sharply compared with 2022.

- While Black Friday and Cyber Monday are best known, Singles’ Day—which originated in China—is gaining popularity in European markets in particular: It’s known by 56% of Polish consumers, 41% of Germans, and 37% of Swiss.

In every country surveyed, consumers are looking for price discounts rather than flash sales or early-access deals, free or reduced shipping, or bundled deals. Asked what would qualify as a “good deal”, consumers say they expect at least 30% off.

“As consumers feel pressure on their personal finances this year, they are more deal-focused than ever,” says Jessica Distler, a BCG managing director and partner, and coauthor of the study. “The challenge for retailers will be to stand out among the noise.”

Now What

To emerge as one of the winners in this changing and highly competitive environment, retailers need to act:

- Experiment with early visibility, like countdown trackers, or target loyalty program members with personalized offers. “Early-on targeting, leveraging your first-party customer data to reach and convert seasonal, lapsed, or current customers, is key,” says Hohmann-Altmeier.

- Adjust the mix of products and lines to match demand and emphasize categories that are particularly sought-after.

- Be sure to offer the big discounts that consumers are looking for—but be intelligent about it, to protect margins. “Take an end-to-end view to understand where you can provide a steep discount versus where you should be more leveled out, ideally with the help of advanced analytics,” advises Distler.

- Think omni-channel: with the mix of in-store and online purchasing that has re-emerged since COVID restrictions lifted, smartly connect all the touchpoints, message consistently, and manage inventory at various points of sale.

Download a copy of the survey here

Local data is available on request for Australia, Canada, Germany, Switzerland, Poland, the UK, and US.