More companies in more industries are experimenting with direct-to-consumer (DTC) sales. The appeal is clear. Bypassing distributors and forging relationships with individual consumers can enable companies to control the brand experience, capture valuable first-party data, and improve profitability.

But for many businesses, the economics of the DTC model are proving more complicated than expected. Instead of receiving a windfall from reducing their reliance on intermediaries, many companies have been surprised to see their margins clobbered by soaring costs and operational complexity.

A key reason for these difficulties is the transaction-centered DTC approaches that many take. These methods can be effective, but achieving profitable growth with them takes time. Our client experience suggests that a faster way to achieve DTC benefits is to use engagement-centered DTC approaches initially.

It’s Difficult to Go Direct

While the transaction-centered DTC approaches are winning converts in a growing number of sectors—including fashion, toys, automotive and electronics—they are still fairly new, and some companies have experienced growing pains. An audio product manufacturer was forced to halt its DTC effort when its showroom failed to generate sufficient sales. A beverage distributor that hoped to set up a home-delivery service has struggled to scale beyond its initial pilot. And a cosmetics company shuttered its two DTC stores after less than three years. Even pure-play DTC businesses with the digital advantages that come from being born on the web have struggled. Some have seen their market capitalization tumble by as much as 80% since their initial public offering.

The difficulty of achieving their financial goals has come as a surprise to many players. On the face of it, using transaction-centered DTC approaches should allow companies to capture higher margins, since going direct reduces distribution costs. However, gross margin improvements are usually offset by higher fixed costs and operational complexity.

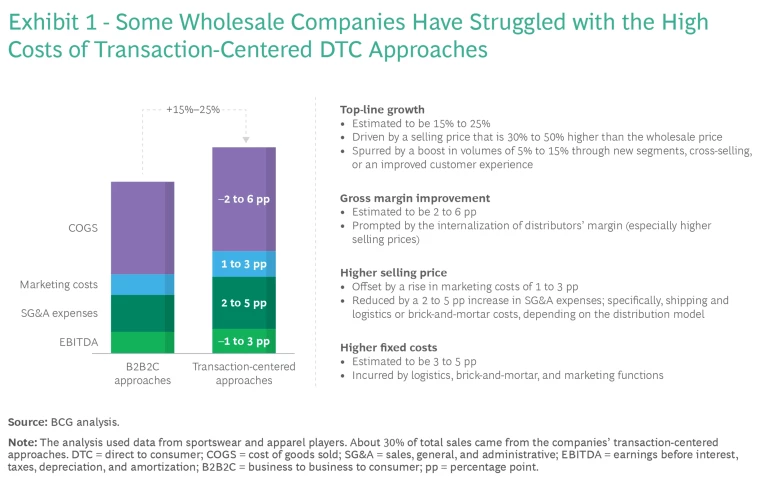

Our analysis of several footwear and apparel wholesalers that adopted transaction-centered DTC approaches found that marketing costs typically rose by 1 to 3 percentage points (pp). Sales, general, and administrative expenses grew by 2 to 5 pp, with most of that increase coming from higher shipping and logistics expenses (up 1 to 2 pp) and brick-and-mortar costs (up 2 to 4 pp). (See Exhibit 1.) There are a number of reasons why. For instance, the rise of cookie- and ad-blocking software and related privacy technologies have made it harder and more expensive for companies to build awareness, driving up customer acquisition costs. The pressure to provide free or heavily discounted shipping is another challenge, especially for companies that produce large, heavy, or perishable products. Yet, companies may feel locked into these practices in order to compete with the likes of Amazon and other digital giants.

We also found that for wholesalers that take transaction-centered approaches, earnings before interest, taxes, depreciation, and amortization (EBITDA) are often far lower than many hoped for, topping out from 9% to 14% for the sample we studied.

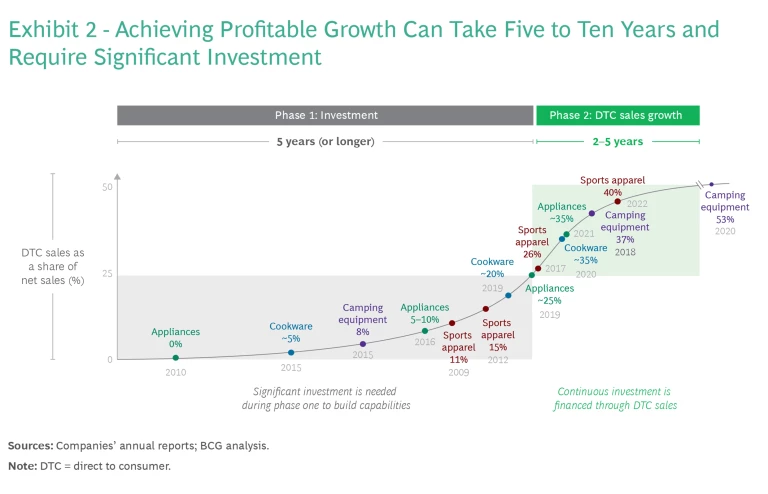

Adding another unwelcome surprise, the investment timeline to achieve profitable growth using transaction-centered approaches can be longer than companies expect. Although some companies have built profitable businesses using these methods, they were patient in doing so. Our research shows that it can take five or more years of sustained investment before companies hit their growth stage and start enjoying the benefits of scale. (See Exhibit 2.)

But the DTC model doesn’t have to be transactional in focus, and companies can often achieve many of the benefits of this model faster by approaching it differently.

Delivering the Benefits Without the Cost Pressures

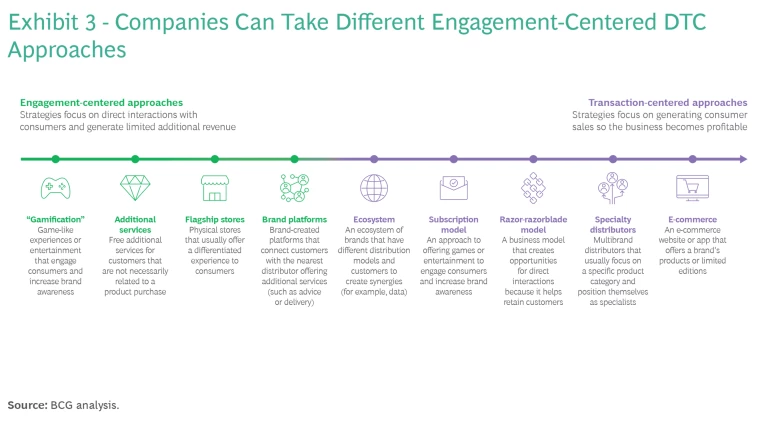

Although the DTC model is often seen as synonymous with e-commerce, leading practitioners have a broader goal in mind. They use it to drive engagement. While jump-starting DTC transactions can be part of that effort, engagement-centered DTC approaches often have no commerce component. The emphasis, instead, is on growing consumer interest, improving interactions, and gaining loyalty—recognizing that heightened engagement creates conversion momentum regardless of where it occurs.

Companies can take many different engagement-centered DTC approaches. (See Exhibit 3.) Colgate, for example, connects with parents and other consumers through Colgate Magik. The smart toothbrush has an app-enabled game that entertains kids, ensuring that they brush for the recommended number of minutes. Estée Lauder offers consumers complimentary skin care diagnostics, and Porsche set up pop-up boutiques in high-traffic locations to create new points of contact with the brand.

As some of these examples show, DTC efforts don’t have to be digital. In fact, as some successful DTC practitioners have discovered, launching physical stores, such as flagship showrooms, can be an excellent way to engage with consumers—and DTC leaders are continually raising their ambition. Lego, for example, has integrated DTC experiences inside its physical stores. These include one-on-one sessions that let consumers ask questions and get advice. They also include distinctive offerings, such as the Mosaic Maker experience that allows customers to create Lego self-portraits.

But while engagement-centered approaches can vary widely, effective ones do three things well:

- They enable ongoing conversations with consumers, leading to better, richer data.

- They use data to provide distinctive experiences, products, and services.

- They convert audience excitement into long-term relationships that grow customer value.

Together, these elements can set off a virtuous cycle. Offering rich and distinctive interactions can attract more interest. When consumers enjoy their experience, they are likely to return. And increased frequency drives loyalty, which ultimately supports stronger top-line sales growth.

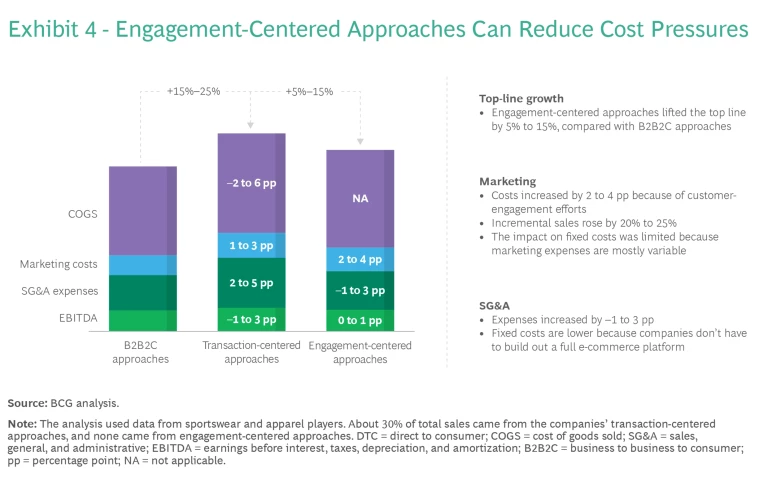

Crucially, using engagement-centered approaches can reduce cost pressures, since companies don’t have to build out a full e-commerce platform. Instead, expenses are largely concentrated in variable cost buckets, such as advertising, influencing, and other marketing investments that can be scaled up or down as needs require. (See Exhibit 4.)

Executing a Winning DTC Strategy

By approaching DTC sales through engagement-centered lenses, companies can capture data, shape the experiences offered to consumers, and drive profitable growth. But achieving these benefits requires executing in the right way. Here are the critical steps.

Create a differentiated value proposition. To avoid getting lost in a crowded marketplace, companies must give their target audience a clear reason to engage in the DTC model. For example, Dyson offers exclusive colors and attachments for some products in addition to the opportunity to buy products before they are available in stores. Nespresso offers loyalty and subscription programs, resulting in lower prices for customers. And Porsche’s boutique venues are designed to attract younger enthusiasts.

But while it’s crucial for businesses to think boldly and risk getting out of their comfort zone in order to be distinctive, they need to be clear-eyed about their starting point. Those just beginning their DTC journey will need to allow time to build consumer awareness and grow their audiences. This was the case for an electronics goods manufacturer; it committed to such an effort for five years.

Put data at the core. Given the importance of capturing consumer data across touch points, companies need to create feedback loops that enable two-way conversations. To aggregate all the comments shared on its brand websites and distributor platforms, for example, L’Oréal developed a semantic and quantitative analysis platform, powered by artificial intelligence (AI), that evaluates consumer reviews. Its consumer feedback loop is a digital dashboard that is updated in real time by the marketing and research teams and underpinned by custom AI algorithms. During the pilot phase, the platform analyzed more than 30,000 reviews a month in the US makeup category.

Stay ahead with BCG insights on marketing and sales

Shein has also invested in having two-way conversations with consumers. On the front end, it collects first-party data from social media engagement. When traffic is directed to Shein’s website, the company uses gamification to incentivize consumers to provide feedback, and then it mines that feedback to create personalized recommendations. On the back end, Shein uses real-time data analytics to validate purchasing trends, funneling insights into forecasting models that it then uses to automatically adjust inventories.

In addition to building strong data and analytics capabilities, most companies will also need to break down internal silos within their organization so that the collected data can be used across functions, including product development, promotion, and customer care. Launching agile teams organized around business use cases or clear value streams is usually a good starting point.

Organize with a startup mindset. To launch an innovative DTC effort quickly, some companies find it helpful to set it up as a business within a larger business. Nespresso took this approach. With the unwavering support from Nestlé’s CEO, Nespresso started as an independent unit, and it grew into a $6.5 billion DTC business with a 20% EBIT margin. Operating Nespresso as a self-sufficient DTC business unit simplified execution. Teams were given control over the DTC channel, allowing them to update the website and apps, as well as create and execute custom campaigns. Like startups, companies should learn how to engage consumers by doing it. Companies can start small, test their value proposition to ensure that the engagement being offered is sufficiently compelling, and grow from there.

Continually raise the ambition. Taking engagement-centered approaches can be the first step in a longer-term DTC journey. Having laid the foundations of the DTC model, moving toward transaction-centered approaches should become easier. Leaders can then begin to expand their vision, exploring new ways to advance direct engagement with consumers, protect valuable distributor relationships, and raise the competitive bar.

Using the DTC model as an engagement lever and not simply as a transactional tool can rewrite the economics of this new and vibrant model—enabling richer and more meaningful connections that can deliver sustained customer and bottom-line value.