Innovation in the consumer-packaged goods (CPG) industry presents a paradox. Most CPG companies fall short in innovation even though it plays a vital, widely acknowledged role in a sector marked by frequent purchases, shifting consumer and retail trends, and the ever-present threats arising from agile newcomers. This shortcoming leaves considerable value untapped, in both the intermediate and long terms.

Among CPG companies, an elite 20% stand out for their ability to leverage innovation to accelerate growth, enhance operations, and sustain a competitive edge, according to BCG’s latest Build for the Future Survey. Such outperformers demonstrate that a robust innovation function is both strategically and commercially beneficial. (See “About the Studies.”)

About the Studies

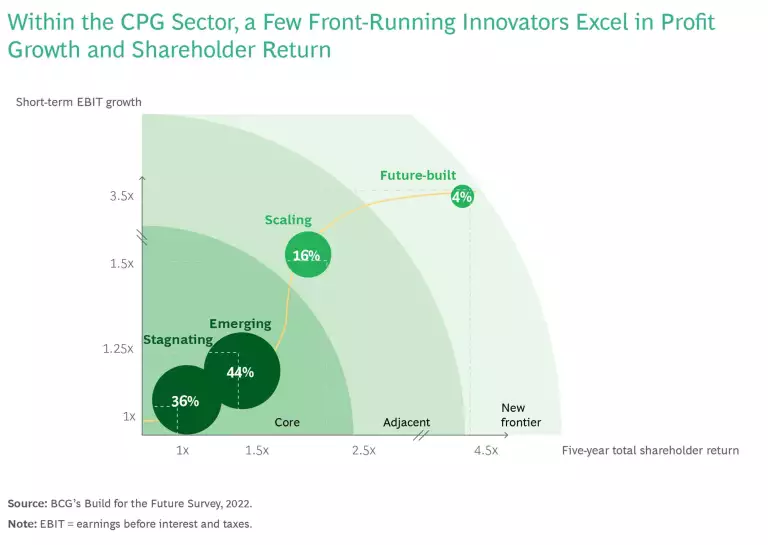

- Build for the Future Survey. The survey’s 2022 edition included input from more than 2,500 C-suite-level executives globally, across various industry segments, including 724 from the CPG sector. It probed areas such as how companies future-proof their performance, rate their current capability levels across multiple initiatives, and plan to allocate spending on digital topics and business outcomes over the next two to three years. To comprehensively examine companies’ preparedness for the future, the study utilized three years of longitudinal research across companies, insights from more than 70 BCG-supported digital transformations, and an assessment of more than 50 corporate factors—including short-term EBIT growth and five-year total shareholder return.

Most Innovative Companies 2023 Report. Based on analysis of more than 1,000 responses, including 68 from CPG companies, the 2023 edition of this annual survey explored the areas of innovation, R&D, and product development that companies are actively pursuing. It inquired into companies' top priorities and the clarity of their innovation vision. It also asked about their proficiency in utilizing big data, advanced analytics, and AI for innovation. The methodology combined a data-driven approach with expert insights.

These CPG front-runners have made a sustained commitment to innovation-related talent and disciplines, expanded ambitions and efforts beyond their core offerings, and continually experimented with new tools and techniques. Other companies must adopt these practices quickly to keep pace with evolving consumer and retailer expectations.

Defining the Innovation Imperative

A resounding 79% of CPG C-suite executives participating in BCG’s Most Innovative Companies 2023 Report rank innovation among their top three priorities for both driving growth and mitigating risk. But the performance metrics tell a very different story. According to BCG's Build for the Future Survey, the innovation maturity levels of 80% of surveyed CPG firms rate as “stagnating” or “emerging”—categories characterized by relatively low EBIT growth and five-year total shareholder returns. In contrast, the 20% that have achieved “scaling” or “future-built” levels see significant performance gains, outpacing the S&P 1200 threefold. (See the exhibit.)

Consumer-centric businesses often use innovation loosely to describe a broad array of initiatives. For greater precision, we define it as a capability, process, or discipline that achieves one or more of three objectives that outperforming companies master to drive value generation:

- Accelerating growth beyond core offerings through new products, services, experiences, or business models

- Enhancing operational excellence by adopting novel processes, technologies, and business models

- Future-proofing the business by preempting disruptions and obsolescence

Unfortunately, most CPG companies focus on short-term innovations for existing brands, which carry low risk and deliver easily measurable returns but yield limited rewards. According to BCG’s Most Innovative Companies 2023 Report, although a significant majority (79%) actively target product innovation, less than half (47%) aim for business model innovation, less than a third (29%) pursue deep-tech innovation, and more than half (56%) focus on go-to-market innovations. Furthermore, BCG’s Build for the Future Survey found that differences in successful scaling and integration of incubators provide a clear contrast between leaders and laggards: 72% of scaling and future-built companies have achieved such success versus just 17% of stagnating and emerging companies.

Overreliance on inorganic growth is another challenge. Historically, the CPG industry has favored M&A as a growth engine, lured by the promise of predictable, significant, and rapid top-line scaling benefits, as well as by low interest rates. However, rising interest rates have altered the risk profile of dealmaking. Recent figures show a change in course, with M&A in the CPG sector declining at a CAGR of 15% from 2018 through 2022. In light of the rising costs and challenges associated with successful M&A in the foreseeable future, CPG companies need to adopt a more comprehensive and expansive approach to growth. Consumers expect this evolution, retailers rely on it, and shareholders demand it.

Consumers and Retailers Demand Innovation

Although the consumer sector may seem stable on the surface, it constantly evolves in behavior, preferences, and technology adoption. Consumers show a keen interest in new products and services that cater more closely to their needs, underscoring the importance of delivering compelling offers and personalized options.

Despite their more limited resources, smaller competitors are outperforming large CPG companies in meeting consumer demand for innovative products. According to Circana's New Product Pacesetters Top 200 list, medium-size companies (those with valuations from $1 billion to $6 billion) represent 35% of Circana's Pacesetter dollars, marking a 15-percentage-point increase since 2021.

Retailers are focusing on innovation, too. The Advantage Sales Retailer Outlook Study, conducted in June 2023, found that 72% of retailers planned to expand their efforts relating to private label brands in the next six months to better address post-pandemic economic changes.

Major retailers, including Walmart, are taking steps to quickly adjust their inventory to better reflect consumers’ current preferences and finances. Emerging trends suggest that consumers are leaning toward reducing pantry stock, minimizing waste, and opting for out-of-home dining, especially as costs for in-home food increase disproportionately.

Three Ways to Leverage Innovation for Growth

There is a timely and compelling case for CPG companies to double down on growth through innovation. Macroeconomic factors, business advantages, cultural benefits, and evolving consumer and retailer expectations combine for a clarion call to action. CPG companies should respond by adopting three critical practices of industry leaders:

- Commit to and cultivate innovation-related talent and disciplines.

- Diversify beyond core offerings.

- Apply new tools and techniques in transformative ways.

Commit to and Cultivate Innovation-Related Talent and Disciplines

Turning consumer-centric ideas into profitable business concepts demands a blend of strategic thinking, creativity, collaboration, and analytical capabilities. CPG companies must commit to cultivating and sustaining an innovation function that encompasses “north star” strategic ambitions, exceptional talent, dedicated capability building, efficient processes, discrete measurement, and effective governance. All too often, the needed resources are embedded in existing business functions, thereby limiting their ambition, scope, and impact.

BCG has analyzed, measured, and codified best practices in the course of working with 46 of the world’s 50 most innovative companies. We found that committing to growth through innovation enhances efficiency and consumer-centricity and promotes significant, predictable business impact.

Diageo has demonstrated this commitment in pursuing its ambition to shape and lead the rapidly expanding nonalcoholic spirits market. The company’s diverse strategy includes building, buying, and partnering. It complemented initial investments in Seedlip and Ritual (made via Distill Ventures, an accelerator that backs startup spirits companies) with R&D and innovation efforts. These initiatives came to fruition with the introduction of Tanqueray 0.0, Gordon’s 0.0, Guinness 0.0, and Captain Morgan 0.0, enabling the company to establish category leadership in its priority markets.

Diversify Beyond Core Offerings

CPG companies that successfully expand beyond their current core offerings employ clear strategies that pinpoint where and how to win. They establish fit-for-purpose teams, ways of working, and success metrics that delineate and protect initiatives associated with core, adjacent, and next-frontier innovations. Such strategies and discipline are critical to ensuring the success of each effort.

PepsiCo has deployed a multifaceted approach to expand its innovation agenda, tailoring distinct innovation teams and processes to deliver close-in extensions of existing brands, introduce new brands (such as Bubly and Starry), and foster partnerships (such as with Starbucks and Celsius). In addition, Pepsi Labs has pioneered initiatives responsible for a dynamic pipeline that promotes growth in core, adjacent, and new-frontier segments.

Apply New Tools in Transformative Ways

Innovation leaders, as defined by our Build for the Future Survey, are 60% more likely than their peers to launch new ventures and 70% more likely to engage in startup incubation. They typically use AI and machine learning across multiple initiatives.

Leading CPG companies are actively experimenting with transformative AI applications. Nestlé, Campbell’s, Mars, Givaudan, PepsiCo, and other pioneers are reportedly using a generative AI platform called Tastewise to help them validate new product concepts and generate market research reports. For its part, Coca-Cola was among the first companies to use OpenAI’s generative AI technology for marketing and consumer experiences, and it continues to experiment with these tools.

Several CPG companies have been acquiring, building, and expanding AI capabilities in recent years, and their moment to integrate this technology with their approach to innovation has arrived. An example is L’Oréal's Modiface, a digital skin diagnostic tool and personalized beauty regimen technology rooted in 15 years of scientific research. Having acquired the technology in 2018, L’Oréal is now scaling it by integrating it into Amazon shopping experiences and virtual makeup sessions with Microsoft. The company has also launched an AI-driven trend-spotting tool that scans more than 3,500 online sources—including social media platforms, search engines, and beauty blogs—to identify current trends and emerging signals.

The future favors CPG leaders and organizations that consistently and effectively harness growth through innovation. Such growth requires a thoughtful blend of institutional commitment, strategic partnerships, and technology adoption. Rather than relying on isolated projects, this approach operates as an interconnected ecosystem in which innovation is important to every function. Companies that master the approach will be better equipped to navigate economic turbulence, emerge resilient, and deliver superior total shareholder return. For CPG companies, effective innovation is not merely nice to have—it is a strategic imperative.