Over the past year, M&A dealmakers have confronted their most prolonged challenges since the 2008–2009 financial crisis. Rising interest rates, geopolitical tensions, and recession fears led to a sustained downturn in deal activity that bottomed out in the first quarter of 2023.

Since that low point, however, an increasing number of dealmakers have returned to the negotiating table, albeit with heightened caution. M&A activity appears to be stabilizing, with some regions and sectors rebounding faster than others.

Moving forward, savvy buyers and sellers will continue to use M&A to generate value, even in unfavorable conditions. As we have previously discussed, downturns can be good times for deal hunting. Beyond traditional motivations, sustainability and digital initiatives remain pivotal drivers for both acquisitions and divestitures. Moreover, capital scarcity—a novelty for many of today’s dealmakers—will likely spur transformational deals to enable companies to reshape their corporate portfolio or enter higher-growth sectors.

M&A in 2023 Is Slowly Recovering

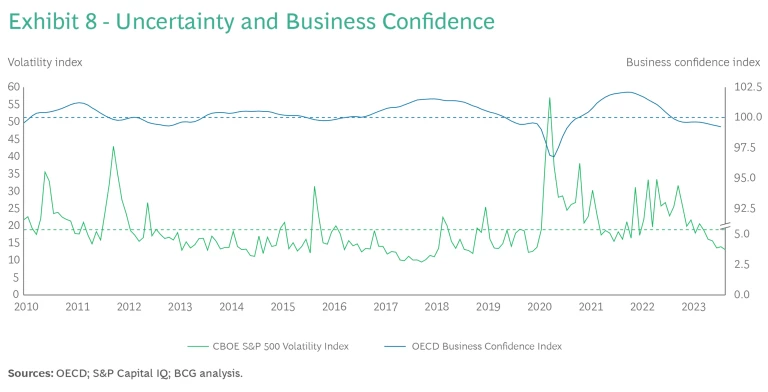

In the wake of the M&A frenzy of 2021 and early 2022, dealmaking during the latter half of last year and the first eight months of 2023 was disappointingly subdued, to say the least. (See Exhibit 1.) Through the end of August 2023, year-to-date, companies had announced approximately 21,500 deals, with a total value of $1.18 trillion. Deal volume fell by 14% compared with the same period in 2022, and deal value plummeted by a staggering 41%.

The sharp decline followed an exceptionally busy period for dealmaking in 2021 and the first half of 2022. After the disruptions of 2020, the post-pandemic rebound was in full force in 2021, as volume reached approximately 41,000 deals—28% higher than in 2020 and 18% higher than in the pre-pandemic year of 2019. In 2022, however, deal volume was already 9% lower, with 37,000 deals announced, and deal value declined by 38% to $2.7 trillion after totaling a remarkable $4.3 trillion in 2021.

The persistent dip in M&A activity since the first half of 2022 was evident across regions. Markets such as India, Taiwan, Italy, and Romania showed slightly more resilience while the US, Canada, France, and Germany took a harder hit.

The most active sectors for M&A in 2022 were energy, power, and resource industries, including renewables, metals and mining, and—especially—construction, packaging, and other materials sectors. All consumer sectors, as well as financials, media, and telecommunications sectors, saw decreased activity, although tech dealmaking has remained relatively active. The health care sector experienced a drop in deal activity this year, too, but it has maintained consistent M&A momentum, especially in Europe.

Private equity (PE) and venture capital (VC) have seen dramatic declines in deal activity. After the dealmaking spree of 2021 and early 2022, factors such as rising interest rates, tighter financing conditions, and broader economic uncertainties curbed much of the appetite for new investments. Even existing investments saw sharp devaluations, with numerous “down rounds” for VC-backed companies.

Middle Eastern and other sovereign wealth funds, along with the companies they back, have bucked this trend. Flush with capital and liquidity, they are investing across regions, sectors, and themes. They have adopted diverse, long-term strategies to diversify away from natural resources and support the growth of their national economies.

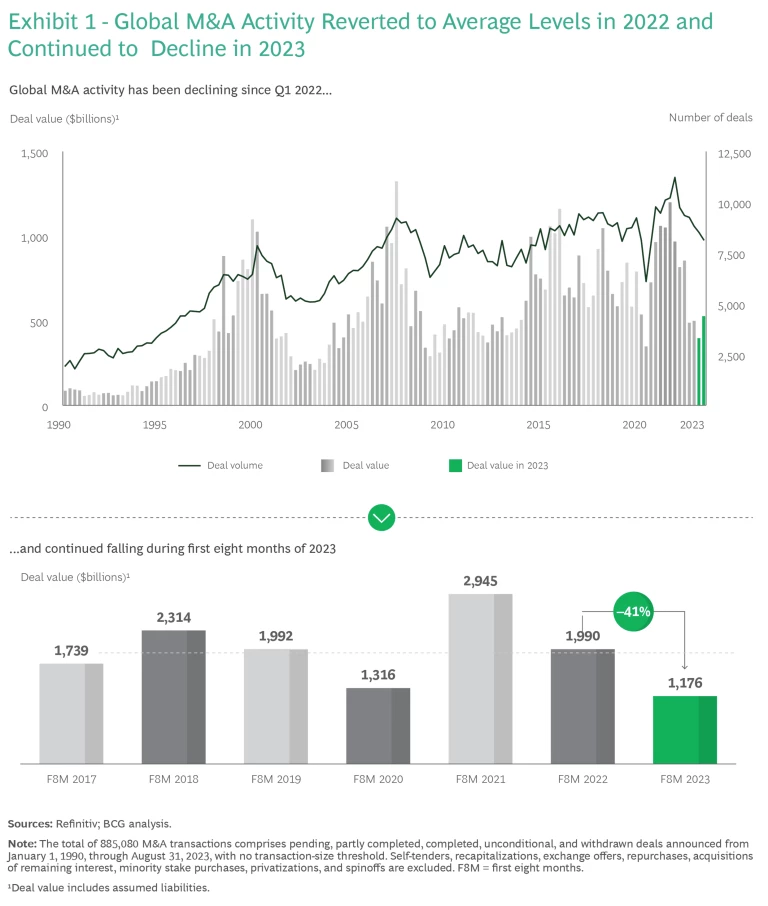

Like overall M&A activity, the number of large deals (those valued at over $500 million) fell sharply in 2022 before finding a bottom in the first two months of 2023. This decline mirrored a diminution in overall business confidence, evidence of the challenging economic environment. (See Exhibit 2.) In recent months, the volume of large deals has gradually reverted to average levels.

Similarly, the number of megadeals (those valued at more than $10 billion) has dwindled. Companies reported only 17 megadeals in the first eight months of 2023, compared with 27 during the same period in 2022. The entire year of 2022 saw 33 megadeals, a decline from 50 in 2021.

As of September 2023, the year’s five largest deals were as follows:

- In March, Pfizer agreed to acquire Seagen, a biotech company focusing on monoclonal antibody-based therapies for cancer and autoimmune diseases. The all-cash transaction is valued at $43.8 billion.

- In April, Glencore announced its unsolicited proposal to merge with Teck Resources, with a deal value of $31.4 billion.

- In September, Cisco Systems agreed to acquire Splunk, a developer of data insight and observability platforms, in a deal valued at $28.1 billion.

- In May, the year's largest transaction involving a special-purpose acquisition company (SPAC) was announced: the proposed merger between VinFast Auto, an electronic vehicle manufacturer and exporter, and Black Spade Acquisition, a Hong Kong–based SPAC. The buyer intends to list in the US, and the deal's value stands at $23 billion.

- Also in May, ONEOK agreed to merge with Magellan Midstream Partners, a US-based provider of pipeline services for refined petroleum products. The deal is worth $18.6 billion.

Near-Term Drivers of M&A

Dealmakers that are returning to the negotiating table continue to grapple with uncertainty in a challenging environment characterized by persistently above-average inflation, higher interest rates, heightened market volatility, fears of recession, and geopolitical tensions. Amid these challenges, we see several near-term drivers of M&A activity.

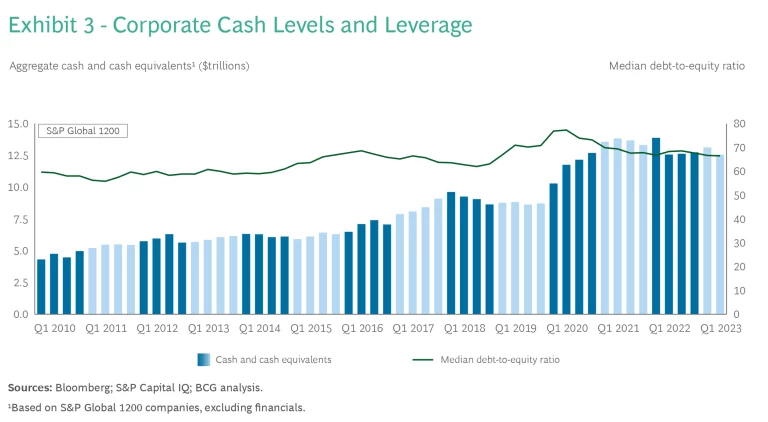

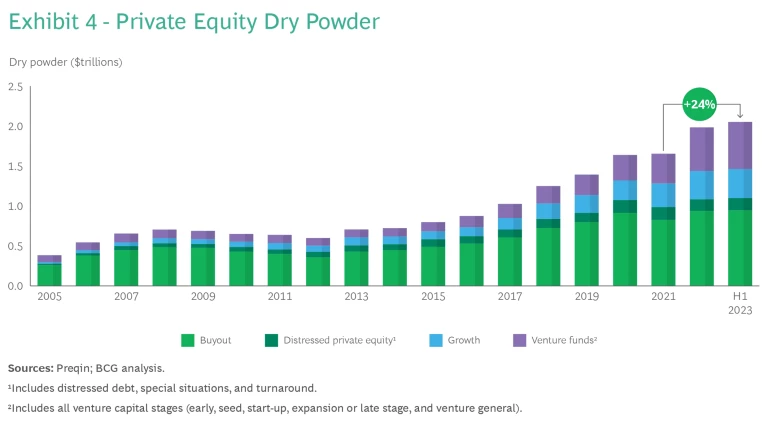

Abundant Dry Powder. Although capital has become more expensive, abundant capital remains available from sovereign wealth funds, PE and VC investors, and some large companies—including technology titans and companies backed by sovereign wealth funds—that are flush with cash and boast strong balance sheets. These factors will bolster dealmaking in the near term. (See Exhibits 3 and 4.) For example, the cash-rich Abu Dhabi National Oil Company has made an offer to acquire German chemicals company Covestro.

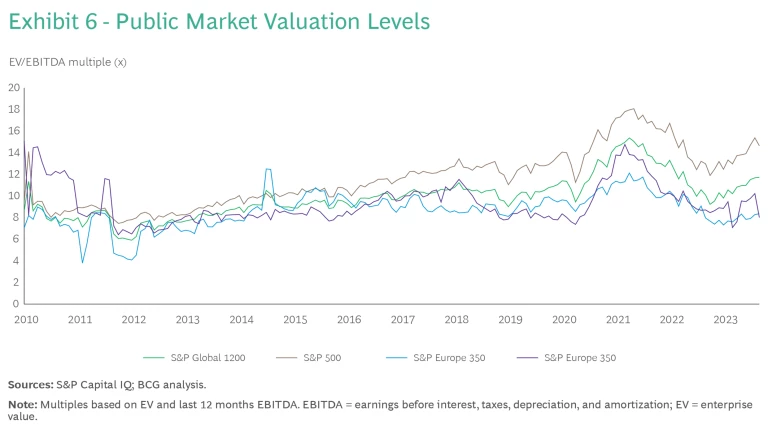

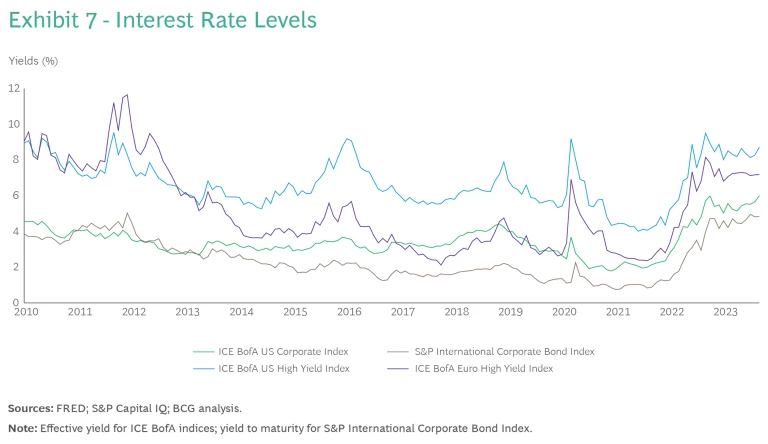

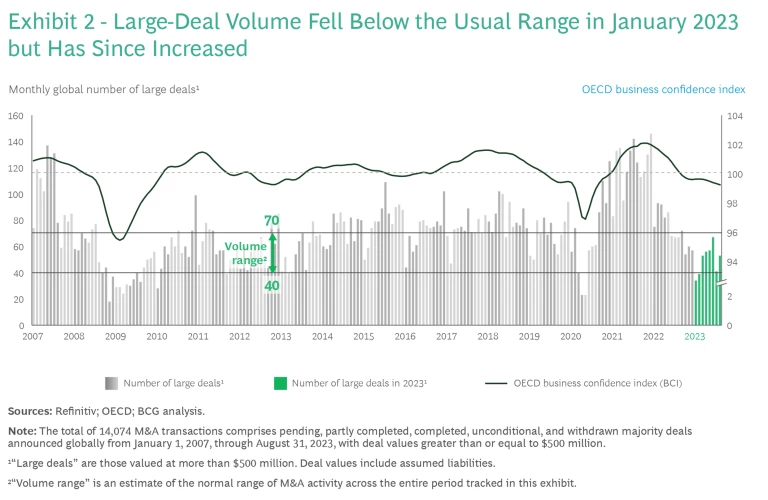

Converging Price Expectations. Disparities between sellers' and buyers' pricing expectations have impeded dealmaking during the past year, especially in light of the abrupt and rapid changes that have occurred in the market environment. However, many factors that influence prices—such as valuation levels, financing costs (that is, interest rates), and uncertainty—appear to be stabilizing. (See Exhibits 5 through 8.) As a result, we expect the gap between sellers’ and buyers’ expectations to continue to narrow over the next few months.

Lower valuation levels may also spur an uptick in transactions to take businesses private and possibly in hostile takeovers once executive confidence increases. Coupled with a more stable economic and market climate, this scenario offers ripe opportunities for activist shareholders who are dissatisfied with company performance. This is evident in a heightened level of shareholder activism in 2023—not just in the US, but also globally.

Evolving Regulations and Policies. Increasingly, changes in regulations and policy are influencing M&A activity. Traditional antitrust regulations often complicate larger deals, especially for major technology companies. Dealmakers must also overcome hurdles involving foreign direct investment regulations, national security considerations, and sanctions. Moreover, M&A processes are now under greater scrutiny as a result of data and privacy protection laws, cybersecurity issues, and ESG and climate change regulations. The impact of these factors varies significantly by country. On the other hand, deals under antitrust scrutiny often spur companies to pursue divestitures as remedies to counter these concerns.

A prominent example is Microsoft's planned acquisition of Activision Blizzard for $75.6 billion. The deal, announced in January 2022, faces stiff opposition from the US Federal Trade Commission (FTC) and the UK Competition and Markets Authority. On the other hand, the European Commission approved it after Microsoft addressed the commission’s concerns and accepted various specific conditions, indicating that regulatory agencies’ perspectives are not always fully aligned. Another example is Amgen’s decision to postpone the completion of its $27.8 billion acquisition of Horizon Therapeutics until September 2023 because of a legal challenge brought by the FTC.

The Pursuit of Resilience. Efforts to strengthen supply chain resilience, such as through regionalization strategies, may indirectly influence M&A, as dealmaking can facilitate these goals. Terms such as onshoring, reshoring, friend-shoring, and glocalization are likely to remain in the business lexicon for the foreseeable future. Cross-border activity is likely to surge, with dealmakers placing greater emphasis on companies in nearer and more economically developed countries. M&A and divestitures can also be part of a company’s toolkit to improve its organizational, operational, and financial resilience.

ESG and Digitization Will Continue to Influence M&A

Beyond near-term concerns and pursuits, two prominent factors—ESG and digitization—will continue to promote dealmaking across most sectors in the medium and longer term.

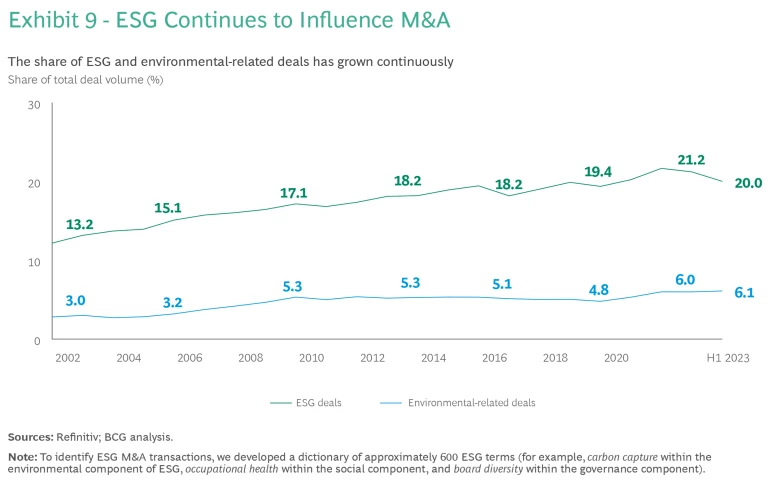

ESG. BCG’s 2022 M&A Report delved into the role of ESG in M&A, with a particular emphasis on “green dealmaking." The share of deals related to ESG in general and to environmental considerations more specifically has grown steadily over the past two decades. (See Exhibit 9.) This trend will continue to drive M&A as companies try to acquire capabilities and assets that address decarbonization, the energy transition, clean tech, and the circular economy.

For example, ExxonMobil's acquisition of Denbury Resources for $4.5 billion illustrates the US energy giant’s ambition to expand its presence in the carbon capture and storage sector. Similarly, the Swiss industrial conglomerate Georg Fischer acquired Uponor, a Finnish producer of household and industrial products, for $2.2 billion—a move that supports Georg Fischer's strategy to become a global frontrunner in sustainable water and flow solutions. Another noteworthy deal is the planned formation by automaker Stellantis of a joint venture with metals recycler Galloo for end-of-life vehicle recycling. This is a step toward increasing both companies’ circular economy activities.

Although the influence of ESG on dealmaking is most evident today in the energy real estate, industrial, and automotive sectors, the topic is becoming increasingly important in the consumer and financial sectors as well. Financial sponsors have amassed ESG-linked dry powder—funds earmarked for investments that align with ESG criteria.

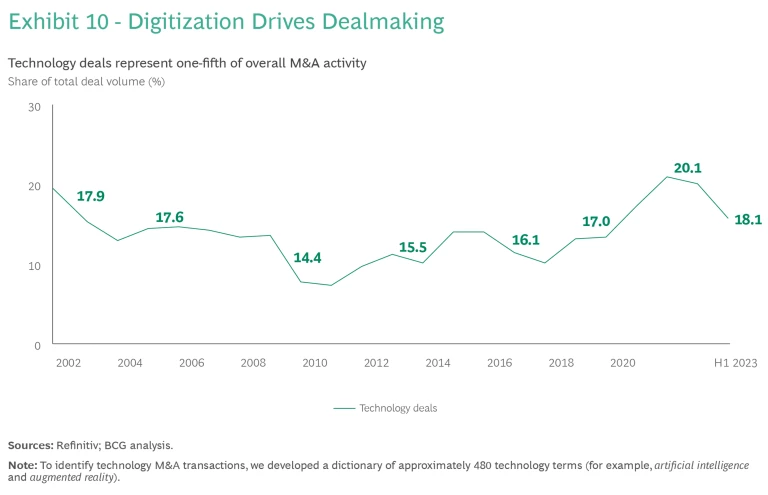

Digitization. The ongoing push for digitization remains a primary driver of deals. (See Exhibit 10.) In light of recent advances in related technology and digital areas, including generative AI (GenAI) and robotics, we expect acquisitions that focus on technological solutions and capabilities to remain key drivers of M&A.

Notably, Microsoft’s investment in OpenAI, the company behind ChatGPT and DALL-E, caused a spike in activity in this sector. In the GenAI domain, Databricks—which owns Dolly, an open data-based large language model (LLM)—acquired MosaicML, which developed two open-source LLMs, in a deal valued at $1.3 billion. Similarly, Snowflake bought Neeva with the intention of integrating that company’s GenAI technology into its own data warehouse platform.

Another emerging trend is "acquihire" deals. Here, the primary motive is to acquire the target company’s expertise and talent pool, rather than simply to acquire its products or services. This is often the underlying rationale for a large tech firm to buy out a smaller competitor or startup known for its skilled and innovative workforce.

Looking Ahead: Capital Scarcity Motivates Transformational Deals

In an environment in which the higher cost of capital and more conservative valuations make capital scarcer, we anticipate an uptick in transformational corporate deals. These deals will focus on reshaping the corporate portfolio or on making acquisitions that support or enter higher-growth sectors.

Strategic portfolio reviews will take center stage, prompting corporate restructurings and carve-outs. Decisionmakers, faced with more stringent capital allocation choices, will likely explore potential divestitures to finance investments in growth areas. Other companies will seize the opportunity to consolidate their markets or expand into adjacent fields that have more promising growth trajectories.

Financial sponsors, currently navigating challenges in securing financing for some larger deals, must also adapt to the evolving financing landscape and changing valuation levels as they seek to deploy their dry powder while ensuring value creation. Some of them may explore alternatives to conventional majority acquisitions. This effort might involve engaging in more creative deals and alternative structures, including co-investing in corporate subsidiaries, making minority investments, or proactively seeking corporate carve-outs.

In a companion piece to this article, titled “2023 M&A Report: The Regional Perspective,” we present views from our experts around the world on regional trends in M&A. Then, in “2023 M&A Report: Bold Moves for Dealmakers in Volatile Markets,” we explore the capabilities that allow experts to use acquisition and divestitures as potent tools for transformation amid uncertainty. Simply put, experience matters when it comes to pursuing M&A in tough environments. Expert dealmakers can direct their efforts more effectively because they have built the capabilities required to take a creative—and bold—approach to M&A.

The authors are grateful to Professor Sönke Sievers, Chair of International Accounting at Paderborn University, and Tobias Söllner and Yiran Wang of BCG’s Transaction Center for their valuable insights and support in the preparation of this article.