Although the M&A environment is stabilizing after a rocky 12 to 18 months, dealmakers continue to face challenges. High levels of uncertainty, rising interest rates, and geopolitical tensions have eroded business confidence, leaving capital scarcer and more costly. Banks are less willing to finance deals, and equity investors are more cautious and expect higher returns.

These tough conditions naturally discourage many potential dealmakers, but experienced hands are not deterred. Expert dealmakers remain active, scouting for bargains or preparing for divestitures. And with good reason: our research consistently demonstrates that deals made in challenging market conditions offer the highest potential for value creation.

Success in this environment requires more than such time-tested ingredients as thorough preparation, focused execution, and a dose of luck. Today, a bolder and more creative approach to dealmaking is crucial. Our examination of how expert dealmakers succeed in tough times has revealed sets of best practices for handling both acquisitions and divestitures.

Dealmakers Are Responding to Capital Scarcity

Capital scarcity has contributed to a slowdown in deal activity by private equity (PE) firms, which rely heavily on debt financing. During the past 12 to 18 months, the volume of PE deals has declined more than overall M&A activity.

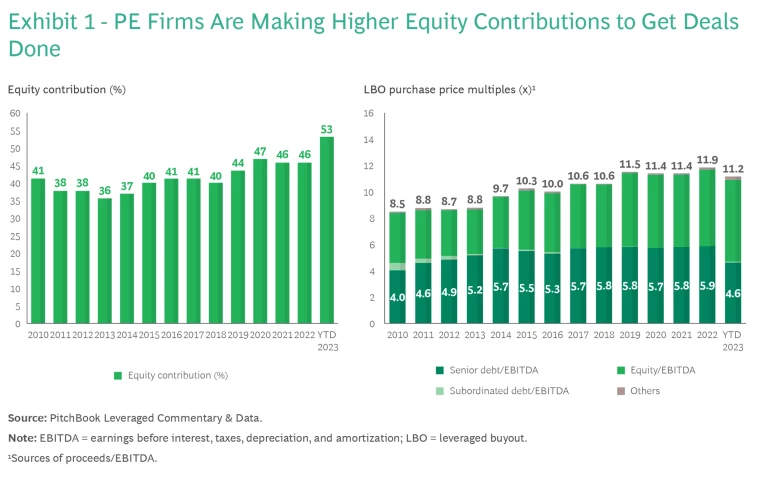

Today’s challenging conditions have also led to observable shifts in financing and deal structures. For example, PE firms need to make higher equity contributions to finance acquisitions. (See Exhibit 1.) There is also a growing trend toward sourcing funds from private debt pools rather than from traditional banks. In addition, we see an uptick in collaborative efforts, such as club deals (with multiple participating firms). Further, minority investments are becoming more prevalent, although full ownership acquisitions still predominate.

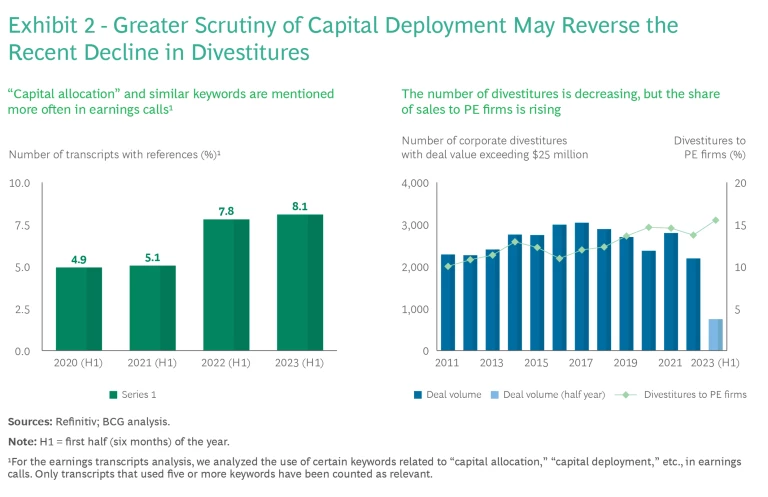

Corporate dealmakers face similar financing constraints and are scrutinizing acquisitions and other capital-deployment decisions more closely. Terms like "capital allocation" and "portfolio review" have gained prominence on business leaders’ agendas and in earnings calls. (See Exhibit 2.) Going forward, we expect the intensified scrutiny of capital deployment to promote divestitures, reversing the recent decline, which is in line with overall M&A activity.

In the sections that follow, we examine how corporate dealmakers can best seize acquisition and divestiture opportunities in the current environment.

Pursuing Acquisitions in Leaner Times Requires Flexibility

Although market volatility in recent times has impeded dealmaking overall, lower valuations have made some companies attractive acquisition targets, potentially at bargain prices. Even so, the shrinking accessibility of funds for acquisition financing creates difficulties for prospective buyers. Addressing these challenges requires considering alternative dealmaking strategies beyond the typical 100% acquisition. Five options stand out among the alternatives that expert dealmakers consider in this area.

Equity Financing. One viable route, akin to the approach that some PE firms currently take, involves financing the deal through equity, with limited or no debt. This option can be particularly attractive for companies that have substantial cash reserves. Our research shows that many companies are in this position; for instance, as of the second quarter of 2023, companies in the S&P Global 1200 (excluding financial institutions) held more than $3.1 trillion. Leveraging their robust financial position, cash-rich companies can use their own resources to execute transactions. To optimize returns, they might later explore refinancing opportunities, taking advantage of improved debt financing conditions when the market shifts.

In 2019, Cisco Systems announced its intention to acquire Acacia Communications, a technology company specializing in optical networking, for approximately $4.5 billion. Cisco financed the acquisition with cash. It later announced its intention to raise debt to refinance the acquisition-related costs and maintain its financial flexibility.

Partial Stake or Staggered Acquisition. Another strategic avenue is to acquire a minority stake initially, with the expectation of buying the remaining shares later. Such a phased approach permits a gradual acquisition while effectively managing financial constraints and gaining initial influence over the target. This also has the advantage of allowing the buyer to dip a toe in the water before fully committing, which is an especially sound strategy when acquiring startups.

Buying a minority stake is particularly useful when the prime motivation for the deal is to gain near-term access to capabilities. If outright control is essential for long-term success, dealmakers should ensure that they have clear pathways to securing a majority position—for example, through call options or a right of first offer. Such an approach helps them avoid getting stuck with a minority stake that does not offer adequate control over the target.

An example is Alibaba's 2017 investment in Sun Art Retail Group, a leading Chinese hypermarket and supermarket operator. Alibaba Group initially acquired a 36% stake as a strategic move aimed at integrating online and offline retail experiences. Then, in 2020, Alibaba announced plans to increase its stake to approximately 72%, further solidifying its presence in the retail sector.

Opportunistic Strategies. Economic downturns occasionally offer dealmakers the opportunity to acquire assets at discounted valuations, especially in instances where targets are financially strained or have already depleted their cash reserves. Typically, however, the bargain price reflects the higher risks associated with buying distressed companies.

This makes it especially important for buyers to have a clear understanding of the target's underlying prospects. Ideally, they should aim to acquire only the viable business units via a carve-out. In addition, to account for any unexpected downsides, they should have adequate cash reserves to finance any additional capital requirements—even if the acquisition cost is minimal or if the seller provides additional financial incentives. Finally, speed is essential because the health of a distressed company's core business can deteriorate rapidly if customers, employees, and other parties jump ship.

An example involving the acquisition of a distressed company is Volkswagen's 2021 launch of a takeover offer, in partnership with Pon Holdings and Attestor Limited, for Europcar Mobility Group, a car rental company facing financial challenges. Another case in point is Siemens Gamesa's purchase of Senvion’s European onshore services business in October 2019, following Senvion's insolvency filing in April 2019.

Collaborative Ventures. Forming a strategic partnership with one or more other companies or PE firms enables the parties to pool resources and expertise. The resulting collaboration can take the form of a traditional joint venture or an equity alliance. Another option is to co-invest in a target with a financial sponsor.

Collaborative ventures offer several advantages. First, they stretch the corporate buyer’s capital and distribute the deal’s risks, which is especially valuable in the case of larger transactions. Second, the presence of a financial investor, with the additional scrutiny and validation that this implies, can enhance perceptions of the deal among a corporate buyer's investors. Third, and most importantly, partnering with a financial sponsor can intensify momentum and a focus on performance, boosting value creation beyond what a single buyer might achieve.

Sharing ownership with a financial or strategic investor can be challenging, of course, so it is essential to clearly define governance and decision rights from the outset. In addition, establishing a clear exit path strategy for the partner is crucial to success.

In 2016, Nestlé and R&R created Froneri, an ice cream and frozen food joint venture operating primarily in Europe, the Middle East, Argentina, Australia, Brazil, the Philippines, and South Africa. After the formation of the joint venture, Froneri made acquisitions to expand its business into North America, Israel, and New Zealand.

Another case in point is the 2019 joint acquisition of staffing firm Sound Inpatient Physician Holdings by OptumHealth (part of UnitedHealth Group) and the PE firm Summit Partners from Fresenius Medical Care for $2.2 billion.

Consortium Break-Up Bids. A more aggressive type of collaborative deal entails working with partners that have complementary interests in different parts of a target's business. The purpose of such a consortium break-up bid is first to acquire the company as a whole and then to carve out relevant assets and divide them among the partners. Such an approach not only helps defray the transaction’s costs and risks, but also ensures a best possible fit with each consortium member’s strategy. Consortium break-up bids are among the most complex deals to orchestrate and execute, as reflected in the small number of examples in recent years.

Indeed, consortium break-up bids are not for the faint of heart. Consider the 2007 acquisition of ABN AMRO by the consortium of Royal Bank of Scotland, Fortis, and Banco Santander. Each partner had a distinct business segment in sight that fit in its profile: investment banking for RBS, Dutch retail banking for Fortis, and operations in Brazil and Italy for Santander. However, RBS and Fortis incurred significant losses stemming from the acquisition, leading to the nationalization of the former and the breakup of the latter. Ultimately, bad timing doomed the deal—the acquisition occurred just before the global financial crisis—but the complexity and inherent risk of the endeavor were already clear to analysts and investors prior to the market downturn.

Amid the cautionary tales are success stories proving that these collaborations can be very rewarding for bold dealmakers that are equipped to navigate them.

Decoding Divestiture Dynamics

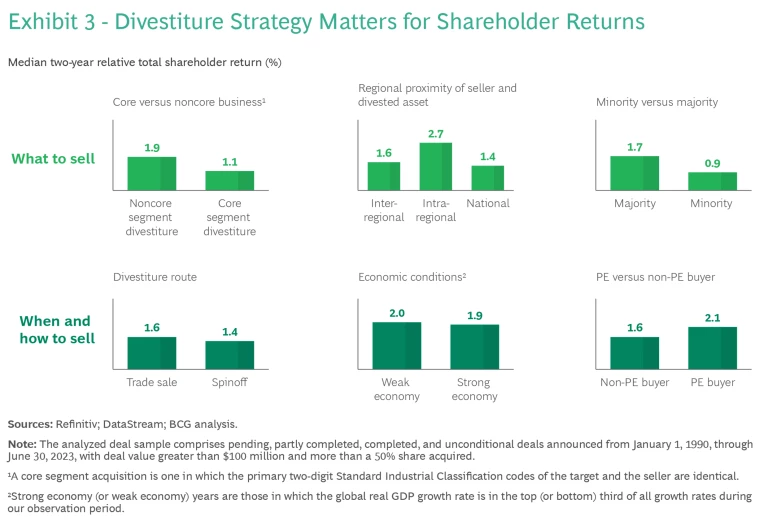

Before delving into how experts approach divestitures, it is worth considering the special relevance of asset sales today. Divestitures are an essential tool for companies that want to reallocate scarce and costly capital to better uses, whether the goal is to refocus the portfolio or to offload underperforming business assets. It is no surprise, then, that investors commonly reward divestitures with high announcement returns. Even so, such sales are not always straightforward. Deciding what to sell and when and how to sell it are critical factors. (See Exhibit 3.)

Our research indicates that successful divestitures have several determinants. Some are rather intuitive—for instance, investors tend to favor majority sales of noncore assets to third parties. Similarly, selling assets that are geographically distant from the main business yields relatively high returns for the seller.

Other findings are more intriguing. For example, sales to financial sponsors yield superior long-term returns. This might be because investors tend to view a transaction with a PE firm as a vote of confidence, signifying that the firm sees value in the target and is willing to pay for it. Most notably, the success of divestitures does not hinge solely on prevailing market conditions. In fact, divestitures concluded during economic downturns exhibit a marginal edge in returns compared with those transacted during buoyant economic periods.

Of course, it is harder to execute divestitures amid volatile market conditions than in more stable times, when eager investors are more abundant. Nevertheless, as the data indicates, these situations can offer great opportunities for value creation. As with buy-side transactions, applying innovative thinking and novel strategies can make the difference between success and failure.

Collaboration Facilitates Successful Divestitures in Leaner Times

In view of the constraints that buyers face in lean times, companies undertaking a divestiture should look beyond conventional majority sales. Collaborative endeavors can serve as interim solutions or even become permanent ones.

Strategic Partnerships. Strategic partnerships, including joint ventures, are viable alternatives to standard divestitures. Companies can unlock synergies by merging complementary businesses into a joint venture. Depending on the relative value of the assets they contribute, one partner may receive proceeds from the other. A partner may then fully divest and monetize its asset later. Such an approach is most suitable for companies seeking to defray future investment requirements and create additional value for subsequent monetization. It is less beneficial for companies seeking immediate capital inflows to invest elsewhere.

Partnership deals have many complexities, including the need to find the right partners, agree with them on the right structure and valuation, and jointly manage day-to-day governance once the deal has closed. But such deals can be an attractive intermediate step toward fully divesting an asset.

For instance, in late 2018, GlaxoSmithKline (GSK) and Pfizer combined their consumer health care divisions into a joint venture. The entity, now known as Haleon, includes well-known brands such as GSK’s Panadol and Pfizer’s Advil. GSK held a 68% controlling stake, with Pfizer retaining the rest of the joint venture. In July 2022, Haleon was publicly listed via a demerger from GSK. The company’s enterprise value at the end of the first trading day was $47 billion. GSK and Pfizer retained minority shareholdings of 13% and 32%, respectively, in the listed entity and planned to further decrease their stakes.

Financial Sponsor Partnerships. Partnering with financial sponsors in a divestiture has several advantages. PE firms excel in optimizing an asset’s potential by adding both direct and indirect value—for example, through improving cost management or fostering a performance-centric culture. Financial sponsors become particularly valuable when an outright sale would not yield an appropriate price. Such a collaboration may serve as a transitional step toward a subsequent IPO, helping to solidify current valuations and accelerate performance on the road to an eventual exit.

Depending on circumstances, financial sponsors can be the majority owner, with the original owner retaining a minority share (“in the pilot’s seat”), or a minority investor, typically holding a stake of more than 20% but less than 50% (“in the co-pilot’s seat”). Both arrangements offer the opportunity for staged exits or—especially in the minority owner's case—temporary measures to fulfill long-term objectives, such as funding, stock price enhancements, and asset transformation. At the same time, each has its own unique features:

- Majority Stakes. PE firms generally prefer to have a majority stake—or at least a controlling interest in voting rights—in the asset. This approach almost always represents an interim step before the seller fully divests the asset. It allows the seller to benefit from ongoing value creation while securing initial capital from sale of the majority stake. For instance, in May 2020, Coty divested a 60% majority interest in its professional beauty and retail hair businesses to KKR. The business features brands such as Wella, Clairol, OPI, and ghd. In October 2021, Coty agreed to sell an additional 9% stake to KKR for $427 million—a 50% premium compared with the price per share of the initial stake.

- Minority Stakes. In this scenario, the PE firm serves as an expert co-pilot. The company selling a stake retains majority ownership and control, yet benefits from the financial backing, proficiency, and oversight offered by the PE firm. Although such arrangements tend to be temporary, they necessitate substantial governance rights and clear exit strategies. They also require the promise of significant returns to appeal to investors, who generally favor full acquisitions or majority stakes. Typically, however, the advantages of an immediate cash infusion and value enhancement, as well as the financial support and momentum generated for the asset’s growth plans, outweigh the challenges. In addition, a co-investment of this sort can send a positive signal to other potential investors. In 2021, AT&T announced a joint venture with TPG Capital to establish a new entity named DIRECTV. This venture aimed to create a separate company for AT&T's US video business unit, including the existing DIRECTV, AT&T TV, and U-verse video services. TPG acquired a 30% stake in this joint venture, while AT&T retained a 70% stake and operational control.

Four Keys to Meeting the Challenges

A volatile environment can be an opportune time for dealmaking. By employing the strategies used by experts, dealmakers can create substantial value through acquisitions and divestitures. Although conventional majority deals will undoubtedly remain the standard approach in many instances, creative structures and partnerships are important tools in a dealmaker's repertoire. Certainly, these strategies come with their own challenges, but companies can avoid or mitigate these difficulties by concentrating on four key topics:

- Strategy. Dealmakers need a clear vision of their ultimate goal for any specific transaction, as each deal type aligns best with certain strategic objectives.

- Partner Selection. Bringing in a partner can lead to considerable complexity and friction. Dealmakers must ensure that the partner’s strategic fit and contribution to value are strong enough to counterbalance any associated risks and costs.

- Governance. A common pitfall of partnerships is the potential for disputes over governance. Prudent dealmakers focus on defining and negotiating decision-making rights and processes from the outset.

- Exit. Most of the partnership strategies discussed are, at least to some extent, temporary. It is therefore essential to define clear and mutually beneficial exit strategies for all parties upfront to minimize future conflicts and facilitate eventual separation.

By keeping these key considerations at the forefront of M&A strategy, and by diligently addressing the finer details of planning and execution, proactive dealmakers can position themselves to benefit from volatile markets.

The authors are grateful to Professor Sönke Sievers, Chair of International Accounting at Paderborn University, as well as Jan Haubrich and Yiran Wang of BCG’s Transaction Center for their valuable insights and support in the preparation of this article.