This is the second edition of the global fintech report, coauthored by BCG and QED Investors.

The global fintech market remains a hotbed of innovation and growth, despite a sobering few years in funding and valuation terms. And there is so much more room for growth. With the advent of game-changing technologies such as GenAI and with still billions of unbanked and underbanked individuals worldwide, fintech has vast potential. We continue to expect fintech to reach a market size of $1.5 trillion in revenue by 2030—growth of roughly five times from today.

However, the rules of the game are changing. Growth at all costs is no longer the watchword. The evolution of fintech has led to a moment in which prudence—the ability to avoid adding risk to the financial system—will be as important as the ability to generate profitable growth. The prize, and the rewards for customers, will be as significant as ever, but the path to success will be more difficult.

This report is based on interviews with more than 60 global fintech CEOs and investors and on our joint experience in the fintech industry. It describes current fintech industry trends and how these strands have combined to create a watershed moment for the sector, with four major themes shifting the grounds for success. Finally, the report explores five imperatives for players in the emerging fintech ecosystem.

A Shift Toward Profitable Growth

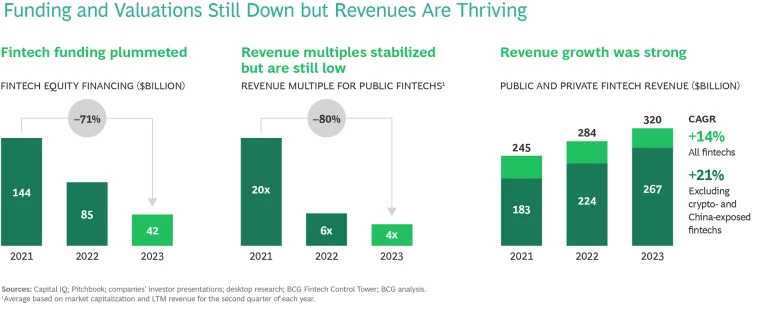

Coming off the highs of 2021, fintech revenue multiples have fallen and funding is down.

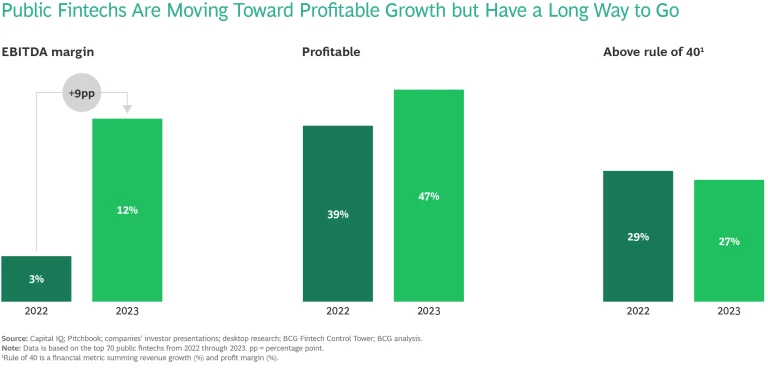

However, we believe these challenges are part of the short-term correction—a tempering of investor enthusiasm—that we discussed in last year’s report . Global fintech revenues have continued to grow at a robust clip: 14% over the past two years across the board, and 21% when crypto- and China-exposed fintechs are excluded. Perhaps more notably, the industry has initiated a shift toward profitable growth, with EBITDA margins improving by 9 percentage points on average. But this shift is still in its early stages, with the majority of the top 70 public fintechs still operating below the “rule of 40” threshold.

Four Major Themes Shaping the Fintech Sector

The last couple of years may have brought the high-flying fintech sector back to earth. However, a streamlined and newly focused set of companies will now emerge, and they—and incumbents—will confront four major themes:

- Embedded finance will be a $320 billion market by 2030. The small and medium-size business (SMB) segment will account for about half ($150 billion); the consumer segment—already humming with activity and adoption in payments, lending, and insurance—will be worth $120 billion in revenue by 2030; and the enterprise segment will reach $50 billion in revenue. Established fintechs will continue to reap the lion’s share of the near-term benefits, while larger, more established banks will claim a growing share over time.

- Connected commerce is poised for liftoff. Connected commerce is emerging as a long-awaited killer app for banks, creating a new revenue stream, increasing customer loyalty, and enabling banks to offer a marketing channel for their SMB and enterprise customers. Using granular customer data, banks surface hypertailored ads to their customers; merchants then pay the bank based on either attributable sales or traffic. As core revenue streams continue to come under pressure, and as deposits risk becoming commoditized in a higher-yield environment, connected commerce hints at a future model for banks.

- Open banking will have a modest impact on banking but a greater one on advertising. We believe that open banking will continue to be relevant but is unlikely to change the basis of competition in consumer banking. In countries where open banking has had significant time to mature, no killer use case has emerged to drive customer switching. Of course, this is not to say that open banking will have no impact. But revenue pools in the connectivity layer will remain modest, with value accruing to the ultimate use-case providers that leverage open banking infrastructure. In advertising, access to transaction-level data will enable more timely and targeted personal offers.

- GenAI will be a game-changer now for productivity, with product innovation to follow. GenAI is already delivering tangible productivity gains in financial services. For GenAI in fintech, given that its digital-first cost structures are heavily weighted toward areas where the technology is delivering huge gains—coding, customer support, and digital marketing—the impact is likely to be even more pronounced in the near term. The use of GenAI in product innovation will lag its uses for productivity—but we expect it to follow.

Where Does Fintech Go from Here?

In a fintech landscape being reshaped by major themes, we see five calls to action for stakeholders in the fintech ecosystem:

- Prudence: Risk and Compliance as Competitive Advantage. The current regulatory environment, along with the growing opportunity for strong bank-fintech partnerships, is increasing the critical importance of risk and compliance readiness. For fintechs, this demands an end-to-end view of compliance—preemptively assessing applicable regulations and proactively implementing industry-grade guidelines and controls. For banks, the call to action is to reinforce their existing compliance strengths and oversight of their fintech partners.

- Profits: A Call for Fintechs to Improve EBITDA by More Than 25 Percentage Points. Only 33 of the 70 largest public fintechs were profitable in 2023, and top-quartile players in terms of EBITDA outpaced bottom-quartile firms by roughly 25 percentage points in 2023 in all cost categories. These figures speak to a significant opportunity for tangible cost savings industry-wide. To improve EBITDA by more than 25 percentage points, fintechs must build a scalable cost structure that will deliver compounding returns as the organizations continue to grow.

- Growth: Journey to IPO (or Strategic Sale) and Beyond. As interest rates moderate, we expect IPOs—along with strategic sales and other M&A activity—to take off. But many fintechs have made the IPO leap only to see their stock prices drop by as much as 40% to 80% from initial listing. As they prepare for IPO, fintechs must tell a comprehensive equity story about how they will attract users at sustainable costs, grow profitably, and meet increasing regulatory requirements. They also need to achieve enough scale, operational stability, and predictability to justify the costs and scrutiny that come with going public.

- Growth: Retail Banks As Digital Engagement Platforms. To provide a counterweight to fintechs that embed financial services into nonbanking journeys, banks can continue to develop their own commerce sites, where they can leverage their vast data on customer needs and behavior. Notably, many connected commerce platforms will succeed or fail on the quality of partnerships between banks, fintechs, and merchants.

- Growth: Government Support for Comprehensive and Integrated Digital Public Infrastructure. Governments, especially in emerging markets, that implement a three-part DPI ecosystem—composed of digital ID, payments, and data exchange layers—have broadened access to financial services, spurring innovation and ultimately benefiting the public. Many countries have tried to emulate the success of the two leading players: India’s UPI and Brazil’s Pix. However, isolated implementations of point solutions for digital identity or real-time payments systems do not suffice to foster widespread adoption. Where DPI has worked, governments have set out the broad vision for the infrastructure and established protocols and nudges for adoption by the private sector.

A “back to basics” theme runs throughout our fintech report. But this does not mean the excitement of the fintech era is over. Formula 1 engineers prioritize improvements to the braking system to help maximize time spent at higher speeds throughout the course. So too, in fintech we must learn how and when to slow down so that we eventually get there faster.