Pilots have a phrase to rank priorities in a crisis: “Aviate, navigate, communicate.” If telecom companies had a phrase, to guide them through today’s rapidly evolving landscape, it would be, “Innovate, innovate, innovate.” To get ahead, telcos must focus on what matters most: creating unique and differentiating products and experiences. But can they truly do this when they are dedicating significant resources—as much as 5% of revenues—to a technology space that potential partners have already mastered?

Today, many operators are steering scarce time, talent, and funding into creating a private telco cloud—and to be sure, a cloud suitable for telco workloads is essential. Future networks will be based on full virtualization. They will leverage commercial off-the-shelf (COTS) hardware, incorporate new features through unified API, and employ AI—including generative AI—for automation, optimization, and orchestration. These functions are the cloud’s stock-in-trade. Little wonder, then, that new network technologies such as 5G standalone and emerging standards such as open radio access network are accelerating the move to cloud-based architecture.

Yet taking cloud development private—which might have been the right call a half-decade or so back—is no longer the optimal path for many telcos. In most cases, creating a private telco cloud has proven to be more expensive and difficult than companies expected. Operators often find themselves tackling more integrations and greater complexity than they bargained for, inviting a rethink of their approach. But while telcos see the shift to the cloud as important, they don’t tend to see it as urgent. So rethinks and changes stay on the backburner.

Meanwhile, hyperscalers—the large public cloud providers—have worked to reduce concerns about data privacy, regulatory compliance, and other risks. And critically, the public cloud can be less public than was formerly the case. Today, telcos can deploy hyperscaler infrastructure on their own premises.

Getting the telco cloud right is no longer a matter of public versus private. It’s a question of balance: making savvy choices on what to build and what to buy, and ensuring that compromises favor speed and agility in developing new products. Striking that balance begins with clearly identifying the company’s business objectives and understanding the true price and competitive benefits of developing a telco cloud. It also entails seeing cloud in a new light: not simply as a route to lower cost of ownership, but as a lever for maintaining a focus on innovation—creating services and business models that create value.

The Public Cloud Evolves

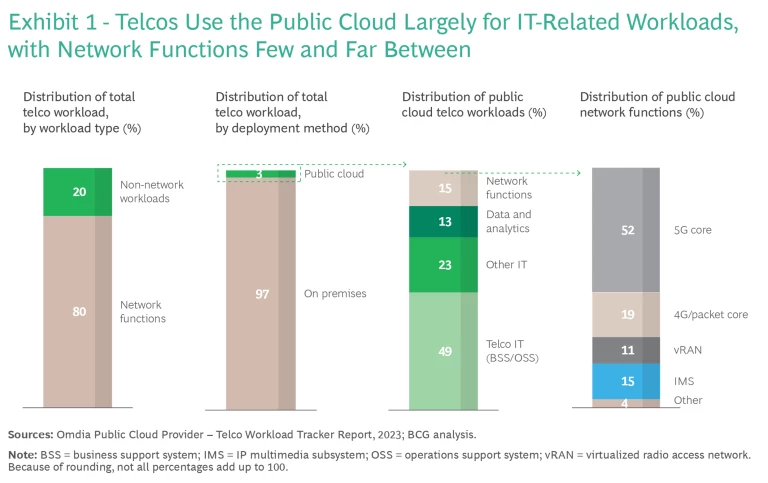

Most telcos view hyperscalers as playing a supporting role rather than a starring one in their operations. To a large extent, public cloud use revolves around running IT workloads, including the business support system (BSS) and the operating support system (OSS). Network functions—a telco’s bread and butter, making up 70% to 80% of its total workload—account for a very small share of activity. (See Exhibit 1.)

When telcos started down this path of using private for core and public for IT, the division made sense. Hyperscalers’ data center footprints typically were insufficient to cover a telco’s nationwide coverage requirements, and the big cloud providers had few, if any, on-premises offerings. Industry-specific solutions didn’t exist, and—just as crucially—hyperscalers lacked a deep understanding of telcos’ business requirements. Finally, when telcos compared a hyperscaler’s price with their estimates for in-house development, private often won.

Yet other industries, most notably financial services, have embraced hyperscalers with far more enthusiasm. Leading banks, which have long seen themselves as technology companies, now consider hyperscaler platforms the gold standard. They run most of their workloads on the public cloud, have shut down in-house data centers, and readily experiment with new hyperscaler services to drive automation, innovate customer experiences, and reduce costs.

Do the banks know something telcos don’t? Perhaps they’ve just been more closely following and adapting to the evolution of the public cloud. New capabilities and offerings reduce risk related to privacy, security, vendor lock-in, and other areas of concern. The hyperscalers have adjusted their processes to meet industry-specific requirements and regulations, developing specialized solutions and contractual frameworks. And significantly, hyperscalers today can deploy parts of their cloud platform on a customer’s premises.

This evolution has important implications for telcos. Hyperscalers now offer tools and solutions expressly designed to support network operations and integrate new network technologies. And by bringing their platforms on-premises, whether running on the telco’s own hardware or on hyperscaler-provided hardware, the large cloud providers solve the point-of-presence problem. They also bring a single “language” to the telco cloud: a universal layer for running workloads and a common toolset for integrating, operating, and monitoring them. This model presents telcos with a compelling new option. They can leverage the advantages of hyperscaler platforms while keeping core aspects—for example, the user plane that carries network traffic—within their own premises.

Telcos’ Private Struggle

Meanwhile, on the private cloud front, telcos frequently discover a gap between perception and reality. Cloud development—together with the cost, control, and customization benefits it promises—is rarely smooth or straightforward. For one thing, network equipment manufacturers and systems integrators, which are telcos’ traditional partners, are still working out their own cloud strategies, so their cloud-native product portfolios are scant. Available network functions do not automatically scale their resource usage, and they are typically hardwired to the underlying cloud platform.

Many telcos also struggle to develop or acquire the talent and skills they need to build flexible, scalable, highly automated cloud infrastructure. And they frequently get bogged down in developing nuts-and-bolts capabilities and tools instead of innovative, differentiating features.

Then there’s cost. When telcos concluded that the private cloud was the more cost effective route, they weren’t comparing apples to apples. Hyperscaler offerings come with clear price tags. But a private cloud incurs costs that may not be apparent at the outset—or easy to calculate. On top of labor, maintenance, and electrical power, telcos should factor in the complexity cost of adapting underlying (and overlying) systems, now and going forward, as well as opportunity costs, since resources allocated to cloud development are unavailable for other initiatives. In the end, most telcos overestimated their ability to build and run a cloud cost-effectively.

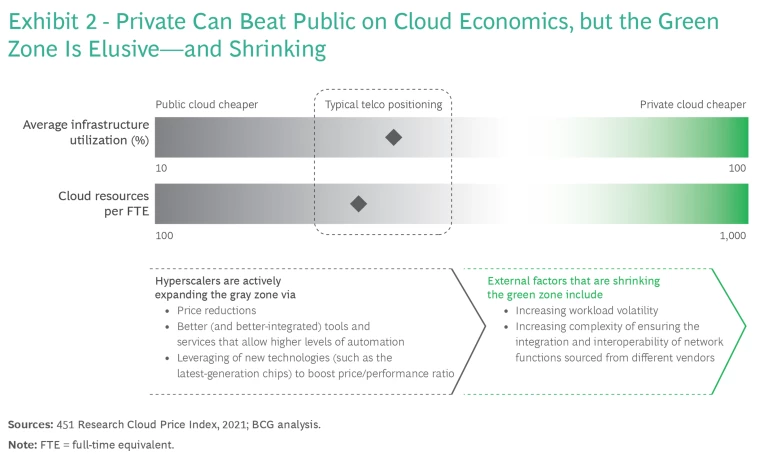

In our experience, there is a “green zone” within which a private cloud can offer the better economics. (See Exhibit 2.) But to get there and stay there, telcos need to master and streamline their cloud platform and operations—no trivial thing. Moreover, the zone is continually shrinking. Hyperscalers have scale advantages and high resource utilization, while telcos, which need to design for peak performance and don’t combine different workloads from different customers, often find their cloud underutilized. Hyperscaler platforms also come with a multitude of tools and services, enabling a very high ratio of cloud resources managed per full-time equivalent.

Three Telco Cloud Archetypes

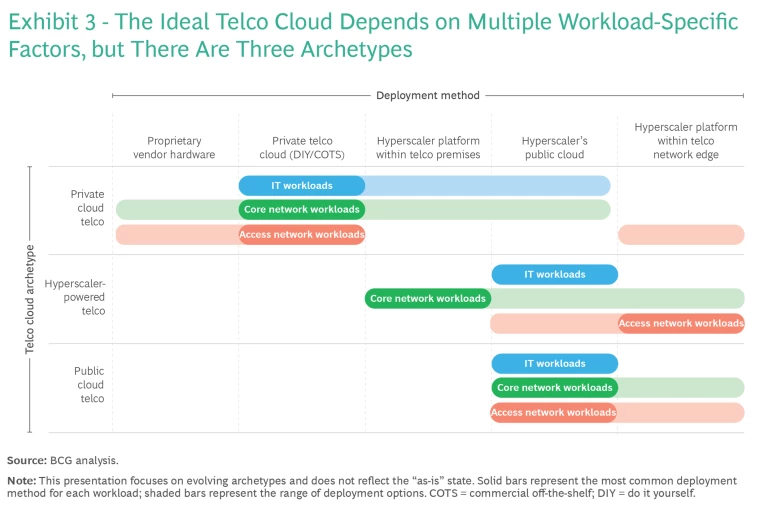

For most telcos, the best path forward—the one that enables them to focus their resources on innovating and creating value—assigns a bigger role to the public cloud. But what is the optimal balance, one that lets telcos maximize the flexibility and other benefits of hyperscalers while ensuring the control and customization they require? Although the answer will vary from one operator to another, we see three evolving archetypes: private cloud telco, hyperscaler-powered telco, and public cloud telco. (See Exhibit 3.)

In each archetype, we separately consider IT workloads, core network workloads, and radio access network workloads. Typically, the IT bucket includes BSS and OSS, along with analytics, AI and machine learning models, internal IT workloads (such as the HR system), and customer IT workloads (such as hosting services). Core network workloads include the user plane, which carries the network traffic, and the control plane, which manages and controls the network. And access network workloads encompass functions that help connect end users to the core network. Each archetype has a range of deployment options, represented by bars in Exhibit 3.

Private Cloud Telco

In this scenario, although the balance still leans heavily toward a private telco cloud, telcos strategically leverage the hyperscaler’s public cloud to realize certain benefits. For example, a telco might experiment with use cases that run disaster recovery cores on standby. Or it may use the hyperscaler’s public cloud as a supporting resource to help provide service during periods of peak demand.

Hyperscaler-Powered Telco

This model sees telcos embracing the public cloud more widely while retaining a strong in-house focus. This involves savvy use of a hyperscaler platform within telco premises to unlock opportunities to realize best-of-both-worlds benefits. For example, in splitting the deployment of its core network functions, a telco might run the user plane function via an on-premises hyperscaler platform and run the control plane function (which is comparable to IT workloads) on a hyperscaler’s public cloud infrastructure. By keeping the traffic-heavy user-plane workload on-premises, telcos can avoid the high ingress and egress fees that hyperscalers charge for moving data in and out of their public cloud.

Public Cloud Telco

Here, telcos go all in on the hyperscaler’s public cloud, ideally backed by long-term strategic partnerships or even co-development agreements. This approach maximizes public cloud benefits, such as instant scaling for new product and service offerings, fast time-to-market, and freeing up in-house resources for value-adding activities. It also enables telcos to realize financial advantages of the hyperscaler route, such as low initial investments. The caveat: telcos need to weigh the implications of this choice for control, customization, and compliance. And given that their telco cloud will be a variable-cost endeavor, operators must master cloud financial management, continuously optimizing workloads to keep costs under control.

Finding the Optimal Approach

As a telco plans its future telco cloud, the three archetypes help frame the discussion. So does knowing where the company currently stands. In our work with telcos, we have found that we can’t overemphasize the importance of self-assessment. This means reviewing, at the outset, the telco’s current cloud strategy and capabilities. But it also means looking at the telco’s track record for developing platforms and enablers, sparking innovation, and fostering the shifts—in culture and mindset—that drive changes in work patterns and in value creation. Such knowledge is crucial for defining a clear and feasible target state and ambition.

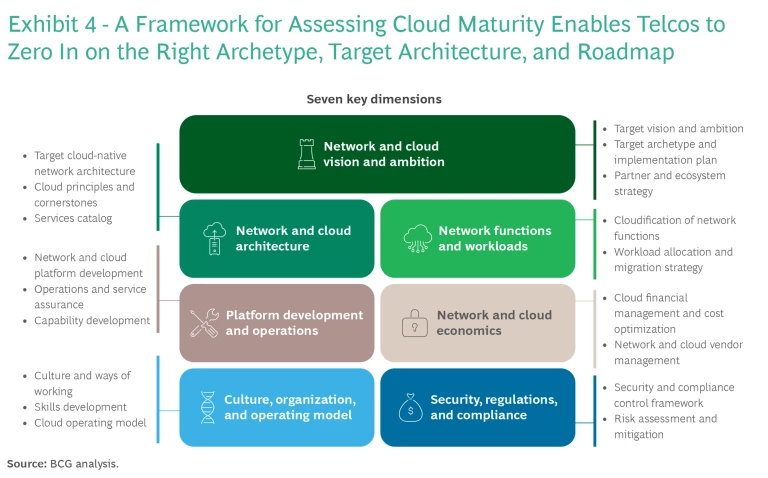

To this end, we’ve created a framework for assessing a telco’s cloud maturity. Centered on seven key dimensions, it creates an unbiased and realistic picture of a telco’s cloud standing, in terms of capabilities, vision, and progress. Just as crucially, it helps telcos zero in on the right public-private cloud mix and understand the capabilities that they need to address as they move toward the appropriate archetype. (See Exhibit 4.)

An archetype enables a telco to see the broad contours of its future telco cloud. Next, the telco needs to shape the journey. This involves looking three to five years down the road and—armed with insights from the self-assessment—developing a target cloud architecture that is optimized for the telco’s goals and circumstances.

By considering certain key dimensions and asking the right questions, telcos can find their way to the optimal cloud. For instance, savvy telcos will look at cloud-based functions and ask whether they are truly differentiating or require deep customization, justifying development. They’ll also consider how evolving technologies such as AI are likely to play in their business. Hyperscalers are quick to incorporate new capabilities, and they offer access to advanced tools and services that can help telcos leverage innovation better and more quickly. Security, reliability, and the pros and cons of hyperscaler partnerships are additional considerations.

Guidelines for Taking Action Now

No matter how telcos envision their cloud future, some best practices can speed their journey:

- Work backwards. Look at the target architecture and create an overarching roadmap for achieving it. Prioritize initiatives that develop the necessary capabilities and bump down—or even stop or phase out—any cloud program or activity that is not essential for reaching the target. But get into the weeds when it comes to the near-term: develop a detailed implementation plan for the next three years.

- Stress robust change management. This means developing, from the start, the skills, culture, and mindset that drives transformation and builds momentum for the journey.

- Weigh your options with care. Think about how deploying an on-premises hyperscaler platform can help strike the right balance of private cloud and public cloud advantages. But if the needle points to a private cloud, make it a business priority. The effort will require resources and energy to get right.

- Look for wider uses. Consider whether there is potential to productize the platform. A differentiated feature or functionality can drive competitive advantage, but it can also drive a new line of business.

This is a critical decision time for telcos. The cloud has been a business disruptor and accelerator for many industries, and telecom operators can join their ranks. With the right approach, telcos can minimize the risks, maximize the opportunities, and build a true engine for sustainable future growth.