The liquified natural gas (LNG) industry is in the news. From inflationary spikes driving record breaking investment to the recently announced Biden administration ‘pause’, the industry is in flux as new supply is built to meet rising energy demand in emerging economies and shortfalls in Europe.

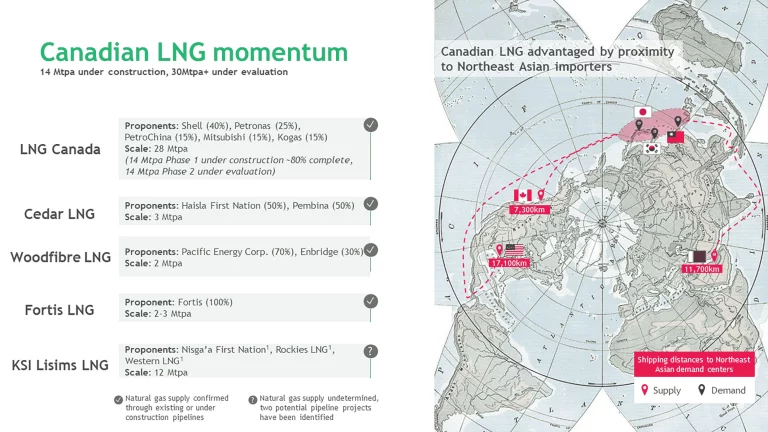

Industry insiders say this momentum is reminiscent of the last cycle, where US producers built over 90 million tonnes per annum (Mtpa) of LNG export capacity. Despite having a similar level of proposed development (~100 Mtpa), Canada failed to ‘catch’ the last wave – developing only two facilities of 16 Mtpa that are both currently under construction.

The Biden ‘pause’ and its resultant market dislocation presents a second chance for the low-carbon Canadian LNG industry to capitalize on an opportunity that was largely missed over the past decade.

Biden’s policy is intended to allow the Department of Energy to take “a hard look at the impacts of LNG exports on energy costs, America’s energy security and our environment”. It will delay 5 projects of 70 Mtpa, leaving Asian buyers looking for alternative sources of long-term and secure LNG supply.

Canada, with 30+ Mtpa of projects under active evaluation, is well positioned to close part of the US export gap given its rigorous net-zero policy framework and its world class low-carbon LNG projects. As Jonathan Wilkison (Canada’s Minister of the Environment) stated “I think there’s an opportunity, …, but it’s on the basis of Canada offering the lowest carbon intensity natural gas in the world and ensuring we’re linking it to the displacement of heavier hydrocarbons like coal.”

Canada now has an opportunity to capture this economic opportunity, while also delivering considerable environmental benefits. However, industry and governments need to move quickly to ensure that Canada doesn’t miss out again.

Norway serves as a template for how Canada can “get this right.”

At home, Norway has reduced per capita carbon emissions by roughly 20% since 2007 by expanding low-carbon power access and electrifying its energy demand. Abroad, Norway has exported lower carbon fuels to countries that would otherwise consume higher-carbon alternatives, enabling global decarbonization.

Opponents argue that Norway’s energy policy is contradictory. We disagree. It might seem inconsistent for Norway to reduce hydrocarbon consumption at home while exporting fuels abroad. But in both contexts Norway’s actions advance decarbonization.

This is where Canadian LNG comes in.

To meet growing Asian demand, global LNG volumes are forecast to increase by 20-30% between now and 2030 and remain elevated through 2040. And, due to the physical advantages of shipping LNG compared to hydrogen or alternative fuels, we foresee a role for low-emission Canadian LNG paired with local carbon capture facilities well beyond 2040.

This is not to argue that change is impossible—we believe the shift toward cleaner forms of energy is both necessary and inevitable. But if LNG is going to be around for decades, as consensus estimates show they will, we should do what we can to decarbonize it.

Canada is well positioned to serve growing demand for LNG due to its vast low-cost resources (top quartile in global cost), its extensive track record as a secure supplier of energy and its advantaged access to Northeast Asian importers (approximately half the distance of leading alternative suppliers - US & Qatar). This potential is validated by commercial momentum. Western Canada has four proposed LNG terminals under active evaluation, with several targeting final investment decisions within the next year. And, critically important, three of the four proposed terminals can be supplied by existing pipelines or those already under construction.

Over their project lifetime, these four proposed developments would generate over $250 billion in investments, employ roughly 50,000 Canadians (directly and indirectly), and generate approximately $50 billion in government revenues. It is also worth noting that Indigenous communities would realize many of these benefits – two of the projects have direct Indigenous ownership, while the others all have benefit agreements. Put differently, these four projects alone would have an economic impact equivalent to half of Canada’s auto industry, all while providing economic opportunities in historically marginalized communities.

And here is the climate kicker—similar to Norwegian exports, Canadian LNG can reduce global emissions by backing out higher-carbon alternatives. Canadian LNG is 25% less carbon intensive than the global LNG average – meaning for every three ton of carbon emitted in Canada, four tons are saved elsewhere. This advantage is driven by lower upstream emissions due to Canada’s stringent fugitive methane regulations and electrified transmission and liquefaction enabled by clean power. As a result, these proposed projects could reduce global emissions by about 8 million tonnes per annum, equivalent to taking two million passenger vehicles off the road.

The alternative of Canada not meeting this demand is higher global emissions and economic benefits that accrue elsewhere. That trade-off should be unpalatable to Canadians of all political persuasions.

To deliver these benefits, we recommend two actions.

First, Canadian policymakers must recognize the climate potential of supplying the world’s lowest carbon LNG. Ongoing negotiations on Article 6 of the Paris Agreement could explicitly enable Canada to incorporate overseas emissions reduction in its nationally determined contribution. If a multilateral solution is not achieved, Canada could work with overseas allies to develop bilateral agreements. Even if this is not plausible, we urge Canadian leaders to recognize that emissions are a global (not local) problem and support Canadian LNG in driving a net reduction of emissions globally.

Second, Canada must expand clean power generation and transmission to support increasing industrial demand. Unfortunately, clean power constraints are hindering LNG proponents’ ability to electrify their liquefaction, eroding some of the environmental benefits of Canadian LNG. We believe that Canada can use the growing industrial demand for LNG to catalyze the buildout of clean power generation (doubling the clean power growth forecast from Alberta and British Columbia to 2030) and upgrade of grid interconnects (connecting renewable resource rich Alberta to British Columbian power demand). This growth is ambitious, but not implausible.

Navigating energy transition trade-offs is rarely straightforward. But Canadian LNG is an opportunity that the entire country can rally behind. Like Norway, Canada can use LNG to accelerate development of clean power at home and reduce the footprint of fuels consumed abroad, all while driving significant economic benefits. This is an opportunity that Canada can’t afford to miss.