Sports and live events programming have become increasingly important for connected television (CTV) providers such as streamers, but they have been among the last areas to embrace buying and selling advertising programmatically—and for good reasons. Complex rights, huge audiences, premium brand-safety expectations, and legacy direct-buy economics make this type of content an extremely demanding environment to operate and monetize programmatically.

However, those constraints are now easing. Maturing technology, cleaner data, and new operating models are enabling hybrid monetization at scale. Three strategic moves can unlock this potential, creating new opportunities for advertisers and potentially delivering an extra $2 billion to $4 billion in revenues to publishers globally by 2028.

The potential is clear in a survey conducted by BCG and Google in July and August 2025 of 400 executives from CTV publishers (including streaming services, digital-first and traditional channels that are moving to digital, device operating system providers, and platforms and apps that aggregate other streaming services) and 400 buyers of CTV ads (including agencies, brands and demand-side platforms). The research shows keen interest among buyers: 82% say that they are likely to increase their programmatic live CTV investment in the next 12 months. It also indicates publishers’ awareness that they must expand monetization: 57% say that they use both direct and programmatic sales, but programmatic is a growing focus in the next 12 months to three years.

Nevertheless, adoption remains uneven because live events place unique operational demands on platforms. Although programmatic has become the backbone of CTV advertising, the growing roster of live-streamed events remains a holdout. Qualitative interviews that BCG conducted in association with the survey suggest that publishers sell only around 35% of live event CTV inventory programmatically.

Demand is moving toward programmatic buying. Live advertising is the last bastion where direct buys are more frequent than programmatic buys. This will change over time.” —VP for global sales at a CTV publisher

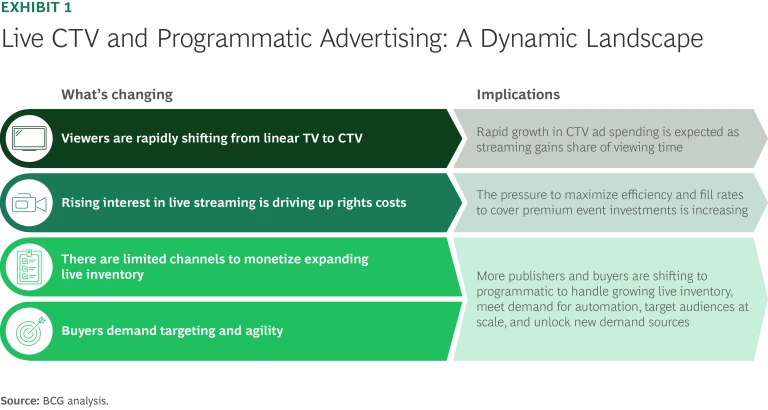

Driving more live inventory through programmatic can support the next wave of growth. (See Exhibit 1.) EMarketer estimates current global CTV ad spending at $40 billion to $45 billion, with growth rates over the next three years of around 12%. Live TV is emerging as a key driver, as BCG estimates that ad spending is already reaching $8 billion to $9 billion in 2025. Of the estimated increase of $5 billion or more in live CTV ad spending through 2028, BCG projects that perhaps 50% to 70% could flow through programmatic channels, yielding in a potential gain of $2 billion to $4 billion in ad spending on programmatic live CTV.

The Challenges in Live CTV

Live CTV revenues are more than a nice-to-have for CTV publishers. These publishers are investing heavily in rights, and they need to recoup their investment. In 2025, streaming services accounted for 20% of global spending on sports rights, up from an 8% share in 2021, according to sports rights data from Ampere. Amazon’s deals with the NFL and the NBA are perhaps the highest-profile transactions. Even Netflix, long wary of sports, is increasing its roster, most recently by acquiring exclusive live coverage of all 47 games of the World Baseball Classic in Japan in 2026.

We need high CPMs to pay for the rights to the sporting events. Even with these high rates, most of the time it doesn't break even. —CTV publisher

In response to the mounting monetization pressure, publishers are increasing their focus on programmatic for live CTV. Programmatic, of course, is already well-embedded in other content streams: 92% of surveyed publishers and buyers say that they are using at least one programmatic channel. It is now emerging as a key solution for live CTV as direct demand—deals negotiated directly between publishers and advertisers—nears saturation, and as technology increasingly has the capacity to deliver programmatic advertising to millions of live viewers. This means that publishers can and should deploy programmatic to monetize remaining live inventory after fulfillment of direct deals.

Programmatic in live CTV works well for buyers too. Done right, live CTV combines the efficiency and automation of digital with the premium, brand-safe reach of traditional TV. In addition, programmatic solutions can help unlock extra demand, giving smaller advertisers accessible entry points into live-event inventory, in contrast to traditional direct deals, which are often limited to big brands with a high cost per thousand impressions (CPM) and large upfront commitments.

This combination of extra inventory, rising share of programmatic, and boosted fill rates underlies the estimate of $2 billion to $4 billion in extra ad spending on live CTV that publishers can unlock over the next three years.

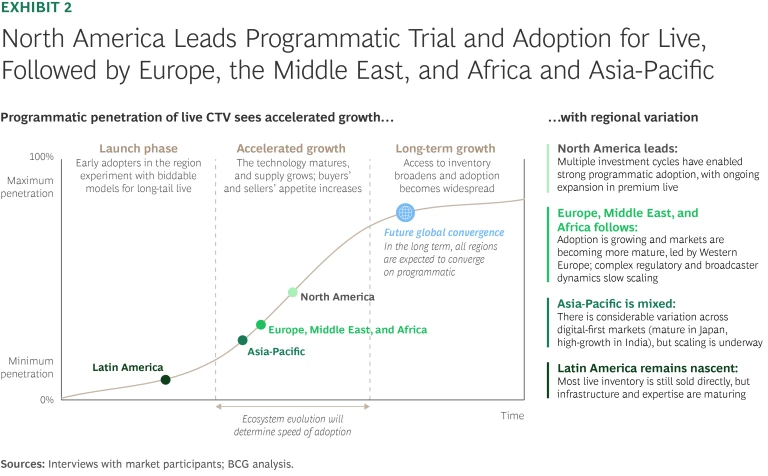

Regionally, however, the picture is highly uneven. Europe, the Middle East, and Africa and Asia-Pacific are following some distance behind North America, but even the US has plenty of room for expansion. (See Exhibit 2.)

India is undoubtedly the biggest growth market. It has massive audiences and is earlier in the adoption curve. —VP for global marketing at a demand-side platform

Among publishers, digital-first streamers are in the best position, thanks to their automation-first design, flexible sales strategies, and lack of legacy constraints. In many cases, they control their own tech stacks, enabling faster deployment of software development kits (meaning publishers can quickly enable the targeting, measurement, and brand-safety tools advertisers need), monetization logic, and integration. With better, authenticated viewer data, they can activate advanced targeting at scale.

By genre, middle-tier, non-tentpole sports events offer especially strong growth opportunities with attractive CPMs and fewer upfront constraints. Publishers also have more scope to take an iterative approach, learning what works for them and their buyers.

Some roadblocks remain, however. Publishers may be concerned about revenue dilution, if bargain-basement programmatic ads end up being positioned within expensive live content. Forecasting viewership is a challenge. And there are issues around serving programmatic ads in real time to potentially vast audiences while delivering a high-quality viewer experience. Avoiding these roadblocks requires a deeper understanding of the diverse needs of players within the CTV ecosystem.

Sellers are concerned about CPM erosion, especially during premium live events, where impressions are valuable and brand relationships are tightly managed. —Director of technology at a CTV publisher

Crafting a Win-Win for Publishers and Buyers

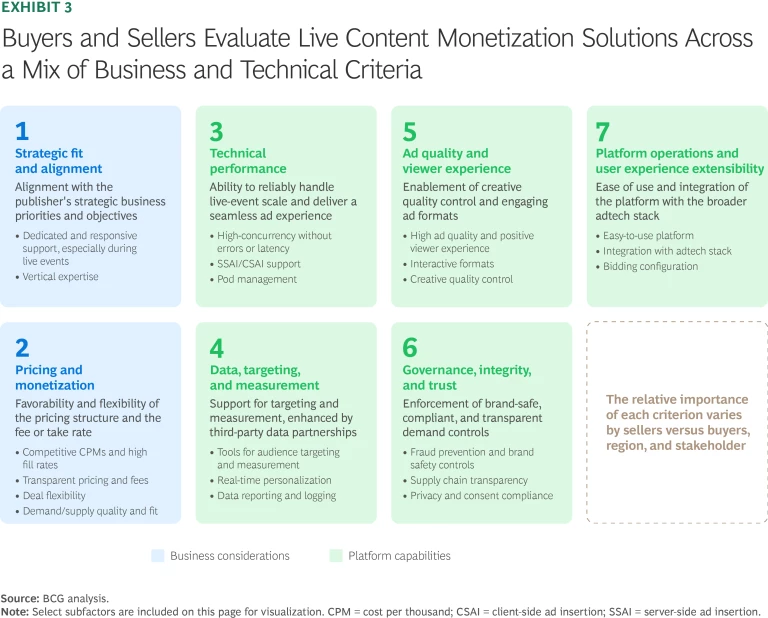

Publishers and buyers use a long list of factors to assess the programmatic monetization of live content. To understand these better, BCG has designed a structured evaluation framework that spans business considerations and technical platform capabilities. (See Exhibit 3.)

Programmatic advertising with live CTV can progress only if both stakeholders have full confidence in their platform’s ability to deliver under demanding, real-time conditions at extraordinary scale. To get a clearer picture of the problems and opportunities that platforms present, the survey investigated these issues in depth.

What Publishers Need

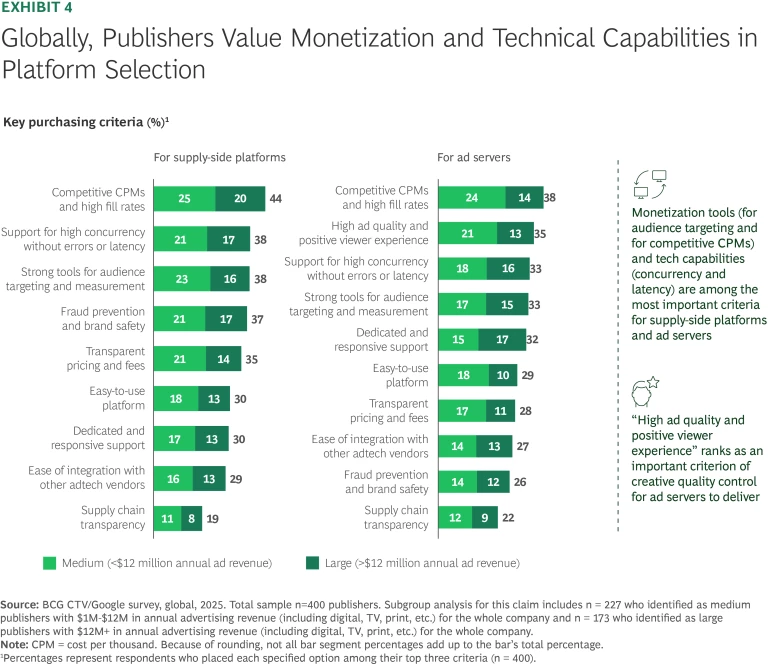

Publishers in the survey ranked key purchasing criteria for server-side platforms (SSPs) and ad servers by their relative importance in serving live CTV ads. (See Exhibit 4.) They ranked competitive fill rates and CPMs highest for both platform types, with high ad quality and positive viewer experience a close second.

There are important regional variations for both SSPs and ad servers. For SSPs:

- North America puts more weight on pricing transparency and clean tech integration, reflecting the region’s relatively mature tech stacks.

- Europe, the Middle East, and Africa emphasizes audience tools and peak-load reliability to manage fragmentation across languages, markets, and rights.

- Asia-Pacific elevates fraud resistance, brand safety, and dedicated support as programmatic scales unevenly and risk controls serve as a marker of quality.

- Latin America shows above-average interest in fee and supply-chain transparency—as well as sharing the global focus on CPMs, fill rates, and reliability—to build trust as premium live inventory expands.

For ad servers:

- North America puts extra weight on reliability and viewer experience, owing to large live audiences and exacting brand expectations.

- Europe, the Middle East, and Africa elevates viewer experience too, reflecting consumer sensitivity and tighter norms.

- Asia-Pacific values hands-on support and risk controls as scale accelerates across heterogeneous markets.

- Latin America stresses reliability at times of peak demand and interoperability with existing vendors, reflecting infrastructure constraints and the need to make current tech stacks work harder.

What Buyers Need

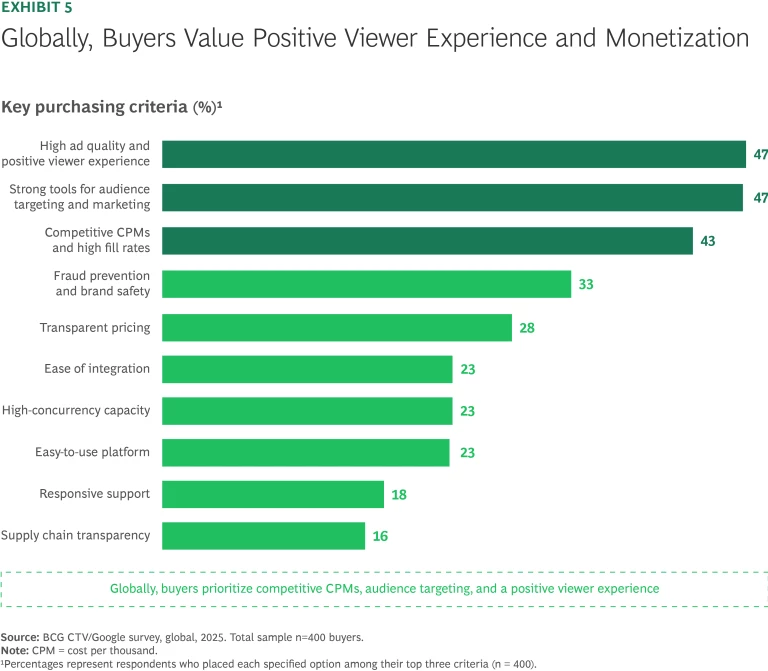

Across regions, buyers consistently prioritize high ad quality and positive viewer experience, robust audience targeting tools, and competitive CPMs when evaluating programmatic solutions. (See Exhibit 5.)

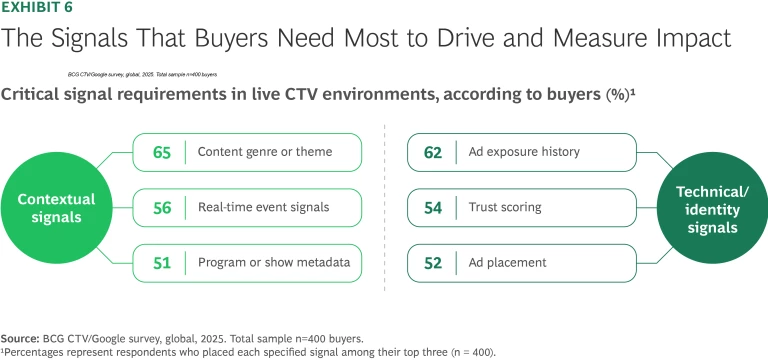

Regional differences were relatively narrow. Regardless of location, buyers need premium-quality, targeted, cost-effective delivery of advertising within live CTV environments. The survey shows the importance of contextual and identity-based targeting signals to driving monetization: 65% of buyers say that they rely heavily on content genre or theme (for example, sports, news, entertainment) most when targeting ads in live CTV environments), and 62% say that ad exposure history is one of the most important technical or identity-related signals when buying programmatic ads in live CTV environments.

The survey also reveals that buyers are using live CTV for more than its traditional role of promoting brand awareness. This is evident from the enlarged buyer expectations for measurement and attribution solutions to track metrics such as purchase intent and conversion. In the survey, 60% of buyers report using return on ad spending to evaluate the return on investment (ROI) of their live, programmatic CTV ad campaigns, and 58% report using media efficiency metrics to evaluate the same ROI.

Stakeholders that seek to fully harness the potential of programmatic solutions within the live CTV ecosystem must meet these distinct, evolving criteria.

A Three-Step Strategy to Unlock the Potential of Live CTV

Clearly, the industry is waking up to the immense potential of programmatic in live CTV. To unlock it, however, senior leaders need to pursue three strategic steps.

Break away from legacy buying models by making hybrid the default. Traditional buying in live CTV emphasizes upfront, premium CPMs with tight controls. However, some buyers lean more toward the flexible, transparent, and efficient options typical of programmatic.

PG is the best of both worlds: you get the efficiency benefits of programmatic but the upfront spend commitments of direct. —VP for global sales at a CTV publisher

Publishers should focus on four goals in this area:

- Make hybrid the default. Mix direct deals with fixed-price programmatic guaranteed (PG), invitation-only private marketplace (PMP), and biddable/open exchange. Publishers that worry about losing yield can protect themselves by codifying deal tiers (event tier, audience value, and pod position) and adding price floors.

- Route by yield and risk. Use ad-server logic to dynamically allocate impressions across direct, PG, PMP, and open exchange. If a guaranteed deal underdelivers, boost its priority in the ad server to ensure the sale of more valuable impressions before PMP or open auction.

- Preallocate critical windows. In tandem with using real-time routing, reserve key event windows such as halftime or the final ten minutes of a game for PG and PMP guarantees and premium floors. If demand does not materialize, release inventory to PMP.

- Win over skeptics. To build advertisers’ confidence, generate credible research demonstrating that blended models (direct plus PG and PMP) outperform closed strategies in generating revenue for buyers.

Improve inventory forecasting and planning. Viewer numbers for live events can be volatile, and current planning and forecasting tools don’t capture live spikes. In the survey, 51% of publishers note that lack of visibility into available inventory across formats and devices is one of their biggest challenges in forecasting and inventory planning for live programmatic CTV ads, and 51% note that forecasting tools that don’t accurately reflect live event spikes is one of their biggest challenges in this area.

It is technically challenging to forecast live inventory, which can be very volatile. This limits spending from advertisers, and we risk over or underselling impressions. —Global EVP for media sales at a CTV publisher

Publishers should adopt the following measures:

- Wire live data into the forecast. Feed event metadata, historical viewing data, and first-party signals such as engagement data into predictive models to produce more accurate impression curves.

- Pace the curve. Apply live-aware pacing to spread impression delivery across the event. Doing so prevents frontloading (burning through inventory too fast) and backloading (holding too much until the end), ensuring smoother delivery against PG and PMP commitments.

- Codify the operating cadence. Run a live dashboard with variance bands and thresholds for changing tactics (such as raising floors or releasing inventory reserves). If available impressions greatly exceed the forecasted or guaranteed amount, deploy a “bonus impression bank”—impressions given for free as a goodwill gesture to enhance select client relationships.

Upgrade technological scalability and infrastructure. Large live events push systems to their limits. Latency, timeouts, and creative errors during concurrency spikes waste impressions, erode trust among buyers, and risk viewer switch-off. In the survey, 46% of publishers say that one of their most persistent issues with programmatic CTV ad delivery during live or high-concurrency events is concurrency spikes that cause impression drops, and 73% of publishers say that they have experienced a higher latency than the target level of latency for their ad server decisioning.

Publishers should keep four objectives in mind:

- Build for peak, not average. Upgrade server-side ad insertion for latency and regional failover, and run full-scale load tests before large events.

- Eliminate avoidable creative failures. Precache all approved ads (in PG and PMP models), with tags validated and backups at the ready. Use AI-powered pre-review to catch issues.

- Elevate reporting levels to that of direct deals. Recognizing that buyers like the verifiable data they get from direct sales, offer the same level of confidence for nondirect sales.

- Share essential signals with buyers. Enrich the bid stream with critical data to convey the value of live inventory, giving buyers highly valuable context and suitability signals. (See Exhibit 6.)

Seizing the Live CTV Opportunity

For publishers, effectively leveraging programmatic technology ensures a return on their expensive sports rights deals. This, in turn, allows them to continue investing in compelling live content, pulling viewers from traditional channels and driving industry growth.

For buyers, using programmatic on live CTV events delivers the mass, engaged audiences that are characteristic of live sports events, but with the precise targeting and measurable results of digital channels. It also democratizes access—giving opportunities to brands that would struggle to sign on for traditional broadcast sports packages or direct digital deals—and increases overall spending.

Using programmatic on live events is much more than a sales tactic for publishers to adopt. It has been validated by CTV’s bold move into sports, which has transported CTV into new markets and positioned the whole ecosystem for continued strong growth.

About the Research

BCG and Google surveyed 800 decision makers across CTV publishers, agencies, and demand-side platforms in North America (Canada and the US); Europe, the Middle East, and Africa (France, Germany, Italy, Spain, and the UK); Asia-Pacific (India, Japan, and South Korea), and Latin America (Argentina, Brazil, and Mexico).

This includes 400 CTV publishers and 400 buyers (agencies and demand-side platforms). The 400 CTV publishers include 227 medium publishers ($1-$12M USD in annual advertising revenue (including digital, TV, print, etc.) for the whole company) and 173 large publishers ($12M+ USD in annual advertising revenue (including digital, TV, print, etc.) for the whole company). Additional depth and context came from 34 in-depth executive interviews with publishers and buyers.

All market sizing figures were estimated by BCG using qualitative inputs from interviews and third-party sources quoted.