For decades, Europe’s broadcasters have been the gatekeepers of home viewing. With their control of the airwaves—the main conduit into homes for video content—they shaped the viewing habits of millions by providing high-quality, culturally resonant media and served as the main advertising channel to mass audiences. That era is rapidly ending.

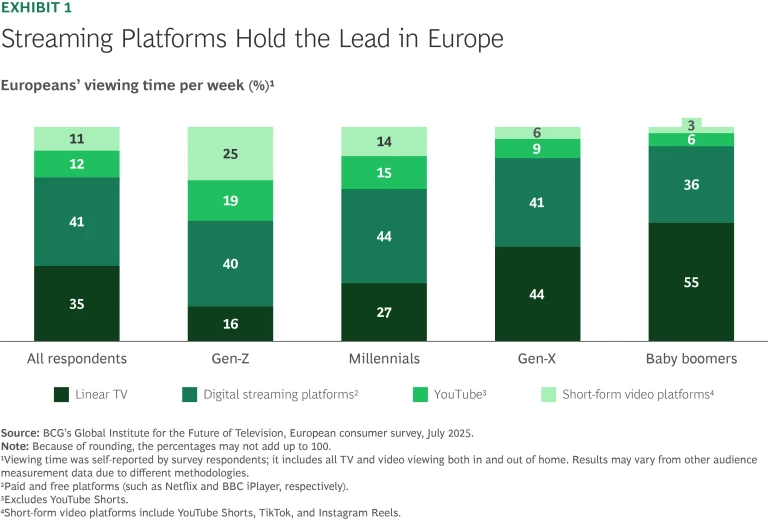

According to a census-balanced survey of 3,500 consumers in the UK, France, Germany, and Switzerland by BCG and NativeResearch, digital streaming and social video platforms reach 97% of viewers in those markets and account for 64% of weekly viewing time. (See Exhibit 1.) Global platforms now hold four of the top five spots in audiences’ self-reported rankings of which services matter most to their streaming experience. These platforms have won over audiences with seamless convenience, must-see programming, and fresh interfaces that appeal to younger, digital-first viewers. Broadcasters that once owned the primary path into the home increasingly find themselves in an underdog position.

Broadcasters still hold meaningful advantages with their established distribution networks, financial resilience, and strong pipelines of local talent and content, including news. Yet streaming giants are moving aggressively into traditional broadcaster territory, including cheaper, ad-supported tiers, local programming, live sports, and even online linear channels. In response, broadcasters have rolled out subscription offers, invested heavily in digital platforms, and expanded their on-demand libraries. But as convergence accelerates and audiences adopt new viewing habits, broadcasters face a narrowing window to act before streamers tighten their grip on the market.

To regain momentum in a world where viewers curate their own experiences across countless devices and platforms, Europe’s legacy broadcasters must adopt a challenger mindset and focus on six strategic imperatives: making the most of their national roots, pursuing scale through partnerships and M&A, expanding distribution across digital and social platforms, diversifying revenue and funding sources, embracing artificial intelligence, and partnering with regulators to update outdated market rules. These actions are not just about business; they’re about broadcasters reclaiming their civic role of producing media that reflects societal values, builds community, and maintains editorial integrity in an era of fragmented attention and fake, AI-generated content.

Stay ahead with BCG insights on technology, media, and telecommunications

The Erosion of the Broadcaster Advantage

The exclusive distribution power that long shielded broadcasters from competition has vanished; anyone can now publish content online. However, viewer attention has consolidated around a few global platforms, including Amazon’s Prime Video, Disney+, Netflix, and YouTube. These platforms, all of which are headquartered in the US, use algorithms that increasingly determine what people watch.

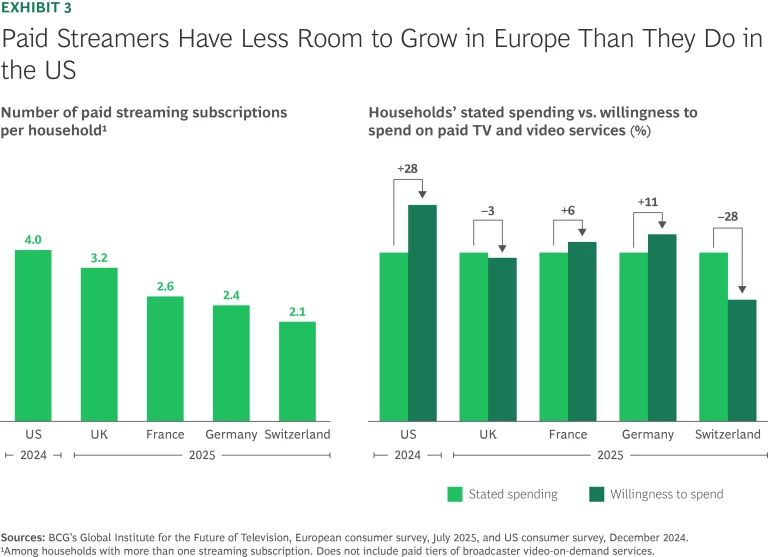

The Shift to Streaming. The global shift from linear TV to digital streaming is reshaping the media landscape and is already visible in consumer behavior. In the surveyed Western Europe markets, about 73% of households pay for streaming, compared with 80% in the US, which may offer a glimpse of the challenge that lies ahead.

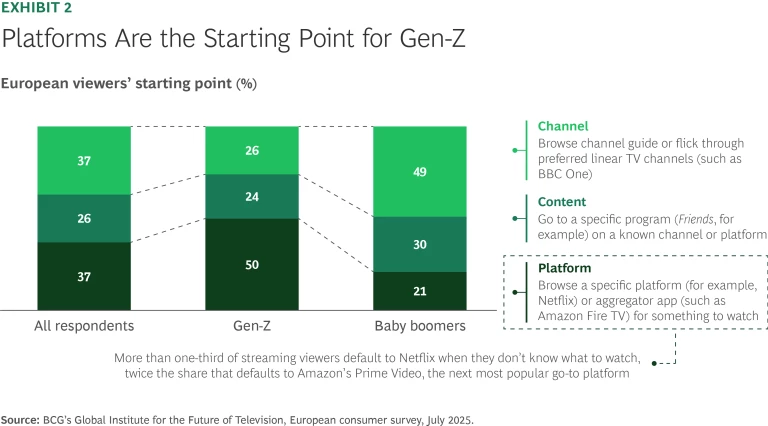

Our survey also reveals that 20% of viewers now access video content exclusively via the internet. Among younger audiences, the shift is even more pronounced: Gen-Z spends only 16% of viewing time on linear TV, compared with 55% for baby boomers. Algorithms, not channel lineups, have become the new starting point. Today, half of all Gen-Z viewers begin by browsing a streaming platform’s recommendations. For baby boomers, the opposite is true: half still begin by channel-surfing. (See Exhibit 2.) Among streaming audiences, more than one-third default to Netflix when they don’t know what to watch.

Furthermore, the survey shows that most European consumers use four or five streaming platforms, with global players claiming at least three of those spots in every surveyed market. That leaves national broadcasters competing for only one or two openings. The competition intensifies around big viewing moments—movie nights or series binges—where choice often narrows to just one or two platforms. The playing field is increasingly unbalanced: global players are generally able to offer viewers a greater choice of content and can draw from their vast resources to make the next big hits.

YouTube and social video platforms are driving the next wave of disruption, together accounting for about 20% of all video viewing time—and more than 40% among Gen-Z. For this generation, YouTube is the most widely used platform, reaching more viewers than Netflix does by 10 percentage points. Its content offering has evolved far beyond casual, user-generated clips to also include live streams, podcasts, and professionally made programming.

That mix further blurs the lines between YouTube and what has traditionally been thought of as TV. One-third of YouTube users now watch TV shows or movies on the platform, with that number climbing to 38% for Gen-Z. High-profile broadcasters are crossing over; Gary Lineker (via Goalhanger Podcasts) and Italian radio presenter Gianluca Gazzoli (via The BSMT), for example, have built large followings on YouTube and social platforms. YouTube viewing is moving from personal computers and mobile phones to the living room, and the platform is now competing more directly with broadcasters to capture key viewing moments and advertising spending. In the UK, 41% of YouTube’s in-home viewing in 2024 was on TV sets, up from 34% the previous year, according to UK regulator Ofcom. TikTok and Instagram are racing to follow, reportedly developing TV-set apps to emulate YouTube’s success.

Short-form video adds another layer of competition. Instagram Reels, TikTok, and YouTube Shorts are not just diverting attention—they are redefining what engaging content looks like. Many consumers—and particularly those in Gen-Z—who view short-form content find it more enjoyable than traditional TV shows. This preference isn’t just about brevity, either. A majority of young people also told us it’s easier to find content that they like on short-form video platforms. They also said that short-form content and creators better reflect their identities and help them live better lives.

Even advertising, often seen as a deal-breaker by viewers, is less of a hurdle for short-form video platforms. While 83% of all viewers notice ads on these platforms, only 39% of these viewers say they worsen the experience, 44% don’t care, and 17% see ads as a bonus. Baby boomers are more critical: nearly half say ads detract from the experience compared with Gen-Z viewers, a contrast with long-form viewing where baby boomers are more ad-friendly. Still, viewers’ overall relative tolerance—especially when the ads feel relevant—shows that advertising can coexist nicely with short-form content.

The Next Battleground. Spending on streaming services is reaching saturation. European households, on average, have one or two fewer streaming subscriptions than their US counterparts do—and most consumers say they are close to their intended spending limits. (See Exhibit 3.) This pressure has fueled the rise of hybrid monetization models, with platforms offering a mix of ad-free and ad-supported options to meet various budgets. As subscription growth slows, the competition for ad revenue is the next battleground—and broadcasters will need to expand their revenue and funding sources.

Global streamers are leaning hard into advertising. Amazon’s Prime Video has the highest share of subscribers on its ad-supported tiers. Netflix and Prime Video consistently rank among the top platforms for ads that viewers describe as entertaining and relevant—a perception that matters in an increasingly ad-supported business. And the recent ad partnership between Disney+ and Amazon signals a broader shift toward consolidating advertising capabilities and reach. While the increase in ad dollars hasn’t been commensurate with the rise in ad-supported tier penetration, further shifts are likely.

To win those dollars, broadcasters and streamers are both experimenting with a variety of ad formats that extend beyond the traditional preroll and midroll spots. Pause ads, interactive overlays, product placements, and “shoppable” videos are all being tested as ways to maximize revenue, minimize viewer disruptions, and enhance the relevance of the commercials. Streamers can also strike global ad deals with agencies and brands, leveraging their global scale in ways that national broadcasters cannot.

Meanwhile, other ad-supported platforms are still finding their footing. In Europe, the percentage of viewers watching free, ad-supported streaming TV (FAST) and fully ad-supported video on demand (AVOD), excluding YouTube, trails the US by up to 40 percentage points—in part because free-to-air broadcasters already fill much of that role. As awareness of FAST and AVOD rises and local content improves, the viewer adoption level could move closer to that of the US, enabling these ad-supported platforms to capture a larger share of television ad spending.

From Incumbents to Underdogs

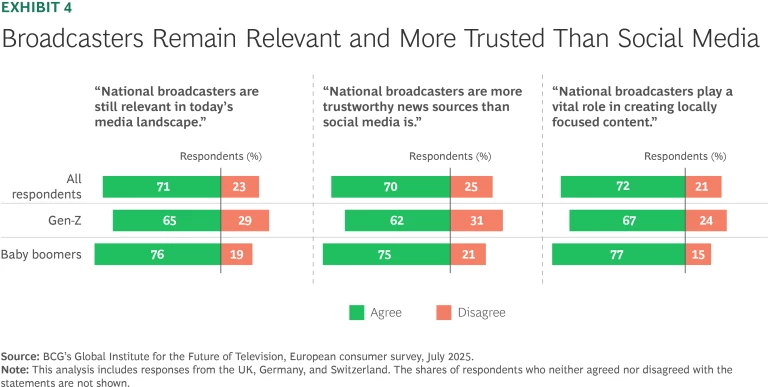

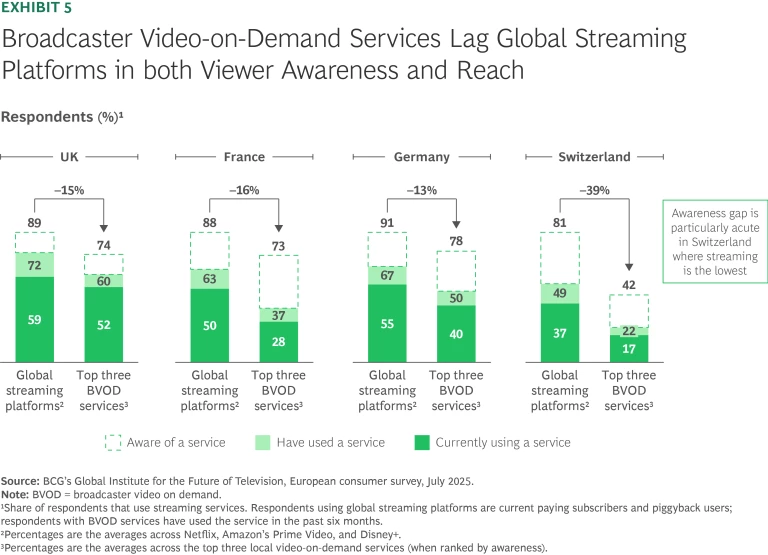

Despite the many attractive alternatives, 71% of consumers still see national broadcasters as relevant—a view consistent across regions and generations. About 70% of viewers also believe broadcasters play a vital role in creating and airing locally relevant content, including news and live sports. (See Exhibit 4.) Yet consumers’ positive view has not fully carried over to broadcaster video on demand (BVOD) services. While BVOD platforms are gaining momentum, some are still perceived as catch-up services, and they continue to lag global streamers in both awareness and reach. (See Exhibit 5.)

For example, Joyn, the German streaming platform owned by ProSiebenSat.1 Media, recently reported its best quarter ever, with the number of average monthly users up by 31% year-on-year and viewing time up by 26%. This growth shows the momentum that BVOD services can enjoy. But despite those gains, Joyn still ranks outside of the top five in Germany by user share. France’s TF1+ and UK-based ITVX have both grown rapidly since their launches but, like Joyn, still have some distance to close on global players. This shows the challenge that lies ahead for these BVOD platforms.

Broadcasters’ traditional advantage in producing local content is being challenged across markets. In the UK, the global streamers have steadily expanded their footprint. Our research shows that their share of all UK creative and entertainment turnover, or revenue, has roughly doubled—from 22% in 2014 to 42% in 2024. While this expansion has brought UK content to new global audiences, it has also reduced the market share of domestic broadcasters, which could limit their reinvestment in local programming. This challenge is even sharper for broadcasters outside the UK, whose smaller, non-English markets limit their global reach and the potential returns on content investment.

Sports rights are similarly contested, with streamers forecast to spend more than $12 billion collectively on rights in 2025, according to Ampere Analysis. These moves impact both free-to-air and pay-TV broadcasters, eroding their traditional positions as the home of major sports competitions in their local markets.

Revenue pressures will affect all broadcasters, but public ones that are funded by license fees paid by each household are particularly exposed. While public sentiment toward broadcasters remains positive, opinions about license fees vary—net negative in Germany, but more balanced in the UK and Switzerland. In the current digital era, license fee funding models are increasingly challenged, raising questions about public broadcasters’ long-term sustainability without reforms. Interestingly, younger viewers, despite watching less public broadcasting, tend to be more supportive of license fees—possibly because they are more used to paying for digital content.

Six Imperatives for Broadcasters

To counter the scale of global platforms, broadcasters need to think and act like challengers—adopting a mindset that prioritizes investing to grow before profitability, focusing resources and building scale where it matters, and adopting new platforms, formats, and business models to extend reach and increase revenue.

Make the most of national roots. Broadcasters’ national roots remain their sharpest advantage. By leveraging their deep understanding of local audiences, closer connection to cultural nuance, and stronger ties to locally relevant advertisers and agencies, they can compete where global scale isn’t enough.

In streaming, this means investing strategically in the genres and viewing moments where broadcasters can become the go-to platform, while also building the potential for exporting their content globally. Doing so requires tradeoffs. Rather than making incremental cuts across the board that spreads resources too thinly, broadcasters must make bold decisions on where to double down and where to cut back. Otherwise, they risk cutting their organizations into mediocrity.

Pursue scale through partnerships and M&A. One way for broadcasters to compete with global platforms is by leveraging their collective scale. Aggregation, partnerships, and consolidation can help level the playing field—domestically by reducing fragmentation for viewers and across borders by giving broadcasters more scale against global competitors. Viewers support the logic: our survey shows that 57% of viewers believe there are too many streaming services, and more than 60% support broadcasters consolidating to better challenge global players.

Regulatory hurdles have been significant, though, as seen in the blocked TF1-M6 merger in France. But recent moves suggest that momentum is shifting. The approved sale of RTL Nederland to DPG Media shows a more pragmatic approach that would enable public broadcasters to pool their resources while still fulfilling their public service mission. Similarly, the recent MediaForEurope takeover of ProSiebenSat.1 is predicated on building regional scale in advertising and sharing the costs of technology and other overhead.

Broadcasters should also explore partnerships with each other to scale their digital reach, ad sales, and technology. Freely, a joint venture by the UK’s major public broadcasters to improve free-TV distribution, is one example. Another is the planned collaboration between Channel 4, ITV, and Sky on a self-service ad marketplace for small and midsized businesses, making it easier for them to buy ad campaigns across all UK commercial broadcasters.

Expand distribution across digital and social platforms. Broadcasters need to meet audiences where they are. Global platforms, while competitors, can also be valuable allies for expanding reach. Our data shows that broadcasters typically reach only about two-thirds of the viewers in their home markets. Of those they miss, more than 90% are active on global streaming platforms or YouTube, or both.

Broadcasters need to design seamless journeys that pull viewers back from TikTok, Instagram, and other platforms onto their own services.

This also means rethinking marketing. Broadcasters can no longer rely mainly on their own channels or on isolated clips. They need to design seamless journeys that pull viewers back from TikTok, Instagram, and other platforms onto their own services. That means combining organic clips with paid campaigns, collaborating with creators, and building communities that stick around before, during, and after a show.

Content and distribution partnerships can also help expand reach. Deals such as those between TF1 and Netflix, France TV and Amazon’s Prime Video, and both ITV and ZDF with Disney+ show how collaborations can grow audiences in the short term. But without safeguards, broadcasters could lose control over their content, viewer relationships, data, and the ability to recommend personalized content. To avoid becoming junior partners, they’ll need strategies that balance the reach of global platforms with the long-term goal of preserving their independence and competitive position.

Diversify revenue and funding sources. Broadcasters face a monetization challenge as their traditional revenue model comes under pressure. Older generations still favor free, ad-supported viewing, while younger audiences are more willing to pay. Global streaming platforms have capitalized on older viewers’ preferences by scaling ad-supported tiers and deepening engagement, but broadcasters have struggled to build robust subscription businesses of their own, not least because the majority of their content is often available for free via broadcast.

Of course, matching the content output of global streamers is unrealistic. But broadcasters can bolster their revenues with ad-free subscription plans—bundling them with other services or tying them to exclusive content built around star talent and franchises. Alternative pay-per-view models could prove fruitful too, fulfilling a consumer demand for choice but at a lower cost: French broadcaster TF1 recently announced plans to introduce micropayments on its BVOD platform, enabling viewers to opt out of advertising on specific shows for less than $1.

Some European broadcasters are making inroads with younger audiences on social video platforms, extending existing content or encouraging creator-driven sharing and remixing. But most still struggle to capture extra revenue, with much of the value flowing to the platforms themselves. To reverse this trend, broadcasters need to test platform-specific storytelling, direct sales, native brand integrations, and seamless e-commerce.

The same logic applies to talent. Social video platforms can serve as a pipeline for new voices, bridging the gap between user-generated and professional content. A test-and-learn approach—with new content formats, creator collaborations, and monetization models—will help broadcasters leverage their brand equity across the social video value chain and double down where they can win.

Build a GenAI advantage to mitigate declining scale. As audiences demand more personalized and dynamic content, generative AI (GenAI) offers broadcasters the opportunity for end-to-end transformation across every element of their business. Where personalization and recommendation engines once required vast resources and global scale, broadcasters can now deploy large language models to deliver tailored experiences and engagement at lower cost.

Most broadcasters are already piloting GenAI, but typically with a focus on individual pilots. These narrow pilots rarely deliver meaningful results. Success comes when GenAI is applied in a connected way—not a single pearl, but a string of pearls that together reshape how broadcasters create, market, and monetize content. Early examples, such as RTL’s use of a GenAI agent to generate marketing assets or ITV’s experiments with AI-driven ad production, illustrate the potential once efforts are scaled and integrated rather than scattered.

As broadcasters embrace GenAI, responsible use must be at the core of adoption. Trust is central to their relationship with audiences, and misuse risks undermining credibility. That means ensuring transparency in how AI-generated content is created and labeled, safeguarding intellectual property, protecting data privacy, and avoiding biases in personalization or recommendations. Broadcasters have a unique responsibility to balance innovation with editorial integrity—using GenAI to enhance creativity and efficiency without compromising truth, fairness, or the human connection that defines their role in society.

Work with regulators to reset the playing field. Many European media regulations were written for an era when broadcasters dominated home viewing. Today, these same frameworks can put them at a disadvantage. Rules on advertising (what can be shown and how much), content guidelines (such as genre mix or local content quotas), or watershed protections apply unevenly, or not at all, to global platforms.

Broadcasters can work with regulators to refresh the rules for an on-demand world. At a minimum, broadcasters and global platforms should be subject to the same level of oversight, adapted to their different distribution and business models. Just as important, efforts to ensure that public broadcasters’ content remains easy to find must be accelerated if governments want public broadcasters to continue producing culturally relevant content. These rules could extend beyond smart TVs and aggregation apps to include discovery on video-on-demand and social media platforms, where much of the audience attention now resides.

The Path Forward

The challenges facing European broadcasters are real, but these institutions are still trusted by viewers and well positioned to provide the distinct local perspectives, cultural context, and editorial integrity that global platforms may lack. To maintain their prominence, they must overcome the regulatory barriers and market complexities that have slowed their ability to act—and begin to move at the same speed as global competitors.

Broadcasters that act decisively on these six imperatives will be best positioned to thrive in a rapidly shifting market. For broadcasters willing to evolve, disruption is not a threat; it is an opportunity to redefine and secure their essential role in European society.

NativeResearch is a specialized market research agency with deep roots in strategy consulting. With over 120 strategic market research projects annually, global reach across more than 160 markets, and a network of over 300 partners, NativeResearch is the trusted partner for high quality, efficient, and impactful market research.