Consumers have historically opted for low cost and convenient foods that taste good, maybe too good. As a result, diets have evolved a long way from basic vegetables, fruit, proteins, and pulses (such as beans and lentils) toward highly processed foods. In the US, for example, two-thirds of the average daily caloric intake comes from seed oils, sugar, refined grains, and alcohol.

But led by younger people, consumers are showing a growing interest in foods that are better for their health, and this realization is starting to be reflected in sales. In an industry known for stability, tight margins, and intense competition over a few basis points of share, a shift is underway from big brands’ processed products in favor of more natural choices from new entrants and house brands. The rapid rise of GLP-1 weight loss and diabetes medications is exacerbating this trend by both reducing and changing appetites. Another warning light: regulators around the world have ultraprocessed foods with identified unhealthy characteristics in their crosshairs.

Consumer packaged goods (CPG) companies cannot afford to stand their ground. They need to adapt. The good news is, for those that move quickly, there are innovative paths to growth: in reinventing products and categories, as well as in reformulating products with less-processed alternatives to current recipes.

Shifting Sources of Satisfaction

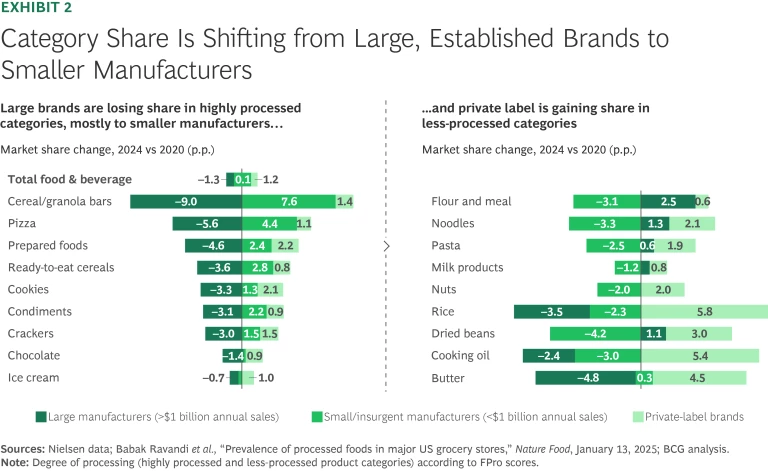

There are multiple culprits, but after years of strong performance, midsize to large manufacturers face a double whammy: they are losing share as industry growth slows. Overall food and beverage market growth fell to 2.1% in 2024 (from an average of 5% in the previous three years), below the 2.9% rate of inflation. For large players (those with more than $1 billion in sales), 2024 growth was only 0.5%, while small and midsize brands outperformed, with growth of 4.9%. Inflation is a key factor, of course, but the CPG business is complex, and plenty of forces are at work, including consumer confidence, the growth of private-label products, and company-specific innovation gaps. But our analysis indicates that three processed-food-related trends are contributors.

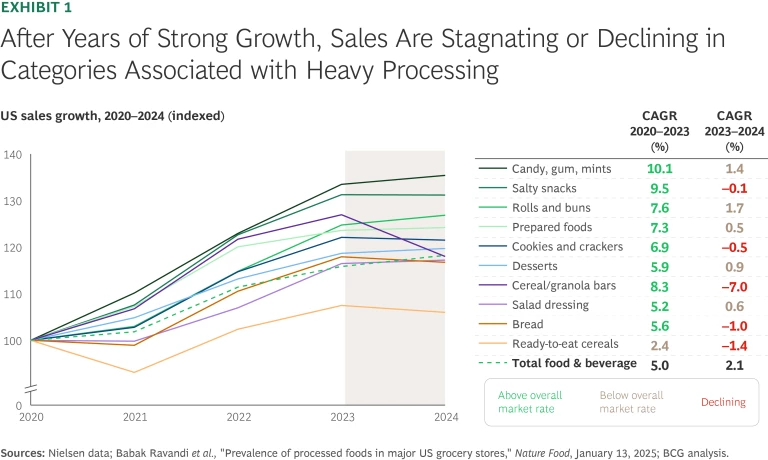

Increasing Consumer Health Awareness. Greater awareness of the health and nutritional attributes of food products is influencing purchase decisions. As a result, CPG sales are stagnating or even declining in categories typically associated with heavy processing. Digital apps such as Yuka provide previously unavailable transparency on nutritional data, enabling consumers to make highly informed choices—right at the grocery store shelf. (See “The Yuka Effect.”)

The Yuka Effect

Launched in France in 2017, the Yuka app reports 65 million users in 12 countries. The app scans barcodes on food and cosmetic products, instantly providing a rating based on the product’s impact on health. The app provides detailed information to help users understand the rating and can also suggest alternative products with a healthier profile.

A study of the app’s impact found that 94% of US Yuka users said they had put back products that received a red (bad) rating, and 92% are buying fewer ultraprocessed food products since they began using the app. Two years after Yuka’s launch, Intermarché, an 1,800-store retailer in France, announced the reformulation of 900 products, removing 142 additives, in order to improve their Yuka scores.

We examined sales data for various food categories using FPro, a machine learning-based metric that quantifies an item’s degree of

The signals behind the headline numbers are even stronger. Consumers aren’t just moving away from processed foods in general; within processed-food categories, buying patterns are changing. Large brands are losing share, mostly to smaller manufacturers and especially in categories such as granola and other cereal bars, where these alternatives are perceived to be “better for you” snacks. At the same time, private label is gaining in less-processed categories, where cost is a bigger factor and products are less differentiated. (See Exhibit 2.)

Take ready-to-eat cereals and yogurts. Sales of large, established brands with high FPro scores (indicating more processing) mostly stayed flat or declined in 2024 compared with 2023. Smaller brands with low FPro scores, such as Illinois’ Lifeway Foods, which makes kefir and fermented probiotic products, grew at rates of up to 55%. Similar trends are at work in peanut butter and granola bars, among other categories.

Rising Regulatory Pressure. Governments around the world are expanding and tightening regulations on ultraprocessed foods. The moves range from outright bans on certain ingredients to taxes on products deemed unhealthy to nutritional information prominently displayed on product labels. For example, in the US, a new ban on erythrosine, also known as Red Dye No. 3, affects some 9,200 items. Restrictions on the food items eligible for the federal government’s Supplemental Nutrition Assistance Program, or SNAP, have been proposed in at least 15 states and in the proposed federal SNAP Nutrition Security Act of 2023. Research by Barclays shows that up to 8%, or $61 billion, of packaged-food and beverage sales could be affected if all ultraprocessed foods were banned from SNAP. Many countries around the world will be introducing warning labels on some foods over the next several years.

Expanding Use of GLP-1s. More and more people are being prescribed GLP-1 receptor agonists for obesity and diabetes. Some 7 million Americans use these drugs now, and BCG projects that 12 million to 30 million people will be using them by 2030. If all adults with obesity took GLP-1s, there would be more than 100 million users in the US and more than 900 million globally.

While the projections for uptake vary, the impact on diet is clear: patients report an all-around decline in consumption. They eat fewer meals and fewer snacks during the day and consume fewer calories per meal. The impact does not stop there. GLP-1s affect the kinds of food users crave. For example, research shows a 12% drop in household spending on chips and other savory snacks and a 10% decline in sweet baked goods six months after at least one household member starts on GLP-1s. It’s already clear that widening use will have a disproportionate impact on highly processed food categories.

Stay ahead with BCG insights on climate change and sustainability

Slowdown or Paradigm Shift?

The $2 trillion dollar question for the global CPG industry is whether these trends portend a slowdown in purchases of ultraprocessed foods or a long-term paradigm shift toward more nutritious products. We suspect the latter, but either way, food companies need to get ready for change.

Historical trends show that public-health concerns drive shifts in consumption, but change can take decades. Alcohol consumption among young people, for example, has slowly but steadily declined since 2000. US per-capita consumption of caloric sweeteners rose from 1975 to 2000 but has now dropped back almost to the levels seen in the 1970s. Major product developments, such as the advent of artificial sweeteners, can accelerate shifts. Regulation can be the strongest accelerator, and trigger events, such as policy changes or innovations, can also speed up change.

In addition, it’s important to remember that there are significant regional variations in food and beverage consumption. Ultraprocessed foods and obesity are big issues in the US, the UK, and (increasingly) continental Europe. They are not yet a big concern in Asia, for example. In Japan, where ultraprocessed intake is estimated at only 27% of total calories, products that would be classified as ultraprocessed in other markets—such as Nissin’s complete-nutrition meals—rank among consumers’ favorites.

Adapt and Grow

Ultraprocessed products will maintain a big share of the food and beverage business for a long time, for the simple reason that consumers like them. Many such foods also have important benefits in terms of affordability, convenience, safety, and added nutrients. But the confluence of the three trends described above means that their share, as they exist today, will likely decline over time. CPG companies need to adapt both their products and their portfolios in response. Those that want to grow also need to introduce new offerings. That process must be based on a firm understanding of consumers’ needs and their reasons for choosing the products that they purchase.

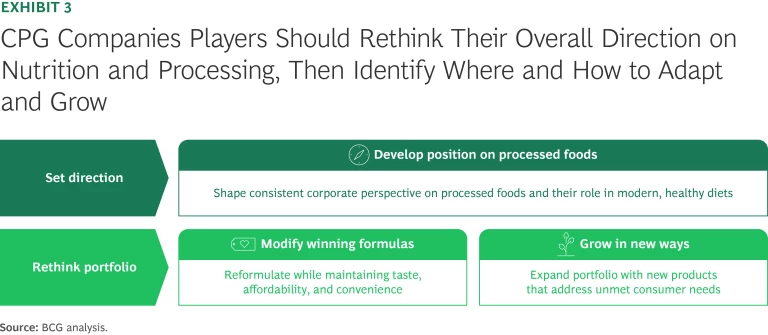

Reset the direction. Food players may want to take a step back and reset their overall direction on nutrition—developing and communicating a transparent and consistent corporate perspective on processed foods and their role in modern diets. They can then identify where and how to adapt and grow. (See Exhibit 3.)

An important part of the reset is defining a clear stance on ultraprocessed food, not unlike the “enjoy in moderation” message adopted by marketers of distilled spirits, wine, and beer. Transparency is key for credibility. Companies need to be upfront and clear about the makeup of their products, the role of all the products in the portfolio, their sustainability, and the reasons for and benefits of reformulations as they occur.

A strong corporate position could emphasize that not all ultraprocessed foods are equal; there are wide variations, and even “indulgent” foods can fit into a balanced diet in moderation—during birthday celebrations and other festive events, for example. Food processing also provides tangible benefits. Whatever the final form of the message, it must be consistently communicated to consumers, employees, and regulators. Companies also will likely want to demonstrate a commitment to continuous improvement through reformulation—and act on this throughout their portfolios.

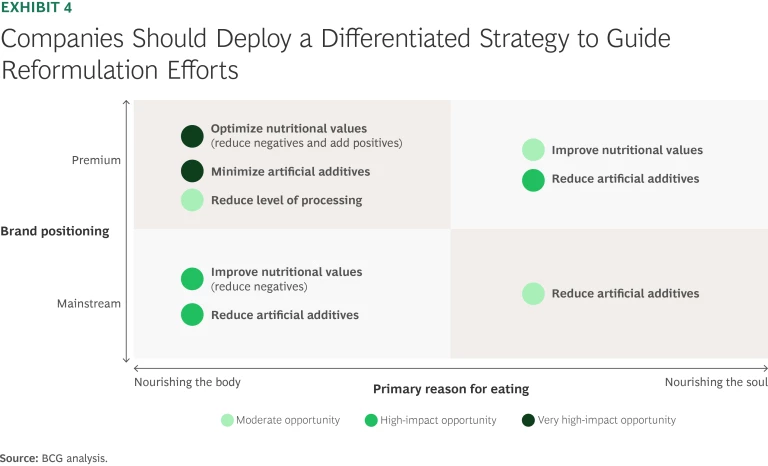

Modify winning formulas. Companies should deploy a differentiated strategy to guide and prioritize reformulation efforts as they face the inevitable tradeoffs among important drivers of consumer choice, such as low price, taste, and convenience.

Not all products can be fully nutritionally balanced, natural, and unprocessed—and there is no need for them to be. Consumers’ needs (such as for value, taste and indulgence, convenience, quality, and health) vary by occasion. Manufacturers can take a differentiated approach to product reformulation using BCG’s design to sustainable value (D2SV) methodology, which has helped many large CPG companies and retailers deliver on health and sustainability goals, enhance margins, and build resilience into their portfolios.

D2SV is an end-to-end approach to innovation that brings together consumer needs, cost optimization, and sustainability considerations to future-proof products. Two factors can guide food and beverage companies looking to adapt their products: the consumer’s reason for eating or drinking the product (what we refer to as nourishing the body or nourishing the soul) and the product’s market positioning (mainstream or premium). (See Exhibit 4.) This yields four categories, each with its own set of priorities:

- Premium: Nourishing the Body. These products need to be rooted in enhancing nutrition (through added protein, fiber, vitamins, or probiotics, for example) while reducing negatives such as sugar and artificial additives. Consumers expect clean labels and functional benefits, so reformulation efforts (and the subsequent marketing) can be bold.

- Mainstream: Nourishing the Body. The trick here is to reduce sugar, sodium, unhealthy fats, and additives while balancing cost and taste. Gradual reformulation works best to maintain affordability and familiarity. Full-scale reformulation is not possible given the limited ability to recoup the premium cost of natural ingredients and other “positives.”

- Premium: Nourishing the Soul. Consumers expect an indulgent experience and are willing to ignore, at least temporarily, certain nutritional guidelines. But they will still look for natural ingredients (real vanilla, for example, as opposed to extracts), as well as great taste. Reformulation should be limited and deliberate, bringing added benefits to rationalize the choice of a premium treat while selectively taking out the negatives (such as certain colors or flavors).

- Mainstream: Nourishing the Soul. There is little room in this category for changes that involve more natural (and usually more expensive) ingredients or major nutritional shifts. But consumers aren’t necessarily seeking or expecting change here. These products are typically fun, cheap, tasty, or convenient; consumers understand that and appreciate them for what they are. Companies should focus on meeting regulatory requirements while minimizing the impact on taste or the consumer experience. For example, Haribo has replaced many artificial colorants in its products in Europe with natural colorants. Many Haribo products now get their colorful appearance from fruit and plant concentrates, such as safflower, spirulina, or radish.

In all categories, price, taste, and convenience will remain the key drivers of choice. The challenge is to balance demand for healthier and more nutritional products with these criteria. Thinking across the portfolio and identifying each product’s role in overall growth and profitability rise in importance.

For some products, only limited change may be viable, and that can be okay, depending on the product’s role. For others, reformulation involving replacement of existing ingredients (or of the product itself) with new, “better for you” ingredients or a reformulated SKU will maintain or expand consumers’ choices—and may even command a price premium. In Japan, for example, functional (and processed) foods, such as Meiji’s R-1 and Yakult Honsha’s Yakult 1000 probiotic drinks, which emphasize immune health, are seeing strong growth.

Fifteen years ago, driven by health and sustainability concerns, the Italian food company Barilla launched a drive to remove palm oil from its portfolio, ultimately reformulating some 400 products. The program was part of a broader effort to reduce sugar, salt, and fat in order to meet consumer demand and health goals and improve sustainability and brand positioning. In similar fashion, Kraft Heinz replaced yellow dyes in its popular Kraft Mac & Cheese with turmeric, paprika, and annatto and reduced sugar by an average of 40% across its Capri Sun juice brand by using monk fruit concentrate instead. A joint venture between Cargill and DSM-Firmenich produces stevia sweeteners, which studies have shown to have both environmental and health benefits compared with sugar.

In all markets, manufacturers will have to carefully manage costs, which have risen during several years of inflation, as well as sustainability concerns. Reformulating toward higher-quality, more natural ingredients can increase both costs and exposure to variability of supply. Tariffs and trade wars, as well as long-term trends such as climate change, make supply chains increasingly vulnerable. Volatility in food supply chains is already at an all-time high, and disruptions can be expected to continue as climate change and geopolitical instability intensify.

Innovate to grow. In addition to reformulation, CPG companies can use a demand-centric analysis (such as our methodology of demand-centric growth) to spur growth through deep innovation: rethinking products to address emerging and unmet consumer needs and defining new product categories. Deep innovation can sidestep the conflicting pressures and consumer tradeoffs often encountered in reformulation efforts. In recent years, startups and major CPG firms have brought to market such innovative new products as refreshing, sweet, and fun-to-eat snacks that are also natural and light (Trü Frü); a meal you can drink that is quick, convenient, filling—and also nutritionally balanced (yfood); and Heineken’s great-tasting nonalcoholic beer that gives consumers an alcohol-free way to celebrate and be social.

An entire new beverage category is taking shape around prebiotic sodas, which are high in fiber and lower in sugar than traditional sodas and promise better digestive health. One brand, Olipop, was founded in 2018 and surpassed $400 million in sales in 2024, a four-year growth rate of more than 200%. In March 2025, PepsiCo announced that it will acquire another prebiotic brand, Poppi, also launched in 2018, for $1.95 billion. Rival Coca-Cola is launching its own prebiotic competitor, Simply Pop. Close collaboration with R&D teams at ingredient suppliers can reduce risk and time to market for these types of innovations.

PepsiCo’s approach (it also has acquired Bare Snacks) highlights another avenue open to large CPG companies: inorganic growth through M&A. Many firms are already active. Mars acquired Trü Frü in 2023, Danone has invested in Lifeway Foods, and Hero is acquiring Deliciously Ella.

Use AI as an Innovation Accelerator. Functional ingredients, such as collagen, pre- and probiotics, and alternative sweeteners, may challenge existing formulations. As they continue to gain traction, another advanced technology—AI—can further accelerate product innovation in the near term. Many CPG companies, major players and startups alike, are using AI to speed both product adaptation and new-product innovation programs.

Several key success factors can expedite the use of AI in product design. These include linking product ingredients and processing to consumer feedback (through social media and other channels), as well as to sensory performance data (relating to taste, texture, and smell, for example); enabling dynamic reformulation and rapid creation and scaling of new SKUs in manufacturing; and implementing change management that facilitates human-machine collaboration.

For those that make the commitment to getting it right, the rewards can be significant. One CPG company built an AI tool that provides optimal starting formulations for new products based on multiple product and process criteria. It has doubled the pool of candidate formulas and expects to cut the time for overall formulation by 30% to 50%.

Consumer preferences are on the move and will be pushed by external factors. CPG companies cannot afford to take a wait-and-see approach to how far and how fast preferences change. They do not need to abandon processing or popular brands. They do need to start a new process that encompasses portfolio review and adjustment as well as investment in innovation to maintain—and grow—their positions in a changing marketplace.

The authors gratefully acknowledge Dafne Kuisch, Lio van Meerbeeck and Catherine McDougall for their contributions to this article.